Shein Enters Online Beauty with SheGlam

Today, Shein is the largest online fashion (and fast fashion) player. Its new makeup line, SheGlam, was launched with the same positioning: a multitude of trendy references, new items every week – at prices that defy all competition. All of it, 100% cruelty-free. Enough to encourage purchases.

This positioning particularly resonates with Generation Z consumers. Often highlighted for their ecological concerns, it turns out they also have a soft spot for low-end products at slashed prices.

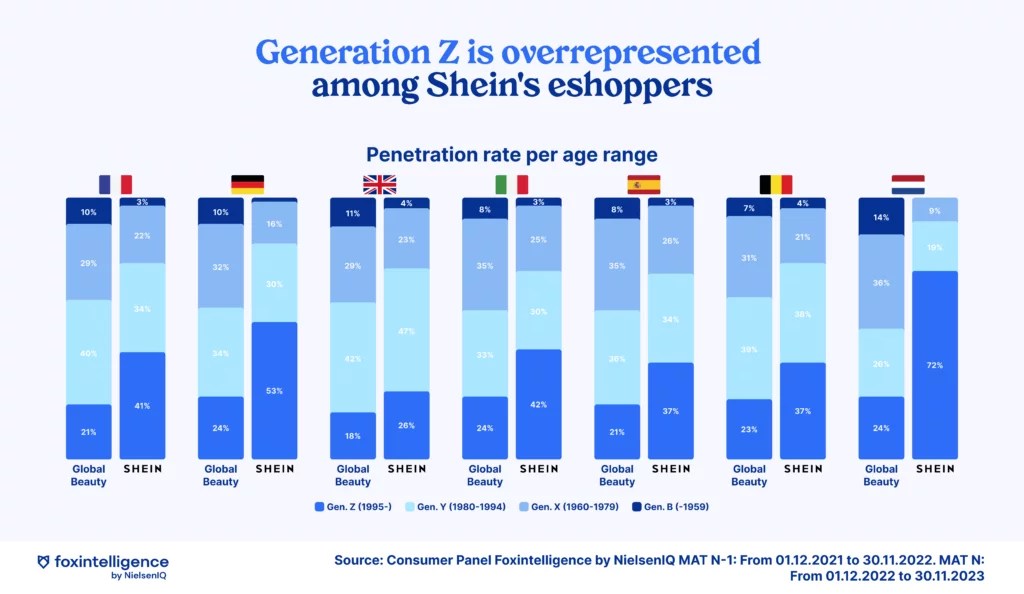

Observing the penetration rate by age group among Shein’s online consumers, Generation Z is overrepresented in almost all countries (except the UK and Belgium). In Germany, 53% of Shein e-shoppers belong to Generation Z, and 72% in the Netherlands.

SHEIN’s buyers tend to spend more on cosmetics than the average. Solely due to a higher purchase frequency, as the average price per item is lower, as is the value of the orders.

🦊 Discover the purchase frequency and average basket of your competitors

Beauty, A New Growth Opportunity for Shein

After conquering the world of ultra-fast fashion, Shein seems to be setting up shop in the beauty sector for the long haul.

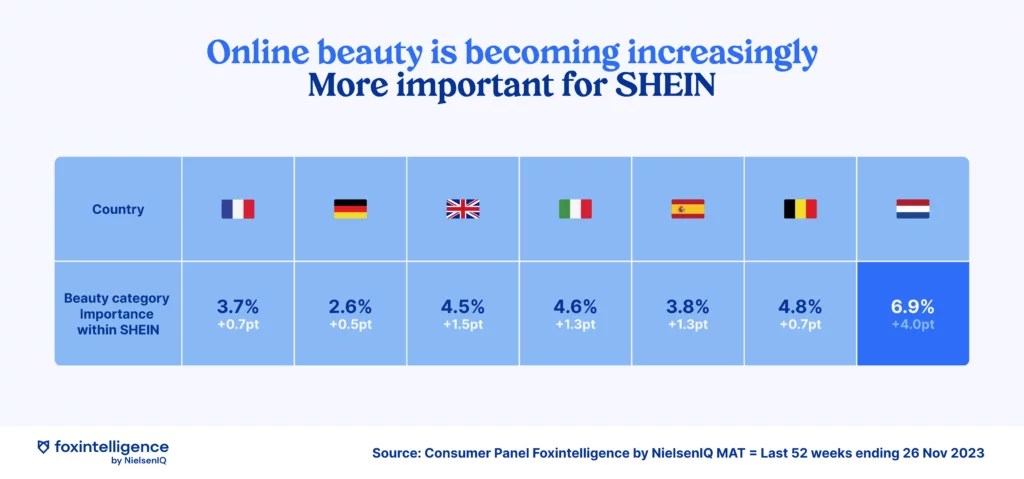

The beauty segment of Shein is actually the fastest-growing: in the Netherlands, the beauty category represents 7% of Shein’s market share in 2023, a figure that has increased by 4 points compared to the previous year. In the French market, 3.7% of Shein’s market share is generated by beauty.

What’s next? The group is now venturing into the home decor sector and is closely interested in pet products. The goal seems clear: to be able to meet all consumer needs.

Zara Increases Its Market Share with Dupes

A dupe, or duplicate, is an accessible brand’s product inspired by a luxury brand product. The difference from an imitation or counterfeit? A dupe is branded by the manufacturing brand, unlike a counterfeit whose goal is to pass for a brand it is not.

Zara has launched into luxury perfume dupes. Its products are branded Zara, their names are different, and the packaging is far from the brands whose products are inspired. A legal practice, become a trend that is booming on TikTok among influencers who look for the best dupes to make videos that reach millions of views.

Like several fast fashion players, Zara has ridden this trend and offers dupes at prices that defy all competition. For example, La Vie est Belle by Lancôme is the favorite perfume of French women, sold for 100€ for 50 ml. Zara’s dupe version is called Red Vanilla and costs 12€95 for 90 ml.

These products are highly favored by consumers, particularly in periods of inflation and reduced purchasing power.

Perfume, A Growth Opportunity for Zara

It’s in Spain that Zara’s perfume category performs the best. Looking at the beauty category mix, 63% of the market share is generated by the perfume sub-category.

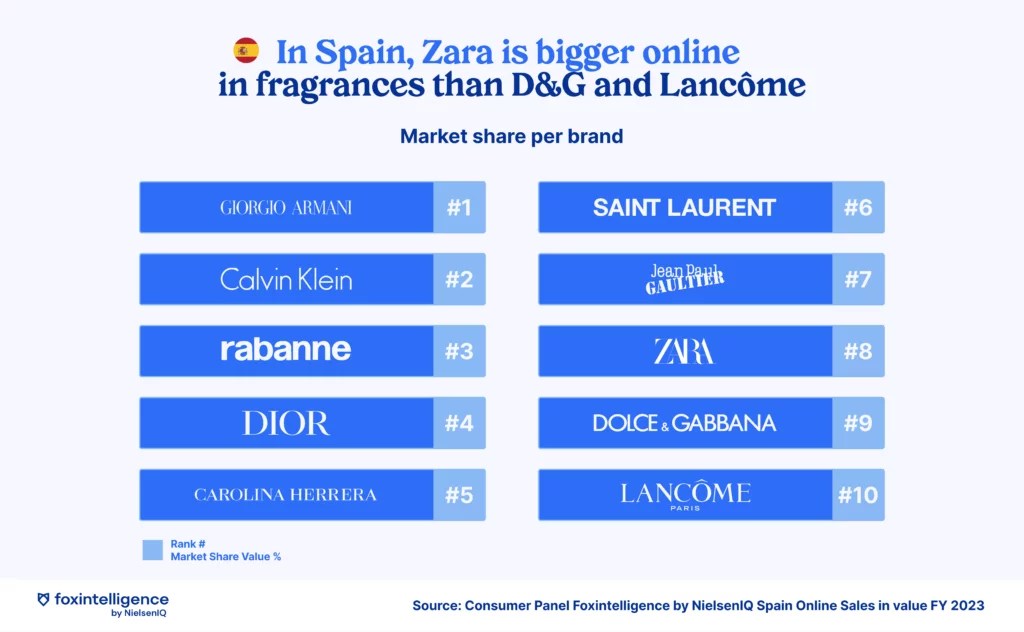

When examining market share by brand, we note that in Spain, Zara has a heavier presence in online perfume sales than Dolce & Gabbana and Lancôme.

As with Shein, Zara’s new range targets young consumers, who are overrepresented among Zara’s buyers. Generation Y accounts for 46% of Zara’s beauty category buyers, and Generation Z for 27%.

🦊 Discover your marke shares by sub-category

Consumption Trends: Key Insights to Remember

- After conquering the fast fashion sector, Zara and Shein are making their mark on the beauty sector.

- In Spain, Zara has a larger online perfume sales presence than Dolce & Gabbana and Lancôme.

- In the Netherlands, the beauty category represents 7% of Shein’s market share in 2023. In the French market, 3.7% of Shein’s market share is generated by beauty.

Find more market studies: