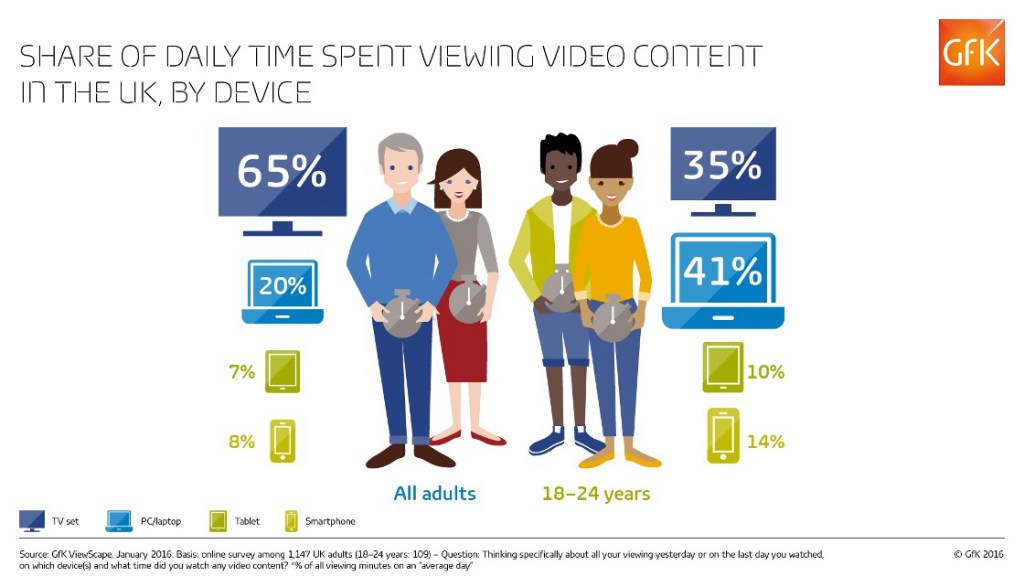

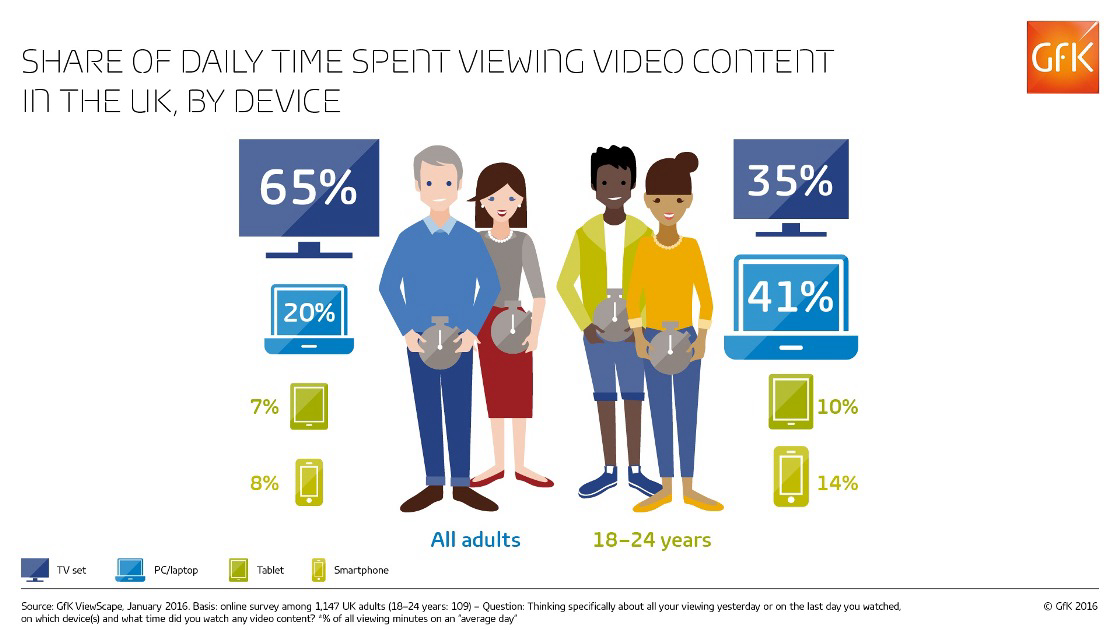

Nuremberg, July 27, 2016 – TV sets are still the preferred viewing device for video-based content1 among the UK adult online population overall, but younger adults show significant deviation from this trend.

Findings just released from GfK’s international ViewScape study show that, when it comes to watching video-based content, UK adults spend two-thirds (65 percent) of their total viewing time watching via TV sets. Only a fifth (20 percent) of total viewing is via PCs or laptops.

For the UK’s young adults (those aged 18 to 24), the picture is quite different and the majority of their viewing time is spent on PCs or laptops. This accounts for 41 percent of their total video viewing, while viewing on a TV set accounts for just over a third (35 percent).

Julia Lamaison, director of media research and insights at GfK, comments, “There are many reasons underlying these findings, including the trend for this younger age group to view less live or scheduled TV content and more on-demand and online streamed video. Added to that is the fact that access to a TV set is lower amongst this group than for all adults: only 84 percent of these young adults say they own a TV set, compared to 95 percent amongst all adults.”

Traditional TV programs and movies drive viewing on PC/laptops more than online video

On the average day, British adults spend around 55 minutes viewing video content via a PC or laptop – with two thirds (67 percent) of the content viewed being traditional formats: TV programs and movies.

For those aged 18 to 24 years old, time spent viewing on a PC or laptop almost triples to 2 hours and 35 minutes per day, with nearly three quarters (73 percent) of that content comprising TV programs and movies. This underlines the importance of content derived from linear broadcast channels.

Whilst this may be watched on-demand or time-shifted, as well as live, traditional TV and movie content still drives the majority of our time spent viewing. Moreover, whilst Britain’s 18 to 24 year olds are conventionally light TV viewers (making them a hard-to-reach group with high commercial value), they are a generation driven by consumption and sharing of visual content and are voracious consumers of video overall.

Lamaison explains, “We are seeing evidence of real change in the ways in which audiences in the UK consume video content – and nowhere is this more evident than amongst young adults. Findings from our recently released ViewScape study show a new generation of young adults who are completely engaged with video, but who are viewing in a variety of different ways and using a wider range of devices than previous generations.

“This presents opportunities – and challenges – for broadcasters, producers and distributors, as they seek to enable audiences to self-curate their viewing options, in addition to traditional forms of linear consumption.”

GfK’s ViewScape study is run in 14 countries: Australia, Brazil, France, Germany, India, Italy, Japan, Netherlands, Mexico, Singapore, Spain, Sweden, UK, US.

Full country reports are available for purchase.

Notes for editors

1Total video content is defined as all of the following:

- Free TV via set top box or integrated into your TV (e.g FreeView, Freesat, Youview)

- Pay TV that you pay a monthly fee to receive (e.g Sky, BT Vision, Virgin Media)

- Free On-Demand offered free as part of your Pay TV package

- Free TV Catch-up (e.g. All4, BBC iplayer, ITV Hub)

- Free online video websites and apps (e.g YouTube, Facebook)

- Free other sources of video content (e.g Bittorrent, The Pirate Bay, , etc)

- Pay per view (rent) video on demand services (e.g Sky Movies Box Office, BT Store etc)

- Paid for download to own video content (eg. iTunes, Google Play)

- Paid for on-demand streaming services that you pay a subscription to receive (Netflix, Amazon Prime, Now TV)

- DVDs/Blu-Ray disks that have been purchased or rented

About the survey

GfK’s ViewScape study interviewed 1,147 adults (aged 18+) online in UK. The study explores awareness, access to, and usage of, all available sources of video content, and measures audience consumption by provider/device and type of video content.

Fieldwork was carried out between November and December 2015, with data weighted to be representative of the online UK population by age, gender, income and internet usage. Data are also weighted by day of week.