What’s Fueling the Shift in the Automotive and Aftermarket Retail Industry?

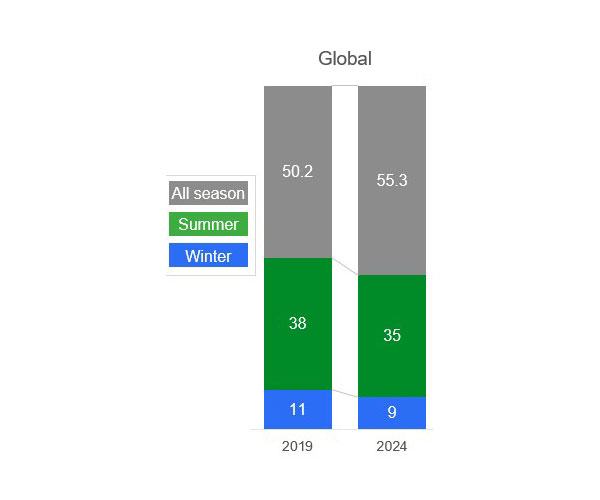

The automotive and aftermarket industries are undergoing significant transformations driven by macroeconomic shifts, evolving consumer preferences, and technological advancements. Time-strapped consumers are gravitating toward convenience, all-in-one solutions. This is especially evident in tire preferences, where all-season tires are steadily replacing traditional seasonal sets. They offer year-round functionality without the need to switch twice a year—making them a perfect match for consumers who value ease and efficiency.

Source: GfK Market Intelligence: Sales Tracking | The road ahead: key trends in automotive & aftermarket industry FY24

At the same time, SUVs continue to outpace sedans in popularity, becoming the go-to choice for families and urban drivers alike. The combination of more versatile driving conditions and a desire for spacious, comfortable vehicles makes SUVs the natural companion to all-season tires.

For the car tires segment that means steady growth, driven by the increasing penetration of SUVs and electric vehicles (EVs). All-season tires, as mentioned, are gaining popularity due to their convenience and advancements in performance. Budget brands are expanding their portfolios to include larger tires, catering to the growing demand for affordability

Beyond the Showroom: How Aging Cars and Regional Growth Are Reshaping the Auto Industry

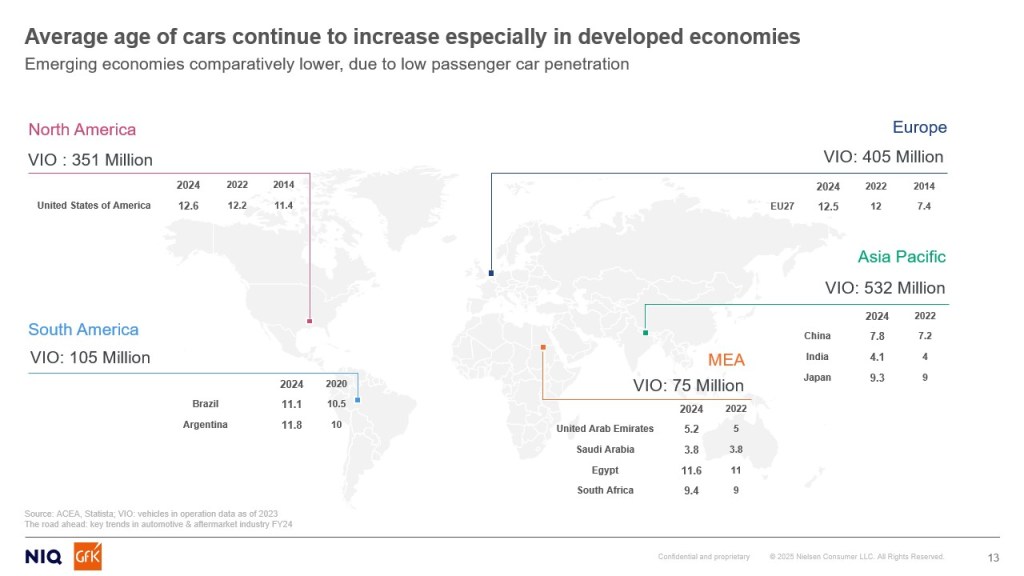

Global passenger car sales are expected to surpass pre-pandemic levels, driven by growth in the EU and US markets. The average age of cars continues to increase, especially in developed economies, indicating a growing demand for replacement parts and maintenance services. For instance, the average vehicle age in the US is now 12.6 years, while in Europe, it ranges from 10.3 to 14.2 years. In 2025, global passenger car sales are forecasted to reach 81 million units, with Europe and North America showing the highest growth rates, driven by easing supply chain constraints, renewed consumer confidence, and a gradual rebound in economic activity.

However, this growth is multifaceted, shaped by regional challenges such as high interest rates, fluctuating EV incentives, and political uncertainty, particularly in the U.S. and parts of Europe

As new vehicle prices remain elevated and consumers delay purchases, the average vehicle age continues to climb—reaching over 12.5 years in the U.S. This aging fleet is a goldmine for the aftermarket industry, from tire replacements to engine oils and diagnostics

Older vehicles mean more frequent maintenance. Are you positioned to meet this demand?

Electric mobility is gaining traction, with China leading the way in EV adoption. The global EV share is projected to reach 18% in 2025, with China experiencing the fastest growth in its EV fleet. However, the transition to EVs will take time, as their share in the overall automotive market remains less than 1%. Government subsidies and regulations are driving this growth, but the impact on the aftermarket industry is still limited.

Outlook for 2025

As we look ahead to 2025, several key trends are expected to shape both the automotive and aftermarket industries. Consumer behavior is increasingly influenced by economic uncertainties, with fears of recession and unemployment driving a focus on affordability and value. This rationalization of purchases is likely to impact both new car sales and aftermarket services.

The penetration of SUVs and electric vehicles (EVs) continues to rise, driving demand for all-season and larger tires. This trend is expected to persist, with manufacturers and retailers adapting their offerings to meet the evolving needs of consumers.

Electric mobility is gaining momentum, particularly in China, which leads the way in EV adoption. However, the overall impact of electric vehicles on the aftermarket industry remains limited, as their market share is still relatively small. Nevertheless, the growth of electric mobility presents new opportunities for innovation and adaptation within the industry.

Technological advancements are reshaping the automotive experience, with innovations such as AI-driven vehicle diagnostics and enhanced in-car entertainment systems offering new possibilities for retailers. These advancements are expected to drive further changes in consumer expectations and industry practices, creating a dynamic and evolving landscape.

Global Tariff Impacts

and Strategic Shifts

As the automotive landscape evolves, global trade dynamics are adding new layers of complexity for Automotive retailers and manufacturers alike. Tariffs are set to raise vehicle prices, especially models built with imported parts. Short-term demand may spike as buyers rush to beat price hikes. U.S. competitiveness could suffer, with automakers facing tough decisions on whether to absorb costs, raise prices, or overhaul supply chains. Chinese automakers are pivoting from the U.S. to Europe, especially in the EV segment. Overcapacity and price pressure are intensifying, even as EU tariffs attempt to slow down the momentum. Despite these barriers, Chinese EV and tire brands are gaining ground rapidly in European markets.

Short-term delivery workarounds may soften the blow, but long-term supply chain shifts are costly and uncertain. Historical data shows that tariffs don’t always lead to more local production—rerouting supply chains is often the preferred strategy. U.S. buyers are accelerating purchases ahead of anticipated price increases. As costs rise, many consumers are expected to delay purchases or switch to more affordable brands—especially as Chinese tires prices remain ~40% below the market average.

Ready to switch gears?

The road ahead is full of opportunities—but only for those ready to adapt. Whether you’re rethinking your tire portfolio, exploring EV-ready products, or investing in smarter retail tech, now is the time to act.

Talk to an expert and discover how our insights can help you stay ahead in the evolving automotive and aftermarket landscape.