It has already been a year since COVID-19 hit us. The pandemic brought new habits and, as a result, new and changed behaviors. Not only in our social and work life but also in our consumption and purchase behaviors. This is the reason why it is important to stay alert to these changes because just as there was a pre-COVID life, there will also be a post-COVID life. And if there is one that may come out as a winner in this post-COVID life, it will be E-commerce.

A turning point for E-commerce in FMCG

As you may know, Belgian shoppers have been less open to purchasing FMCG online in comparison with our neighboring countries. The Belgian population being particularly risk-averse, shoppers tend to pick trends later than in other Western European countries, shopping FMCG online being one of them. Well, 2020 might have been a turning point for the trade channel.

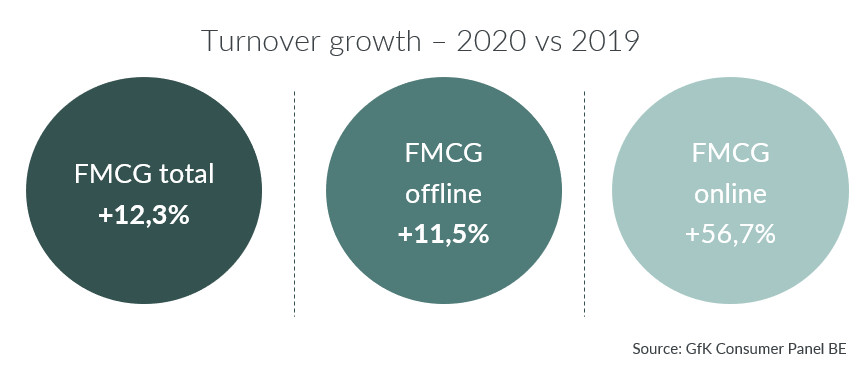

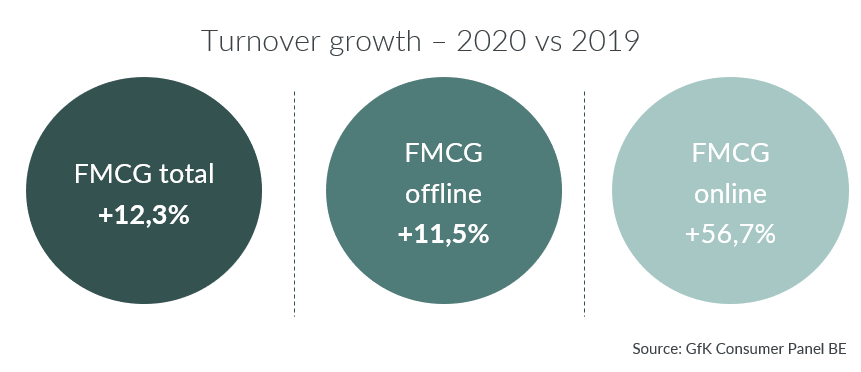

While FMCG offline grew by +11.5% last year, the turnover of FMCG online increased by +56.7%.

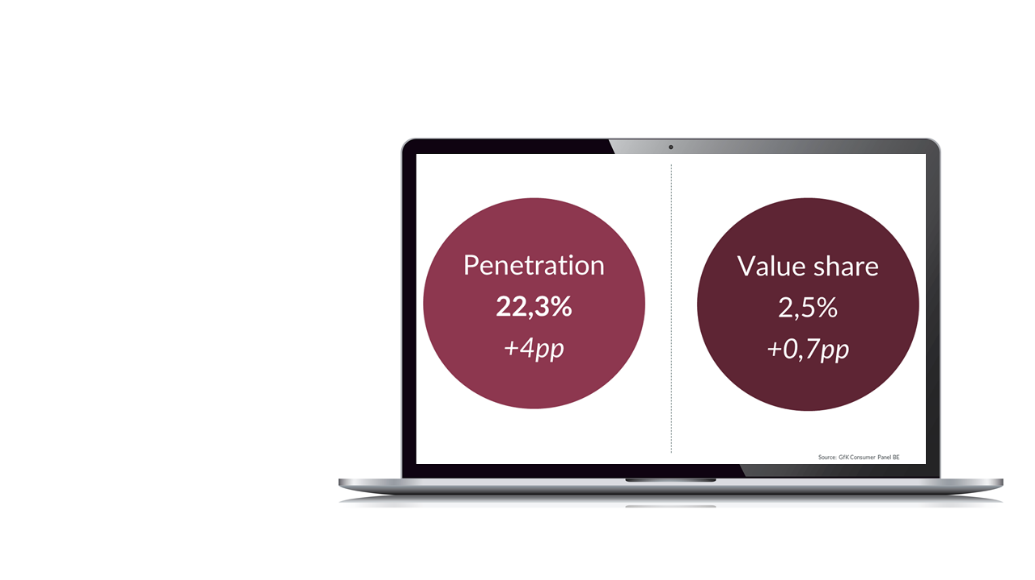

Even though E-commerce remains small within FMCG, the channel continued to increase its importance within the market: it reached a market share of 2.5% and recruited close to 200,000 additional households within a year.

However, the growth of E-commerce in FMCG might have been higher. Back when the first lockdown started, some retailers were not prepared to meet the exploding demand for online orders. Some prioritized servicing clients in their physical point of sales, at the expense of online orders. Their logistics not being prepared for such a demand lead to missed recruitment opportunities at that time.

The particularity of the E-commerce buyer

It is interesting to analyze the overall shopping behavior of the online shopper. We clearly see that the online shopper spends more offline than the exclusive offline shopper itself:

An E-commerce shopper makes 18 extra trips per year and spends as much as an exclusive-offline shopper when grocery shopping offline.

This fact makes the online shopper very valuable: he or she combines a more intense offline purchase behavior with extra shopping trips online. This shouldn’t surprise you: the high-income families with children represent nearly 26% of the E-commerce buyers.

What is the outlook for 2021?

The current evolution of the health situation can only reinforce the potential of E-commerce to further grow in Belgium. And the convenience it offers might convince Belgian households to stick with it post-COVID.

We also need to keep in mind that new players may enter the Belgian market. The arrival of a new pure player in FMCG could trigger a whole new dynamic in the market.

Do you need support to fuel your strategic thinking on E-commerce? Contact us for more information: cp.belgium@gfk.com.