2025 Q3 China CBI index interpretation

Industry data shows that major promotional events such as “618” and “Double 11” are not only periods of concentrated online sales but also key windows for consumers to engage in quality brand consumption. However, while fully leveraging the impact of these events, maintaining steady operations during off-peak periods is equally critical—especially in terms of how to retain users and brand awareness accumulated during promotions and convert short-term sales spikes into sustained repurchases and long-term value. In mature brand management, peak and off-peak periods are not a zero-sum game; they can form a mutually reinforcing virtuous cycle.

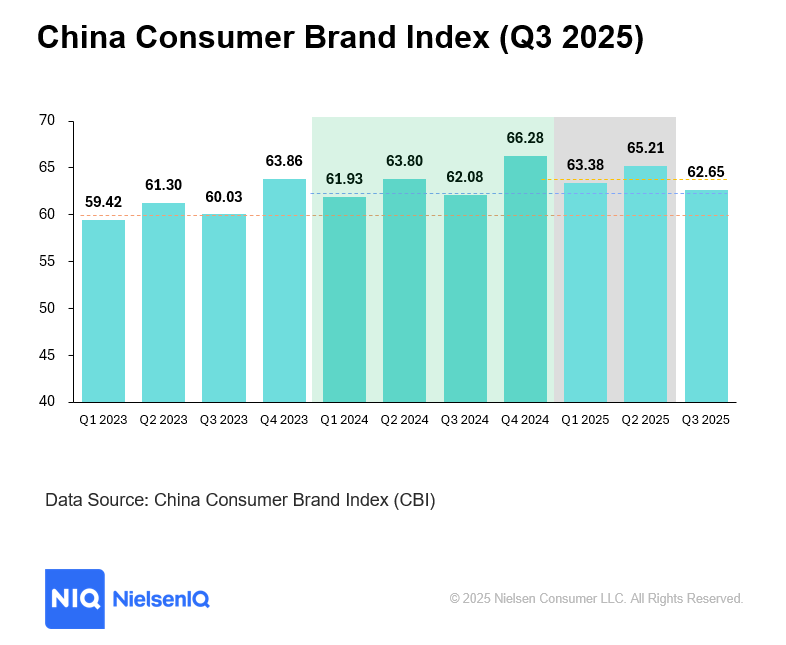

Recently, the National School of Development at Peking University released the China Online Consumer Brand Index (CBI), and NielsenIQ’s latest retail research shows that in Q3 2025, the CBI rose 4.4% compared to the same period in 2023, and 0.9% year-on-year. This shift indicates that Chinese consumers’ willingness to purchase branded products continues to strengthen even outside major promotional cycles. Changes in related brand metrics also provide important insights for observing off-peak brand management strategies.

Why is the off-peak period so critical?

Promotions bring scale leaps, but off-peak periods determine whether a brand can enter consumers’ everyday choice set. In other words, off-peak is the essential path for brands to move from traffic dividends to consumer mindshare. It not only tests product strength and service experience but also examines whether a brand has the capability for sustained operations.

During off-peak periods, consumer purchasing behavior becomes more rational, price incentives weaken, and scenario-based and content-driven strategies become core. Brands must build stable sales curves through membership programs, refined traffic retention, and repurchase mechanisms. This not only secures the base but also accumulates momentum for the next major promotion.

Scenario-Based Operations: From “People Searching for Products” to “Products Finding Scenarios”

The marketing logic of off-peak periods is undergoing profound change. In the past, brands relied on platform traffic and price wars; today, scenario-based storytelling has become the lifeblood. Brands need to integrate products into specific life slices—dorm socializing, first day at work, weekend camping, music festivals… These scenarios not only provide purchase reasons but also make consumers feel that buying during off-peak is worthwhile.

Behind this shift lies a deep exploration of emotional value. Gifting rituals, customized services, and self-indulgent experiences are all effective ways for brands to strengthen user stickiness during off-peak periods. Through live streaming and short videos, brands can continuously “plant seeds,” maintain buzz, and avoid falling into traffic troughs.

Industry Trends: Structural Changes and Youth-Oriented Scenarios

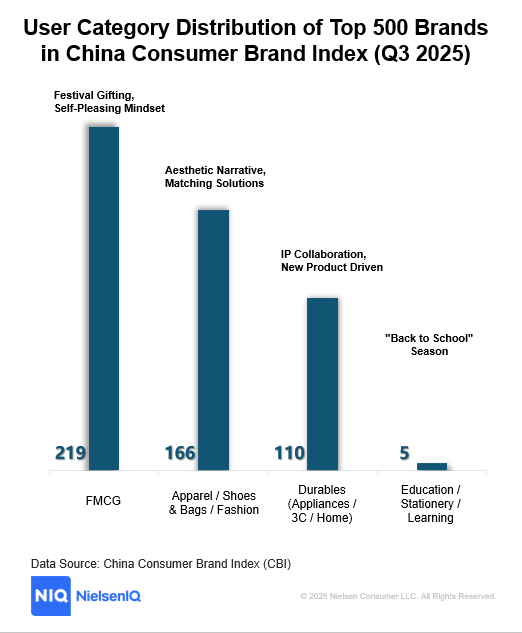

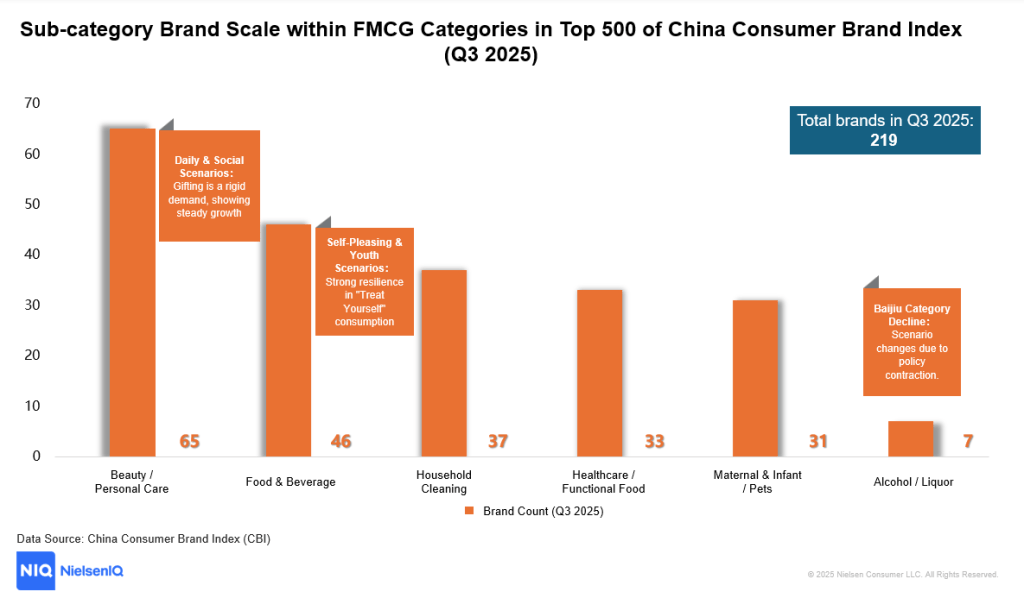

By category, beauty, food, and liquor show different performances during off-peak periods, but the core logic remains consistent: scenario-driven strategies and mindshare penetration.

- Food & Snacks: Tap into “holiday gifting” and “health & self-care,” combine seasonal and social scenarios, and create high-appearance packaging and functional concepts to build social currency attributes.

- Liquor: Under policy pressure and high-end market constraints, the industry is accelerating youth-oriented strategies by launching low-alcohol, small-bottle products targeting light drinking, solo consumption, and casual social scenarios.

- Beauty & Personal Care: Leverage the “romantic economy” by introducing portable fragrances and emergency masks—small yet chic items that meet Gen Z’s spontaneous consumption and social photo needs.

- Apparel: Capitalize on the “aesthetic dividend” by offering outfit solutions for work, camping, and exhibitions, driving multi-piece purchases.

These trends show that off-peak periods are not just sales windows but critical stages for brand value accumulation. Brands that achieve steady-state operations during off-peak will stand out in a competitive, stock-driven market.

Brand Strategy: Private Domain Accumulation and Omni-Channel Synergy

To win the off-peak period, brands must strengthen private domain operations, accumulate audience assets, build membership systems, and accurately identify high-value customers. At the same time, leverage platform tools to shift from “people searching for products” to “products finding scenarios,” improving matching efficiency.

More importantly, brands need to accumulate mindshare through scenario-based storytelling and build self-sustaining capabilities. Off-peak is no longer passive waiting—it’s an active process of creating purchase reasons. Only by doing so can brands unlock higher-quality growth in future promotional cycles.

NielsenIQ continues to monitor market dynamics, providing deep insights and strategic recommendations to help brands seize opportunities and achieve sustainable development in an increasingly competitive landscape.