Pulse check: Brands worth your time and attention

Across categories, feminine care, oral care, and sleep, these companies have proven to be valuable players in over-the-counter (OTC) products—they’ve amassed a $570 million with sustained double-digit growth according to NielsenIQ E-commerce.

These brands specialize in products that offer solutions and convenience with an unconventional approach—all of which appeals to Gen Z and Millennials but is not limited to them.

For example, in 2019, Unilever acquired Olly Nutrition, a colorfully branded, B Corp gummy vitamin and supplements company1. Olly Nutrition widened supply distribution to include brick-and-mortar drugstores like Walgreens and CVS Health. NielsenIQ E-commerce data shows that D2C brands like Olly own nearly 10% of the total sleep and focus supplement market2.

High caliber collaborations

As we look across the last three years and nearly every category, there’s a compelling case for why retailers and manufacturers should monitor up-and-coming direct-to-consumer brands beyond acquisitions. Not only do they receive direct feedback from consumers, but they’re also making waves with their partnerships.

As of July 2021, direct-to-consumer oral health brands owned 11.6% of the oral care market. Quip set itself apart from the competition when it teamed up with UnitedHealthcare to launch digital resource tools and special promotions in the name of better dental care.

Colleen Van Ham, the CEO of UnitedHealthcare Dental highlighted the benefits of this partnership, noting that, “As more Americans adopt a digital-first mindset, these new initiatives advance UnitedHealthcare’s approach of using technology to improve access to quality, cost-effective medical and dental care, while empowering people with personalized information.”3

Don’t reach for the stars, reach across the aisle

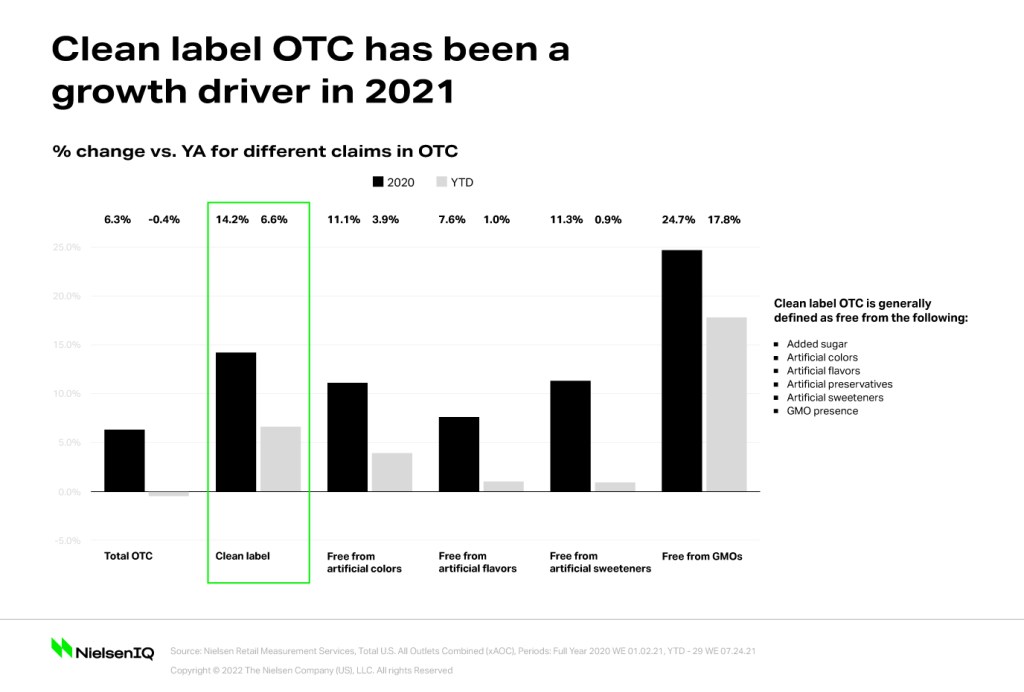

The natural and sustainable trend is also making headway in OTC products, powered by an increased desire for cleaner ingredients and sustainable attributes. Driven by the clean beauty movement, consumers continue to examine ingredient lists and seek out brands that offer increased transparency.

Sherry Frey, NielsenIQ Health and Wellness thought leader, discussed how healthcare trends have crossed in-store and online shelves in the Look Ahead Webinar. “We saw a 13% increase in digestive health, especially in pre and probiotics, but we’re really seeing that growth across the store. It’s not just about digestive health—the gut, brain, and skin are all connected. Consumers have a more holistic view of how they’re thinking about wellness.”

Direct-to-consumer companies have driven a renewed interest in the OTC category, propelled by health and wellness trends. While NielsenIQ analysts have seen interest in what constitutes a “clean label” wax and wane clean over the years, one thing remains clear— consumers continue to demand product label transparency. Direct-to-consumer brands specialize in this, and retailers would be wise to follow their example.