Balancing retail partnerships, eCommerce and D2C

At the IFA Retail Leader Summit, NielsenIQ’s Alexander Dehmel delivered a powerful session tailored to leaders in consumer technology. His presentation explored how omnichannel strategies are reshaping the way consumers discover, evaluate, and purchase products in this fast-evolving sector.

From the rise of social commerce to the nuances of regional eCommerce dynamics, the session offered actionable insights for retailers looking to shape smarter strategies and stay competitive in a fragmented consumer technology landscape. Read more as we highlight the key takeaways from the session.

The Shopper Journey is More Complex Than Ever

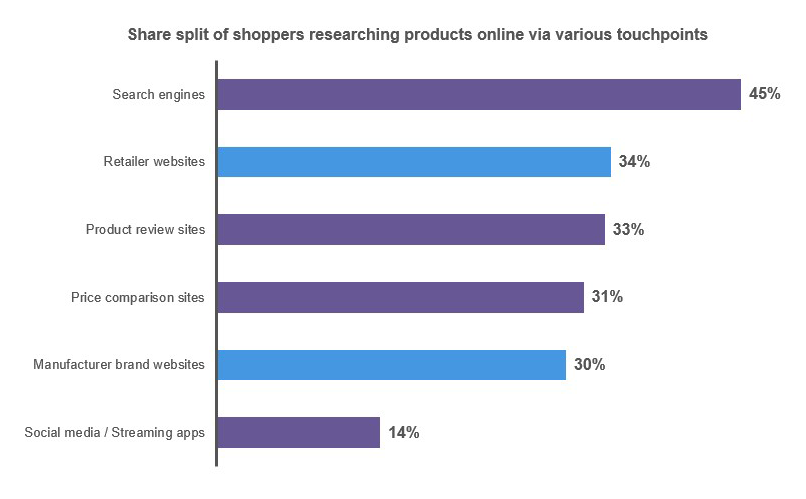

Consumers no longer follow a linear path to purchase. Instead, they engage with multiple digital touchpoints: social media, brand websites, price comparison platforms, and search engines, before making a decision. 56%1 of all online shoppers actively research via various online touchpoints, highlighting the importance of a seamless and informative digital presence. Retailers must ensure consistency and relevance across all channels to influence decision-making effectively.

The consumer journey is more complex than ever due to digitization and personalization enabled by technology – and with that requires new ways to engage and influence consumers.

This complexity is further amplified by the rise of social commerce, which is rapidly reshaping how consumers discover and buy products. In Germany, for example, TikTok Shop saw a dramatic increase in purchase penetration in online shoppers – from 1.2% to 5.8% in just 14 weeks3. Categories like Beauty & Personal Care and High Tech led the way, with beauty accounting for over 50% of purchases in the first 6 weeks4. This shift signals a clear opportunity for consumer technology brands to explore new formats and partnerships that meet consumers where they are – on platforms they trust and engage with daily.

“Rising complexity in the shopping journey demands new ways to engage and influence consumers”

Alexander Dehmel, Head of Customer Success Tech and Durables DACH

Regional differences in eCommerce dynamics

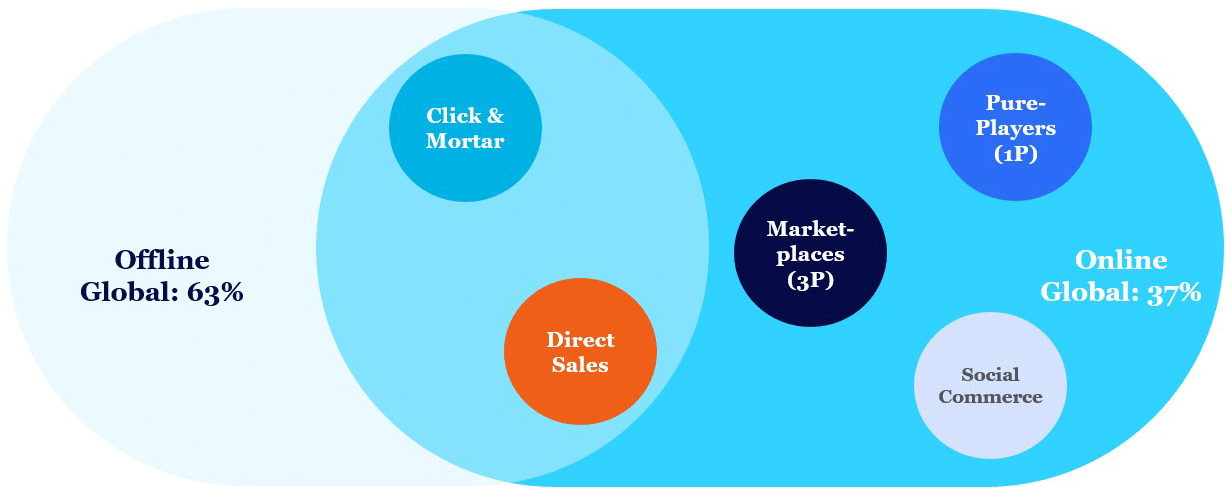

While in H1 2025 37% of global retail sales are now online5, the composition of eCommerce varies widely by region:

- In LATAM, marketplaces and pure players dominate, with 19% and 11% revenue shares respectively.

- In Europe, omnichannel retailers lead with 56% of online revenue.

- In China, 25% of SDA (small domestic appliances) sales come from social commerce.

These differences highlight the importance of tailoring strategies to local market behaviors and infrastructure.

D2C: A strategic balancing act

Direct-to-consumer (D2C) channels offer brands in the consumer technology space a unique opportunity to build deeper relationships with their customers. By bypassing traditional retail intermediaries, brands can deliver more personalized experiences, gain richer consumer data, and maintain greater control over pricing and messaging.

However, D2C is not without its challenges. It requires significant investment in logistics, customer service, and digital infrastructure. Consumers expect more from D2C channels especially in areas that directly impact their satisfaction and loyalty.

Consumer will prioritize the following when buying directly from brands:

- After-sales service: Consumers expect responsive support and warranty handling, making this a critical differentiator for D2C.

- Detailed product information: Rich, accurate content (specs, comparisons, and usage guides) are more valued in D2C environments than in traditional retail.

- Knowledgeable support: Even in offline contexts, consumers associate D2C with expert guidance, whether through chat, video consultations, or community forums.

These expectations are more important in D2C than in total retail, meaning brands must deliver not just convenience, but confidence and care throughout the customer journey.

“Sales opportunities and brand-building potential are clear – but brands must weigh these against the operational costs and consumer expectations.”

Namrata Gotarne, Global Strategic Insights Director, Tech and Durables

For consumer technology brands, the key is to strike the right balance: leveraging D2C for strategic differentiation while maintaining strong retail partnerships to scale reach and accessibility.

Looking to reshape your strategy?

The future of retail is omnichannel – and it’s already here. To stay ahead, brands and retailers must embrace data-driven strategies that reflect the complexity of today’s consumer journey.

Source references

- Source: gfknewron Consumer FY2024 | Categories: Vacuum Cleaner, Food Prep, Shavers, Dental Care, Haircare, Hot Bev. Makers | Country: Belgium, Brazil, France, Germany, Great Britain, Italy, Japan, Netherlands, Poland, Spain, Turkey | Interviews:407,699

- Source: gfknewron Consumer FY2024 | Categories: Vacuum Cleaner, Food Prep, Shavers, Dental Care, Haircare, Hot Bev. Makers | Country: Belgium, Brazil, France, Germany, Great Britain, Italy, Japan, Netherlands, Poland, Spain, Turkey | Interviews:407,699

- Source: NIQ Digital Purchases | Total E-commerce | Penetration | 31/3/2025 – 6/7/2025

- Source: NIQ Digital Purchases | Total E-commerce | 31/3/2025 – 6/7/2025

- Source: NIQ Market Intelligence, in sales value

- Source: NIQ Market Intelligence, in sales value