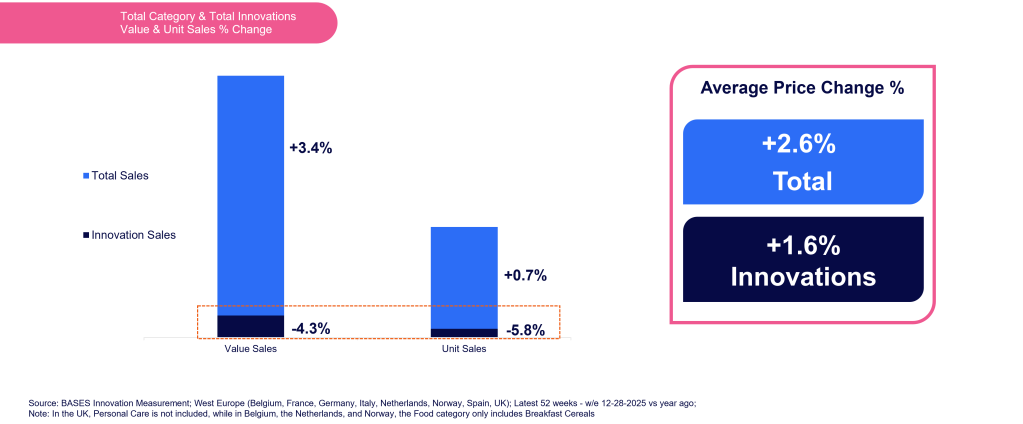

Western Europe closed 2025 with a familiar paradox: total FMCG value grew—up +3.4%, fuelled almost entirely by higher prices—yet innovation sales declined in both value and units, signaling a widening disconnect between what manufacturers launch and what shoppers actually choose to buy.

Across markets, the story is strikingly consistent: price lifts the topline, but innovation no longer pulls its weight.

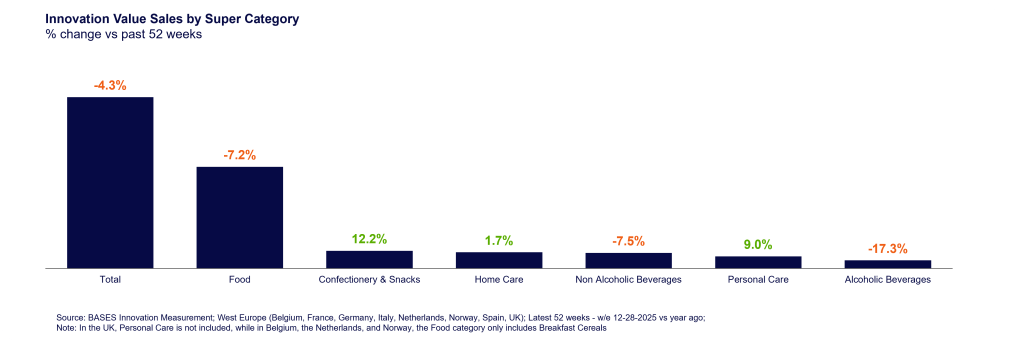

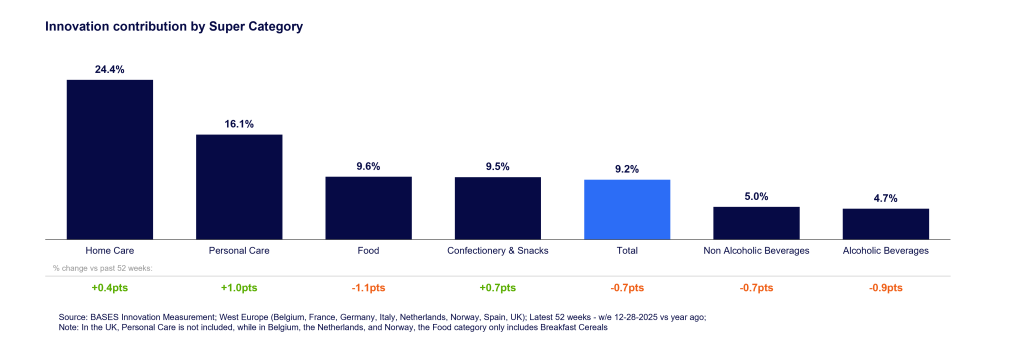

Unit declines (-5.8% for innovations) reveal that many launches struggled to create repeat appeal or justify their premium in an increasingly value‑driven environment. Meanwhile, innovation momentum has shifted toward smaller, faster‑growing categories such as Personal Care, Home Care, and Confectionery & Snacks, while the sheer scale of Food and Beverages continues to anchor overall innovation performance downward.

Why innovation is losing impact

Consumers remain deeply focused on value. According to NIQ’s Consumer Outlook, shoppers across Western Europe report:

- Monitoring basket costs (34%)

- Switching to lower‑priced brands (31%)

- Buying whatever is on promotion (34%)

These behaviours create a more demanding innovation climate, where propositions must do more than simply expand a line or introduce a new flavour.

In 2025, shoppers demonstrated that “good enough” is no longer good enough. Innovations must deliver visible, relevant, and emotionally resonant benefits—or be ignored.

Where the region still shows signs of promise

Even in a challenging year, certain patterns stand out:

Confectionery & Snacks maintains strong engagement, benefiting from its role as an affordable indulgence—often one of the last categories consumers are willing to cut.

Personal Care consistently emerges as a bright spot, with growing innovation contribution across several major markets. Even cautious shoppers are willing to experiment when the promise is tied to efficacy, sensorial delight, or self‑care.

Home Care shows similar resilience, as consumers reward formats and formulations that make daily routines easier, faster, or more sustainable.

These categories share a common trait: they offer immediate, tangible payoffs, which helps innovations overcome price sensitivity.

Private label: both a threat and a signal

Private Label continued to expand its innovation footprint across the region, particularly in Non‑Alcoholic Beverages, Confectionery & Snacks, and Food, depending on the market. But the real story is not PL competition itself—it’s what PL’s success indicates.

Retailers are increasingly filling the relevance gap left by branded manufacturers. In many markets, PL innovation is either stabilizing declines or outpacing branded innovation altogether. This underscores a key insight: the opportunity is not disappearing— manufacturers are simply losing the race for it.

What Western Europe needs to do next

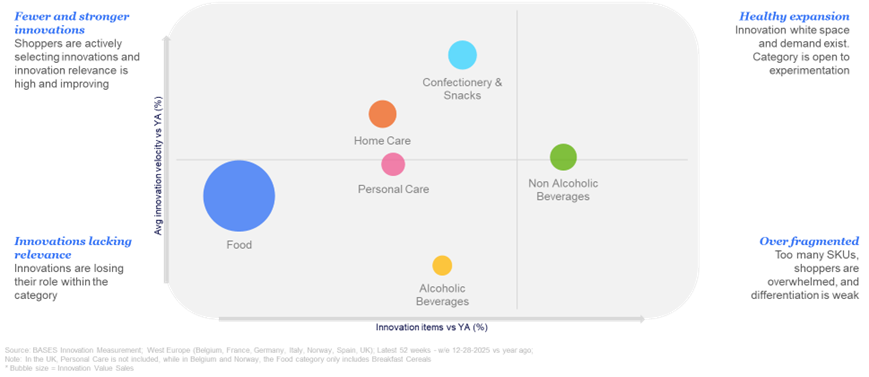

To restore innovation’s role as a growth engine in 2026, manufacturers must resist the temptation to “launch as usual.” The data clearly indicates that incremental approaches are facing adverse consequences, while over-fragmented portfolios are reducing overall effectiveness.

Three actions to rebuild innovation impact in 2026

1. Focus on fewer, stronger bets

Portfolio fragmentation continues to dilute velocity and category clarity. Manufacturers should double down on propositions with true differentiation—benefits that shoppers can feel, see, or taste immediately.

2. Redefine the value equation

Today’s consumer mindset demands innovations that clearly answer: “Why is this worth it?”

Reassess pack-price architecture, sharpen claims, and ensure communication makes the benefit trade-off unmistakable.

3. Validate relevance before launch

The region’s innovation declines reflect proposition quality—not innovation fatigue. Tools that quantify incrementality, demand, and repeat ahead of launch are now essential, especially in Food and Beverages where scale magnifies weak outcomes.

A region ready for reinvention

Western Europe is not rejecting innovation—it’s rejecting weak innovation. Where launches offer authentic consumer value, demand still rises. In 2026, winning will require manufacturers to reset, refocus, and rebuild innovation around the consumer rather than the calendar.