The squeeze on disposable income and low UK consumer confidence push households to cut back during retail’s biggest annual event

London, 5th December 2025: Despite its status as one of the most critical dates in the UK retail calendar, Black Friday failed to deliver in 2025, with declines across both Tech and Home. It is a sobering reflection of the pressure facing UK households as they confront the cost-of-living squeeze, rising economic uncertainty, and weakening confidence.

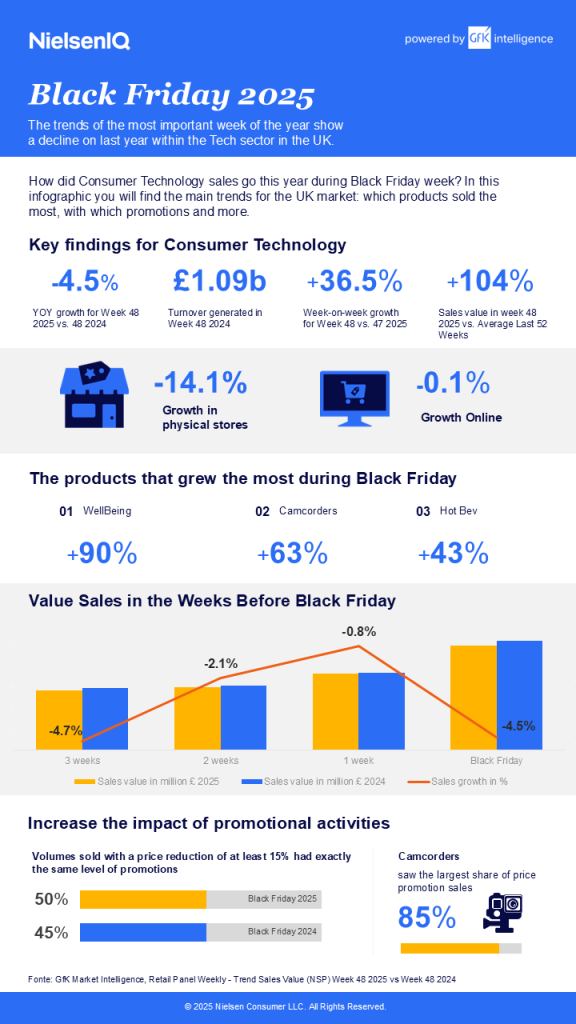

Kelly Creaby, Head of Retail Customer Success, NIQ says: “For the first time in a Black Friday event, we have seen sales declines across nearly all categories within Tech & Durables, with only Personal Care showing growth (+4%), despite retailers increasing the number of discounts. The share of items sold with a 15%+ price cut climbed from 45% in 2024 to 50% in 2025, yet this still failed to stimulate demand. Economic uncertainty and low consumer confidence mean UK households are prioritising essentials over discretionary purchases — and we’ve seen the impact of that caution during this subdued and disappointing Black Friday period.”

With weaker demand for big-ticket items and appliances and limited innovation, Tech saw value drop 4.5% and volumes down 3.3% versus last year.

Deeper discounts couldn’t compensate for poor consumer confidence

This retreat in spending is consistent with wider UK sentiment data. In November, GfK’s UK Consumer Confidence Index dropped to -19, with all five measures down. Crucially for the UK Black Friday period, the Major Purchase Index fell to -15, signalling that UK consumers increasingly believe this is the wrong moment to buy big-ticket items – precisely the categories Black Friday success relies on. Even deep promotions were not enough to overcome the financial caution that defined the UK market in November.

We needed a hero

One of the defining features of previous Black Fridays has been the importance of the ‘hero product’ that captures consumer attention and drives sales across categories. Who can forget the runaway success of the Hot Air Fryers and 2024’s LED Face masks? But in 2025, UK households proved they weren’t in the mood to buy. As a result, there were just a few packets of growth:

- Personal care products such as LED facemasks helped boost sales in the Wellbeing category by 90%.

- Coffee Machines posted a robust performance, up 43%.

- Knitting and Crocheting rose 35% year-on-year, reflecting a growing interest in hobbies and crafts.

- Large screen TVs increased 23%.

- Homewares. Bedding Linen (+5.6%) and Sofas (+4.3%) grew, suggesting consumers continued focus on comfort and home improvement, with corner sofas a particular area of investment.

Kelly Creaby, Head of Retail Customer Success, NIQ says: “We will remember this year’s Black Friday for consumers’ withdrawal of discretionary spend. As the UK heads into 2026, the challenge for manufacturers and retailers is not just the absence of a ‘must-have’ hero product, but the deep financial caution shaping every household purchase decision. Categories linked to comfort, hobbies and in home improvement may continue to hold up, but across Tech & Durables, the environment remains tough and deeply value driven.”

About NIQ

NielsenIQ (NIQ) is a leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. NIQ combined with GfK in 2023, bringing together two industry leaders with unparalleled global reach. Our global reach spans over 90 countries, covering approximately 85% of the world’s population and more than $7.2 trillion in global consumer spend. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View™.

For more information, please visit www.niq.com

Forward-Looking Statements Disclaimer

This press release includes forward-looking statements that reflect NIQ’s current expectations and projections about future market trends and consumer behavior. These statements are based on available information and reasonable assumptions but are subject to risks and uncertainties that could cause actual results to differ. NIQ does not undertake to update these statements, except as required by law.

Responsible under press legislation:

Marketing, GfK

Anna Paszek-Weglarz

7/F Blue Fin Building

110 Southwark Street London SE1 0SU Anna.Paszekweglarz@nielseniq.com