The consumer technology industry in 2025 is characterized by cautious optimism.

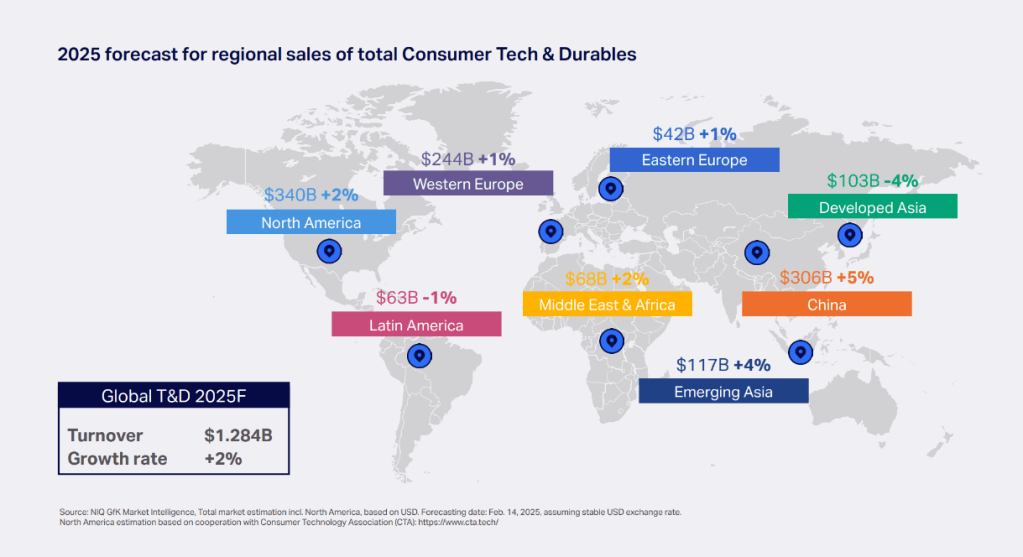

Consumer spending is gradually improving, and NIQ’s market experts—in partnership with the Consumer Technology Association—expect global sales of consumer tech goods to reach 1.29 trillion USD in 2025—the equivalent of 2% growth over 2024.

However, many of the forces shaping technology industry trends this year are still evolving. These require deep understanding and a nuanced approach across sectors and regions, if brands are to maximize their profitable growth.

This report explores the major dynamics to watch—from consumers’ financial outlook and global trade tensions to replacement cycles kicking in for key products and the likely impact of Artificial Intelligence (AI) innovation on consumer tech purchasing behavior.

It focuses on the “digital” areas of home entertainment, smartphones, health tech, and workspace tech, highlighting the products that are positioned for growth this year and why, the challenges facing other products, and how and where brands can best capture consumers’ increasing willingness to spend.

Consumer tech insights are just a click away.

Consumer Tech Industry Trends 2025 explores anticipated product performance across four digital consumer tech categories, including:

1

Home Entertainment and Gaming

- TVs

- Portable and home audio (e.g., headphones, soundbars)

- Gaming PCs

- Gaming consoles and portable gaming devices

2

Smartphones

3

Health Tech

- Core wearables

4

Workspace Tech

- PCs (non-gaming)

- Laptops

- Accessories (e.g., monitors, keyboards, mice

How to maximize growth in 2025

To maximize growth in 2025 and beyond, manufacturers and retailers should focus on several strategic areas, as focus for value growth shifts from traditional appliances to digital sectors. Thoughtful differentiation and targeted innovations are essential to resonate with today’s intentional consumers—and those innovations must show clear use cases and tangible value as consumers seek products that enhance their experiences and justify costs. Emphasizing premium features like AI functionality can attract value-conscious consumers willing to invest in enhanced performance and convenience. Thus, educating consumers on the benefits of AI-enabled devices is critical.

Monitoring geopolitical and economic developments, such as US tariffs and China subsidies, is core to strategic planning this year, to help brands navigate potential volatility and economic uncertainties. Manufacturers and retailers must be equipped to stay abreast of fast-paced developments in a complex political landscape, understand the impacts across specific markets and audiences, and be ready to pivot to meet the emerging scenarios. Focusing on growth in nascent regions like China, Emerging Asia, and the Middle East & Africa is crucial. Tailoring strategies to these markets will sustain growth, as they are expected to drive most of the value growth in the Consumer Tech & Durables market this year.

Leveraging major promotional events to drive sales and encourage premium purchases remains crucial. These periods help move large volumes of stock and justify higher-priced items through discounts. Balancing affordability with premium features is essential: Consumers are searching for the best prices but are willing to invest in products offering enhanced durability, performance, user experience, and convenience.

The bottom line: Manufacturers and retailers must focus on targeted innovation that encourages consumer spending, closely monitor global developments, capitalize on promotional events, and target emerging markets.

The data-driven, forward-looking insights in this report come from our team of T&D experts and are based on past performance, current trends, and market-specific factors in the following regions:

- Asia Pacific

- North America

- Latin America

- Western Europe

- Eastern Europe and Middle East & Africa

To succeed in 2025 and beyond, T&D manufacturers and retailers must:

- Innovate to encourage consumer spending

- Closely monitor global dynamics

- Capitalize on major promotional events

- Target emerging markets

NIQ’s Global Strategic Insights team is continuously monitoring and measuring tariff-related impacts on T&D sales. Contact your NIQ advisor for more information.

Consumer tech insights are just a click away. Complete the form to download our Consumer Tech Industry Trends 2025 report.

The Tech & Durables sector is bigger than just these “digital” sectors.

Find insights on Small and Major Domestic Appliances in our Innovate to Elevate: Driving spending in 2025 report.

Key trends in consumer technology

Hear our T&D experts discuss how they expect the global digital sector to perform in the year ahead. Watch our State of Consumer Tech in 2025 webinar.