Read on to uncover some of the top use cases and insights our team has uncovered for this powerful dataset.

Benchmarking Performance

In the first three months of 2025, the world’s largest club retailer grew 70 bps faster year-over-year than US total retail. Given this growth dynamic, greater distribution with club is an opportunity most brands would jump at, but they are faced with a key question:

Does my specific category performance at this retailer warrant the investment?

Suppliers need granular data, down to subcategories, brands, and items, to quantify the opportunity.

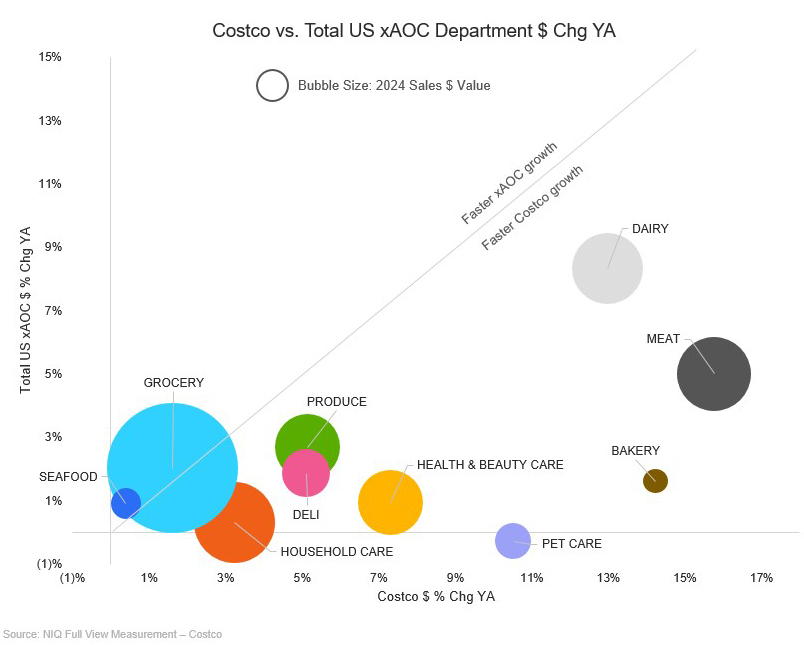

Department-level sales data is the first step in answering that question—and it reveals significant disparities across the club that are worth acting on. Additionally, there are notable differences compared to the total US market for many individual departments. This pattern extends below the department level, with granular subcategories showing similar disparities. Quantifying these differences is invaluable for brands making prioritization decisions within their portfolios and determining which products to invest in as club-packs at the world’s largest club retailer. This information is also helpful in assessing the performance of their retailer-specific products relative to a relevant competitor set and subcategory.

Evaluating Pricing

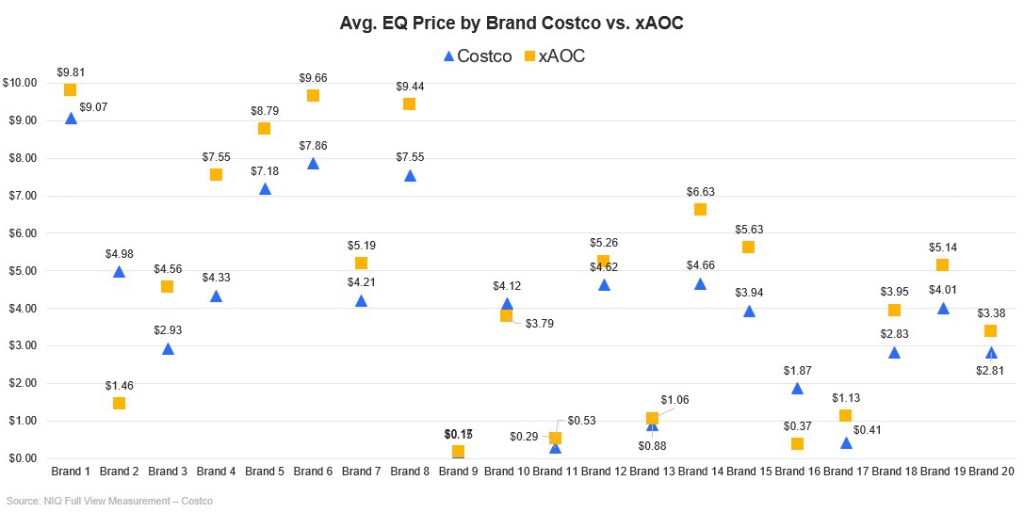

The warehouse club business model is famous for its value positioning, where shoppers buy channel-specific club packs and access superior equivalized (EQ) pricing. For brands, tracking EQ pricing across varied retailers can be daunting, especially for club with its unique pack sizes. FVM – Club allows brands to make these comparisons and uncover insights like the below. For 20 top national brands nationally and at the world’s largest club retailer, the club has superior EQ pricing for 17 out of 20.

Understanding Private Brand Dynamics

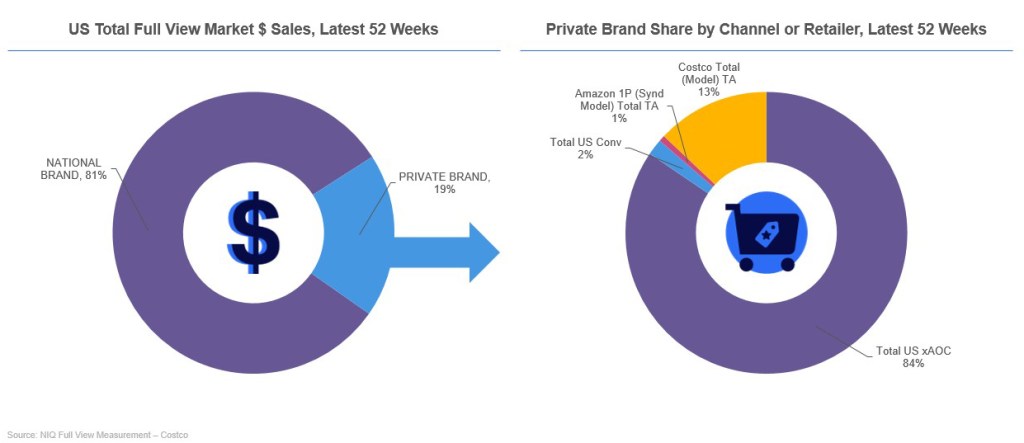

Private brand is a major part of a club retailer’s overall strategy and has a meaningful impact on the dynamics of many categories. Private brand now accounts for 19% of the total US market today, and the world’s largest club retailer makes up 13% of total private brand sales.

FVM – Club quantifies private brand sales down to the item level. This information can help brands understand just how competitive private brand is in their product categories, making them more informed vendors in discussions with their club buyer.

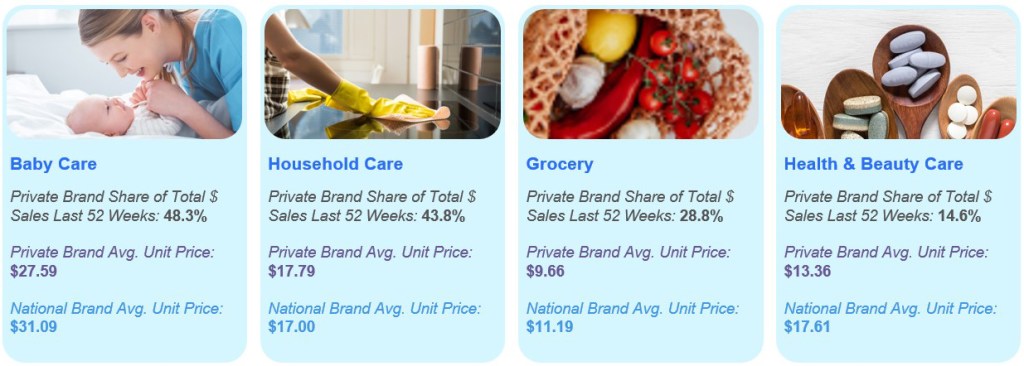

Analyzing a selection of departments at the world’s largest club retailer shows private brand penetration varies. Private brands at club retailers are not positioned purely as a value play, with the high quality of the products being a key consideration for shopper in most cases. But value is still a meaningful part of their positioning. Private brands at the world’s largest club retailer tend to be priced lower or at parity with national brand peers. For example, private brand products in the Health & Beauty department are on average $4.25 less per unit, representing 32% savings, versus national brand competition.

Working with Club Buyers

Given the relatively limited assortment of warehouse clubs, buyers are highly discerning of what they bring to shoppers. Buyers value data-driven insights into consumer trends relevant to the category and analysis of how a particular product may see disproportionate growth because of these trends. FVM – Club allows for the segmentation of data by product attributes, enabling analysis of which attributes are seeing growth – all with comparability to the broader US market or other retailers. This allows brands to bring deep category insights to their buyer on what up-and-coming product trends they should collectively prepare for.

When looking at the data, products with Lactose Free claims saw above-average sales growth in the US in the first three months of the year. These products are seeing even greater success at the world’s largest club retailer (which carries 48 lactose free items), growing substantially faster than the retailer is overall and faster than lactose free products are in the broader US. These types of insights can empower conversations with buyers about adding new lactose free assortment. Demonstrating data-driven innovation to buyers can enhance the overall retailer-brand relationship and perpetuate further success.

Full View™ – Club is here to empower Club Success

The enhanced data granularity and visibility of FVM – Club brings numerous opportunities for better strategic decision making around the club channel. From pricing power to private brand competition, trending attributes to assortment gaps, this dataset gives you the tools to speak the language of club retail —and grow with confidence.