- The last four weeks saw Total Till growth slow to +4.0% from +4.7% recorded last month.

- Online FMCG sales grew (+4.7%) boosting the channel’s share of FMCG sales to 12.9% an increase from 12.7% four weeks ago.

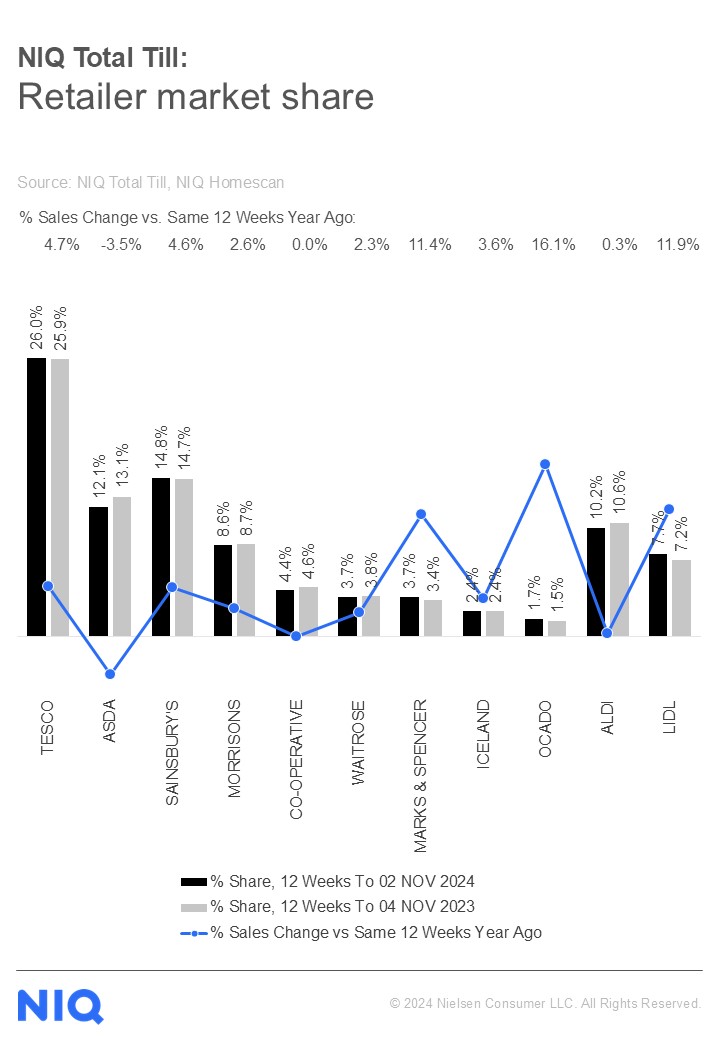

- Ocado, Lidl and M&S lead as the fastest growing retailers in the last 12 weeks.

London, 13 November 2024: Total Till sales slowed down at UK supermarkets (+4.0%) in the last four weeks ending 2nd November 2024, down from +4.7% in the previous month, according to new data released today by NIQ. This is likely due to shoppers intentionally holding back their spend in anticipation of upcoming Christmas festivities and Black Friday promotions at the end of the month.

Despite slowing inflation, NIQ data reveals that shoppers remain cautious with their grocery shop, with spend per visit down 6% on last year at £18.67. Shoppers are also being savvy with how they spend as NIQ data shows a slight increase in sales for items on promotion, with sales at 25%, up from 24%. The biggest increase for this came from brands, with 36% of branded sales coming from promotions – up from 35% a year ago with brands heavily reliant on shopper purchasing in Q4, for example beer, wine and spirits, continuing to push for volume growth1.

With shoppers looking ahead to the Christmas period, online sales increased (+4.7%) in the four week period, boosting the channel’s market share to 12.9%1 up from 12.7% last month. Confectionery (+10.5%) was the fastest growing category over the four week period, as shoppers stocked up on sweets for Halloween and Christmas. Almost 1 million shoppers purchased Christmas chocolate tins in the last 4 weeks and 4% of households bought chocolate advent calendars. However, shoppers reigned in on essentials with subdued growth in the packaged grocery category (+1.7%) and a decline in unit growth (-0.8%)2.

Moreover, despite an increased level of promotions, shoppers have cut back on purchasing beer, wine and spirits with a unit sales decline of -0.4% – a sign that shoppers are holding back until nearer the festivities. 2 In fact, NIQ Homescan survey shows that price reductions and promotions are almost expected by consumers ahead of Christmas. The most popular being retailer vouchers with money off (24%, up from 17% last year) and product promotions (35% up from 29% last year) which are the key factors considered by shoppers when choosing their Christmas store3.

The latest data also shows that the cautious consumer sentiment has also put pressure on general merchandise with sales value down (-1.4%) and unit growth (-5.5%)2.

In terms of retailer performance over the last 12 weeks, the fastest-growing retailers were Ocado (+16.1%), Lidl (+11.9%) and Marks and Spencer (+11.4%). Tesco (+4.7%) and Sainsbury’s (+4.6%) also gained market share.

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, said: “Total Till sales over the last four weeks have slowed, with shoppers pulling back their spend. Shoppers so far have been cautious and it’s evident that they are saving on grocery essentials to be able to afford treats and indulgences and we have a polarised consumer with 50% of households continuing to feel pressure on personal finances.”

Mike Watkins adds: “However, the start of the Christmas advertising campaigns are an opportunity for brands and retailers to entice consumers and showcase what’s new and what’s different. And given that it’s possible that many shoppers will ‘dine at home’ more in the next few weeks, we expect this to boost sales in premium private label food and drink, which NIQ expects to do very well this Christmas.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change.

Notes

Unless otherwise stated all data is NIQ Homescan Total Till

1 NIQ Homescan FMCG

2 NIQ Scantrack Grocery Multiples

3 NIQHomescan Survey October2024.

About NIQ Homescan Total Till

NIQ’s continuous panel of 30,000 GB households and our widest read of retailer performance is designed to measure household purchasing through major supermarkets intended for in-home consumption and brought back into the home. It includes all food and drink, household, and personal care and an estimate of non-food spend (e.g. clothing, electrical, cards and stationery, newspapers & magazines, toys, music, general merchandise, etc.).

About NIQ

NielsenIQ (NIQ) is the world’s leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. NIQ combined with GfK in 2023, bringing together the two industry leaders with unparalleled global reach. Today NIQ has operations in more than 95 countries covering 97% of GDP. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View™.

For more information, please visit www.niq.com