The overall industry landscape

Looking at the big picture, overall BPC product sales in the U.S. have remained strong and shown positive growth in Q2 2022. NielsenIQ data shows that in-store sales in this period reached $55.5B (up +5%) while online sales reached $22.1B (+18%).

But we are also seeing a slowdown in unit sales. Even more concerning is the gap between dollar sales and unit sales, which is growing larger and can no longer just be attributed to increasing premiumization of the industry.

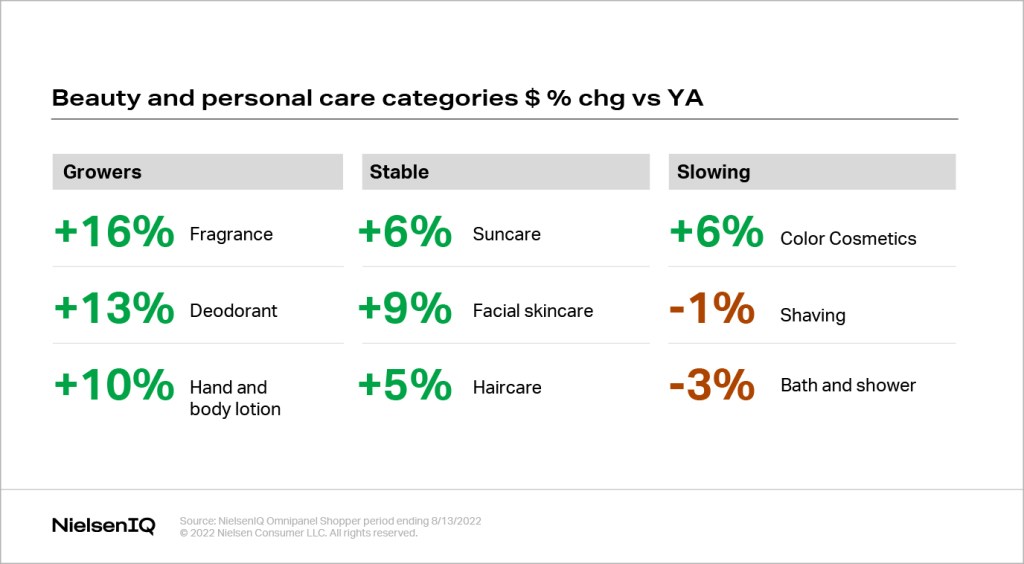

Category pricing has risen dramatically in the last quarter, and shopper behavior is quickly evolving in response to the current economic instability. Some categories continue to grow while others stagnate.

Is our love affair with lipstick over?

Consumers with the lowest incomes have been hit hardest by rising costs. NielsenIQ research indicates that they have reduced their dollar spend on beauty by 3% in the past 12 weeks, and unit sales for this consumer group have dropped by 11%.

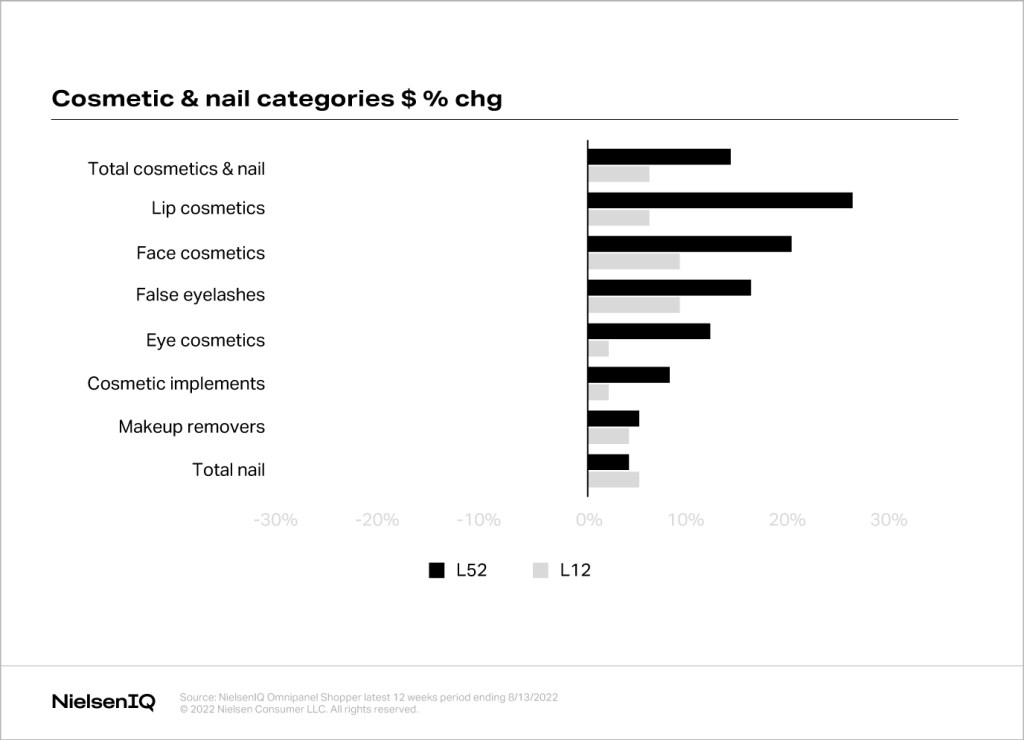

It’s become clear that many of these lower-income consumers were over-indexing on Color Cosmetics. Now that they have suddenly pulled back from spending, the category has seen much lower growth than usual in the last quarter.

Lipstick sales are down and, conversely, it is now the Luxury sector that is driving growth within this category, not Mass. Younger buyers are also contributing to category growth. In addition to losing the spend from lower-income consumers, Color Cosmetics is now losing its older shoppers too—notably the Boomer generation—with recent drops in both dollar and unit sales for this consumer group.

The sweet smell of success

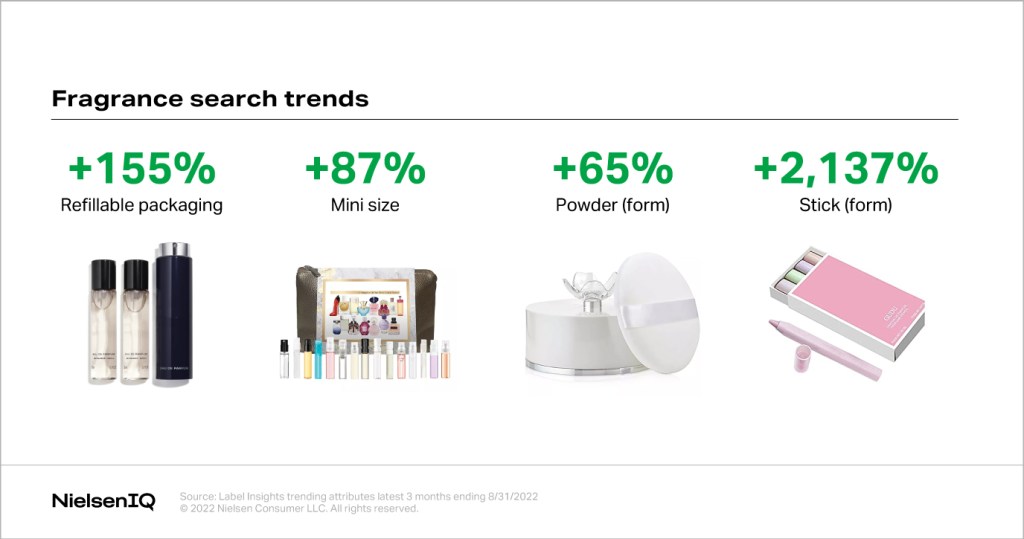

Fortunately, some BPC products are on the rise. The once-stagnant Fragrance category is now thriving: dollar sales have been increasing over the past 2 years. NielsenIQ data shows that the category is up by +16% in terms of dollar sales, +3% in terms of unit sales, and there has been a 13% rise in the average product price. Gen Z (+14%) and high-income (+8%) buyers are driving the increase in fragrance purchases.

In recent years, there has been more innovation and experimentation in the formats, textures and product types available, which could explain the growing popularity with younger consumers.

It now appears that the “Lipstick Index” theory may no longer apply to the Beauty and Personal Care industry. As the space continues to evolve and historical best practices are disrupted, CPG firms must keep a close watch on consumer spending habits to come out ahead in 2023 and beyond.