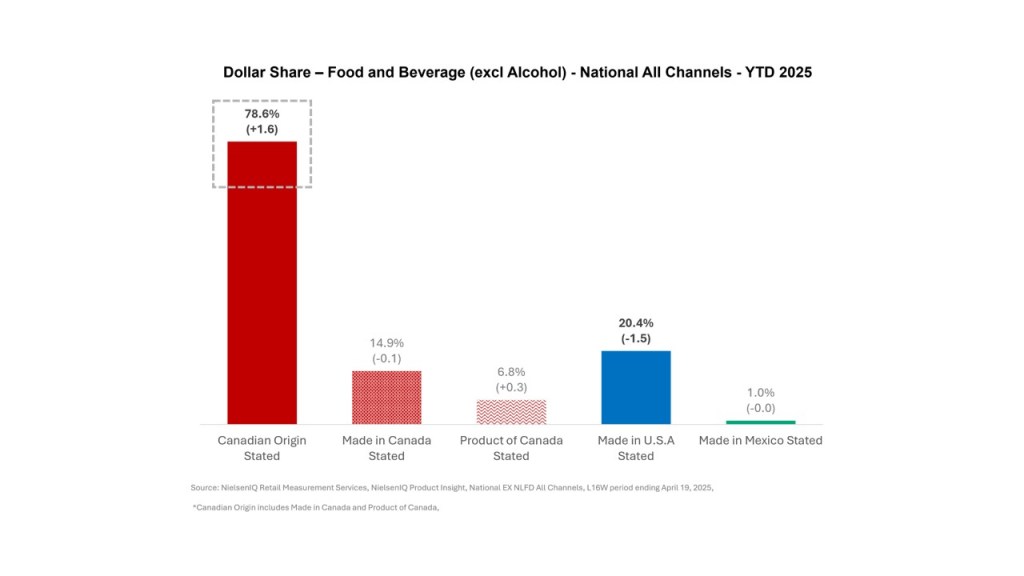

In Part 2, we examined how rising national pride was fueling a “Buy Canadian” mindset. That momentum has only grown. Canadian-made food products, in particular, are thriving—winning share from U.S. competitors and driving category growth despite a 16% higher average unit price. In Personal Care, where U.S. brands dominate, Canadian options are fewer but gaining visibility through strategic advertising and display. As consumer habits solidify, the opportunity for Canadian brands to lead—and grow—has never been clearer.

Download the full Part 3 report

The Retail Ripple of Patriotic Sentiment, to explore the data behind this shift, category-level insights, and what it means for manufacturers and retailers navigating a more nationally conscious consumer landscape. Discover how Canadian origin is not just a label—it’s a growth strategy.