2025 total T&D full-year projection (value growth):

- China: +6%

- Emerging Asia (without China): +4%

- Developed Asia: -2%

2026 home appliance projections (value growth):

- MDA

- China: +4% to 7%

- APAC (without China): -2% to +1%

- SDA

- China: +3% to 6%

- APAC (without China): +1% to 3%

APAC market overview

Price will remain pivotal in China, where 70% of consumers have used the trade-in subsidy to replace items, and in India, where consumers generally prefer to replace items only when they’re broken (aka, unserviceable).

However, even a small increase in spending appetite among middle-income households across these countries’ enormous populations can boost premium sales significantly. Notably, in India, which was recently hit by 50% US tariffs, the government is reforming the income tax and the Goods and Services Tax (GST) to bolster its population’s spending capacity.

Value will be key in the developed economies of Australia, Japan, Singapore, and South Korea—particularly regarding premium purchases with strong and demonstrable benefits for consumers.

Price-sensitive developing markets such as Indonesia, the Philippines, Thailand, and Vietnam also present significant new MDA and SDA sales growth opportunities, particularly for affordable multifunctional products.

What will drive APAC sales growth in 2026?

By appliance type

The most popular large home appliances will offer convenience, multifunctionality, energy efficiency, and convenience. Examples range from premium dishwashers with auto dosing, energy saving, and app controls to smart washer-dryers that automatically identify laundry type and select the optimal program, or dual-drum washing machines that allow for separate washing of different types of clothing. Value for money will be key, as competition increases from Chinese brands offering premium functionality at lower prices. Space-saving and slimline innovations will also see increased demand in key countries such as China, India, Japan, Singapore, and South Korea.

Among small home appliances, demand will be highest for products that offer greater performance, convenience, and/or multifunctionality. Despite consumers in many APAC countries continuing to be price conscious, we expect successful premiumization around these types of appliances. Examples include robotic vacuum cleaners with automatic self-cleaning and switching between wet and dry cleaning; multifunction hairdryers that also straighten and curl hair; pump coffee makers; and all-in-one microwave-cooker-air-fryer-grills.

By channel

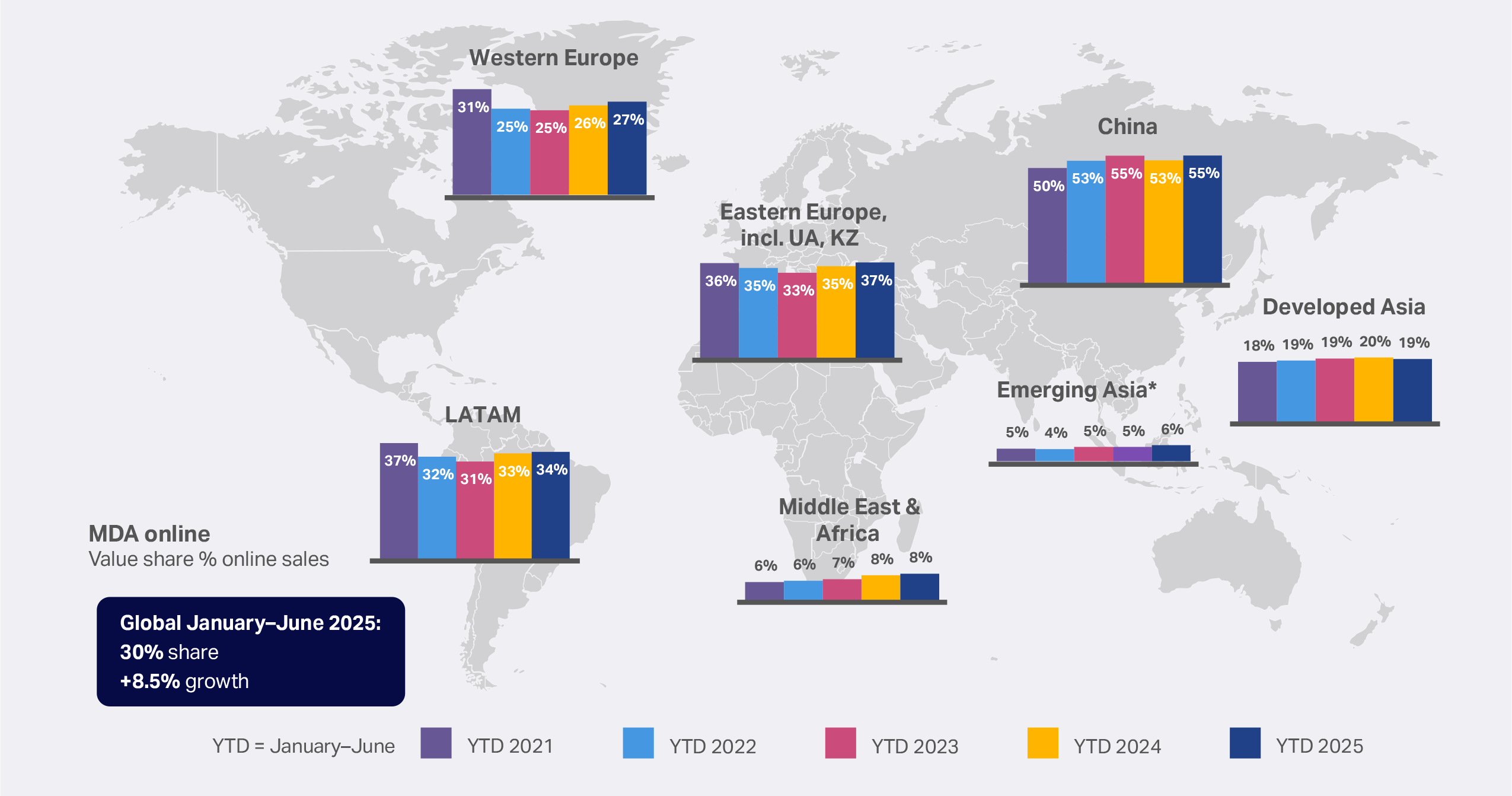

In China, online continues to be the preferred channel for purchase of household appliances, accounting for 95% of SDA sales and 55% of MDA sales in the first half of 2025—with an upward trend over the last five years. In Developed Asia and Emerging Asia, the popularity of online has remained largely stable over the last five years. However, we expect online purchases to grow among the rising numbers of middle-income urban consumers, driven by competition from new brands being offered online.

Across all markets, online channels are gaining additional importance as a consumer touchpoint that often triggers offline purchases. Social e-commerce through TikTok and Instagram will be ever more popular, especially in South Asian markets and China, and online marketplaces will gain further ground. Quick e-commerce will continue to thrive in the urban regions of markets such as India.

SDA online share has always been higher than for Consumer Tech and Durable Goods overall

It continues to grow—and it’s hitting almost 50% in some regions

MDA e-commerce improves over 2025

Online share of total sales grows again in select regions.

By payment model

The popularity of payment models such as “buy now, pay later” or “subscription as a service” will continue to expand in price-conscious markets across the region. For example, consumers in South Korea habitually pay for larger appliances, such as air conditioning units, over three years, during which time the company maintains the product.

By promotional activity

Major annual promotional events—such as Singles’ Day (Double 11) and 618—will continue to dominate sales in Asia. Additionally, double-date promotions—where time-limited discounts are offered on dates such as 1/1, 2/2, etc.—are expected to grow in relevance, particularly for small home appliances, where consumers are more willing to make impulsive purchases when they see an attractive offer. Key markets for this include Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.

APAC key takeaways for 2026

- In major household appliance sales, manufacturers and retailers should prioritize smart energy efficiency and compact forms while capturing growth in air conditioning and AI-enabled washers and dryers.

- MDA should also focus on trade-in and flexible ownership payment models to encourage price-sensitive consumers to replace or upgrade. Fixed monthly payment or buy now, pay later options will remain key in India and Southeast Asia.

- In small household appliances, product innovation should focus on convenience, hygiene, health, and climate change (e.g., air coolers, water purifiers, electric fans, steam cleaning).

- Channel choices will be critical. Sales performance will benefit from the right balance of in-store experiences, effective online presence, and online sales via the savvy use of social commerce.

- “Quick commerce” (ultra-fast delivery) will become another competitive battleground for retailers and brands selling into increasingly urbanized markets, especially India, where consumers will have increased spending capacity from the reductions in the income tax and the Goods and Services Tax (GST).

Get the full global picture

Go to our Home Appliances Outlook 2026: What consumers want report.

NIQ’s home appliances market expert, APAC

Mukund Tripathi

Customer Success Leader, T&D, Southeast Asia, North Asia, and Pacific (SEANAP) and India

Forward-Looking Statements Disclaimer

This report may contain forward-looking statements regarding anticipated consumer behaviors, market trends, and industry developments. These statements reflect current expectations and projections based on available data, historical patterns, and various assumptions. Words such as “expects,” “anticipates,” “projects,” “believes,” “forecasts,” and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future outcomes and are subject to inherent uncertainties, including changes in consumer preferences, economic conditions, technological advancements, and competitive dynamics. Actual results may differ materially from those expressed or implied in these statements. While we strive to base our insights on reliable data and sound methodologies, we undertake no obligation to update any forward-looking statements to reflect future events or circumstances, except to the extent required by applicable law.