The evolution of SMBs

Over the course of the last decade, countries around the world displayed a new economic attitude toward small and medium-sized businesses (SMBs), recognizing their contributions to economic growth and stability.

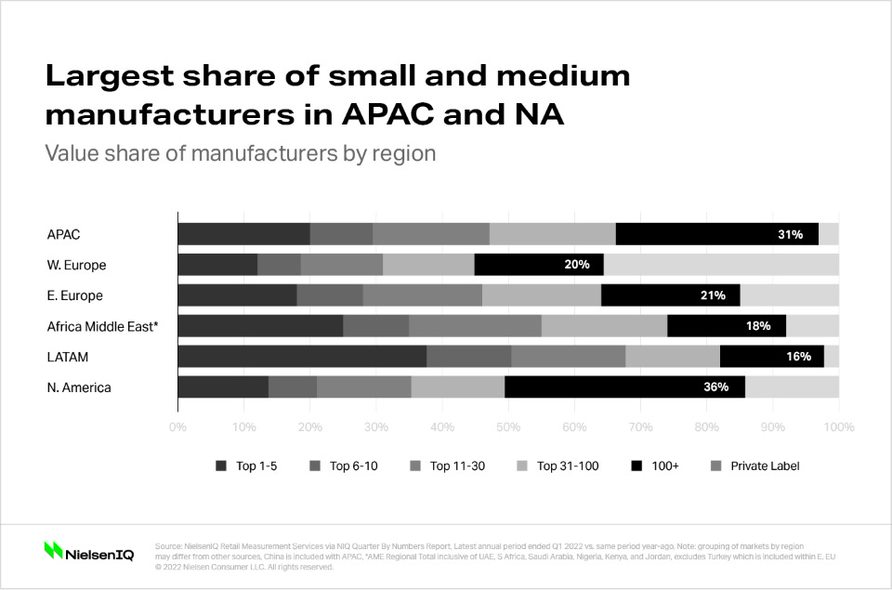

Consequently, smaller brands are taking up a growing piece of the pie, showing consistent growth across all regions.

While countries made major moves such as funding for start-ups, consumers are also showing a shift in attitude towards those brands.

Official definitions of SMBs are usually centered around the number of employees, total revenues, and contribution to GDP—but how do consumers themselves define them?

According to NielsenIQ data, among the leading traits according to global respondents are that smaller brands tend to be “local” (33%), “independent” (31%), and “unfamiliar” (27%). Large brands, on the other hand, are viewed as “very popular, recognizable, or world-renowned” by 46% of those surveyed.

These distinctions form a very compelling baseline for brand perception, where small and medium-sized businesses can strive to hone and create demand for their strengths as new, different, or locally affiliated options for consumer interest.

A quick look at SMBs in Latin America

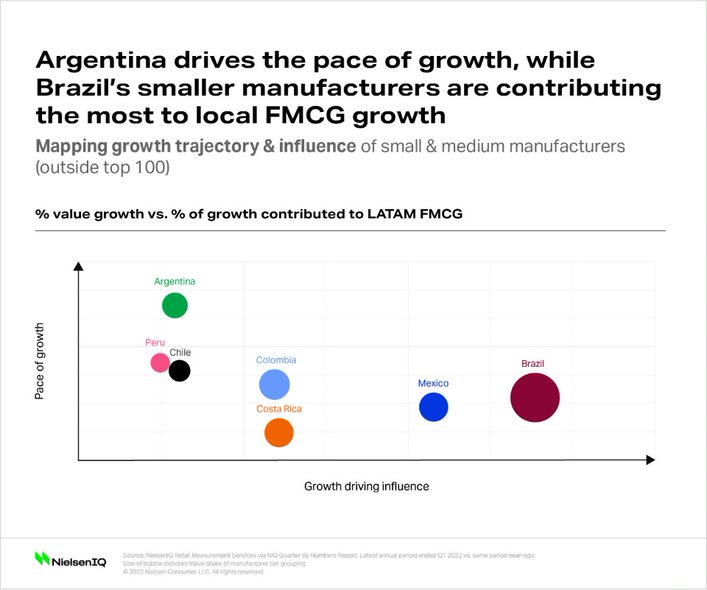

SMBs in the Latin America region might have the smallest share in relation to other regions, but the pace of growth is faster than all others at 13.4% in the past year.

Further investigation into the region shows that each market is operating at its own pace and level of growth driving influence, with Brazil leading the latter. In other words, while these SMBs are not growing as fast as in other markets, they’ve helped to reshape and grow the FMCG market.

Consumers evolve toward smaller brands

The pandemic shifted consumer purchasing dynamics in more ways than one, and a preference toward smaller brands (versus well-known and popular brands) was one of them.

NielsenIQ’s global study, the 2022 Brand Balancing Act*, shows that more than half of the respondents in Latin America (57%) have started buying a greater variety of brands across multiple categories. The highest ranking on that sentiment was Mexico at 59%.

It is also important to note that 55% of respondents Mexico claimed that they plan to more frequently purchase smaller brands in the future, indicating they feel these brands are better suited to their needs. This is relatively higher than the regional average of 49%.

Consumers in Brazil seem to fall only slightly behind in comparison to regional averages when it comes to their enthusiasm in trying out local brands (42%). Meanwhile, their purchasing preference for smaller brands seem to be driven by pricing, as 57% of respondents believe that small brands are usually the cheaper or more cost-efficient purchase option.

What’s next for SMBs?

Market and consumer indicators show signs of an indisputable fact: the future belongs to SMBs. There are three pillars of success for you as a small business owner:

- Get others to believe your vision by highlighting growth potential and opportunities

- Understand your consumer

- Stay agile with the market changes

It is critical for entrepreneurs and key decision makers for small manufacturers to stay connected to the most accurate and up-to-date information. Be sure to take the necessary steps to ensure you are keeping up with the ever-changing SMB landscape.

*The NielsenIQ global study, the 2022 Brand Balancing Act, shines a light on core facets of brand choice with a particular focus on how consumers perceive and prioritize smaller brands. The results of this global data investigation have formed the backbone of a simple and essential framework to guide the strategy of small and medium-sized businesses in 2022 and beyond.