CPG Unit Price Increases and Inflation Trends

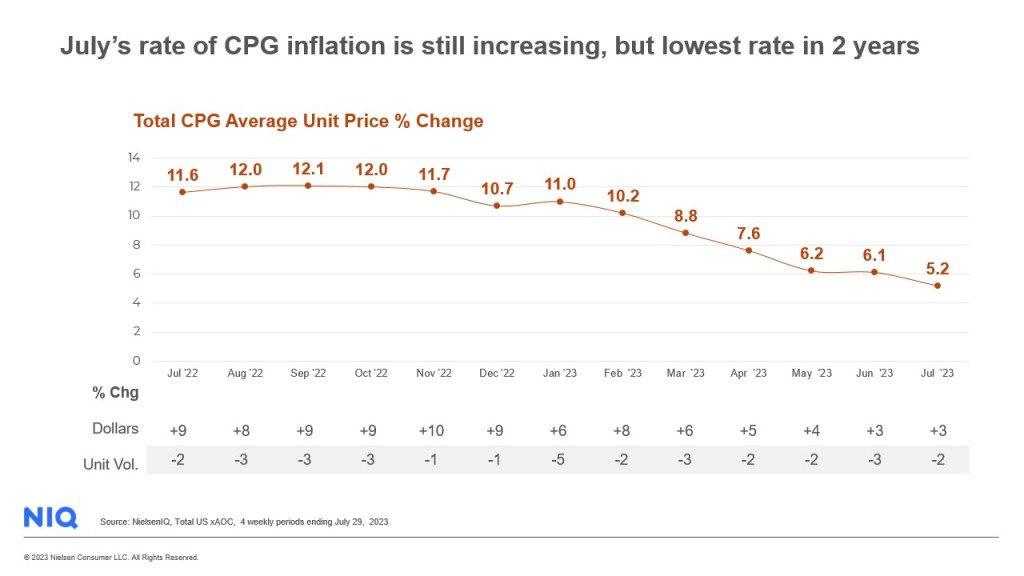

CPG prices continues to rise with July dropping to its lowest rate of increase since July 2021. The rate of CPG unit price increases came in at 5.2%, 0.9 points lower than June. After June’s overall inflation increase, hit a 2-year low, July increased slightly to 3.2%. CPG increases continue to trend higher than the U.S. Consumer Price Index (CPI), but the gap is narrowing.

Consumers are spending more and buying less as a result.

CPG sales growth continues to be fueled exclusively by rising prices, but the pace of dollar growth is slowing due to lower levels of rising prices. The industry is concerned over lower consumption levels as volume continues to dip compared to the last year. Consumers may be spending more, but they are purchasing fewer items. July reported an 3.3% lift in CPG dollar sales, whereas unit consumption lagged, down 1.8%.

Rising prices still affecting key departments

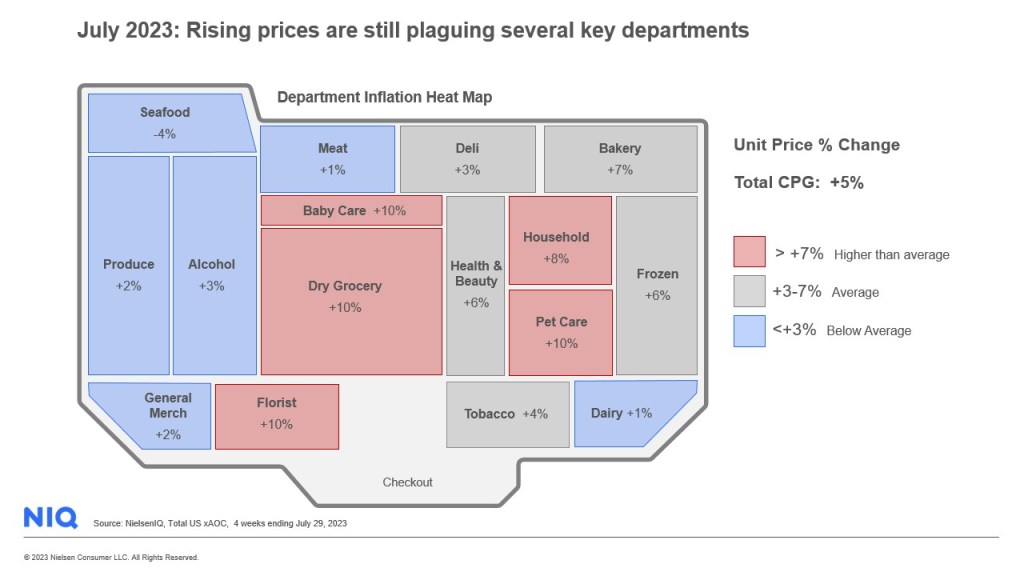

Declining consumption remains a concern for the industry as consumers focus their spending on the essentials. The rate of food inflation increases are slowing but still high at 5% with consumption down -1%. Similarly, non-food prices increased 6% and unit sales declined 4%.

Very few CPG departments are immune to rising prices as it continues to hit all areas of the store. The top 4 increases for food were: Dry Grocery, up 10%, Bakery, up 7%, Frozen, up 6%, and Deli, up 3%. For non-food, the top 4 increases were Pet Care, up 10%, Baby Care, up 10%, Household, up 8%, and Health & Beauty, up 6%. Food will continue to fuel sales as consumers are scrutinizing their purchases with 35% of shoppers focused on only buying the essentials (a 3 point increase since October 2022).

As prices stabilize in the coming months, retailers and manufacturers must explore new strategies for growth, considering the ongoing decline in consumption. This includes focusing on innovation, promotions, and targeting specific consumer groups, such as the aging population and multicultural communities.

Desire for value fueling growth

Consumer behavior is also evolving, with an increasing preference for private label products, value-based retailers, and promotions. Private label sales, which offer an average of 13% savings compared to national brands, have grown by 4% in July. Retailers with diverse and well-established private label offerings will benefit from this trend. Value-based retailers have experienced a sales increase of 6% compared to the previous year, capturing 42.4% of CPG sales, with food being the main driver of their gains. Promotional sales have also risen by 7% in July, accounting for 26.3% of CPG sales. However, retailers must be cautious not to over-promote, as this may not be a sustainable profit strategy and could undermine customer loyalty.

Prepare for slower retail growth in the months ahead

With heightened awareness of price increases, American consumers have adjusted their shopping behaviors to accommodate their budgets. Looking ahead, the pace of dollar growth is projected to decelerate, and slight relief will not offset the decline in consumption. As the market grapples with novel challenges, growth opportunities demand a strategic focus on gaining market share within specific categories. Identifying the driving forces and impediments to business success, optimizing trade expenditures, and collaborating effectively with retail partners are crucial steps for navigating the evolving landscape.