A strategic blueprint for consumer technology retailers in 2025

In today’s retail landscape, consumer technology retailers face a pivotal challenge: how to deliver seamless, personalized experiences across a growing number of digital and physical touchpoints. At the IFA Retail Leader Summit 2025, NielsenIQ’s Michael McLaughlin, SVP Technology & Durables Retail, addressed this challenge head-on.

His session, “Mastering Omnichannel: How to Become a Best-in-Class Retailer,” offered a data-driven roadmap for brands looking to evolve from multichannel operations to unified commerce ecosystems.

With global eCommerce share rising and consumer expectations shifting, the message was clear – omnichannel is no longer optional; it’s the foundation for future growth.

Digital Behavior is the Baseline – Omnichannel is the Minimum

With over 5.5 billion internet users globally and 52% of purchases influenced by social media1, digital-first behavior is now the default.

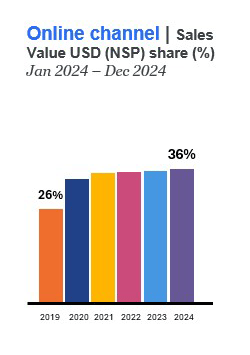

In consumer tech and durables, 36% of global sales (excluding NA and RU) are online, up from 26% in 2019. The first interaction with a product is often digital, even if the final purchase is made offline.

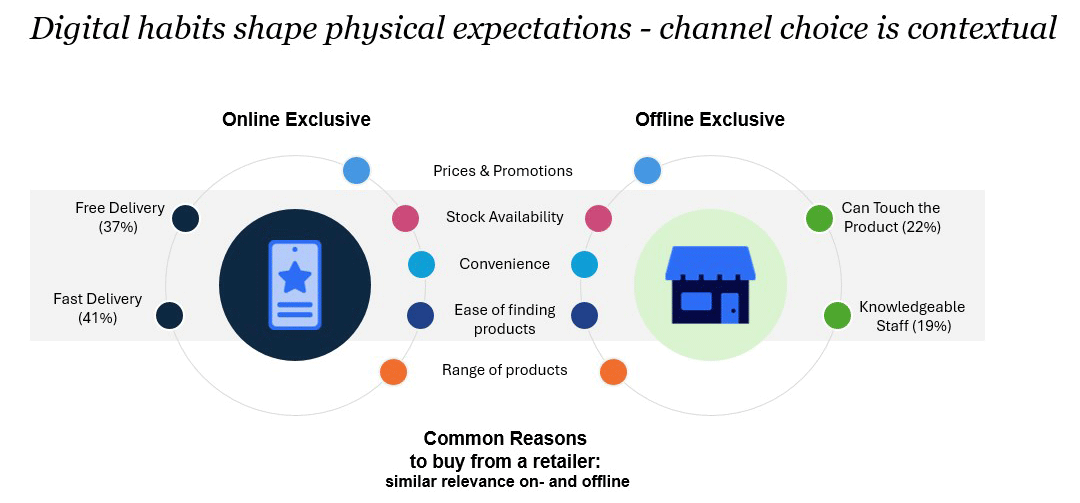

Consumers expect seamless transitions between online and offline touchpoints. They don’t think in channels – they think in moments and experiences. This means retailers must deliver consistent messaging, availability, and service across every touchpoint.

“Digital shopping behavior is no longer a trend – it’s the baseline.”

Michael McLaughlin, SVP Technology & Durables Retail, NIQ

Retail Ecosystems Drive Differentiation and Loyalty

Retailers offering ecosystem services, like installation, setup support, loyalty rewards, and flexible payment options, are outperforming others.

These services are especially valued in categories like major domestic appliances (MDA) and consumer electronics, where post-purchase support is critical.

The omnichannel players benefit more via their offline reach, and that retail service ecosystems are becoming a key differentiator. Consumers increasingly expect personalized service bundles, not just product availability. The retailer service ecosystem has become a differentiator in the consumer journey.

Accessing both on and offline touchpoints during the purchase journey drives the likelihood of increased spending.

Unified Commerce is the Future of Retail Strategy

Omnichannel is evolving into unified commerce – a model where all channels are consolidated into a single front- and back-end system. This enables personalized experiences, consistent service, and real-time data activation.

Online-exclusive brands are now shifting to offline, signaling a maturing market. For the first time, there’s a decline in online-only assortments, while curated omnichannel offerings are growing. This reinforces the idea that channel strategy is product strategy. Retailer that will win the race will be does who evolve into a unified commerce bundling personalized touchpoints and service ecosystem.

Consumers today expect more than just products from their retailers – they demand a seamless, consistent experience across all their preferred platforms. The line between online and offline shopping continues to blur, and with 36% of global revenue in tech and durables now coming from online channels, even retailers with a strong physical presence must prioritize their digital visibility and engagement.

Looking to master the omnichannel?

Looking to transform your retail strategy, and move beyond multichannel approaches towards a unified commerce?

Source references

- Source: UN Local govt bodies, GSMA intelligence, ITU, GWI, Eurostat, CNNIC, APJII, Social media platforms, Self-service advertising tools, company earning reports. Data for January 2025 | NIQ Market Intelligence, International coverage | NIQ ConsumerLife 2025, Global

- Source: GfK Market Intelligence: Sales Tracking, International Coverage (excl. North America and Russia), Sales revenue growth 2024 vs 2023

CE includes Multifunctional Technical Devices and SDA includes Personal Diagnostics