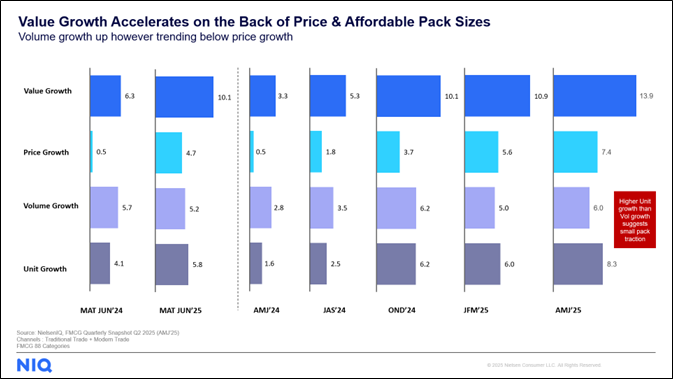

Mumbai – August 13, 2025: NielsenIQ (“NIQ”), a leading consumer intelligence company, in its Quarterly Snapshot for Q2’25 (AMJ’25) reports that India’s FMCG (Fast moving consumer goods) industry achieved a 13.9% value growth vs. Q2’24, driven by sustained rural demand and a steady urban recovery. The market recorded a 6% rise in volume alongside a 7.4% increase in prices, with unit growth outpacing overall volume growth—signaling a stronger consumer preference for smaller packs. (Refer to Chart 1). Rural markets grew faster than urban areas for the sixth consecutive quarter, while urban regions continued to rebound, narrowing the growth gap.

Sharang Pant, Head of FMCG Customer Success at NielsenIQ in India, stated: “The Indian FMCG sector continues to demonstrate resilience, with rural markets leading the charge for six consecutive quarters. While urban recovery is gaining traction, particularly in smaller towns, rural demand remains the cornerstone of volume expansion. E-commerce is emerging as a key growth engine, especially in the top eight metros. With inflation easing and a favorable monsoon forecast, the outlook for consumption remains optimistic. However, sustaining this momentum will require deeper channel engagement and sharper, value-led propositions. The industry is entering a phase where agility and consumer-centric innovation will be critical to future success. Additionally, the rapid rise of small manufacturers outpacing overall industry growth highlights shifting market dynamics and intensifying competition.”

Source: NielsenIQ, FMCG Quarterly Snapshot Q2’25 (AMJ’26)

Market Dynamics: Rural Demand Sustains FMCG Growth Momentum

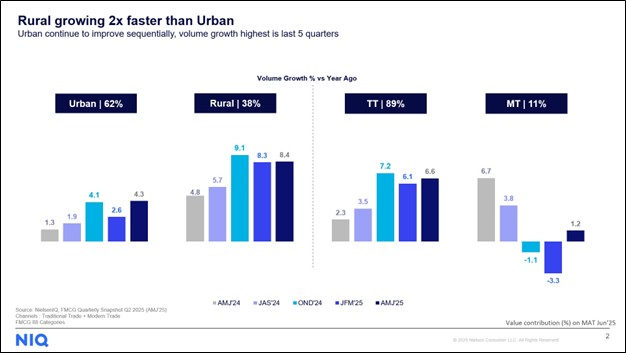

Rural India has outpaced urban regions in volume growth for six consecutive quarters, recording an 8.4% increase compared to 4.6% in urban areas. However, the gap is narrowing as urban areas show signs of sequential recovery. (Refer to chart 2). This resurgence is primarily driven by smaller towns, while metropolitan areas continue to experience a decline in consumption owing to channel shift.

Source: NielsenIQ Quarterly Snapshot Q2’25 (AMJ’26)

Rural Demand Lifts HPC Growth as Food Consumption Slows in Q2 2025

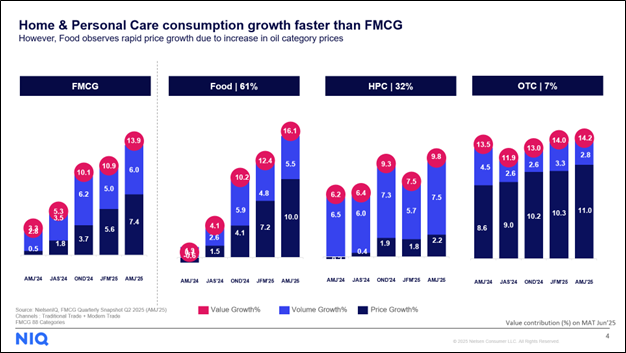

In Q2 2025, food consumption largely remained stable at 5.5%, driven by increased volumes in staples and impulse categories. Meanwhile, Home and Personal Care (HPC) saw stronger momentum, with 7.5% consumption growth. Over the counter categories posted a robust 14.2% increase in value sales, largely driven by an 11.0% rise in prices. (Refer to chart 3).

Source: NielsenIQ, FMCG Quarterly Snapshot Q2’25 (AMJ’25)

E-commerce Gains Ground

E-commerce continues its upward trajectory, gaining ground on modern trade (MT) in eight Metros. Southern metros are leading the e-commerce charge, with a higher share at 18.4%, compared to 15.8% in eight Metros in Q2’25. Even though e-commerce accounts for just 11–13% of FMCG value share in Metros, it’s already delivering more than half of the omnichannel growth. Despite the pullback of quick commerce dark stores, Q2’25 consumption in e-commerce surged—driven by higher shopper penetration and consistent spending, even among new shoppers.

Small Manufacturers Maintain Steady Growth

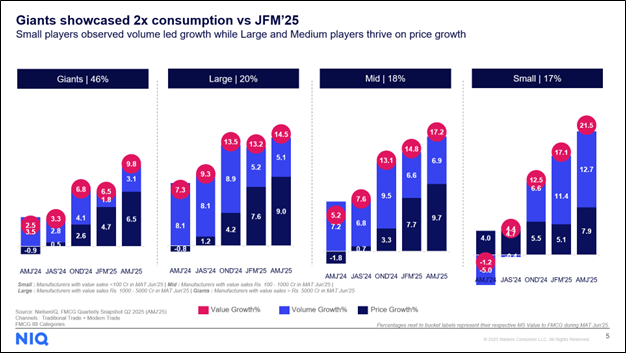

Small manufacturers continued to drive FMCG consumption in Q2 2025, supported by steady volume growth across both Food and HPC categories on a lower base. In contrast, large players saw stable growth. A combination of strong rural demand, and easing inflation has enabled small players to outperform overall industry growth. (Refer to chart 4).

Source: NielsenIQ, FMCG Quarterly Snapshot Q2’25 (AMJ’25)

About NIQ

NielsenIQ (NIQ) is a leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. Our global reach spans over 90 countries covering approximately 85% of the world’s population and more than $7.2 trillion in global consumer spend. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View™.

For more information, please visit www.niq.com.

Forward-Looking Statements Disclaimer

This press release may contain forward-looking statements regarding anticipated consumer behaviors, market trends, and industry developments. These statements reflect current expectations and projections based on available data, historical patterns, and various assumptions. Words such as “expects,” “anticipates,” “projects,” “believes,” “forecasts,” and similar expressions are intended to identify such forward-looking statements.

These statements are not guarantees of future outcomes and are subject to inherent uncertainties, including changes in consumer preferences, economic conditions, technological advancements, and competitive dynamics. Actual results may differ materially from those expressed or implied in these statements.

While we strive to base our insights on reliable data and sound methodologies, we undertake no obligation to update any forward-looking statements to reflect future events or circumstances, except to the extent required by applicable law.

Media Contact

Liza Martja: liza.martja@nielseniq.com