Private label continues to gain popularity worldwide

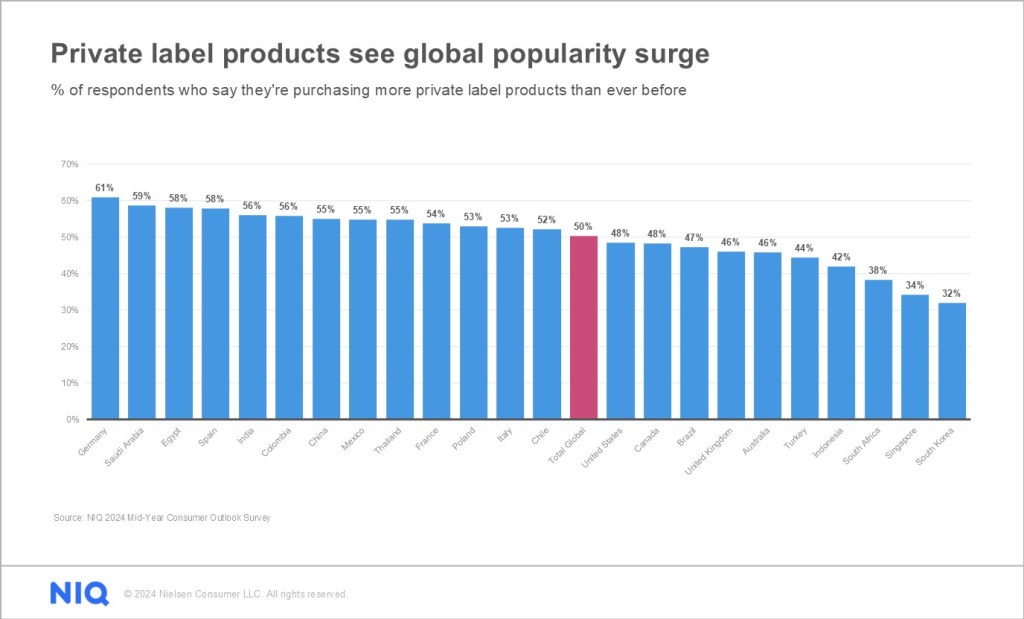

Historically, Europe has been at the forefront of private label adoption, but we’ve seen consumers in markets around the world showing a newfound respect for store brands. In a survey conducted in August 2024, German (61%) respondents lead surveyed shoppers who said they were buying more private label products than ever—but respondents in Saudi Arabia (59%), India (56%), and Colombia (56%) all exceeded the global average of 50%.

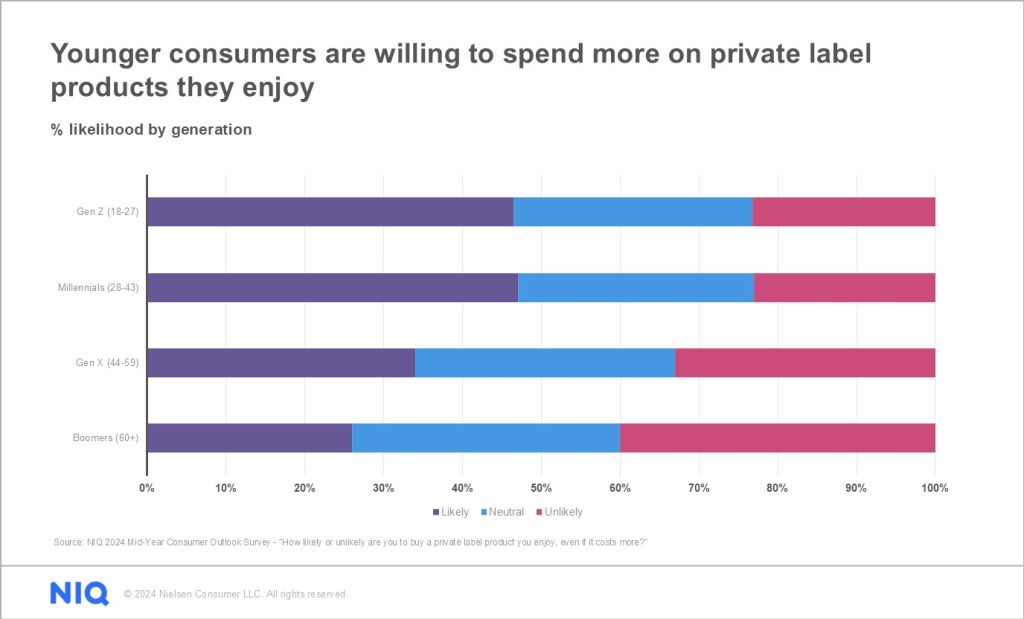

Perhaps even more indicative of the perception shift currently happening with private label products is seen in the demographics of consumers who say they’ll buy a private label product they enjoy—even if it costs more.

Twice as many Millennial (46%) and Gen Z (46%) respondents in the Mid-Year Consumer Outlook survey said they’re willing to spend more on private label products than the 23% of Boomer respondents who said they wouldn’t. As explored in our Spend Z report earlier this year, up-and-coming generations of consumers are emerging as a critical and largely untapped lever of growth. Millennial and Gen Z shoppers will have incredible spending power in the years ahead, and they’re already developing product preferences and loyalties today.

Beyond positive private label sentiment among desirable shopper groups, recent sales trends confirm that consumers are practicing what they preach.

Mid-Year Consumer Outlook: Guide to 2025

Future-focused insights into consumer spending and growth opportunities

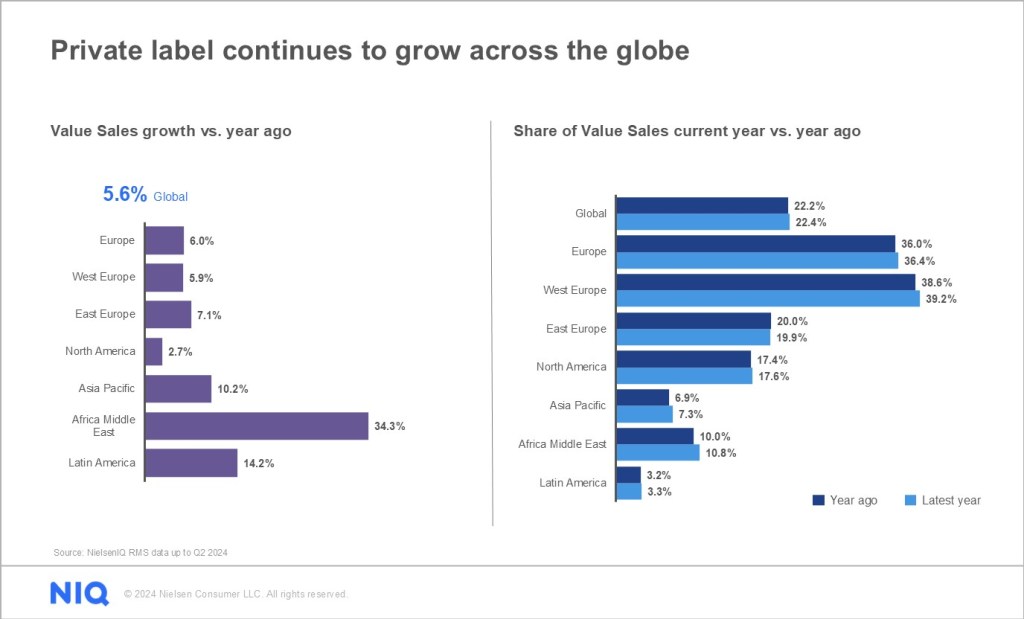

Private labels deliver value growth and gain share globally

While global consumer attitudes about spending are showing signs of improvement heading into 2025, the impact of compounding inflation has deeply ingrained consumer scrutiny over purchases. As a result, shoppers will spend with more intention after identifying the product attributes that they deem worthy of their dollars. Recent shifts in sales data prove that consumers are finding unique value in the private label products they’re buying.

NIQ RMS data from Q2 2024 showed that private labels delivered +5.6% of value sales growth over a 12-month period. Middle East/Africa (+34.3%) and Latin America (+14.2%) showed the fastest growth, driven by higher inflation levels. Though more modest, global value share also grew in this time period, supporting the claims that shoppers are buying more private label products than ever.

Of course, all markets globally aren’t necessarily at the same stages of product development, quality, or availability, so understanding the key factors that matter to shoppers in each of these regions becomes paramount to success.

Deliver more to earn consumer dollars

The final leg of the journey for retailers and manufacturers is rising to meet consumers where they’re shopping and to take into account how lifestyles impact purchasing behaviors. As consumer needs and shopping motivators vary by market, it has never been more important to provide a seamless shopping experience.

“As we head into a new year, consumers are telling us with their words and their wallets that they are more open to a variety of brand choices than perhaps ever before,” says Lauren Fernandes, Vice President of Global Thought Leadership, NIQ.

“Consumers view their definition of ‘discount’ in an entirely new light, which means that the playing field has been leveled in many respects for both private labels and name brands. Companies that recognize the democratization of the playing field are leaning harder into earning consumer dollars by delivering more. Today, consumers are not only intrigued by—but have come to expect—a hybrid approach to delivering value for money. If you’re still asking yourself if your customer expects you to deliver quality, innovation, sustainability, availability, etc. – the answer is ‘yes’ to all of the above.”

Understanding how to pull the right levers based on nuances and preferences in market has become the key to brand success. Fine-tune your brand strategy with NIQ Brand Architect, a key resource to connecting with your consumers, increasing brand strength, and delivering remarkable brand experiences.

Private Label Brand Growth

SMBs Pay Attention:

Keep your eye on private labels

The State of Private Labels in the U.S.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.