Why Men’s Grooming Is on the Rise

The surge in men’s grooming reflects a broader cultural shift toward self-care and wellness. Men are increasingly prioritizing appearance and health, with 60% purchasing products to maintain their look over time. Social media influence, humor-driven branding, and the appeal of natural, multifunctional products have made grooming more accessible and aspirational. Combined with the convenience of online shopping and the rise of gifting occasions, these factors are transforming men’s grooming from a basic routine into a lifestyle category with sustained growth potential.

Key Trends and Consumer Insights

Men’s attitudes toward personal care are evolving—59% express concern about aging, and 40% believe premium brands are worth the price. Humor-driven branding and scent variety continue to resonate, especially among Millennials and households with teens, which spend 26% more than average. Social media plays a pivotal role, with TikTok and Instagram accelerating brand engagement. Emerging brands like Dr. Squatch and Dude Wipes are thriving by blending natural positioning with playful messaging.

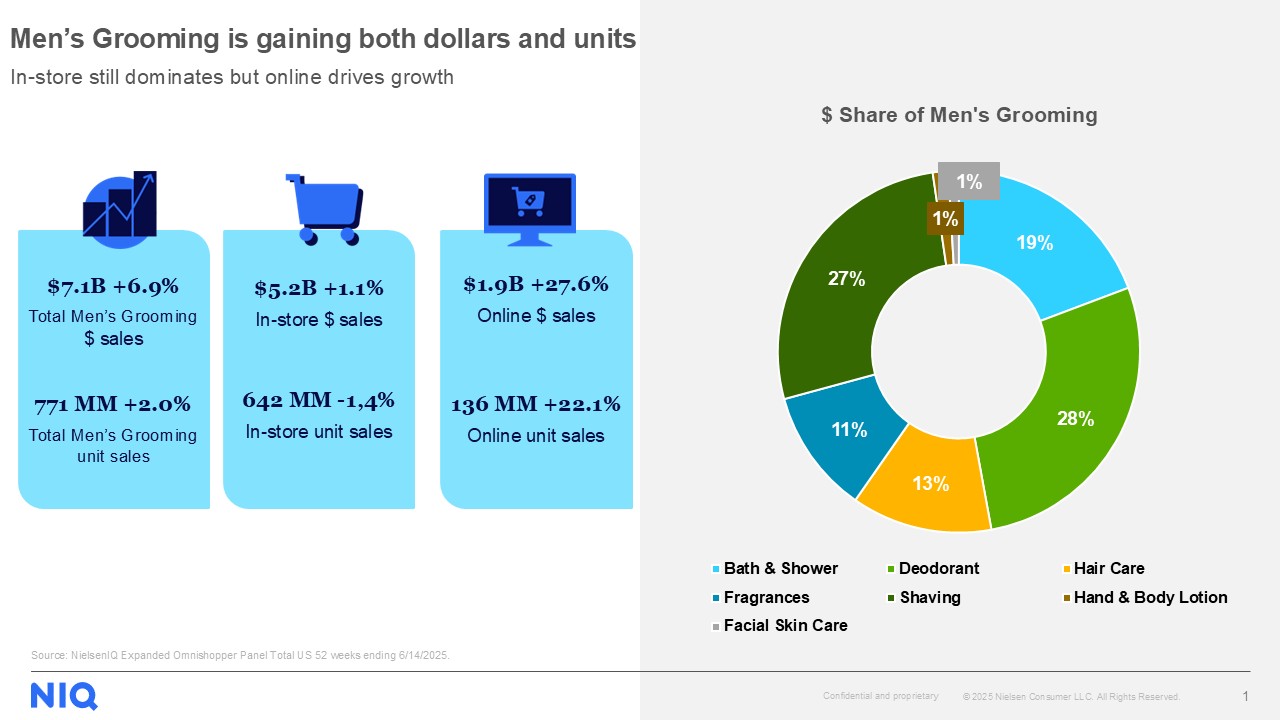

Category Highlights and Opportunities

Bath & Shower leads the category, with body wash commanding a $1 billion in sales, while bar soap posted 33% growth. Deodorants grew 11.4%, propelled by whole-body formats (+150%). Shaving rebounded with 14.5% growth, thanks to Gillette’s dominance and rapid gains from Harry’s and Manscaped. Hair care remains fragmented but shows promise in premium and growth-focused products. For brands, opportunities lie in multifunctional products, clean ingredient claims, and strategic pricing across mass and digital channels.

New Report: