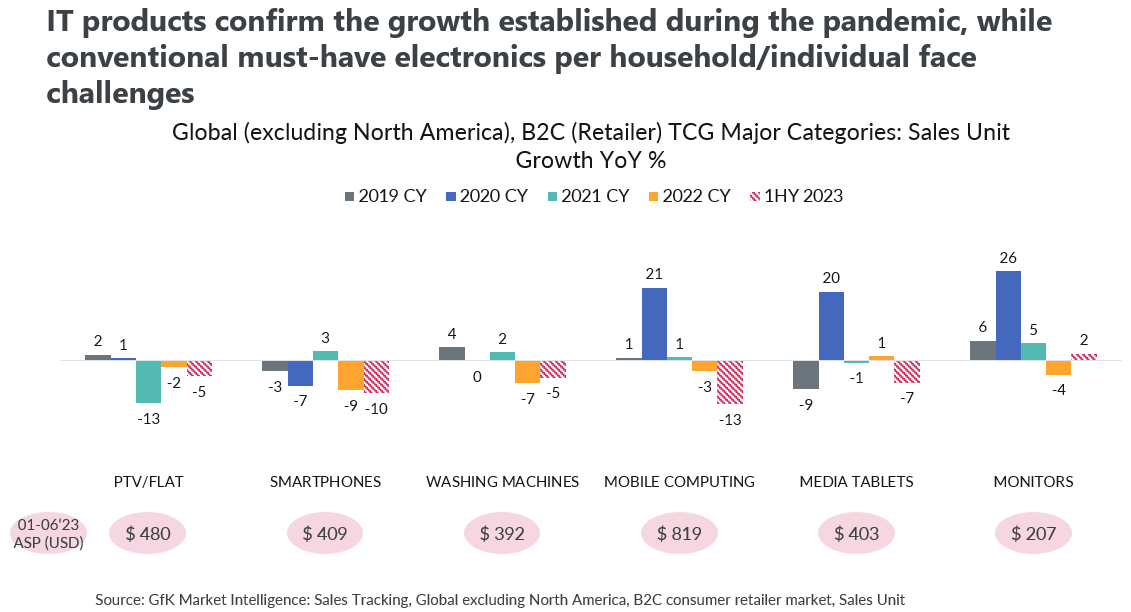

The mobile PC market is highly cyclical, with continual technological innovations, evolving consumer preferences and shifts in the global economy all powering periods of growth. These highs are, of course, typically followed by declines. Following a pandemic-driven surge in demand, the mobile PC market has seen a fall in sales over the course of 2023.

The pandemic was a disruptive event for the mobile PC market, with tablet and laptop demand rising as people adapted to remote working. For a market still recovering from widespread chip supply shortages, the sudden closure of Chinese factories meant that supply initially struggled to meet demand. This growth was sustained throughout 2020 before evening out in 2022. Since 2023, the market has seen a significant drop in sales unit growth.

As with all cyclical markets, the current downshift provides important insights for brands – as well as opportunities for when growth returns. Let’s look at what the data shows about where the mobile PC market is heading.

Tracking usage shifts

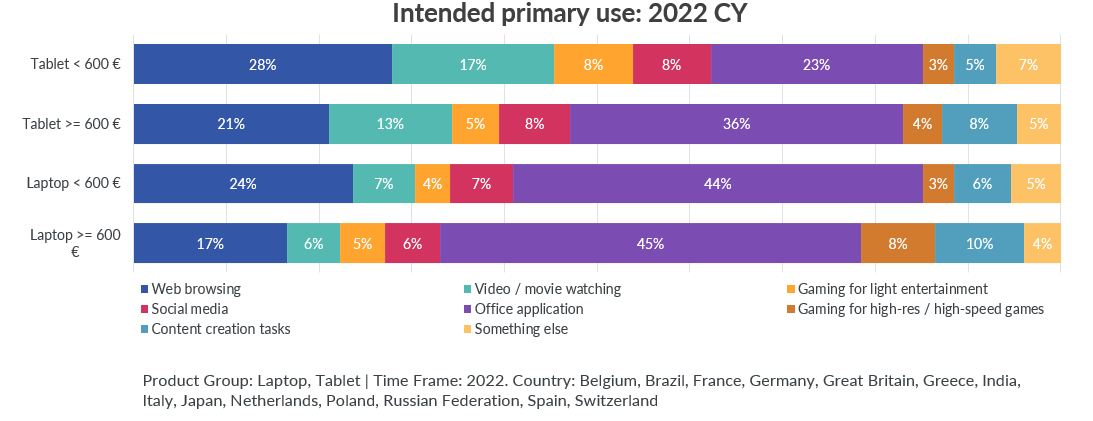

Recent years have seen the mobile PC scene undergo a significant usage shift. This shift is primarily driven by the increasing demand for high-spec usage in gaming and content creation.

With the rise of high-spec usage, mobile PCs (including gaming laptops) have emerged as the preferred choice for productivity-focused tasks. 61% of consumers who purchased a laptop in 2022 did so primarily for productivity or intensive purposes like work tasks, gaming or content creation. Their powerful capabilities and versatility make them ideal for professionals and individuals seeking efficiency and performance in their work or hobbies. Tablets, on the other hand, have become the go-to tool for media consumption.

This division between productivity and media consumption has created a clear distinction between mobile PCs and tablets. While mobile PCs excel in delivering the power and performance required for demanding tasks, tablets are designed to offer a more streamlined and enjoyable experience for media consumption.

Post-pandemic demand trends

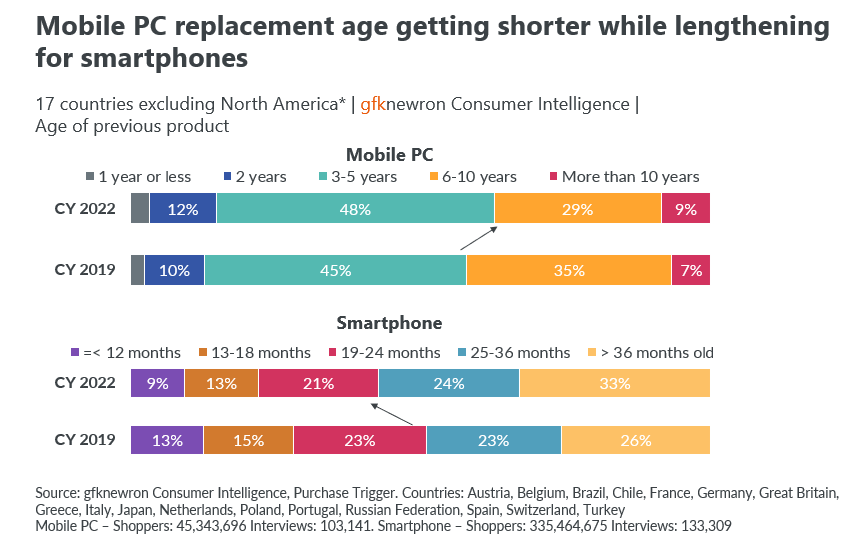

2023 looks likely to be the year the market begins to reset after the pandemic. But the replacement cycle for the mobile PC market typically runs every 4–5 years, with more than 60% of consumers replacing their mobile PC after less than five years usage in 2022. This is longer than the replacement cycle for smartphones, where the majority of consumers look to upgrade after 25 months. It is worth noting, however, that overall the replacement cycle for mobile PCs seems to be shortening while the typical lifecycle of smartphones is also getting longer.

This means 2024 and 2025 will likely see many consumers who purchased a laptop in 2020 and 2021 looking to replace and upgrade their existing models. The pace of technological innovation means many consumers will look to access the latest features and performance from their laptops and tablets.

The anticipated market recovery and the increasing focus on innovation and technological advancements provide opportunities for businesses to adapt and thrive. It is crucial for companies to closely monitor these market demand trends and align their strategies accordingly.

A normalization of prices?

The last 12 months have seen prices begin to normalize in the mobile PC market. The combination of increased demand, supply chain disruptions and global chip shortages had seen prices rise significantly. While average prices are beginning to come down, they remain high with an average selling price of $817 USD. The increased consumer demand for higher-spec devices show that people continue to value the latest innovations and features – and are willing to pay for them.

The journey towards price normalization is not an overnight process. It requires time for the market to rebalance in the face of shifting demand and usage patterns as well as continued turbulence in the global economy. Nonetheless, the current signs are promising, indicating a positive trajectory toward price stability in the near future.

Promotions as the key to unlocking post-pandemic growth

The mobile PC replacement cycle means that the market is likely to begin recovering in 2024 and 2025. The focus of brands needs to shift from the penetration and saturation of the pandemic to driving sales through device replacement.

However, interestingly, the market has seen high promotion rates throughout 2023 – even outside of core seasonal events like 11/11 or Black Friday. This is part of retailers’ efforts to push out older stocks in preparation for an expected new model ramp-in recovery next year. As a result, 2023’s core promotion season in November might concentrate strongly on clearing out the last of these old stocks. So the current high promotion sales rate could help to accelerate the normalization of the market’s model age structure in time for replacement cycle-related growth in the years ahead.

Any growth strategies need to begin from an understanding of how saturated the current market is. With strongly established players and fierce competition, offering attractive deals for device upgrades and replacements emerges as a highly promising strategy with the right promotion strategy alongside it. In fact, 36% of consumers in markets where sales are down on 2022 but still higher than 2019 reported that replacing a faulty product was their primary purchase trigger for a new mobile PC. This rises to 46% in markets that are currently underperforming compared to both 2019 and 2022. Promotion strategies need to be carefully considered though. By focusing too narrowly on price cuts, margins for brands and retailers could suffer. Instead, there should be clear objectives, such as encouraging consumers to upgrade to higher spec models or attracting younger consumers looking to purchase their first mobile PC.

Replacement is likely to become a significant catalyst for new sales. As consumers seek to keep up with the latest technological advancements, positioning device upgrade replacements to unlock enhanced features, improved performance, and a better user experience, brands can effectively tap into this desire for novelty.

Brands that proactively engage with consumers across their digital and physical shelf, offering compelling incentives and benefits for upgrading or replacing their devices could gain a competitive edge. This is especially important when it comes to targeting specific types of users such as gamers, content creators and those looking for high spec and performance around storage, display quality or battery life. Exclusive discounts, trade-in programs, or bundled packages that encompass not only the device itself but also additional accessories or services will all prove useful in enticing potential customers.

Always stay aligned with your customers and ahead of PC market trends with gfkonsult.

![]()