Inflation in Latin America

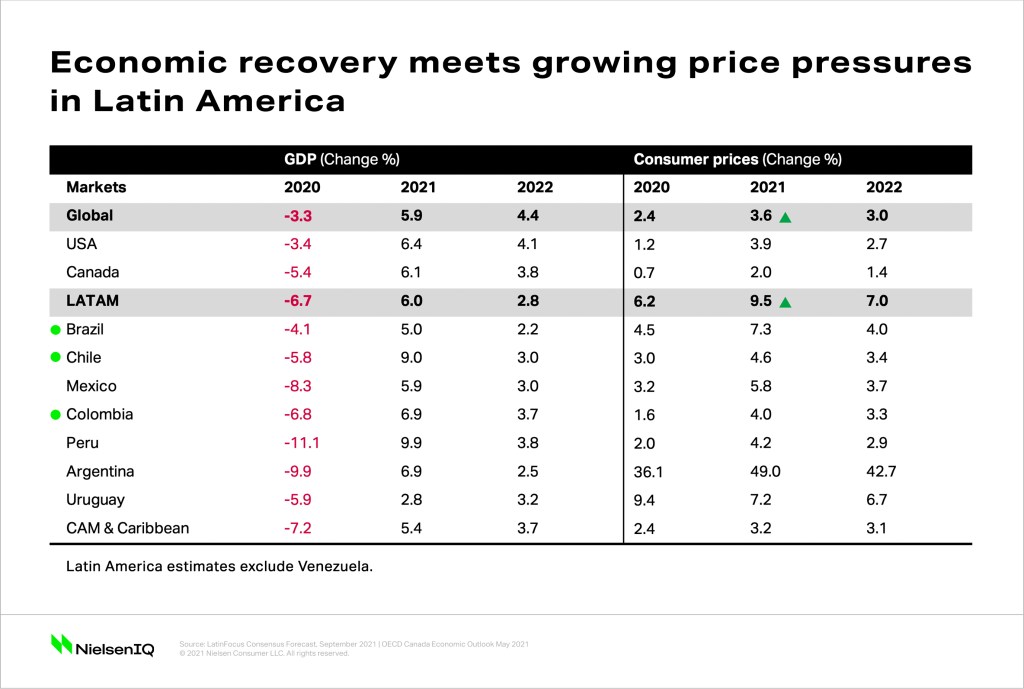

Latin America has a longer history than most with inflation. Argentina, Bolivia, and Brazil have all experienced triple-digit annual inflation rates in recent years, while at the most extreme, Venezuela had the world’s highest inflation of 5,500% in 2020. This hyper-inflationary climate in Latin America has lingered in this region for decades, with prices continuing to climb. In Brazil, the average price percentage change for household goods versus a year ago was up 17% as of August 2021. In Argentina, consumers saw the price of popular items like 354 ml cans of sparkling soft drinks spike 41% versus a year ago (September). While some economies are showing signs of recovery, price pressures continue to grow across the region.

Lesson 1: Consumers will continue to shop

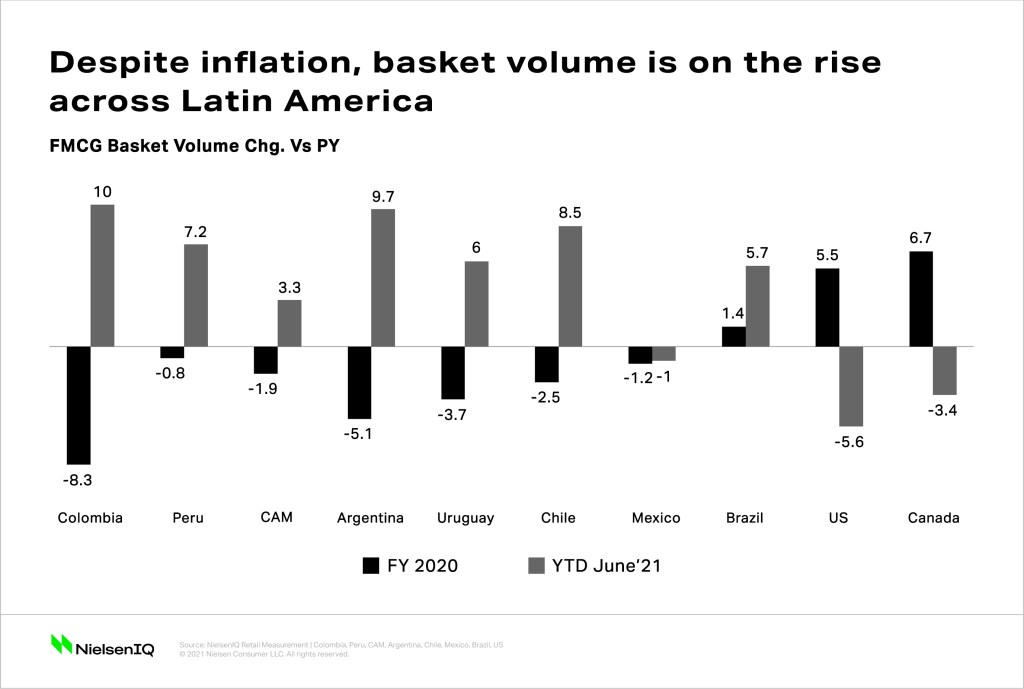

High inflation in Latin America does not necessarily mean a mass consumption decrease. Within Latin America, most countries are actually seeing consumption increases in consumer baskets, reinforcing the notion that consumers have adapted to the varying states of inflation in Latin America.

For marketers looking to know how to prepare for inflation, it is important to remember that consumers will adapt. Do not ignore the importance of understanding consumer behavior and the nuanced needs and preferences of consumers in a price-sensitive marketplace.

Optimize your Revenue

Maximizing profits goes beyond making the right pricing Take control of your price and promotion strategy. Contact us and master the rules of the pricing game.

Lesson 2: Understand the changes in shopper behavior in inflationary environments

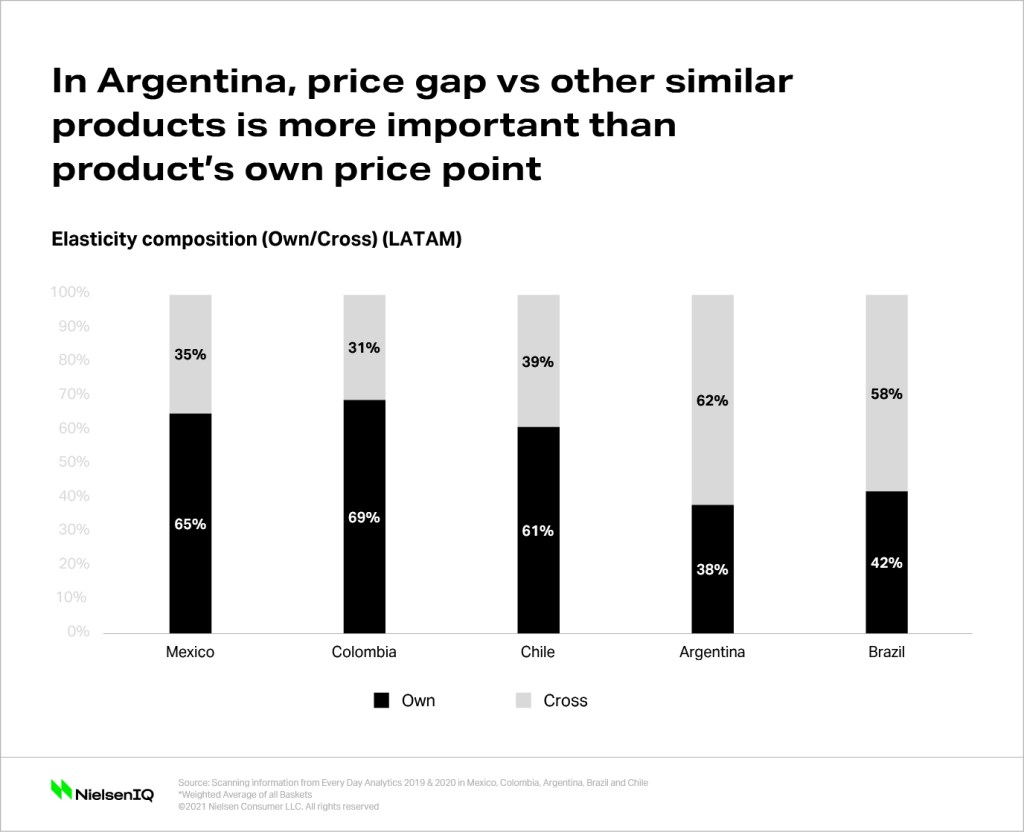

As prices rapidly rise, consumers are testing their personal boundaries and beliefs around their need states, which products are worth paying more for, and which aren’t. This decision-making process is tightly tied to price elasticity —how responsive customer demand is for a product based on its price. Marketers need to understand how elastic (how sensitive consumers are to price fluctuations) or inelastic (ambivalent to price changes) their product is relative to the marketplace. At the root of understanding elasticity and inelasticity is understanding consumer behavior.

However, it is interesting to note that Argentinian consumers are not only price-watching products, but also prioritizing price comparing across products and categories. In business terms, this means that cross-category elasticity should also be top-of-mind. For companies looking to understand how to price products right now, the key lesson from Latin America is to not make pricing decisions in a silo. Consumers will shop the entire landscape of products where items are compared across categories and channels.

Lesson 3: Pay attention to your channel strategy

As consumers adapt to their evolving pricing environment, they will question what to buy, as well as where to shop. Being aware of the four consumer groups driving spending will be important to understanding channel preferences and behaviors. For example, insulated consumers—who in Brazil represent 27% of consumers—are showing a preference toward stocking up on items in order to protect themselves from future price increases.

In Latin America, this is fueling the growth of non-traditional channels such as Cash & Carry, a retail format similar to warehouse clubs in terms of assortment and display of products, but without requiring membership. Cash & Carry has grown by 15% since 2019 in Latin America.

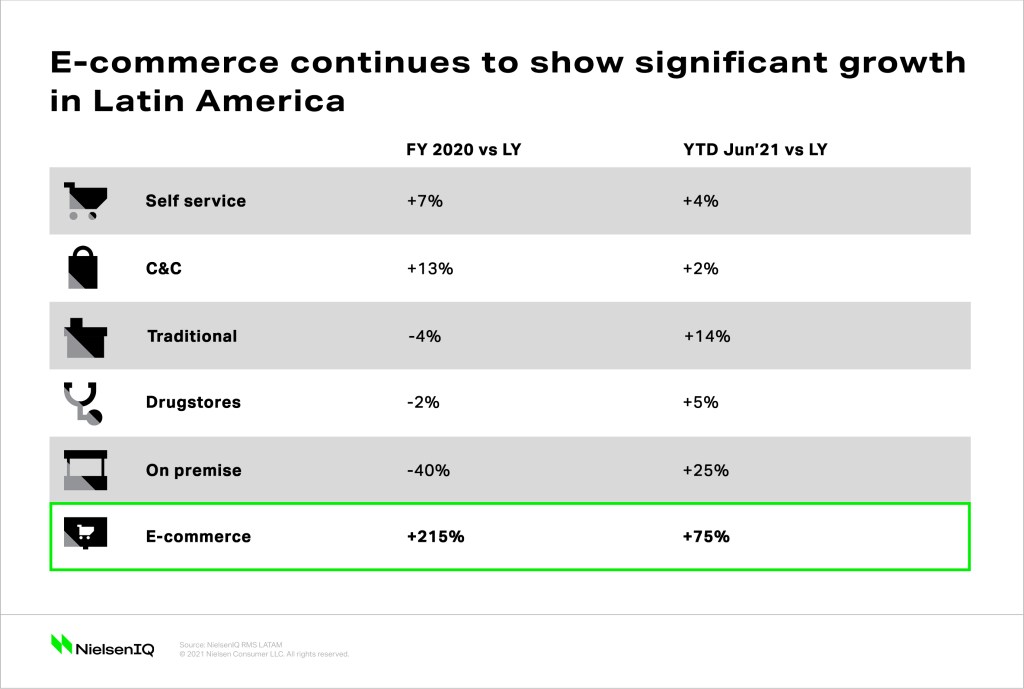

On the other hand, constrained consumers—which in Brazil represent 73% of consumers—are less likely to stock up and are downsizing what they place in their baskets instead. Constrained consumers in Latin America are also shopping more frequently with smaller fill-in trips, shifting to value brands and likely to purchase premium “favorite” brands less frequently. For constrained consumers, price comparing across the online universe has become a major appeal, which in turn has contributed to the rapid rise of e-commerce in Latin America.

The key lesson from Latin America is to be aware of shifting channel dynamics and consumer preferences in inflationary environments. Whether consumers change their consumption, stock up, or downsize, manufacturers and retailers should not lose sight of the nuanced ways different channels can fulfill consumer needs.

Lesson 4: Be aware of price compliance across retailers

As prices rise, price compliance across the retail universe has become an inflation-specific challenge for Latin American retailers and manufacturers.

With many different intermediaries involved across retail channels, the possibilities for price communication breakdown are high. For small/family-owned traditional trade outlets in particular, the challenges are even greater due to the lack of visibility into relative price, absence of a clear communication channel with manufacturers, and the fact that they may already be receiving products at a higher price point due to passed-on fees from distributors.

Perhaps the most challenging for traditional trade retailers in a high inflation environment is trying to define an appropriate margin that considers not only current costs and future costs for reinstating stock in stores. For consumers who rely on their local stores, the prices they see on shelves may be the most dynamic across the entire retail landscape. This frustrating experience may erode channel loyalty, especially as online shopping and price comparing continue to rise. For manufacturers, price dispersion across the retail landscape and lack of price compliance can weaken brand equity.

One strategy that has helped to improve price compliance in Latin American countries with inflation is price communication directly on the packaging. Clearly communicating prices across the board is critical. The key lesson from Latin America is to be aware of the risks of price compliance in a high inflation environment. Having clear and established communication protocols across all retail channels will be critically important to maintaining price compliance.

What’s next

It should be emphasized that inflation is not a one-size-fits-all challenge. Inflation varies across regions and therefore, experiences seen in one market may not exactly translate to another. However, these lessons from Latin America can provide visibility into how to prepare for inflation by understanding how consumers behave and how brands can respond within an enduring inflationary environment.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.