The 2023 picture – META

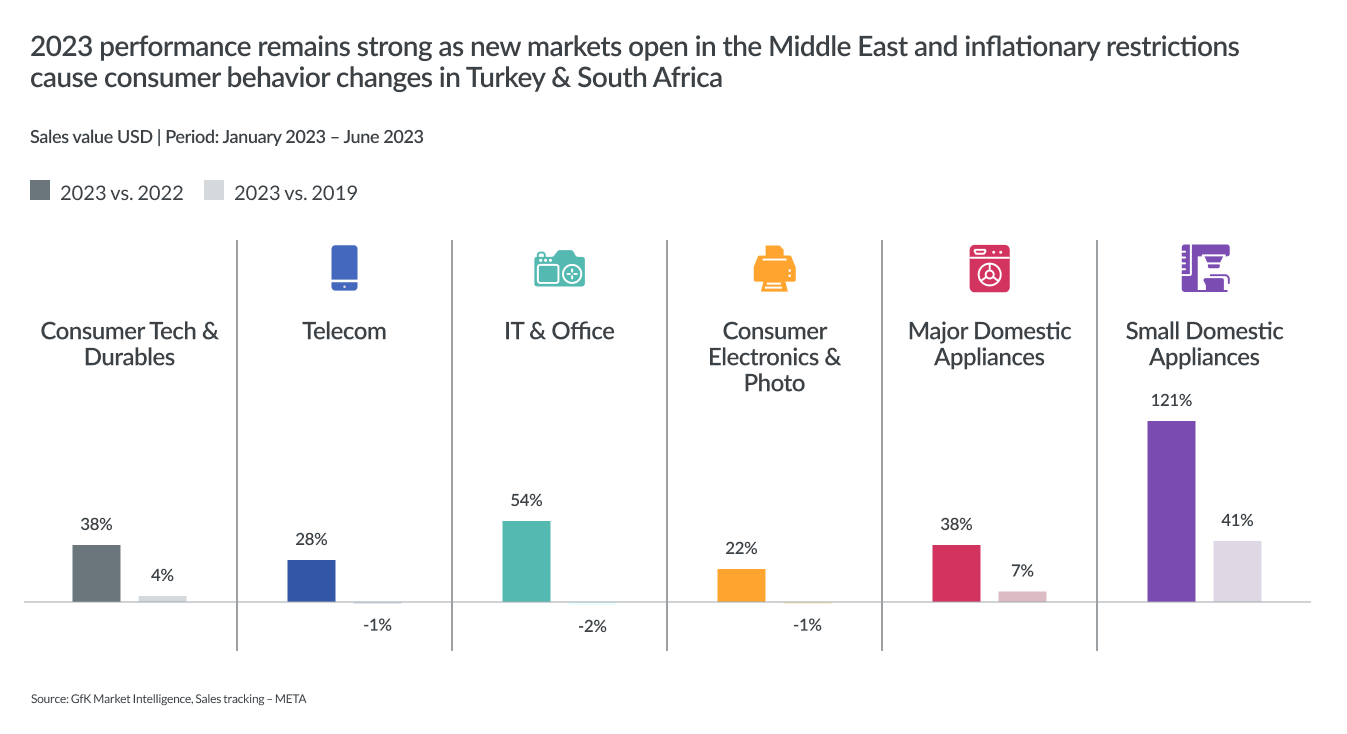

The first half of this year has seen META consumers returning to increased level of spending for Consumer Tech & Durables (T&D) – especially domestic appliances.

After the sharp growth in sales for META’s T&D market in 2020 and 2021, last year’s revenue stayed flat. However, the first six months this year have seen a +4% increase in revenue compared to the same period in 2022.

Purchases of domestic appliances have led this positive bound, driven by new markets opening in the Middle East, and inflationary restrictions in Turkey and South Africa driving a change in consumers’ willingness to buy. Sales revenue has been especially strong for small domestic appliances, growing +41% in January to June this year compared to the same period last year.

Product innovation

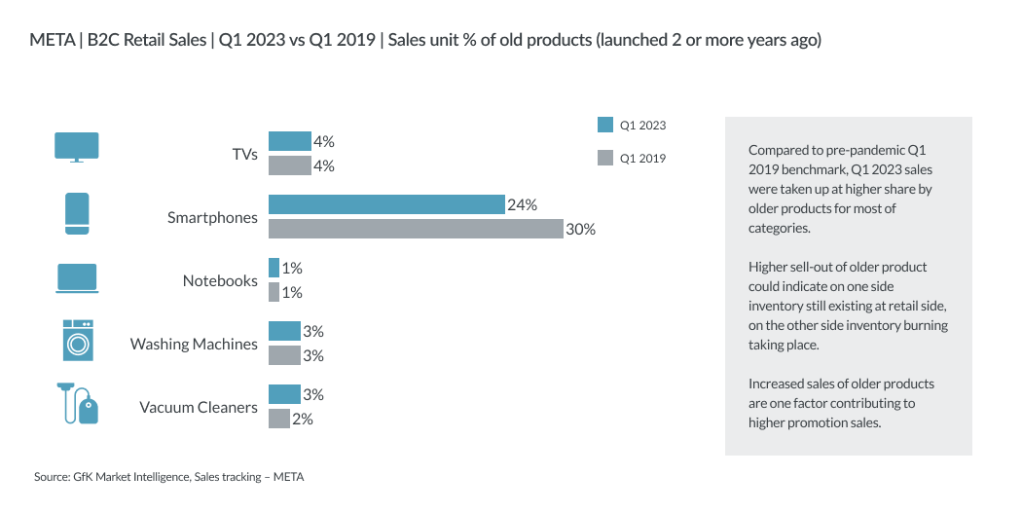

Disruption driven by launches of products offering dramatic innovation has been low this year. This means that META’s consumers have often not always seeing a persuasive reason to buy the latest, newly launched products in certain categories, rather than buying an older model. Across TVs, tablets and some home appliances, models launched two or more years ago make up the same share of purchases as we were seeing in 2019. An exception is smartphones, where new models have taken a greater share in Q1 this year compared to Q1 2019.

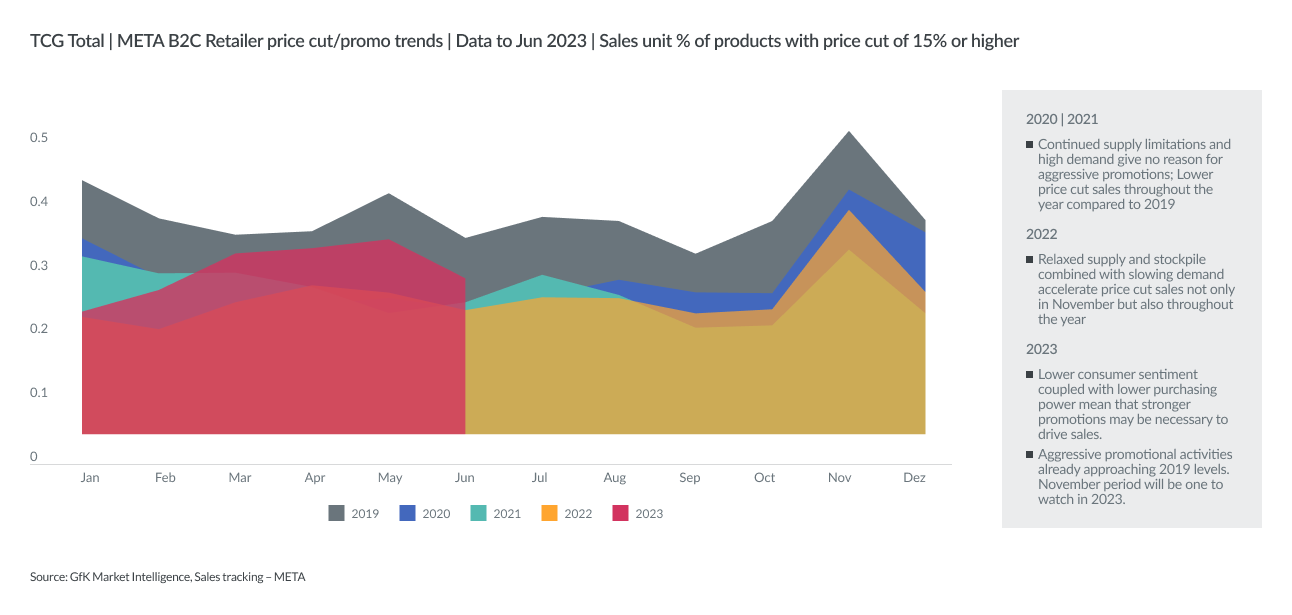

While significant discounts obviously impact retailers’ margins, promotional activities seen across META so far this year are approaching levels last seen in 2019. These events are motivating consumers to open their wallets, and we expect similar promotions will be crucial to trigger volume demand in the remainder of 2023.

What factors will drive consumer spend in 2024+?

Planning for 2024+ global recommendations

How do manufacturers and retailers capitalize on the consumer trends above to shape an ambitious but sustainable strategic plan and budget allocation for 2024+?

With budget planning for 2024 in full swing, these are our global recommendations on how to drive growth over the next few years. The local market and consumer landscape set out above will drive how best these are implemented at regional and country level.

01

Invest in targeted innovation (product & service)

Innovation continues to appeal but must deliver value that is directly relevant to the consumer’s life. Develop targeted, consumer-centric use-cases that show the benefits of upgrading to ‘affordable premium’ models.

02

Build up your brand to be a differentiator, as well as your product

The emotional connection between consumers and a brand plays a crucial role in competitive markets. Balance tactical activity with long-term, upper-funnel brand marketing that allows you to differentiate based on brand, rather than product or pricing alone.

03

Intensify manufacturer-retailer collaboration to optimize omnichannel category management

By teaming up to deliver consumer-centric planning that is unified across their respective merchandising, marketing, and supply chains, manufacturers and their retailers can optimise their mutual goal of creating a consistently personalised and enjoyable product experience at every touchpoint.

04

Planning for the upcoming shopper generation:

Gen Z will soon surpass millennials in size. Two-thirds are aged 15-24 and starting to frame opinions about brands. They consume 53% more content than the average but spend 50% less time on content than millennials. Like any generation, they include complex segments with differing demands.

05

Review regional and category footprint to capitalize regional growth opportunities and mitigate individual category risks

Each region has unique market, category, and consumer dynamics. Manufacturers and retailers must have a full view across all regions and categories, and map this against their own portfolio, to pinpoint where growth opportunities exist for their products.