2025 total T&D full-year projection (value growth):

- Latin America: +2%

2026 home appliance projections (value growth):

- MDA: +3% to 5%

- SDA: +4% to 6%

LATAM market overview

Established markets, including Brazil, Chile, and Mexico, are seeing moderate value growth in home appliances as volume of demand increases but average prices fall due to competition from attractively priced Chinese brands. Value for money, even in the premium segment, remains important, so brands and retailers need to push products with relevant and compelling features.

Meanwhile, in Argentina, where triple-digit inflation has shackled the market for several years, conditions are stabilizing, and consumers are gradually buying more appliances. From a recent low baseline, therefore, we expect strong growth in this market in 2026.

What will drive LATAM sales growth in 2026?

Convenience, capacity, performance, and space savings will be critical in MDA and SDA purchases next year. Energy efficiency will not be a key factor for many consumers due to the relatively low cost of power in the region. Demand for small home appliances will be boosted by replacement of higher-end items bought during the pandemic.

By appliance type

In major home appliances, tumble dryers will see significant demand in 2026, driven by the current low penetration rates. Freezers will also be in demand among high-income groups wanting extra convenience. In both categories, Chinese brands are increasing the competition across LATAM markets and driving down prices by offering products with strong features at lower cost. Replacement cycles for MDA will start in 2027. Due to many middle- and higher-income households having home help—meaning that the buyer is not always the main product user—innovation around performance will be more in demand than innovation around convenience of use, with items such as smart washing machines becoming more popular.

In small home appliances, product innovation that delivers greater convenience will drive sales, especially as prices fall with recent innovations becoming more mainstream. This will be key in categories such as robotic and wet-dry vacuums, mini ovens, hot beverage machines, and food preparation machines. For personal grooming appliances, there will be opportunities to drive premium sales from 2026, as replacement cycles start to take effect and consumers look to upgrade their current appliance to one offering higher performance, convenience and versatility—such as multifunctional hair dryer/stylers or portable wet-dry shavers for men.

By channel

Across LATAM, sales channel popularity differs substantially across categories and markets. In Chile, for example, following a period of economic decline, online sales are growing rapidly. But trust in online shopping channels remains low in some other LATAM markets.

In the first half of 2025, half (50%) of SDA and one-third (34%) of MDA purchases were made online, with both showing a steady increase over the last three years. In 2026, the popularity of online marketplaces is expected to grow as customers see value in being able to compare prices, features, and user reviews quickly and conveniently

SDA online share has always been higher than for Consumer Tech and Durable Goods overall

It continues to grow—and it’s hitting almost 50% in some regions

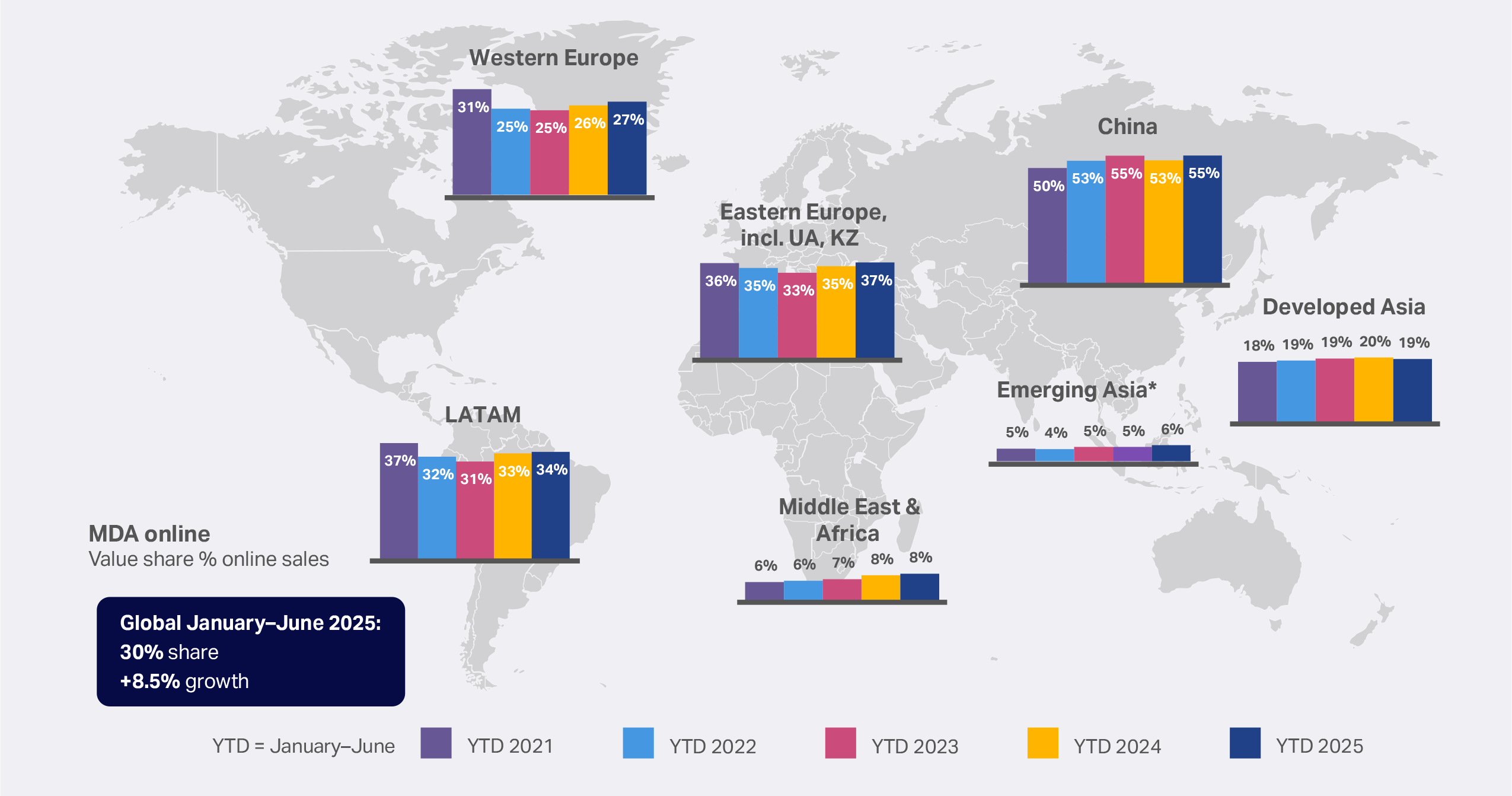

MDA e-commerce improves over 2025

Online share of total sales grows again in select regions.

By payment model

Flexible payment options, such as monthly installments or subscription or rental models, will continue to be in demand in 2026. These flexible options offer retailers an opportunity to not only differentiate themselves from competitors, but also to encourage consumers to look at more premium products that they might not otherwise be able to afford, all in one go.

LATAM key takeaways for 2026

- In major household appliance sales, brands and retailers will focus on tumble dryers and freezers as growth segments with currently low penetration, alongside smart cooling.

- In small household appliances, we expect demand in products offering higher levels of convenience and/or performance, such as robot vacuum cleaners, and multifunctional food kitchen appliances.

- With the port in Chancay, Peru, serving to increase Chinese imports, all established manufacturers within LATAM will increasingly need to offer affordable premium items to remain competitive.

- It will be critical, too, for retailers to upgrade their online offerings by improving product assortments and consumer experiences across research, buying, and delivery, to strengthen trust.

Get the full global picture

Go to our Home Appliances Outlook 2026: What consumers want report.

NIQ’s home appliances market expert, LATAM

Enrique Espinosa de los Monteros

Regional Director, T&D, LATAM

Forward-Looking Statements Disclaimer

This report may contain forward-looking statements regarding anticipated consumer behaviors, market trends, and industry developments. These statements reflect current expectations and projections based on available data, historical patterns, and various assumptions. Words such as “expects,” “anticipates,” “projects,” “believes,” “forecasts,” and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future outcomes and are subject to inherent uncertainties, including changes in consumer preferences, economic conditions, technological advancements, and competitive dynamics. Actual results may differ materially from those expressed or implied in these statements. While we strive to base our insights on reliable data and sound methodologies, we undertake no obligation to update any forward-looking statements to reflect future events or circumstances, except to the extent required by applicable law.