Consumer Climate in Germany continues its recovery in October.

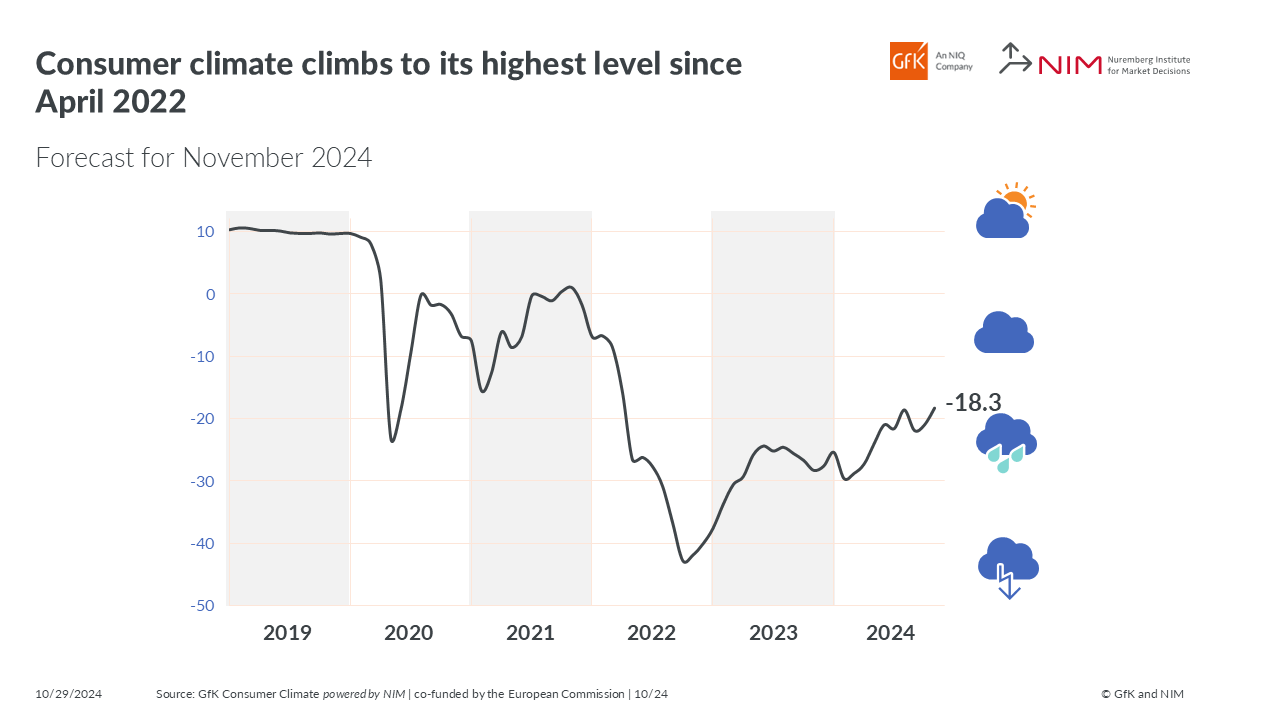

Nürnberg, October 29 2024 – Consumer Climate in Germany continues its recovery in October. As both income expectations and the willingness to buy show an improvement for the second time in a row and the willingness to save falls slightly, the Consumer Climate forecast also improves for the second time in a row: for November, the Consumer Climate is forecast to rise by 2.7 points to -18.3 points compared to the previous month (revised -21.0 points). This is the highest value since April 2022 – although the level of Consumer Climate still remains low. However, German consumers are once again somewhat more pessimistic about overall economic development. This is shown by the latest results of the GfK Consumer Climate powered by NIM. It has been published jointly by GfK and the Nuremberg Institute for Market Decisions (NIM), founder of GfK, since October 2023.

The increased willingness to buy, but above all the more optimistic income prospects, are the reason that the Consumer Climate continues its recovery. A moderate decline of 4.8 points in the willingness to save supports this positive development.

“Following the slight improvement in the previous month, the Consumer Climate continues to improve. It has climbed to its highest level since April 2022, when -15.7 points were measured after the start of the war in Ukraine,” explains Rolf Bürkl, consumer expert at NIM. “But despite the increase, the level of Consumer Climate remains very low. The uncertainty caused by crises, wars and rising prices is still very much present and is preventing factors that encourage consumption, e.g. the real income growth, from taking full effect. Reports of a rising number of company insolvencies and plans to cut jobs or relocate production abroad are also preventing a more significant recovery in consumer sentiment.”

Negative trend in economic expectations continues

In contrast to consumer sentiment, German consumers are once again somewhat more pessimistic about economic development over the next 12 months. Their economic expectations are falling for the third time in a row. With a slight drop of 0.5 points, the economic indicator currently stands at 0.2 points. A lower value was last measured in March 2024 with -3.1 points.

The German government has also revised its forecast for economic growth downwards this year. Gross domestic product is now expected to fall by 0.2 percent.

Income expectations continue to recover

For the second time in a row, respondents are slightly more optimistic about their own household’s future financial situation regarding the next 12 months. The income expectations indicator increased by 3.6 points compared to the previous month, climbing to 13.7 points. Compared to the same period last year, the increase is a significant 29 points.

Falling inflation rates and significantly rising wages and salaries are currently causing real income growth to rise significantly. Pensioners are also currently experiencing a real increase in income.

Willingness to buy climbs to highest level since March 2022

Rising income optimism has a positive effect on willingness to buy. The indicator gained 2.2 points and now stands at -4.7 points. This is the highest level in more than two and a half years: The last time a better value was measured was in March 2022 with -2.1 points. The willingness to buy is therefore currently showing a slight upward trend. However, the level is still very low. In addition, further negative circumstances may arise in the coming months: Unemployment and the number of company insolvencies have risen slightly recently. This will increase job concerns for employees. And this concern can have a negative impact for the willingness to consume.

The following diagram shows how the Consumer Climate indicator has developed over recent years:

Planned publication dates 2024 (CET):

- Wednesday, November 27, 2024, 8 a.m.

Please note: the time of publication on 27.11.24 has been postponed from 8:00 a.m. to 10:30 a.m. - Thursday, December 19, 2024, 8 a.m.

About our method

The survey period for the current analysis was October 4 to October 15, 2024. The results are extracted from the “GfK Consumer Climate powered by NIM” study and are based on around 2,000 consumer interviews per month conducted on behalf of the European Commission. The report presents the indicators in the form of graphics accompanied by brief comments. Consumer sentiment refers explicitly to all private consumer spending. Depending on the definition used, however, retail accounts for only around 30 percent of private consumer spending. Services, travel, housing costs, healthcare services, and the wellness sector as a whole account for the rest. Again, this does not apply to retail sales, but instead to total consumer spending. Like all other indicators, willingness to buy is a confidence indicator. It indicates whether consumers currently consider it advisable to make larger purchases. Even if they answer “Yes” to this question, there are two further requirements for making a purchase: The consumer must have both money required for such a large purchase and must also see a need to make this purchase. Furthermore, this only concerns durable consumer goods that also require a larger budget.

GfK Consumer Climate powered by NIM

The GfK Consumer Climate survey, which is being conducted regularly since 1974 and monthly since 1980, is regarded as an important indicator of German consumer behavior and a guiding light for Germany’s economic development. Since October 2023, the Consumer Climate data collected by GfK has been analyzed and published jointly with the Nuremberg Institute for Market Decisions (NIM), the founder of GfK. By joining forces, it will be possible to invest further in the analysis and development of the Consumer Climate study to gain an even better understanding of the background to changes in consumer confidence.

About GfK – a NielsenIQ company

For 90 years, clients around the world have trusted us to provide data-driven answers to key questions for their decision-making processes. We support their growth through our comprehensive understanding of buying behavior and the dynamics that influence markets, brands, and media trends. In 2023, industry leaders GfK and NielsenIQ have merged to offer their clients unparalleled global reach. With a holistic view of retail and the most comprehensive consumer insights, provided by forward-looking analytics on state-of-the-art platforms, GfK is driving “Growth from Knowledge.”

About NIM

The Nuremberg Institute for Market Decisions (NIM) is a non-profit research institute at the interface of academia and practice. NIM examines how consumer decisions change due to new technology, societal trends or the application of behavioral science, and what the resulting micro- and macroeconomic impacts are for the market and for society as a whole. A better understanding of consumer decisions and their impacts helps society, businesses, politics, and consumers make better decisions with regard to “prosperity for all” in the sense of the social-ecological market system. The Nuremberg Institute for Market Decisions is the founder of GfK. Further information is available at https://www.nim.org.