Building from cautious to intentional consumer spending

The global outlook for consumers is improving. Consumers are determined in their resilience to stay ahead, vigilant against further disruption, and intentional about every aspect of their daily spending.

Some pressure points have shifted, but many have lingered in mind and body. In this climate, there is a prevailing mindset of determination, where any gains are being intentionally evaluated and repurposed wisely. To build upon any inroads made in the first six months of 2024 and maintain their positive momentum, consumers will redirect their spending to where it matters most, shifting from cautious to intentional consumption.

In this multifaceted analytical assessment of the state of consumers, we uncover what has changed, what disruptions remain, and what companies need to anticipate as they prepare for 2025. Below, we give an overview of each chapter of the downloadable report.

The current state of consumers is determined

Although they are bracing for more geopolitical, economic, and environmental changes in the months ahead, consumers are determined to remain resilient through adversity, vigilant in safeguarding their savings, and intentional in their spending, focusing primarily on what gives them a sense of prosperity and well-being.

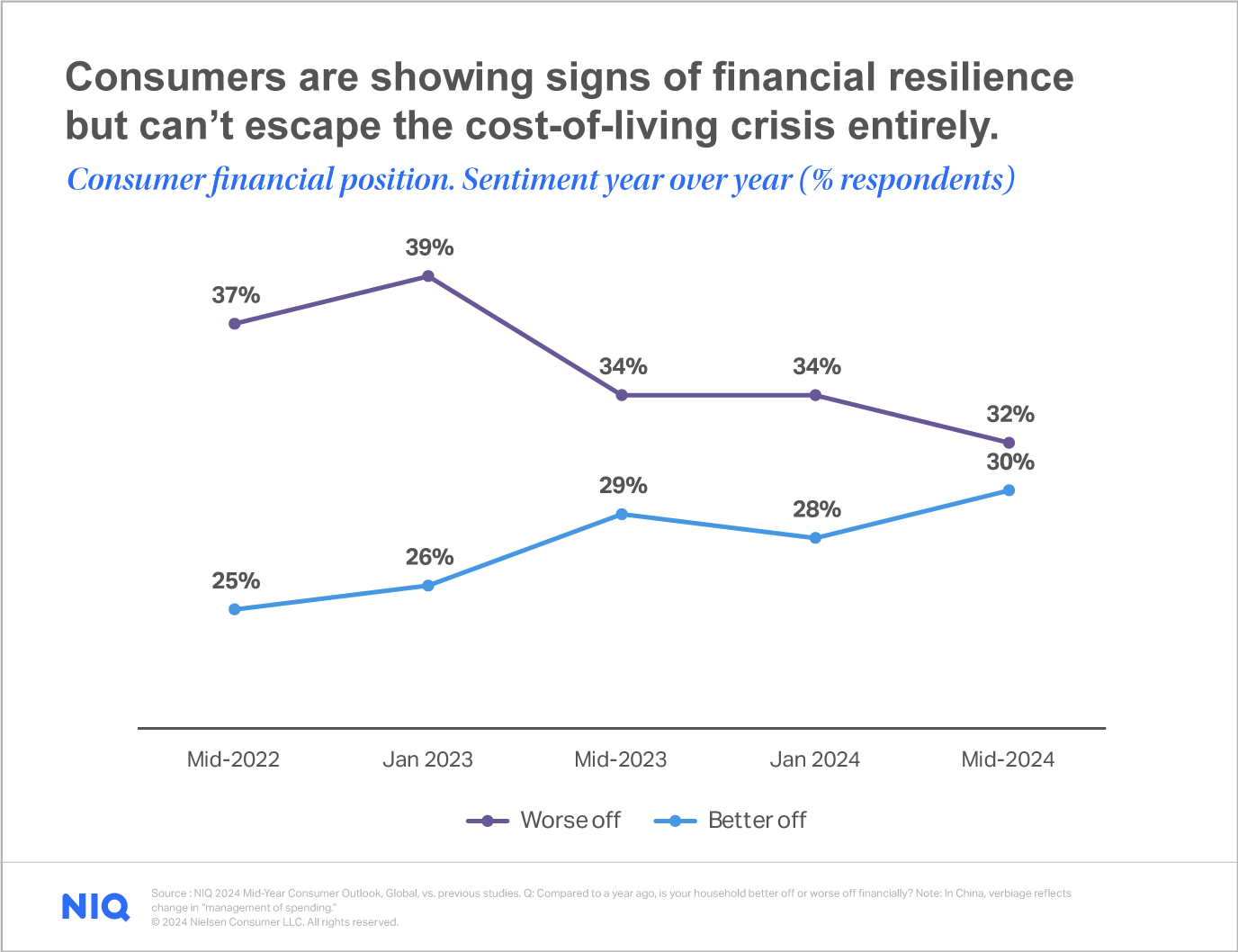

The strength and determination of consumers is evident: In the past six months, we’ve seen rebounds in the percentage of the population who feel worse off financially compared with a year ago. Today, just 32% feel this way—an improvement from January, and a marked uptick from the trying times of early 2023.

This chapter explores interesting differences that exist in financial sentiment across countries and the top concerns that are weighing on the minds of consumers. The common thread is that consumers across regions are spreading their spending very purposefully—and any excess will be leveraged in strategic ways.

Is growth beyond inflation possible?

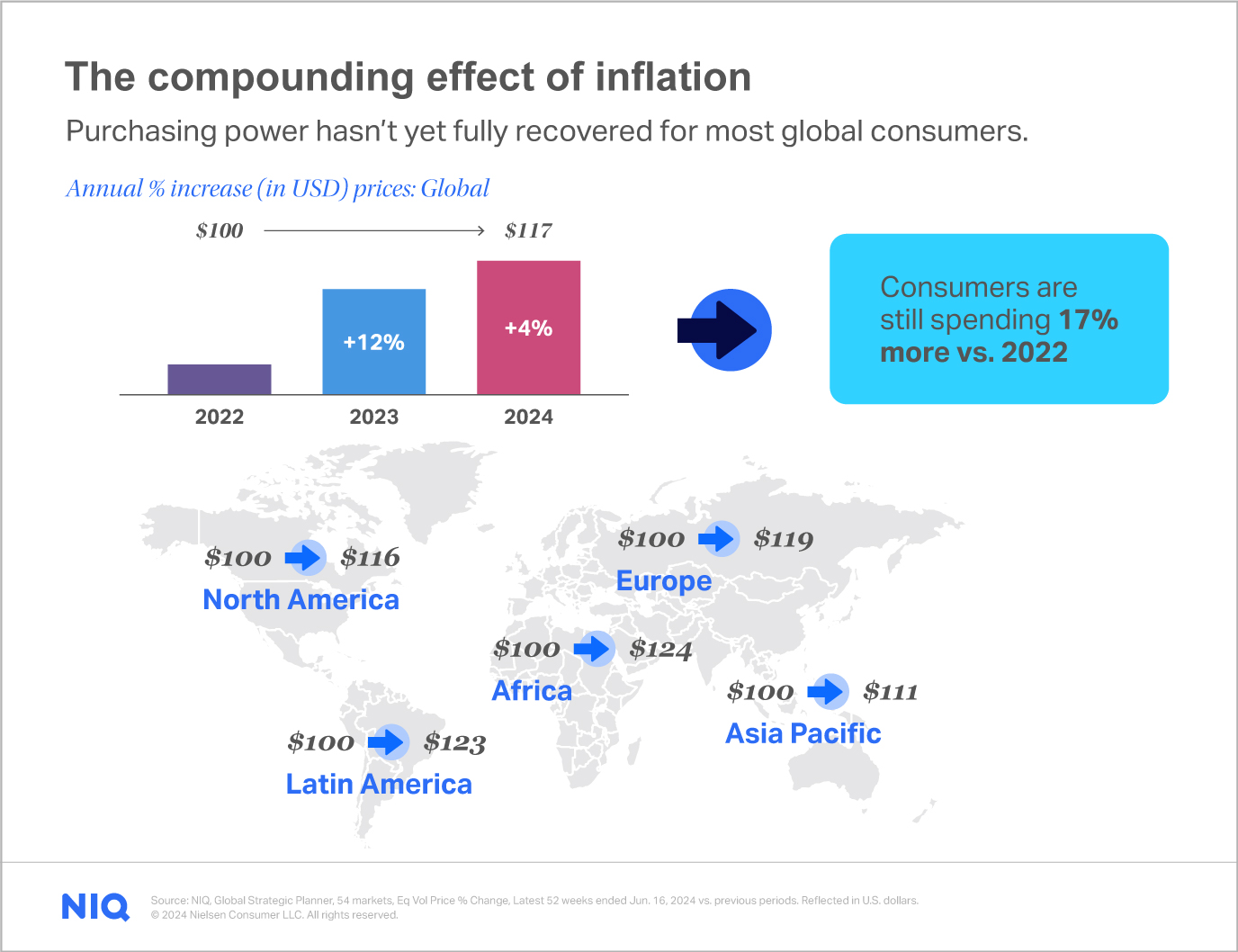

Inflation has decelerated in many parts of the world. But the compounding effect of the past couple years will be felt for some time. It’s become a very careful balance to manage household expenses with uncertainty around every corner. Because companies look to consumers to drive volumetric consumption rates forward, we must remember that even though conditions have changed for the better, it will take time to regain eroded purchasing power.

Consider everyday spending, for example. As illustrated below, a 100 USD spend for consumer packaged goods in 2022 would cost at least $117 today. Even with the slowing rate of price increases, it’s important to remember: Deceleration is not decline, and consumers are on a long-term path to financial recovery.

We explore departmental inflation and volume heat maps to illustrate how growth beyond inflation is possible. It can only be done with a full view of all available consumer targets (to know who you’re looking to engage) and with a deep understanding of how consumers of all financial circumstances will be spreading their spending across categories of interest.

In case you missed it

Watch our Mid-Year Consumer Outlook: Guide to 2025 webinar to uncover what has changed in consumer spending, what disruptions remain, and what companies need to anticipate in the months ahead.

How is the financial divide influencing consumer spending?

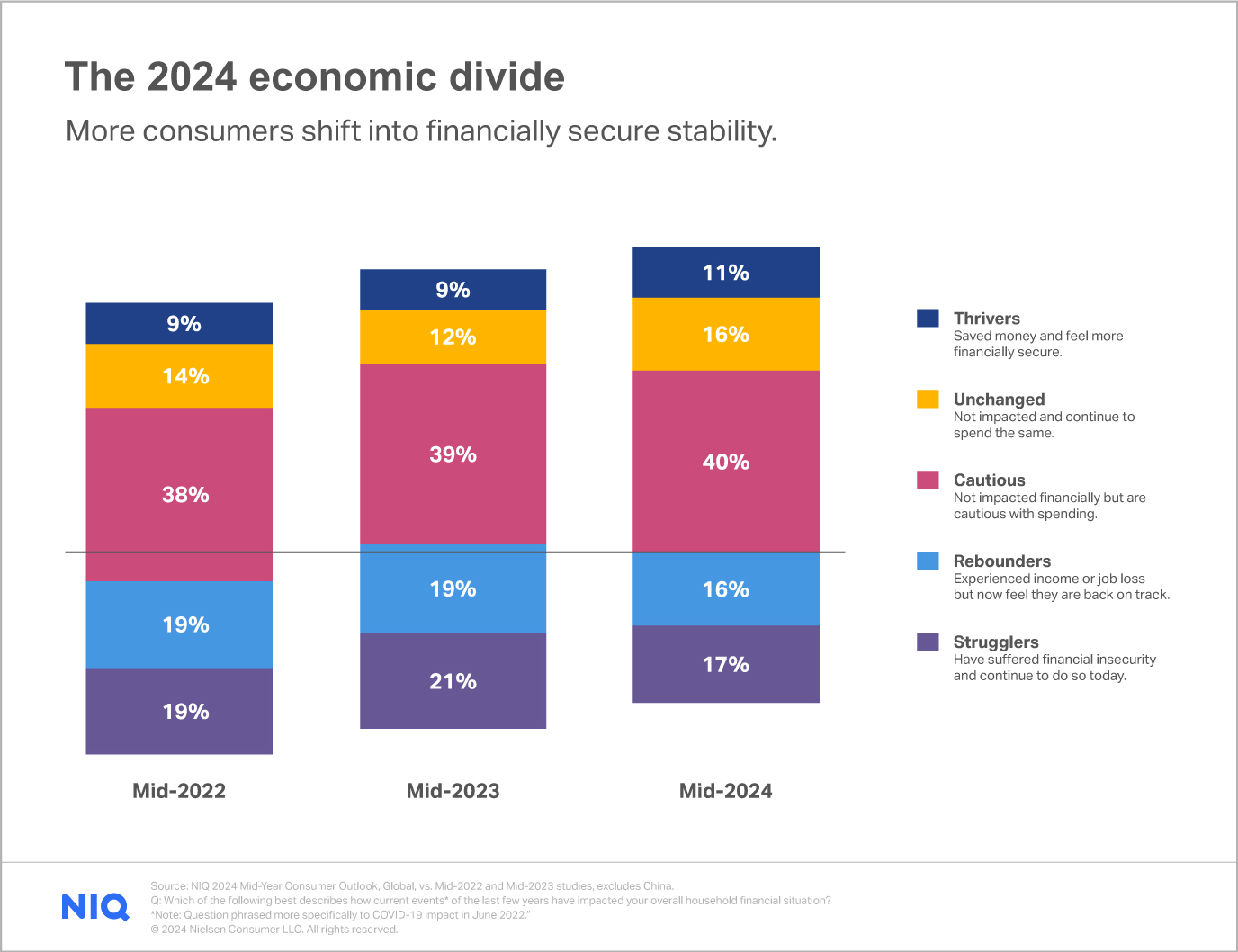

Global consumer wealth is accumulating in divisive ways. Even as vulnerable households face rising fixed costs of living, others have found further security and savings as their wealth grows. Anticipating consumer spending by category and geography alongside patterns of wealth vs. insecurity is essential to understanding and planning for growth in 2025.

Across the current landscape of consumer prosperity, we turn to NIQ’s segmentation on the economic divide: a key visual to how secure or insecure consumers feel economically, given any recent impact to their income or ability to save money. Interestingly, in the last year, we’ve seen a continued shift toward the more financially secure end of this spectrum, where 27% of surveyed consumers are either unimpacted or thriving financially, compared with 21% from this period in 2023.

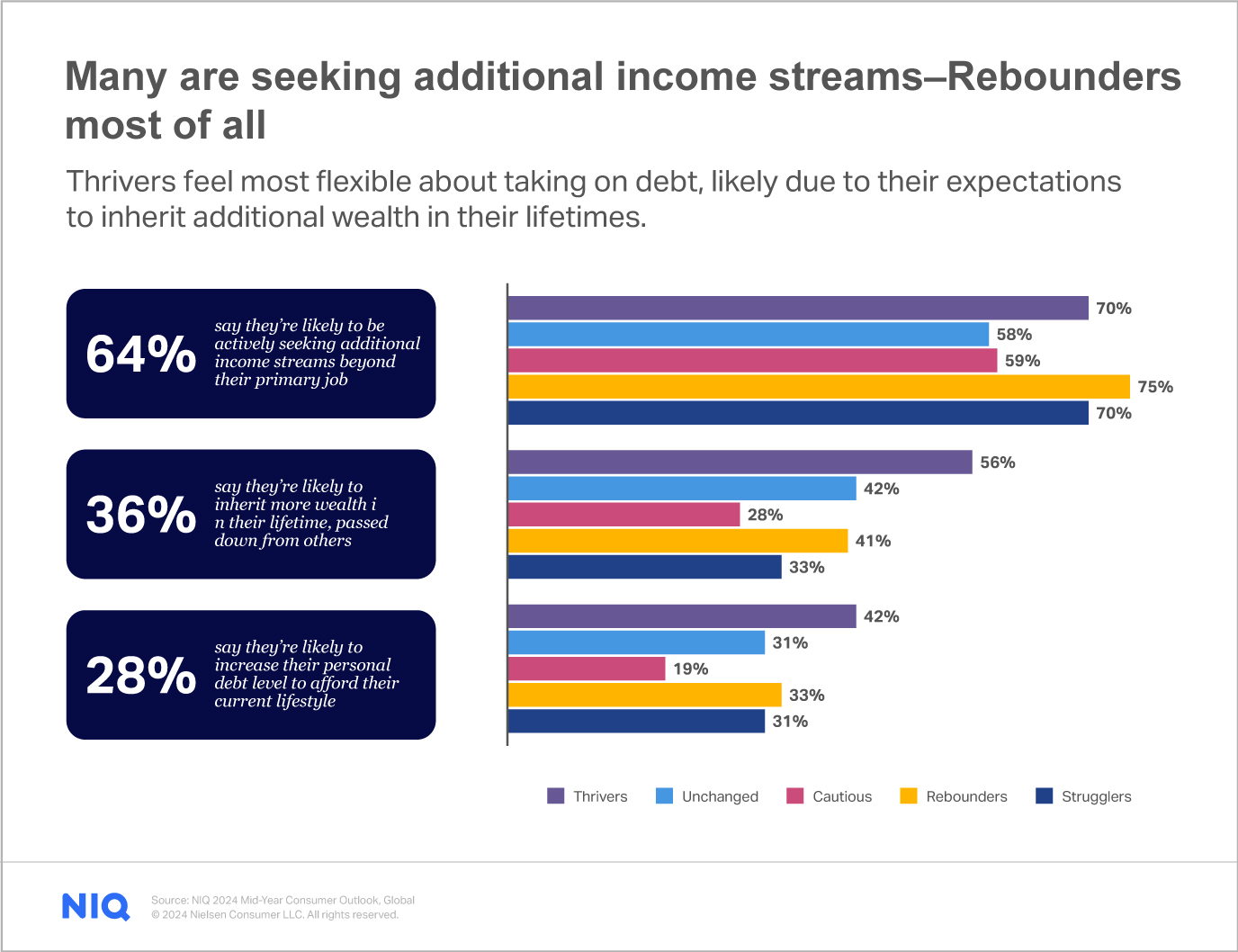

While overall consumer sentiment is clearly trending toward feeling more secure, a deeper look at changes in mindset indicates that many people are not resting on their laurels. In fact, 64% of global respondents say they are seeking additional income streams beyond their primary jobs.

In this chapter, we examine specific consumer spending intentions across categories and forecast emerging consumer trends powered by World Data Lab. These forward-looking measures illustrate how essential it will be to segment and target consumers aligned to the shifting spending power of financially polarized consumer groups

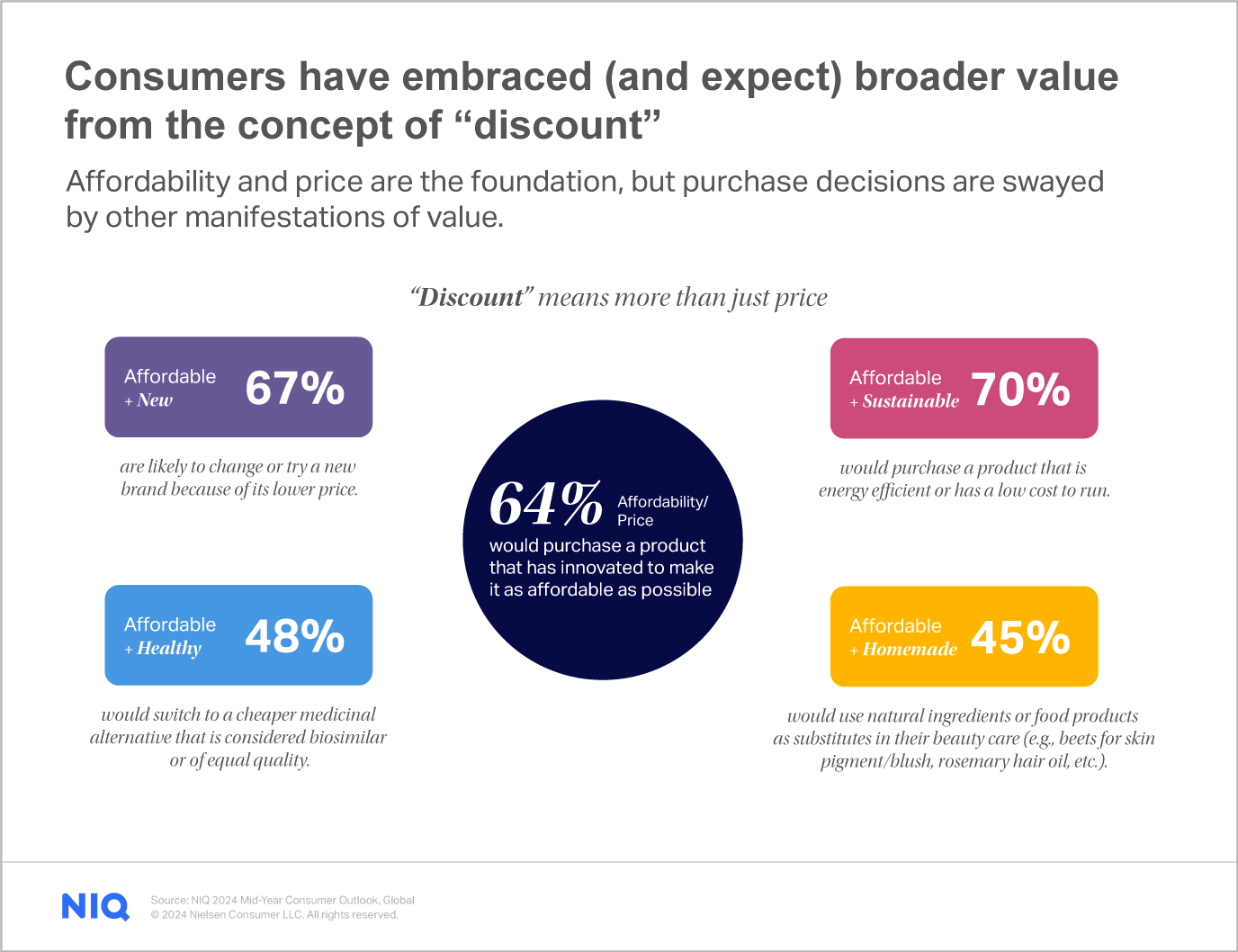

Consumers are redefining “discount”

Affordability and price are almost always the baseline factors shaping consumer decision making. But as inflation has begun to stabilize and the past six months have brought some renewed signs of resilience, consumers are viewing their definition of discount in an entirely new light, creating new opportunities for companies that recognize this shift. Today, consumers are not only intrigued by—but have come to expect—a hybrid approach to delivering value for money.

But what happens when consumers are confronted with multiple promotional options, each offering a different value proposition? Companies must assess these nuances to learn how to align their promotional support, as well as merchandising and assortment strategies, to the specific deal types, pack sizes, formats, and channels that consumers would most like to encounter.

Assortment can influence pure price decisioning

Lower cost per use

65%

say they’re switching to buy more large, bulk pack sizes of their product of choice

Lower cost to buy

52%

say they’re switching to buy more of the smaller pack sizes of their product of choice

Source: NIQ 20024 Mid-Consumer Consumer Outlook, Global

In the case of “lower cost per use” vs. “lower cost to buy,” it’s clear that, right now, a larger majority (65%) of global consumers would prefer to buy larger, bulk pack sizes rather than smaller pack sizes at a lower initial cost to purchase (52%). This finding illustrates the importance of analyzing how assortment can be leveraged to influence—and even overcome—pure price-based decisioning.

To further underscore the real-world application of this sentiment, we provide a deep analysis of retail data and the associated shifts in channel dynamics. Brands that can deliver on consumer expectations, innovate often, and deliver affordable value in multiple ways will discover a world of opportunities previously unavailable to them.

Anticipating catalysts to change in 2025

This last chapter of our future-focused analysis highlights four vertical-specific opportunities that we’re tracking now and will continue to monitor in the years ahead. These emerging factors—among the many shifting consumer minds, wallets, and actions—should be carefully considered when seeking new avenues for growth. They include:

- The GLP-1 ripple effect

- The new face of omni

- Artificial Intelligence (AI) readiness

- Hot commodity costs

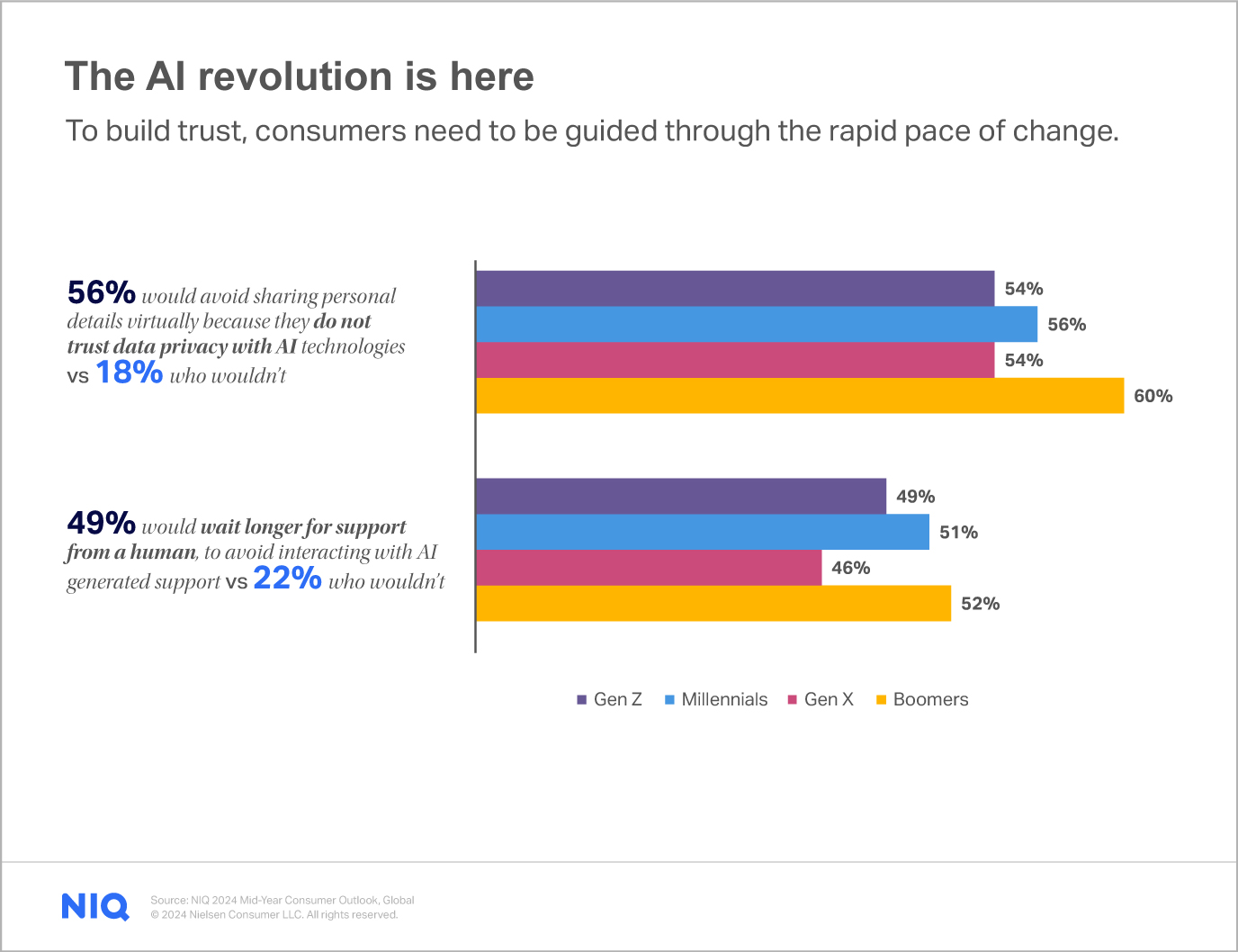

We explore the current consumer sentiment around these trends and apply additional layers to consider in the months ahead. For example, given the buzz and the rapid pace of advancements in AI, it’s crucial for companies to understand how consumers are feeling about the fast-moving pace of innovation infiltrating their everyday actions.

Our survey uncovered that 56% of global respondents said they would avoid sharing personal details virtually because they do not trust AI technologies to protect the privacy of their data, compared with 18% who would be willing to share personal information. What’s more, nearly half (49%) said they feel most comfortable with person-to-person support interactions and would wait longer for support from a human.

Notably, these feelings are consistent across generational groups, with the highest level of resistance coming (perhaps not surprisingly) from older consumers. Given these sentiments, it will be essential for companies to assess which AI advancements make sense for their business and which will appeal to (rather than alienate) consumers.

All four emerging trends explored in our report outline the opportunities and challenges that exist for companies to capture momentum into 2025 and remain aligned to shifting consumer preferences along the way.

Your 2025 strategy roadmap to consumer spending

As retailers and manufacturers plan for 2025 and beyond, it’s important to leverage a full view of forward-looking data to anticipate how consumer demand and spending will continue to evolve.

Our guide to 2025 consumer spending can shine a light on how emerging needs, shifting spending power, and new retail considerations can be leveraged to maximize growth for manufacturers and retailers in the years to come.

Lauren Fernandes is a data-driven thought leader and content strategist, serving as Vice President of Global Thought Leadership, Marketing & Communications for NIQ. Based in Toronto, Canada, she has a passion for exploring emerging trends and shifting consumer behaviors. Her work has scaled global audiences and clientele, helping manufacturers and retailers make more informed business decisions. For the past decade, Lauren has enjoyed sharing her perspectives and analytic pursuits via thought leadership content, industry publications, and to diverse audiences within the NIQ network and beyond.

Consumer spending to grow 6% in 2025: Nielsen IQ report

Watch NIQ’s Tracey Massey discuss some of the findings from Mid-Year Consumer Outlook on Yahoo Finance’s Wealth! show.