- Total Till sales grew by +5.8% in the last four weeks, up from +3.8% the previous month, the highest four weekly Total Till growth since August 2024 (excluding Christmas and Easter).

- Warm weather boosted value sales of classic summer staples including cider (+11.2%) and fresh cream (+13.8%). Shoppers also spent £132 million on strawberries.

- Discounters remain the fastest growing channel with FMCG sales growth of +8.7% as almost two-thirds of GB households shop at either Aldi or Lidl in the last four weeks.

London, 23 July 2025: Total Till sales growth at UK supermarkets soared (+5.8%) in the last four weeks ending 12th July 2025, up from (+3.8%) recorded in June according to new data released today by NielsenIQ (NIQ).

With three heatwaves in four weeks and the hottest week of the year ending 12th July, the sunny spell hit just as the summer of sport peaked. Big events like Wimbledon and the Women’s Euros helped move the dial on impulse purchasing, boosting incremental spend across categories. In this week sales peaked at +7.9%.1

And, as shoppers looked to stay cool in the continued warm weather, sales of air conditioners, fans and air treatments (humidifiers) increased +135%.2

The 4 weeks saw an increase in unit sales for soft drinks (+14%), with value sales up (+21%). There was also double digit growth in value sales for frozen food (+12%) – driven by ice cream and desserts. General merchandise also saw a lift in value sales, helped by more outdoor living and dining. 1

The warm weather also boosted sales of classic summer staples: cider saw a +11.2% rise in value while fresh cream surged +13.8%. Strawberries remained a seasonal favourite, with £132 million spent over the period (+18.5%) and 58.6 million units sold (+15.3%).1

NIQ data shows that shoppers, however, continue to manage budgets carefully with the number of items bought per shopping trip continuing to be less than last year (-4%) balanced by more shopping occasions (+5.6%) as shoppers visit stores more often to hunt down savings across supermarkets, discounters, and value retailers. 3

Retailers are doubling down on value-for-money campaigns and focussing on price cuts delivered through member loyalty schemes. However, overall promotional activity has held steady, with 23% of value sales coming from promotions, just slightly down from 24% last year.

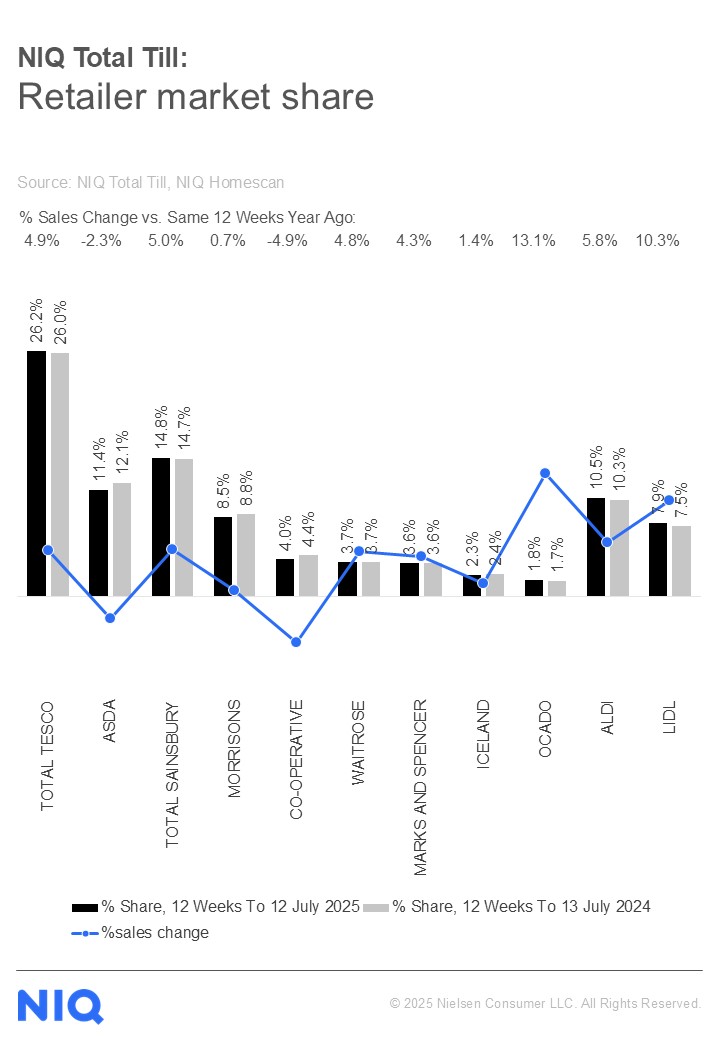

In terms of retailer performance, Ocado (+13.1%) and Lidl (+10.3%) remain the fastest growing retailers. Discounters remain the fastest growing channel with FMCG sales growth of +8.7% and almost two-thirds of GB households shopping at either Aldi or Lidl in the last four weeks.

Growth at Sainsbury’s (+5.0%) and Tesco (+4.9%) was ahead of Morrisons (+0.7%) and Asda (-2.3%). Waitrose also experienced good momentum with a +4.8% growth in sales.

Mike Watkins, Head of Retailer and Business Insight at NielsenIQ, said: “While Asda sales are still in decline, the trend is improving. Despite the average spend per visit being down due to the deflationary impact of Rollback prices, there are green shoots of recovery as the percentage of shoppers visiting Asda held at just over 50% over the last 12 weeks. And in the last four weeks, visits were up just over 5% which is in line with the industry.”

Watkins adds: “The summer holiday season is now in full swing, but consumer purchasing habits tend to become less predictable during this period. The outlook for the next six weeks depends on two key factors: First, with the rising cost of eating out, shoppers may decide to prepare more meals at home. Second, inflation is expected to climb further, which could affect how much shoppers are able to spend. Nevertheless, price competition among retailers will give shoppers more opportunities to save by comparing prices and shopping around.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

Notes

Unless otherwise stated all data is NIQ Homescan Total Till

1 NIQ Scantrack GB (Total Coverage)

2 GfK Total Cooling Products 4 weeks ending 28.06.25

3 NIQ Homescan FMCG

About NIQ Homescan Total Till

NIQ’s continuous panel of 30,000 GB households and our widest read of retailer performance is designed to measure household purchasing through major supermarkets intended for in-home consumption and brought back into the home. It includes all food and drink, household, and personal care and an estimate of non-food spend (e.g. clothing, electrical, cards and stationery, newspapers & magazines, toys, music, general merchandise, etc.).

About NIQ

NielsenIQ (NIQ) is a leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. NIQ combined with GfK in 2023, bringing together two industry leaders with unparalleled global reach. Our global reach spans over 90 countries covering approximately 85% of the world’s population and more than $ 7.2 trillion in global consumer spend. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View™.

For more information, please visit www.niq.com