Retail Channels Landscape

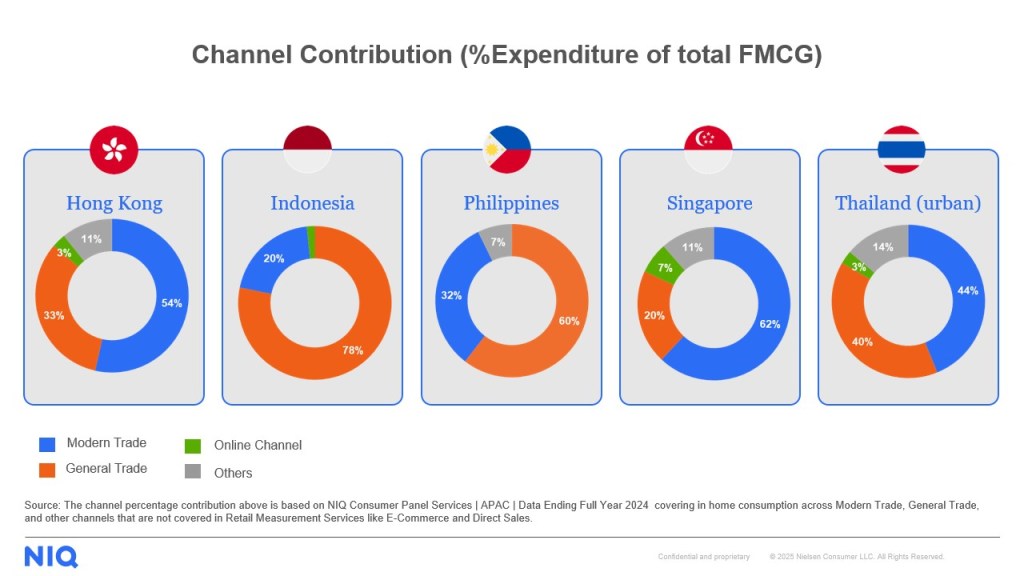

The retail channel landscape in Southeast Asia is shaped by three primary channels: modern trade (minimarkets, supermarkets, and hypermarkets), general trade (local markets, traditional stores, and sari-sari stores), and the online channel. Each market in the region has unique consumer preferences. Modern trade dominates in Singapore, Thailand (urban), and Hong Kong, while general trade leads in Indonesia and Philippines.

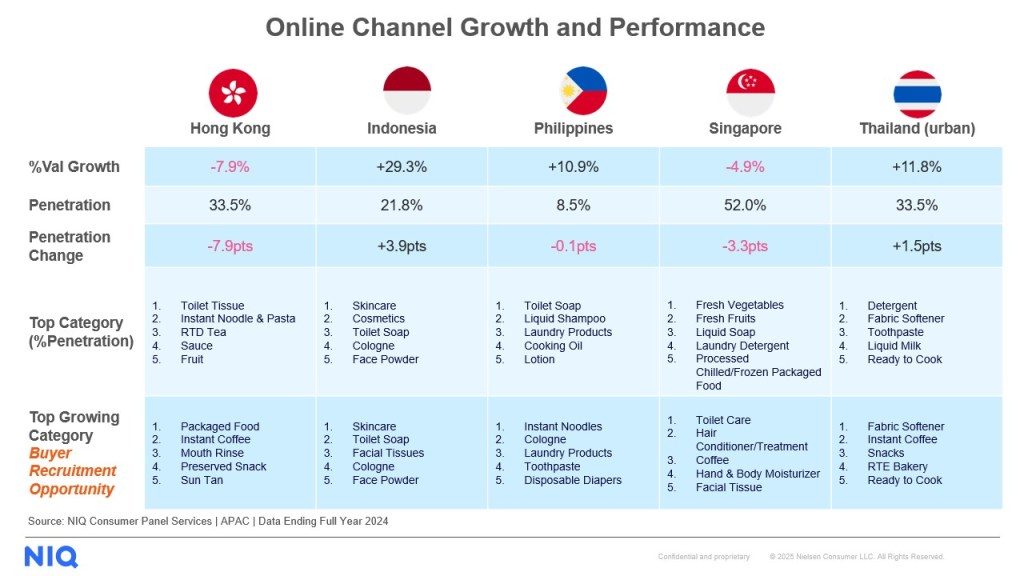

The online channel has become a focal point for retailers, continuing its upward trajectory across Southeast Asia, even though its overall market share remains smaller than traditional channels. Indonesia, Philippines, and Thailand are experiencing rapid growth in online sales, while Hong Kong and Singapore show slower growth but still boast a substantial and mature online buyer base.

Singapore: Rise in cross-border shopping, supermarkets adapted to growing demand for online delivery services

Singapore, a market predominantly characterized by Modern Trade and a high cost of living is witnessing a significant number of consumers looking for more affordable options, especially in essential categories. This has led to a surge in cross-border shopping, which has grown by over 20%. Currently, 1 in 3 households shops outside Singapore, driven mainly by lower-income in smaller households. This shift has affected other channels inside Singapore frequented by this group, such as deep discount retailers.

Meanwhile in e-commerce space, 1 of 2 consumers in Singapore has experienced online shopping with food purchases online being a significant driver in this channel. Supermarkets have adapted to the growing demand by offering online delivery services, catering to convenience-driven consumers.

Thailand: CJ supermarket leading with aggressive promotions; online shopping is growing driven by non-food items

Modern trade is leading in Thailand (urban), and competition within Supermarket is tightening. The rapid growth of the CJ Supermarket chain is a threat to other Supermarket retailers as CJ doubled its buyer base in two years, driven by store expansion and promotions. Outside of Supermarkets, CJ has also impacted Convenience Stores due to its similar positioning.

The increasing adoption of mobile technology and e-commerce platforms has simplified online shopping for a wide range of products, from clothing to electronics. Although non-food categories contribute more significantly, food categories are also showing rapid growth in the online market.

*Disclaimer: Promotion data in Homepanel is based on panelists’ self-reported claims

Hong Kong: Supermarkets as the primary channel, with stagnant growth

Supermarkets remain the primary choice in Hong Kong but are stagnating as consumers manage their budgets more carefully. The slowdown in spending is evident in in-home dining categories such as fresh, packaged, and frozen food, which together account for over half of FMCG sales. This decline is driven by a combination of factors, including some impact from dining out, more frequent travels, the accessibility of cross-border shopping, and reduced shopping frequency among lower-income consumers due to constrained purchasing power.

Within the online channel, HK TVMall and Wellcome are leading players, with the focus coming more from Food categories. Supermarkets have adapted to the growing demand by offering online delivery services, catering to convenience-driven consumers.

Indonesia: Minimarkets and Online shopping are growing fast

Indonesia’s market is predominantly driven by general trade. However, the minimarket channel is experiencing faster growth, largely driven by the expansion of Alfamart, one of Indonesia’s largest minimarket retailers alongside Indomaret. In the last two years, Alfamart has successfully attracted upper-middle SES by pushing higher promotions through categories like homecare, showcasing an ability to target specific demographics effectively. On top of that, they manage to keep buyers loyal through a membership program.

In the e-commerce sector, online shopping is rapidly expanding as it can offer more affordable prices than offline channels, with delivery discounts. Personal care and beauty products are leading the way, particularly on Shopee. Social commerce platforms like TikTok Shop are gaining popularity, fueled by the rise of live shopping, which provides real-time interaction and flash sales, as also seen on platforms like Shopee. Moreover, its youthful appeal draws younger consumers in Indonesia who favor creative and personalized content over traditional advertisements.

*Disclaimer: Promotion data in Homepanel is based on panelists’ self-reported claims

Philippines: Stronger opportunity for sari-sari stores as consumers find more value in convenience

Sari-sari stores remain the leading force in Philippine retail, posting a 5% sales growth in 2024, mainly due to price inflation. Their proximity makes them a go-to for urgent essentials, especially among budget-conscious shoppers who favor affordable sachets and small packs. In response to growing demand, these stores have expanded beyond the basic categories, a trend that accelerated after the COVID-19 pandemic. This shift has influenced consumers, as they now anticipate future needs, leading to higher spending per visit but lower shopping frequency. Some manufacturers address this by launching smaller packs while keeping prices unchanged, as consumers remain willing to purchase smaller quantities.

Despite making up a small portion of the total market, the online channel in the Philippines is still growing, driven mainly by non-food products, as consumers prefer to buy fresh grocery items offline from local sari-sari stores or supermarkets.

What’s next for Retailers and Brands

The shifting channel dynamics across Asia present both challenges and significant opportunities. Success hinges on proactively adapting strategies to meet evolving consumer needs and market realities. Brands and Retailers must be agile, data-driven, and have a deep understanding of local consumer behaviors.

- Increase engagement and reach more buyers in the modern channel: Develop collaborative, tailored promotional strategies—from membership programs to industry-specific campaigns—to effectively engage and attract more buyers.

- Adapt to price sensitivity: Businesses should offer the right products at the right price, particularly in essential categories. This includes providing competitively priced items and adjusting packaging sizes to fit consumer budgets, ensuring affordability and convenience. It’s also important to highlight clear, compelling value-for-money options to attract cost-conscious shoppers.

- Capitalize on E-commerce and Social Commerce growth: Brands must strategically enhance their visibility and sales efforts on dominant e-commerce platforms in their local markets. This involves optimizing product listings, ensuring a seamless purchasing journey, offering exclusive online deals, and actively building brand authenticity. The explosive growth of platforms like TikTok Shop cannot be ignored. Brands need to develop capabilities in creating engaging short-form video content, fostering authentic influencer partnerships, and leveraging features like Live Commerce to offer personalized, interactive, and entertaining shopping experiences—especially targeting younger demographics.

Unlock Consumer Spending Behaviors to Drive Growth

Dive deeper into understanding your consumer spending behavior and discover how to seize opportunities in today’s changing channel dynamics. Schedule a consultation with us to learn more.