Change in priorities

With the increased pressure on household budgets and ongoing concerns of a recession, consumers are responding by adjusting their spending habits and lifestyle behaviors. In regard to lifestyles, the social disruption caused by COVID-19 caused consumers to prioritize mental and physical health above all else. Financial security has also proven to be an important factor, leading them to pivot towards more restricted spending.

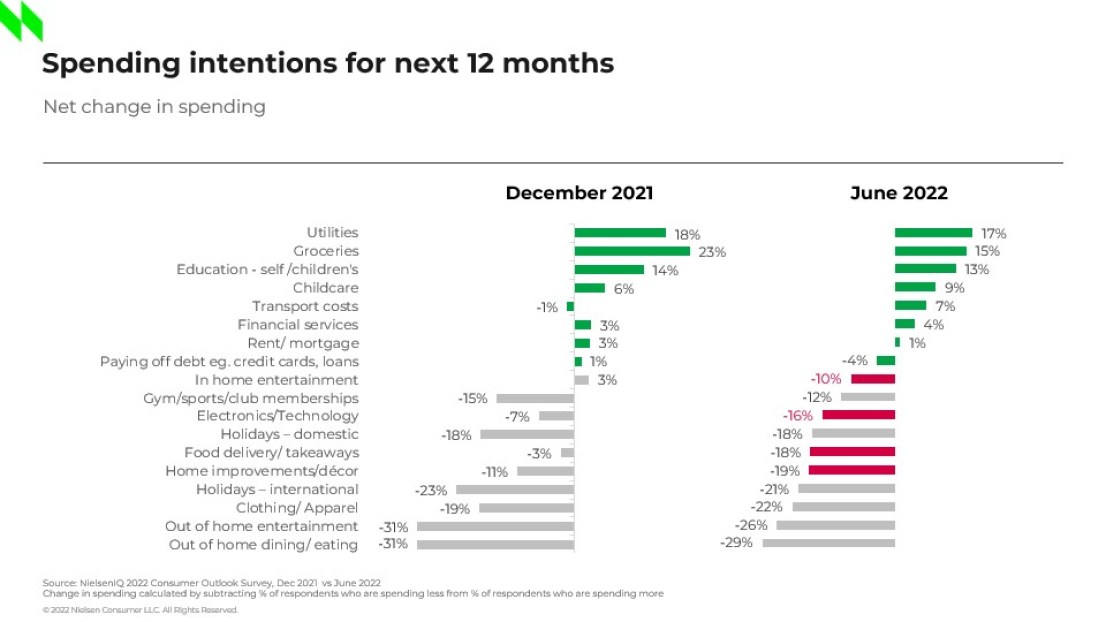

Reduced discretionary spending

At the beginning of the year, consumers surveyed by NielsenIQ intended to continue cutting back on mini splurges like dining out, gym memberships, and out-of-home entertainment. Their spending strategies focused instead on day-to-day essentials, prioritized by basic needs and necessities, such as utilities (17% are prioritizing) and groceries (15%). However, as inflationary pressures continue to increase, consumers now plan to tighten their belts even further with greater cutbacks on food deliveries and other indulgences that can be enjoyed at home.

The last time we saw a significant decline in discretionary spend was in 2020, during the COVID-19 pandemic. Once again, economic uncertainty is causing people to adjust their behaviors across all areas of life, from how and how often they shop to how they choose to entertain themselves or maintain a healthy lifestyle.

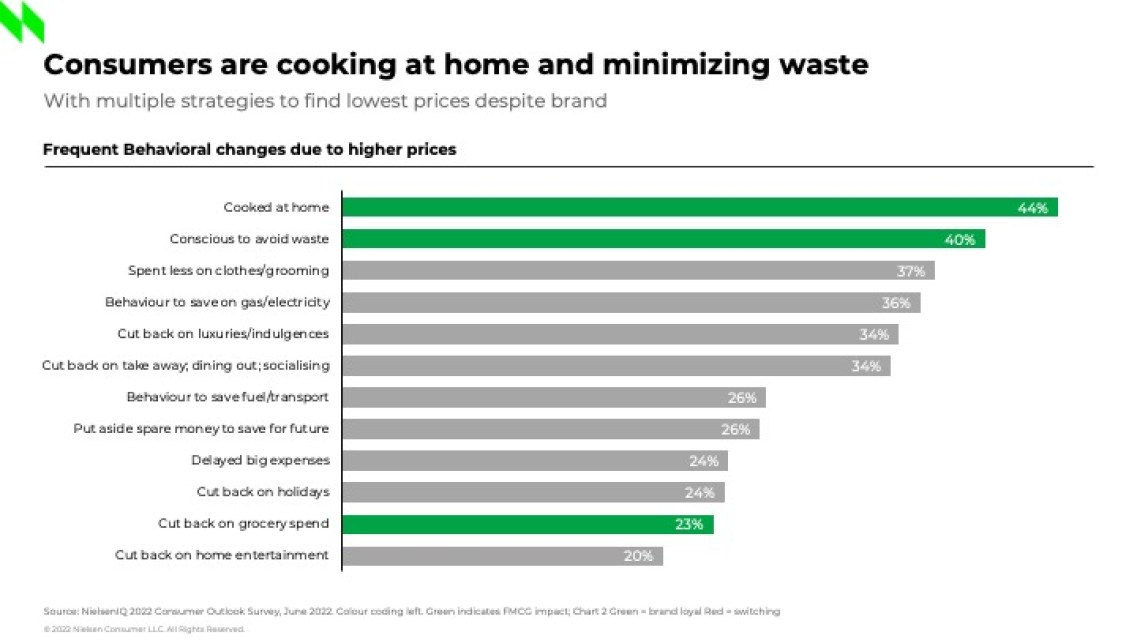

Staying at home

The lifestyle trends that gained popularity during the pandemic are being embraced once again, such as food preparation and dining at home (44%), spending less on clothing and grooming (37%), and cutting back on luxuries like dining out (34%) and vacations (24%).

Selective shopping

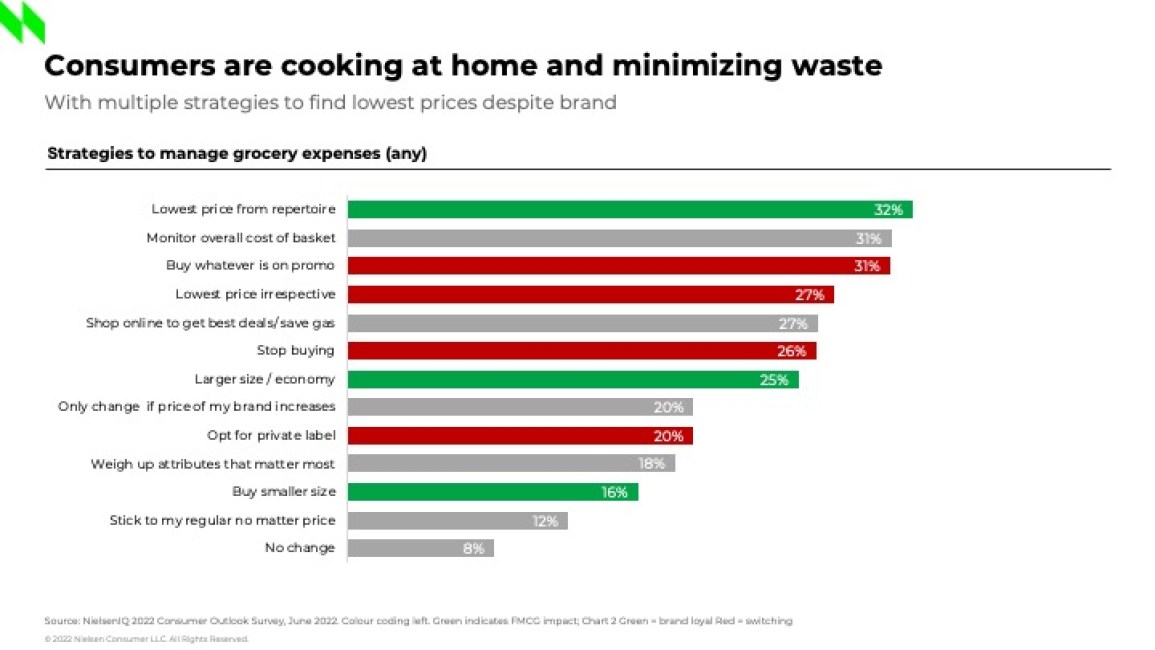

Consumers are not only being more mindful of how much they spend and what to prioritize, they are also shopping differently. They believe the way to combat inflation is by embracing a selective mindset.

In addition to shopping consciously, many are switching to buying lower-quality items and shopping more at discount stores or traditional trade outlets. Brand loyalty has taken a hit as 31% of consumers admit to buying whatever is promoted, 27% look to whatever is cheapest, and 26% stop purchasing certain categories altogether.

Selective shopping has become popular among all consumers who have been financially impacted by the pandemic and other economic factors, including people with high incomes who have been relatively unaffected. Shoppers across the economic divide are seeking discounts and promotional opportunities across various shopping channels and retail stores. In fact, discount retailers around the world recently reported increases in grocery sales, including stores like Aldi, Lidl, and Walmart.

Private label preferences

This shift in loyalties presents an opportunity for private label brands. As consumers are forced to make tradeoffs, alternate products offering quality at a lower price provide greater appeal. Twenty percent of consumers say they will opt for a private label to help manage their grocery expenses, which supports the recent sales surge in this sector.

This growth is evident in multiple regions around the world, including the U.K., India, and South Africa. In the U.S., the progress is prevalent in various grocery categories, including baking goods, dairy, household products, health & beauty, and deli foods.

Looking forward

Research shows that inflation may linger on beyond popular shopping seasons such as back to school and the winter holidays, possibly until 2023. Considering consumers around the world will seek out ways cut back on spending while saving for the future, retailers and manufacturers will have opportunities to manage pricing across portfolios, with the goal of retaining customers.

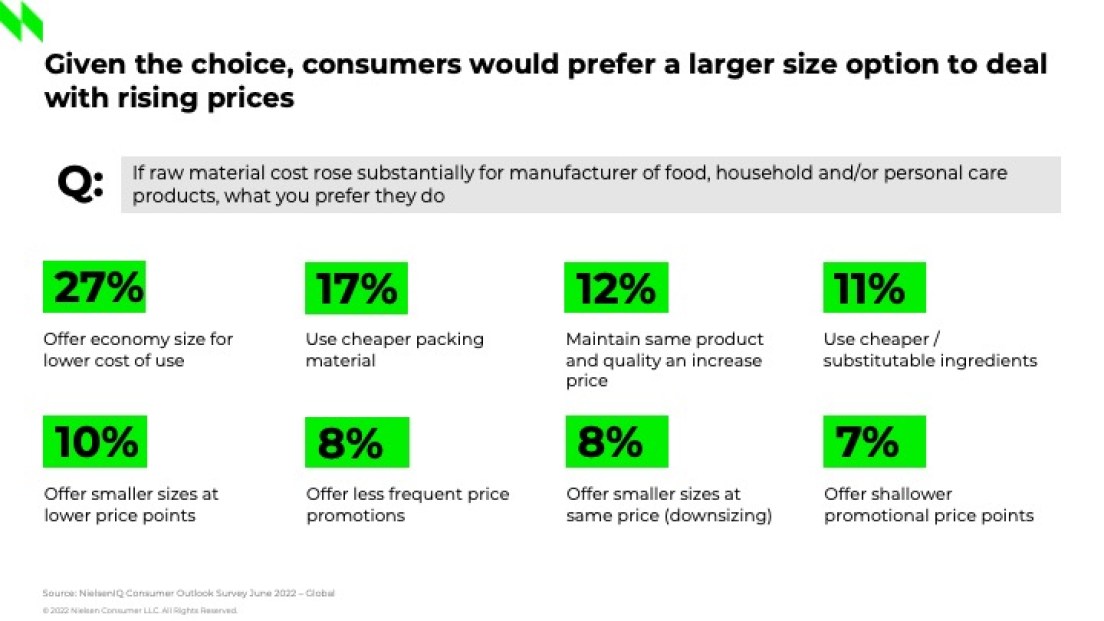

When NielsenIQ asked how consumers would prefer manufacturers deal with rising prices, some consumers said they’d rather see bulk or economy size offerings (27%) versus smaller sizes (8%) because it helps them deal with inflation. Others are driven by a motivation to minimize waste (40%).

Should the cost-of-living continue to rise, these various lifestyle changes and shifts in shopping behavior may become more pronounced across consumer segments.

Global inflation hub

Review our monthly updates on the latest pricing trends, consumer behavior changes, and more.

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)