Do-it-yourself defined beauty and personal care in 2020

Amid statewide stay-at-home mandates, mass business closures, and rapidly climbing infection rates last year, there was far less of a need (and even ability) to purchase and wear cosmetics.

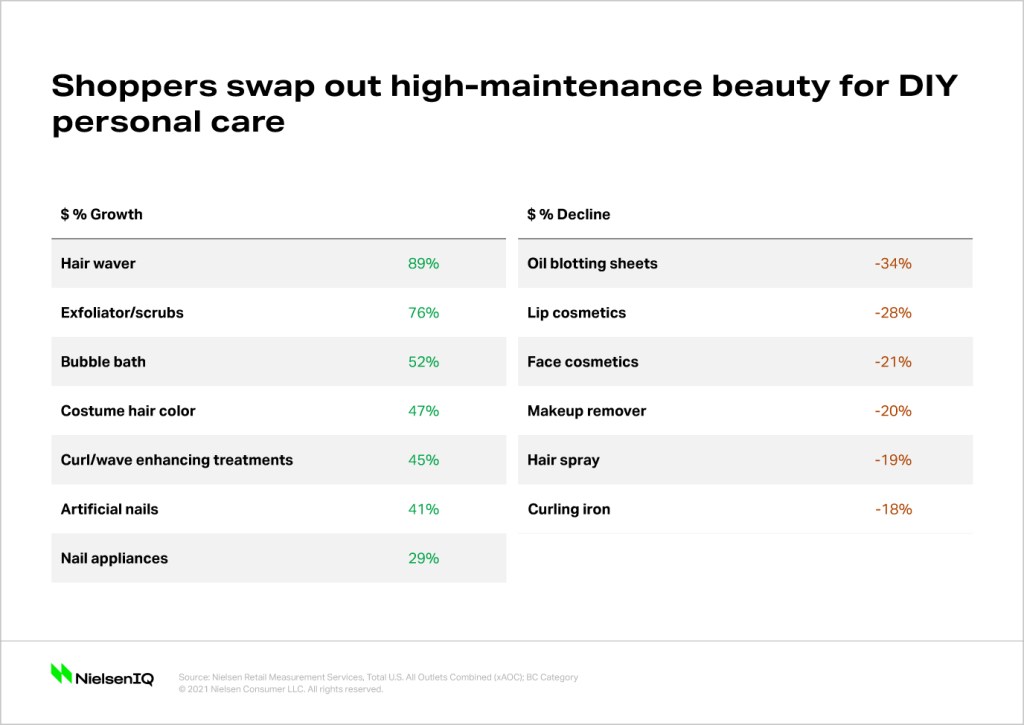

As a result, many shoppers swapped out their high-maintenance cosmetics and styling tools for lower-maintenance self care items. This DIY self-care movement that took hold across the U.S. in the beauty and personal care industry resulted in an impressive 16% dollar growth across all channels in 2020.

Are routines developed during the pandemic here to stay?

The DIY personal care movement has continued to be resilient into 2021, with 15% of surveyed U.S. beauty consumers saying they were cutting their own hair, 19% embracing a more natural look and 26% wearing less makeup overall.

Consumers took lockdown as an opportunity to enhance their skin and hair health and built entirely new at-home personal care routines. The widespread notion of building and maintaining healthy hair and skin caused many shoppers to heavily decrease their usage of traditional cosmetics and higher-maintenance hair care products that are known to cause damage. As shoppers adjusted to their new homebody lifestyles, they continued to invest time and money into their pandemic personal care routines and drove substantial sales increases for specialty products like exfoliating scrubs, curl enhancing treatments and artificial nails.

While we can expect this trend to continue as they flaunt their new and improved skin and hair, time will tell how this behavior could change as shoppers are no longer homebound. Consumers will gradually venture out of their homes, seek out experiences, and attend more social gatherings as vaccine rollouts progress, infection rates decrease, and restrictions are lifted.

The various personal care products and DIY methods picked up by consumers during the pandemic will remain important for many, but we can expect shoppers to build on their existing routines with an emphasis on natural beauty looks and products. Manufacturers and retailers who are able to appeal to the needs of newly developed routines, while also catering to reemerging pre-pandemic needs are poised to see tremendous basket growth.

Uncover the truth behind the latest beauty insights

Find out how you can better understand evolving consumer interest in clean, sustainable, and cross-channel shopping habits within the beauty category—for today and tomorrow.

Personal care is never a one-size-fits-all equation

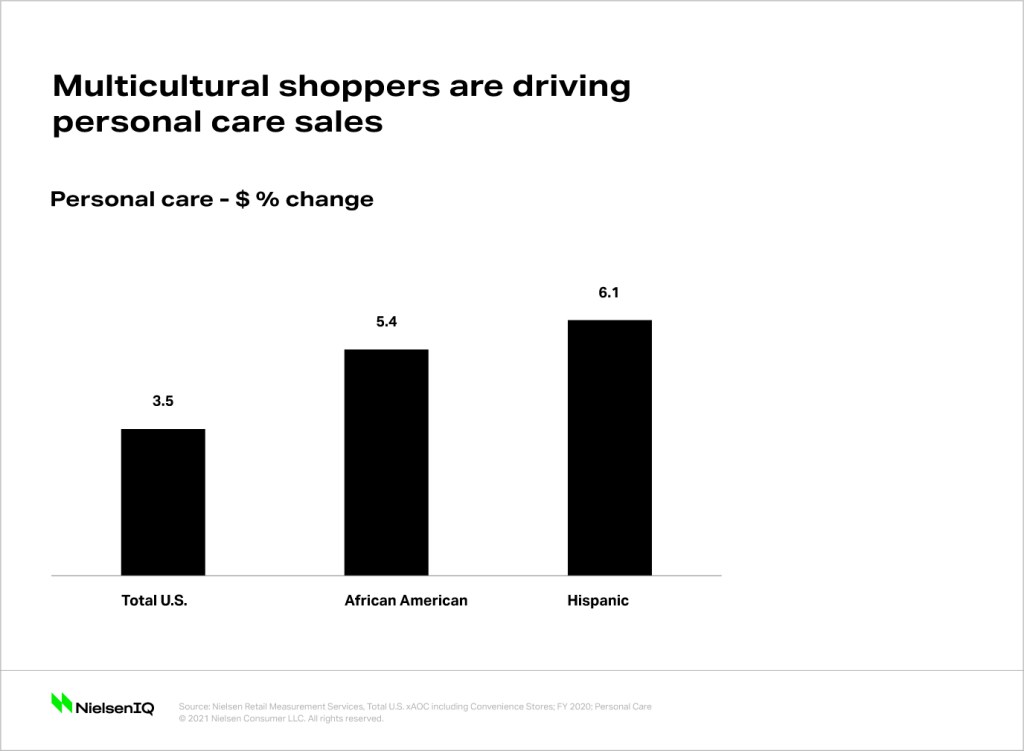

While the industry at large saw this shift away from professional treatments during 2020, some groups were more impacted than others. In fact, purchasing trends revealed that multicultural beauty consumers had to pivot past the general population when spending on personal care during the pandemic.

Hispanic consumers have a strong cultural foundation for beauty that went relatively undeterred last year as they were the only ethnic cohort to drive color cosmetics volume in 2020, and spent 13% more than the average consumer on beauty and personal care.

Despite being subject to the same living and working restrictions, sales data showed that Hispanic shoppers continued to purchase and wear cosmetic products that were ditched by many. For instance, when compared to the general population, this group is 1.4x more likely to buy lip cosmetics than any other segment. When taking a deeper look into which shoppers are driving this growth, low-income shoppers (<$50,000) make up the largest portion of both buying households (38.8%) and dollars (39.6%) within the Hispanic segment, presenting a tremendous opportunity for beauty and personal care retailers.

Hispanics have also kept pace with the rise in natural DIY beauty and over-indexed for hair care treatments and artificial nails measured in 2020. The pandemic caused all types of consumers to place health and wellness at the top of mind, but Hispanic shoppers developed a stronger sentiment for natural and sustainable beauty than most.

According to NielsenIQ’s Summer COVID-19 Survey, 21% of Hispanics said they would seek more natural products in the near future vs. 11% of White shoppers. As the demand for cosmetic and personal care incrementally increases amid the vaccine rollout, retailers can appeal to Hispanic shoppers through high-value, natural cosmetic products with an environmentally friendly focus.

African-American beauty trends during COVID-19

African-American women are traditionally known to rely on salon visits and professional styling products to maintain their hair and had to make some drastic adjustments during lockdown. The widespread disruption brought on was evidenced by the 41% of African-American women who indicated that the COVID-19 crisis prompted changes to their hair styling and maintenance regimens.

The swift transition from salons to consumers’ homes caused African Americans to dramatically increase purchasing for hair care products, and they’re now 2.4x more likely to buy hair treatments compared to the average beauty shopper. Similar to the Hispanic segment, low-income shoppers account for a much larger share of African American beauty buying households (43.3%) and dollars (39.1%) than middle and high-income shoppers, meaning retailers need to hone in on value-based products and execute promotions when targeting multicultural consumers.

The sharp rise in Black-owned beauty brands has allowed African Americans to discover an entirely new world of products that are specifically geared towards them and their at-home needs, further fueling consumers’ newfound preference for natural beauty and DIY self care.

Black-owned brands and brands who have spoken out about social justice causes have been heavily resonating with this segment, and 39% of African Americans expect to purchase more products from Black-owned brands while another 29% plan to purchase from brands that have spoken about the Black Lives Matter movement.

The Black Lives Matter movement caused multicultural consumers to demand more representation and options from beauty brands and retailers. These shoppers will gravitate toward brands which align with their social values and products that are specifically tailored to their skin and hair care needs. Health and wellness will remain a priority for most, meaning multicultural consumers will continue to seek out products with organic, natural and cruelty-free claims.

As many prepare for a shift toward normalcy and more consumers feel comfortable venturing out of their homes and attending social gatherings, the demand for beauty and personal care will further accelerate. Categories that experienced steep declines will regain their relevance, but will need to consider newfound consumer preferences.

Hispanic and African-American consumers have a track record of far out-spending other ethnic groups when it comes to beauty and personal care, and multicultural consumers likely will continue to fuel cosmetics growth into 2021 as they look for products that enhance their natural beauty rather than mask it.