- Total Till sales growth slows (+3%) in the last four weeks compared to growth over Easter (+9.6%).

- Discounters led the pack (+6%) as the fastest growing channel over the last 12 weeks as shoppers opted to save on groceries to make up for enjoying celebratory treats in the previous month.

- In-store visits increased (+7%) compared to the same time last year while online sales growth fell (-1.7%) with the channel also seeing its overall share of grocery sales fall to +12.3%.

- Brits go fresh with meat, fish and poultry (+8.4%) being the fastest growing super category.

London, 29 May 2025: Total Till sales growth slows to +3% at UK supermarkets in the last four weeks ending 17th May 2025. This is down from the +9.6% recorded last month, according to new data released today by NielsenIQ (NIQ).

The lower growth rate is a reset as shoppers reign back spending on groceries after treating themselves over the Easter holidays, and unit sales at the Grocery Multiples fell -1.4% compared to a year ago. This change in spending has been seen across in store and online formats and FMCG spend per visit fell (-4.2%) to £18.2. The number of items in the shopping basket also fell compared to last year, indicative of a cautious consumer faced with rising household bills since April.

However, in-store visits are up +7% compared to this time last year, as shoppers take advantage of ongoing retailer promotions. 23% of FMCG sales were on promotion, this is down slightly from the 5 year high at Easter but is helping consumers save more at the checkout. NIQ data also reveals that 41% of households say that loyalty card promotions also influence where they choose to shop1 which is also helping to drive the increased frequency of visit to stores.

Online sales were relatively weaker with sales down 1.7% on this time last year and online share of grocery sales fell slightly to 12.3%. The number of orders has continued to increase but the average size of order is getting smaller and the number of GB households shopping online every 4 weeks has plateaued this year at 27%2.

In terms of category performance, the fastest growing super categories were meat, fish and poultry (value sales +8.4% and unit growth +1.5%) signifying continued shopper habits to prioritise healthier options and enjoying home cooked meals. Warmer weather and sunshine also led to growth in soft drinks (+6.7% and +1.2%) with Ice cream value sales up +13% and suncare sales soaring +20% 3 .

In contrast, the weakest super categories were packaged grocery where value sales fell -1.5% and unit sales -5.4% as well as Beer, Wine and Spirits (value sales -2.1% with unit sales down -3.8%).

Mike Watkins, Head of Retailer and Business Insight at NIQ, says: “There has been a reset in spending in recent weeks despite the continued good weather which is indicative of a change in shopper behaviour after Easter. Shoppers are still prepared to indulge but are holding back spending on some categories such as household, pet and also some frozen foods”.

Watkins adds: “Consumer confidence improved a little in May but it is still negative (-20 according to GFK), and shoppers are uncertain about their personal finances. The settled warmer weather gave retailers a boost as shoppers were able to plan more outdoor activities and enjoy alfresco dining, aswell as bring forward spend on fresh foods and drinks. However, with shop price inflation in food starting to move up (+2.8% in May, NIQ BRC) we expect Total Till value growth to now remain at around 3% in June.”

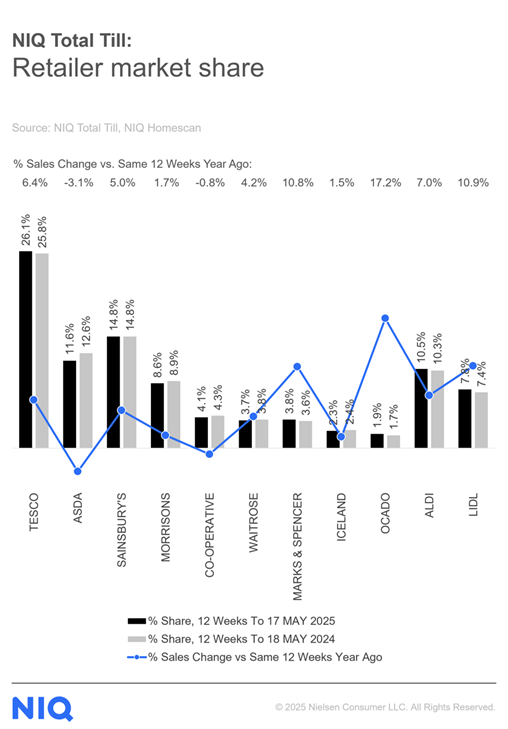

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

About NIQ Homescan Total Till

NIQ’s continuous panel of 30,000 GB households and our widest read of retailer performance is designed to measure household purchasing through major supermarkets intended for in-home consumption and brought back into the home. It includes all food and drink, household, and personal care and an estimate of non-food spend (e.g. clothing, electrical, cards and stationery, newspapers & magazines, toys, music, general merchandise, etc.).

About NIQ

NielsenIQ (NIQ) is a leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. NIQ combined with GfK in 2023, bringing together two industry leaders with unparalleled global reach. Our global reach spans over 90 countries covering approximately 85% of the world’s population and more than $ 7.2 trillion in global consumer spend. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View™.

For more information, please visit www.niq.com