NIQ’s Holiday Shopping Index reveals where, what, and how much consumers spent while offering insights on future Black Friday sales trends and holiday shopping behavior

- This report analyzes global seasonal shopping trends from 2022 to 2024 using NIQ’s Holiday Shopping Index (HSI), which isolates event-driven sales and reveals long-term patterns beyond simple year-on-year comparisons.

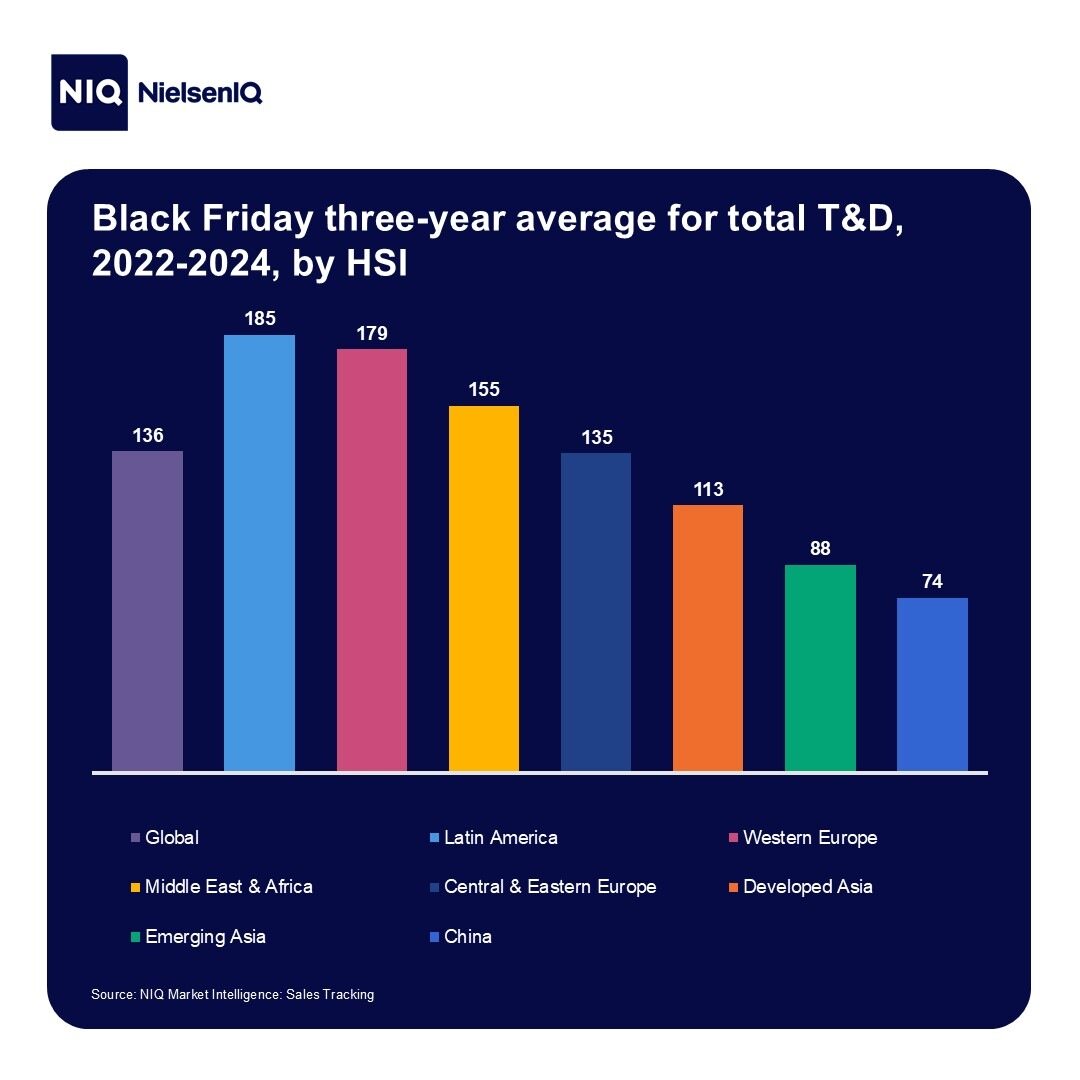

- Engagement varies widely by region: Latin America leads with the highest HSI, followed by Western Europe and Middle East & Africa. Category trends highlight strong gains in Consumer Electronics, Computers and Gaming, and appliances, driven by innovation, replacement cycles, and evolving Black Friday consumer behavior.

A seasonal shopping occasion like no other

Black Friday is a thrill for shoppers, but for brands and retailers in Consumer Technology and Durable Goods (T&D), it’s a high-stakes test of product and merchandising strategies. Months of planning come down to one week: Did the right products and promotions drive sales—or fall flat? Did merchandising add to margins—or eat into them?

These questions matter even more as Black Friday shopping trends shape competitive performance. We hear a lot about Black Friday sales and in-store foot traffic in the United States, where the shopping holiday originated. Much of this focus is on prior-year comparisons—an analysis that can be easy to grasp but can miss the bigger picture. Also, we don’t often get a global view of Black Friday retail performance outside the US.

This analysis redresses those shortcomings by taking a multi-year look at T&D Black Friday sales activity in the regions outside North America.

How we measured Black Friday appeal

This analysis uses a proprietary NIQ algorithm, the Holiday Shopping Index (HSI), which we first introduced in July 2025:

- The algorithm measures the incremental value sales generated by a shopping event or holiday, by the week.

- It accounts for long-term trends, seasonality, inflation, and other market dynamics, ensuring the metric reflects only event-driven sales.

- Increases are measured by values over 100; an HSI of 150 means sales were 50% higher than one would expect for that week without an event or holiday—providing valuable holiday shopping statistics for retailers and manufacturers.

We gathered sales data from in-store, online, and major e-commerce platforms, reflecting the reality of shoppers’ increasingly omnichannel journey. We examined T&D sales in seven regions, with a mix of large and small economies in each region:

- Central and Eastern Europe

- China

- Developed Asia

- Emerging Asia

- Latin America

- Middle East & Africa

- Western Europe

Source: NIQ Market Intelligence: Sales Tracking

What we found:

Leading regions for Black Friday engagement

In our analysis, we looked at T&D sales for the week of Black Friday in 2022, 2023, and 2024. Even though Black Friday isn’t a major event in all regions, in aggregate, HSI for all categories of T&D has shown a steady rise: Between 2022 and 2024, the HSI for T&D increased 11.7%—underscoring growing Black Friday consumer trends.

For this analysis, the strongest regions with highest HSI are (in order), Latin America, Western Europe, Middle East & Africa, and Central and Eastern Europe. In Developed Asia, results are mixed. The three former British colonies are strongest: Australia, New Zealand, and Singapore. Conversely, engagement is consistently low in Hong Kong, Japan, and Taiwan.

Other regions: Competing and compelling holiday sales

In many Asian markets, Black Friday faces stiff competition from earlier shopping events like Singles’ Day (11/11) and Diwali.

Singles’ Day, originating in China and amplified by platforms such as Alibaba and JD.com, drives massive sales across Asia Pacific, peaking at 129 in China’s T&D sector in 2024. Similarly, Diwali, which fell on Oct. 31 in 2024, spurred strong T&D spending in India—reaching 204 during its peak week—thanks to promotions from Amazon India, Flipkart, and Meesho.

These events significantly reduce Black Friday engagement in Emerging Asia, China, and much of Developed Asia.

Breakdowns by regions, countries, and categories

The importance of Black Friday as a T&D sales event is hard to overestimate in the regions with the highest HSI values. Black Friday week consistently outperforms Christmas week in Latin America, Middle East & Africa, and Western Europe, revealing clear consumer spending Black Friday patterns.

| Latin America | Middle East & Africa | Western Europe | |

| Black Friday week HSI value | 195 | 152 | 189 |

| Christmas week HSI value | 104 | 102 | 116 |

| Variation (%) | +87.5% | +49% | +62.9% |

Let’s break down the nuanced category and product differences by region.

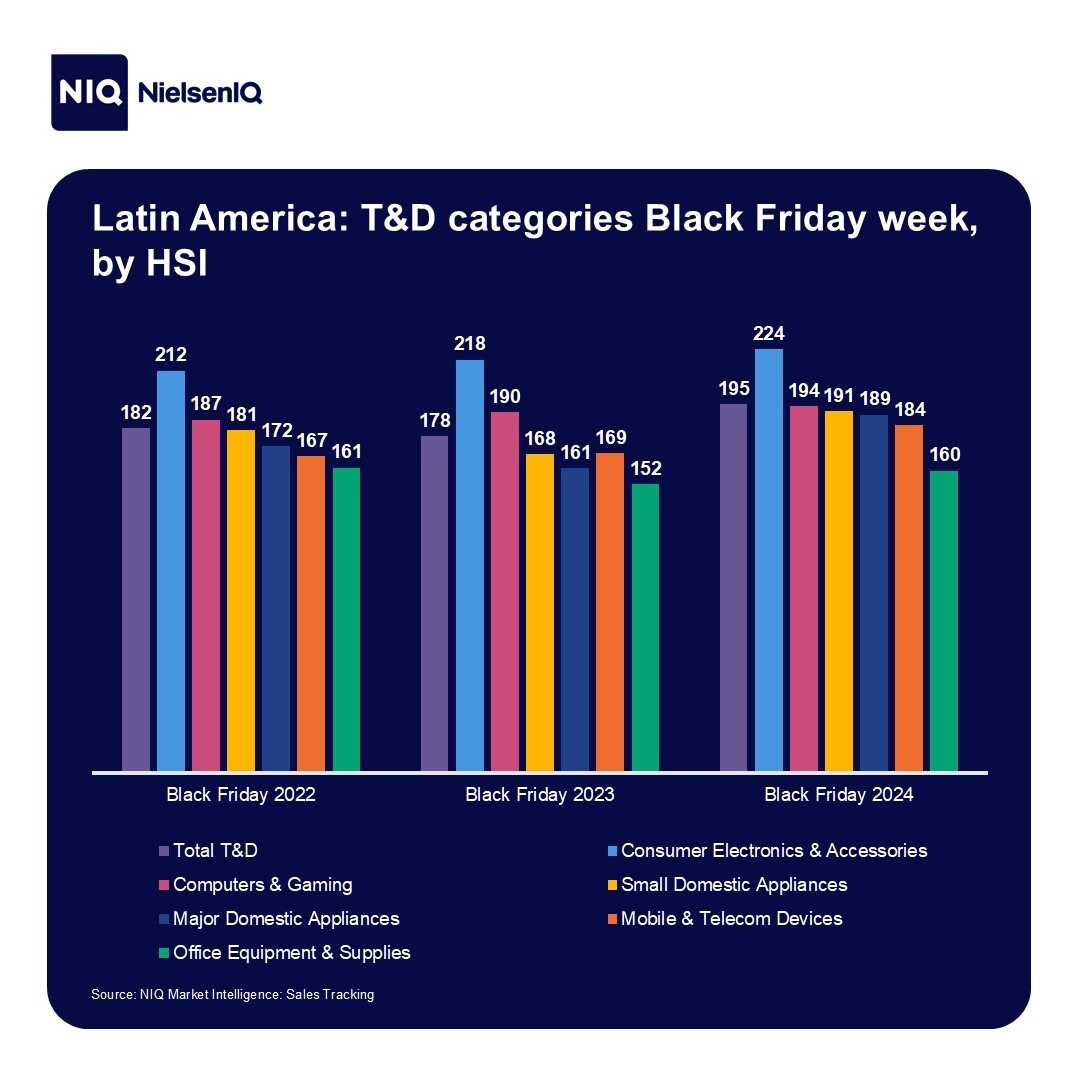

Latin America: A robust rebound

In Latin America (LATAM), we examined Black Friday in Argentina, Brazil, Chile, Colombia, and Peru.

HSI values dipped in most T&D categories between 2022 and 2023 but recovered in 2024 as inflation cooled in the region. In 2024, this group had the highest HSI for total T&D sales (195), as well as the highest average for all three years (185), underscoring strong Black Friday buying trends.

- Brazil (223) and Colombia (207) stood out in Black Friday 2024 with HSI values above 200—meaning sales activity was more than twice what would be expected for that week without a shopping holiday or event.

- Chile (181) trailed closely, while Peru (133) showed modest gains and Argentina (where inflation had been more stubborn) barely moved the needle (106).

- Consumer Electronics & Accessories was the strongest category in 2024, followed by Computers and Gaming, Small Domestic Appliances (SDA), Major Domestic Appliances (MDA), Mobile & Telecom Devices, and Office Equipment & Supplies.

- From 2023 to 2024, MDA surged 17.3%, with SDA up 13.7%. Over the longer period, 2022–2024, Mobile & Telecom posted the biggest jump (+10.2%), with MDA close behind (+9.9%)

- Top products in LATAM in 2024 included electric fryers (mostly air fryers), loudspeakers, TVs, digital cameras, tumble dryers, and air conditioners.

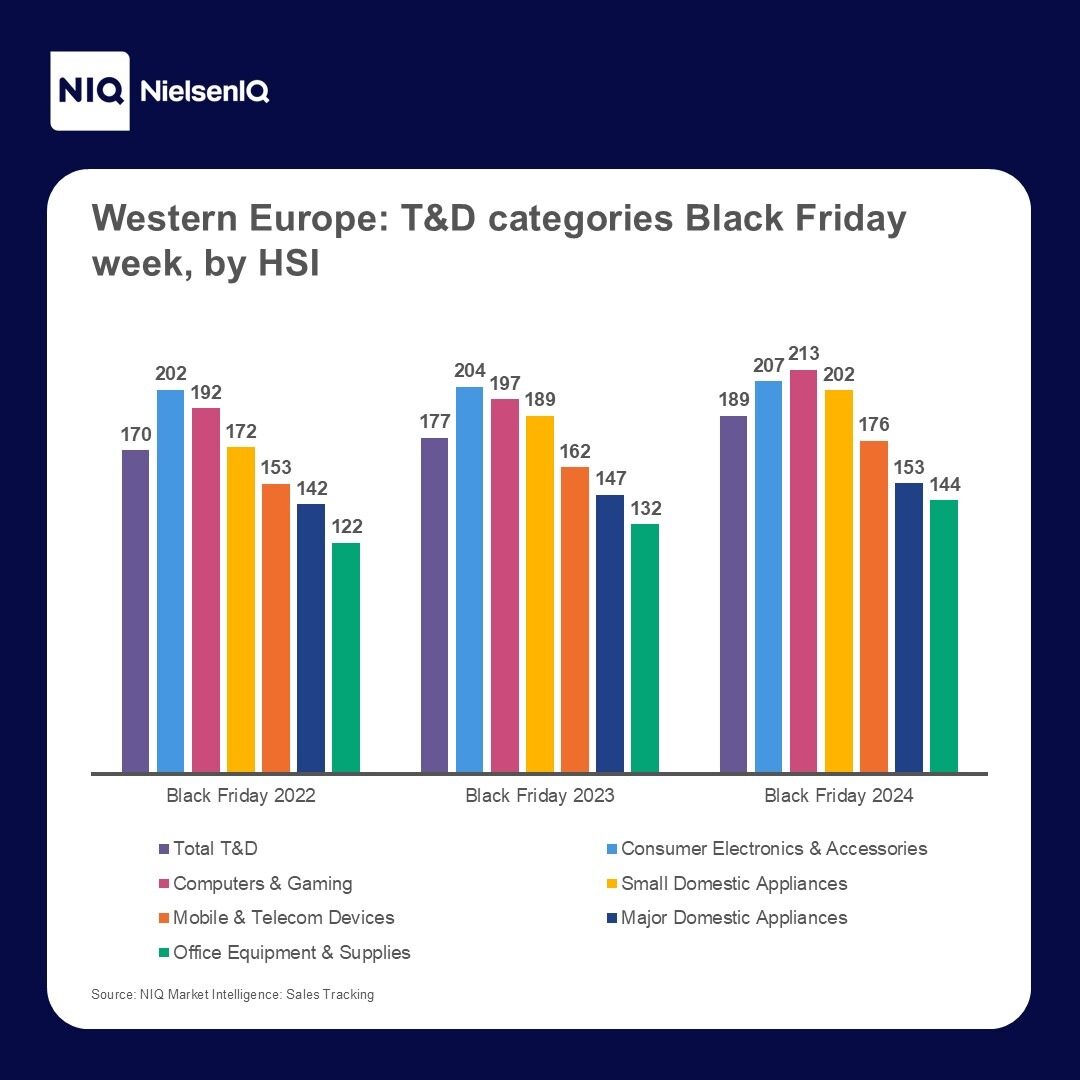

Western Europe: Steady growth for Black Friday

This region recorded steady year-on-year growth for Black Friday and had the second-highest HSI average for total T&D over three years (179). We included 15 Western European countries in our analysis.

- Ranking by HSI, the top five countries for Black Friday T&D total sales in 2024 were (in order): Finland (256), Switzerland (243), Sweden (226), Spain (221), and Denmark (208).

- Among the five largest-GDP countries, the highest HSI values were (in order) Spain (221), Germany (194), France (186), Italy (180), and the United Kingdom (169).

- Computers and Gaming topped all categories in 2024—the only region in this analysis where these categories ranked higher than Consumer Electronics & Accessories.

- The next categories were Consumer Electronics & Accessories, SDA, Mobile & Telecom Devices, and MDA.

- From 2023 to 2024, Office Equipment & Supplies had a higher increase (9.1%), followed closely by the Mobile & Telecom Devices increase (8.6%). Over the longer period, from 2022 to 2024, increases for Office Equipment & Supplies were high (18%), closely followed by SDA (17.4%).

- Iced desserts/Yogurt makers (259) were popular for Black Friday in 2024. Hot summers and rising demand for healthy, low-fat, and probiotic treats have made these appliances more popular.

- Other top products included mobile computing, software, vacuum cleaners, and headsets.

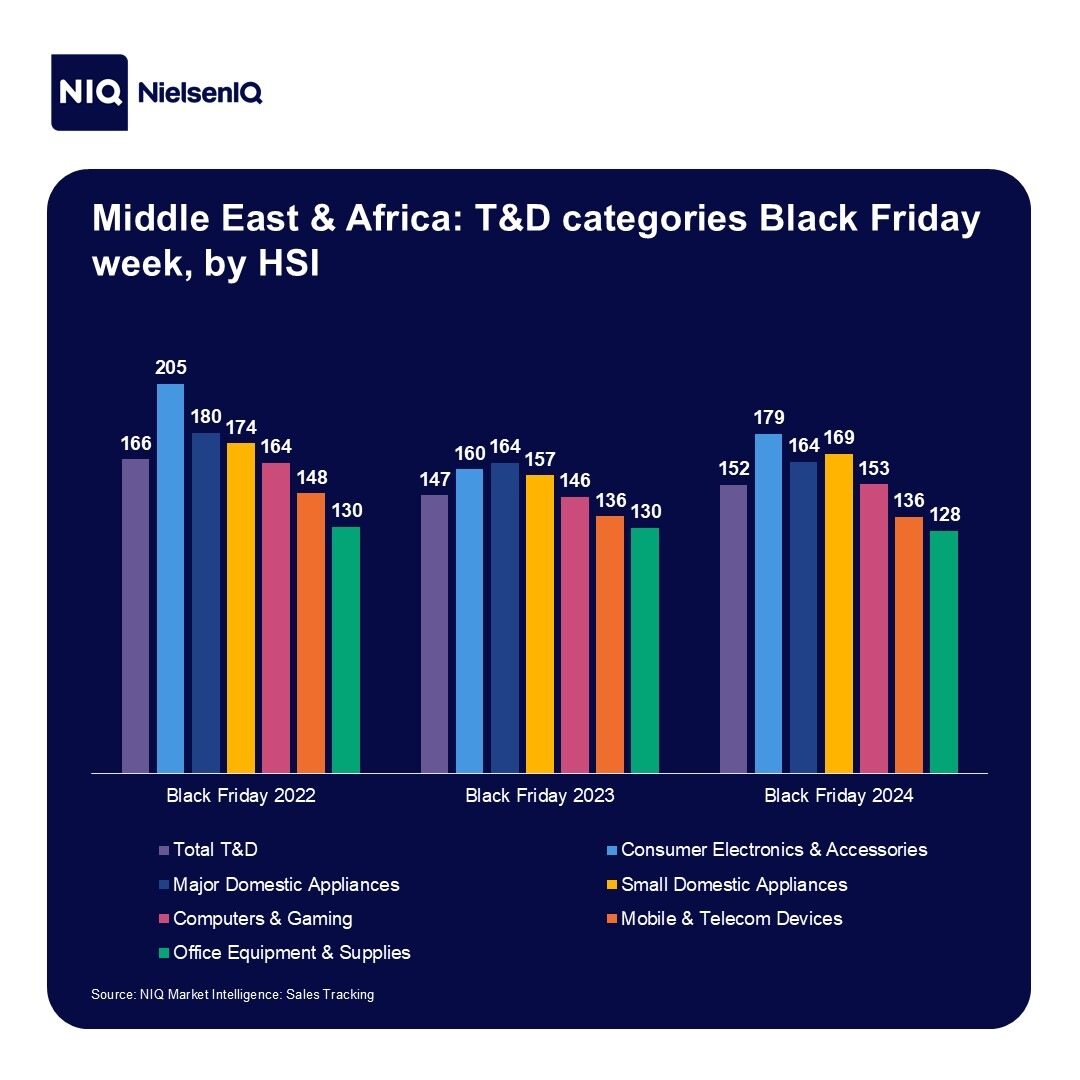

Middle East & Africa: Mixed and middling results

For our analysis of the Middle East & Africa (MEA), we included Israel, Morocco, Saudi Arabia, South Africa, Türkiye, and United Arab Emirates (UAE). MEA ranks third in the three-year average of total T&D sales (155), ahead of Central and Eastern Europe. However, T&D sales levels dipped from 2022 to 2023 and only partially recovered in 2024—but did not surpass 2022 levels, signaling weakness for Black Friday.

- South Africa (185) took the top spot for Black Friday 2024. In recent years, Black Friday has become a major shopping holiday with promotions running through much of the month (often referred to locally as “Black November”) but still culminating during the week of Black Friday.

- Israel (161) had the next-highest HSI, followed by Türkiye (146), Saudi Arabia (142), UAE (137), and Morocco (108) showing very little increase on Black Friday.

- For Black Friday 2024, Consumer Electronics & Accessories led other categories, closely followed by SDA, MDA, Computers and Gaming, Mobile & Telecom Devices, and Office Equipment Supplies.

- From 2023 to 2024, three categories rose: Consumer Electronics & Accessories (+11.9%), SDA (+7.6%), and Computers and Games (+4.8%). No categories increased consistently over the three-year period from 2022 to 2024.

- Top T&D products for Black Friday 2024 included electric fans (by a wide margin), TVs, microwave ovens, vacuum cleaners, and tumble dryers.

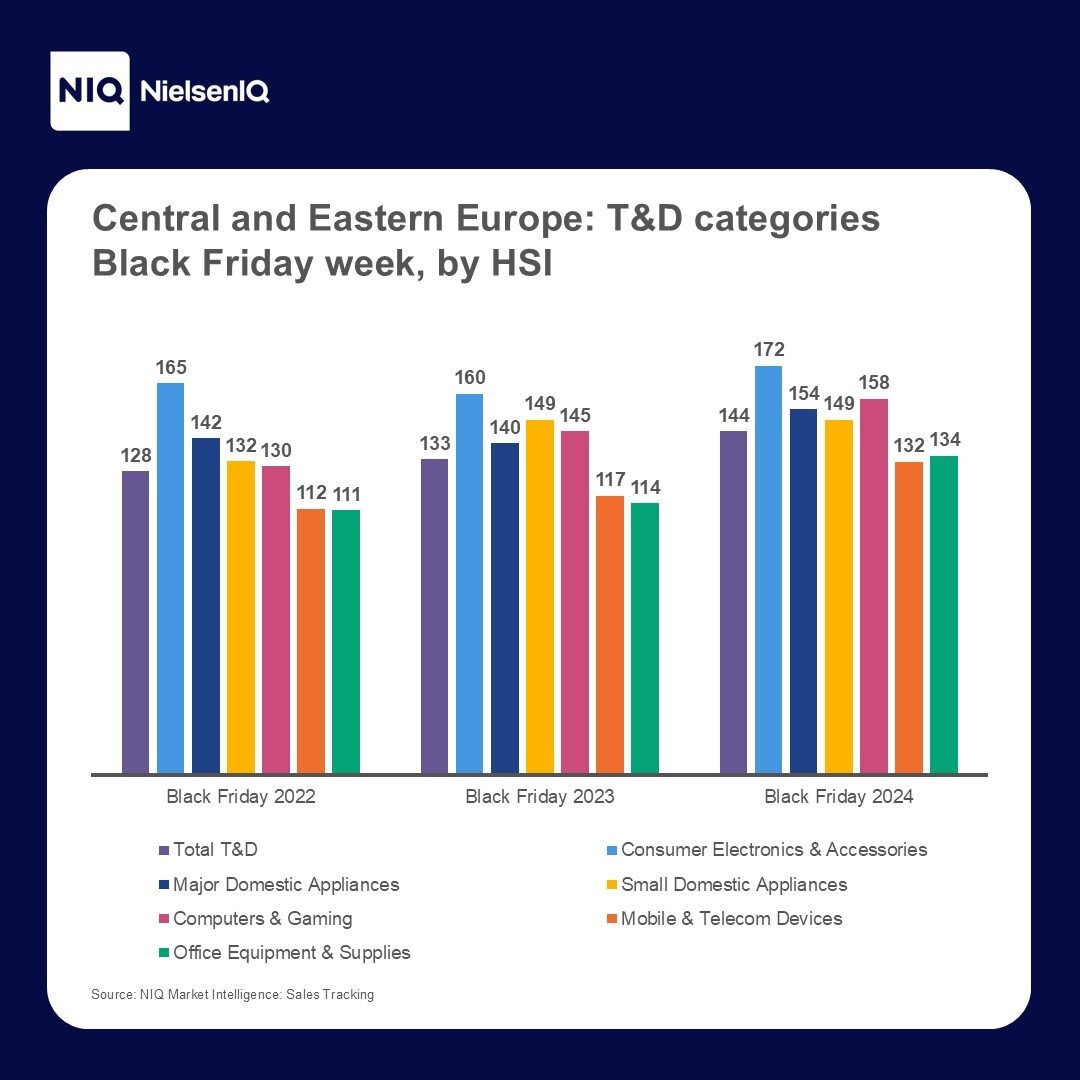

Central and Eastern Europe: Appliances aplenty

Our analysis of Central and Eastern Europe (CEE) includes a mix of large and small economies: Czechia, Hungary, Kazakhstan, Poland, Slovakia, and Ukraine. Black Friday engagement in CEE has been rising steadily each year from 2022 to 2024.

- In 2024, Ukraine led this group with an HSI of 206. Conflict-driven inflation and other effects of war such as supply chain disruptions and damaged infrastructure have increased price sensitivity and accelerated digital shopping.

- Ukraine is followed by Poland (149), Czechia and Slovakia (both 131), and Hungary and Kazakhstan (both 123).

- Consumer Electronics & Accessories are in the top spot, followed by Computers and Gaming, MDA, SDA, Office Equipment & Supplies, and Mobile & Telecom Devices.

- From 2023 to 2024, Office Equipment & Supplies increased the most (17.5%), followed by Mobile & Telecom Devices (12.8%). Over the longer period, from 2022 to 2024, two categories—Computers and Gaming and Consumer Electronics & Accessories—tied for the biggest increase (21.5%), closely followed by Office Equipment & Supplies (20.7%).

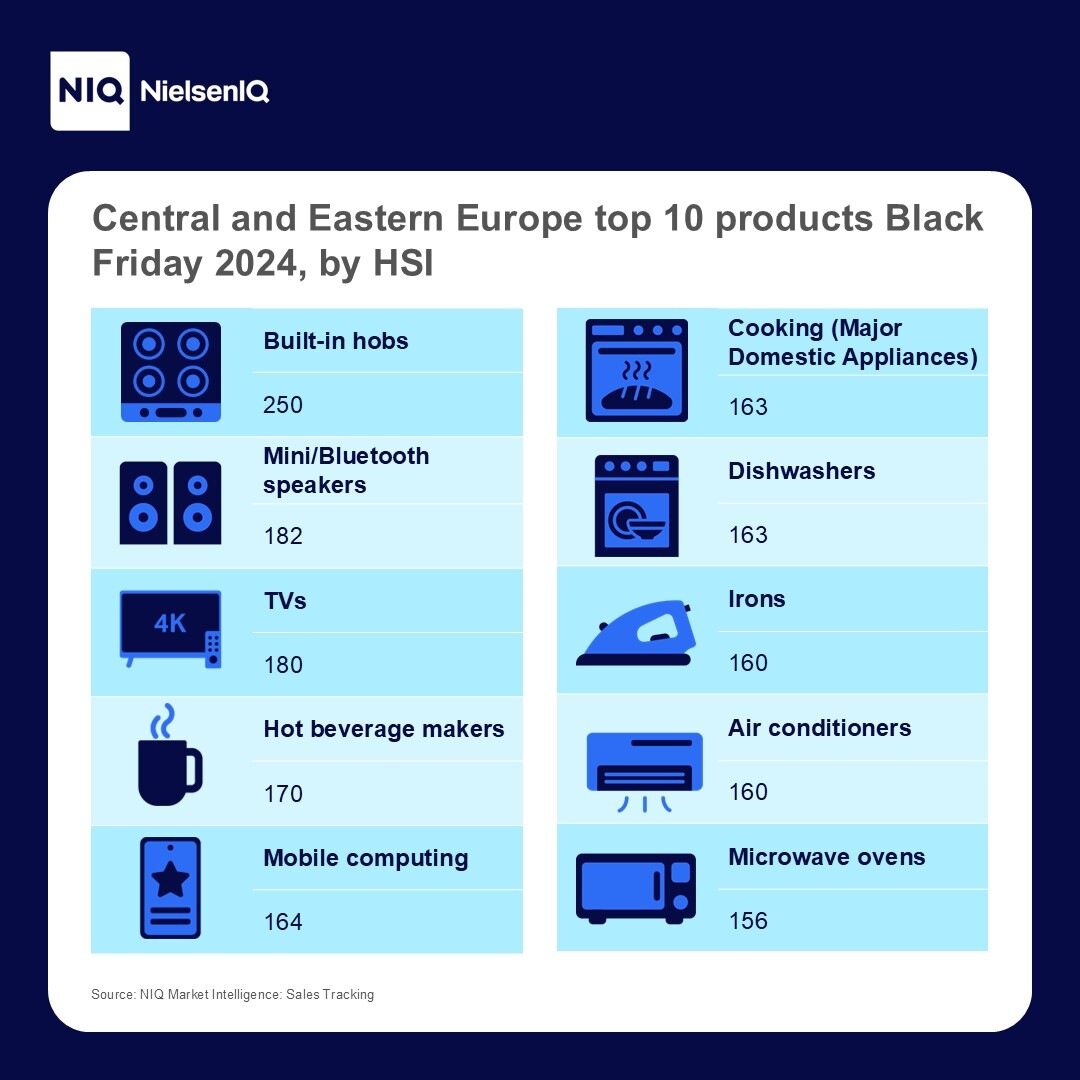

- Major appliances were prominent in the top 10 products for Black Friday 2024—most notably built-in hobs, dishwashers, air conditioners, and microwave ovens.

Key observations

Consumer Electronics Friday

It’s clear just how dominant the Consumer Electronics & Accessories category is on Black Friday. This category delivered high incremental sales across all regions, revealing a key global Black Friday sales trend. Driven by innovation and deep discounts, this category lets consumers match the thrill of holiday gifting with the urge to get the latest and greatest consumer tech.

Don’t let AI’s potential get lost in translation

In-product AI within T&D has big promise, but right now it’s more a maker-led push than a shopper priority. Take robot vacuum cleaners: Only 12% of buyers say AI mattered in their final choice of product, while 46% bought for the mopping function. The twist? It’s the in-product AI that powers that vacuum’s smarter navigation, automatic surface recognition, and auto-mopping. AI is the engine behind enhanced performance and convenience—which are consumers’ clear purchase drivers. We expect consumer interest in certain smart products to increase strongly in the long term, as they better understand the very relevant benefits that AI functionality delivers.

Hopping on the replacement cycle

In Western Europe, Black Friday saw Computers and Gaming outperform Consumer Electronics—a unique regional trend driven by replacement cycles, as many consumers upgraded pandemic-era devices and responded to the end of Windows 10 support. As noted in our Consumer Tech Industry Trends 2025 report, this surge was further fueled by rising demand for gaming PCs and consoles, driven by new product launches and improving consumer confidence in 2025, while gamers also continue their focus on accessories.

All appliances great and small

Both Small and Major Domestic Appliances saw strong Black Friday sales. SDA growth is driven by shorter replacement cycles and ongoing innovation (e.g., air fryers, robot vacuums), while MDA sales are steadier due to longer cycles. As noted in our recent Home Appliances Outlook 2026: What consumers want report, shoppers are prioritizing durability, energy efficiency, and convenience, with premium features and multifunctionality gaining importance in emerging markets, and price remaining a key factor in developed ones.

Maximizing Black Friday’s impact

While marketing, consumer insights, and product innovation remain essential, this analysis makes clear that understanding replacement cycles is a decisive competitive advantage. When consumers are ready to upgrade or replace appliances and tech, windows of opportunity open that can define annual results.

For T&D manufacturers and retailers, the message is clear: Keep a sharp eye on when these cycles peak, and be ready with the right mix of innovation, value, and omnichannel presence.

- Manufacturers must balance affordability with features that address evolving needs and value-driven decision-making rises.

- Retailers should prioritize assortment and merchandising choices that are informed by replacement cycles to focus on the most in-demand categories.

Ultimately, those who time their strategies to align with replacement cycles—striking when consumers are most receptive—will be best positioned to thrive during competitive shopping occasions and events like Black Friday in the coming years.

For more seasonal shopping insights from around NIQ, be sure to visit and bookmark our hub.

Your next move

Globally, consumers are shifting from cautious saving to intentional spending, but their priorities are sharper than ever: localized demand, value-driven choices, and focused purchasing. For Tech & Durables manufacturers and retailers, this means strategies must be tailored market by market to meet evolving expectations and capitalize on emerging Black Friday sales trends.

NIQ is here to help you navigate this complexity. Our consumer technology experts deliver deep insights into industry trends and consumer dynamics, empowering you to craft strategies that resonate and drive growth. Contact us for more information and guidance.