The 2023 picture – EUROPE

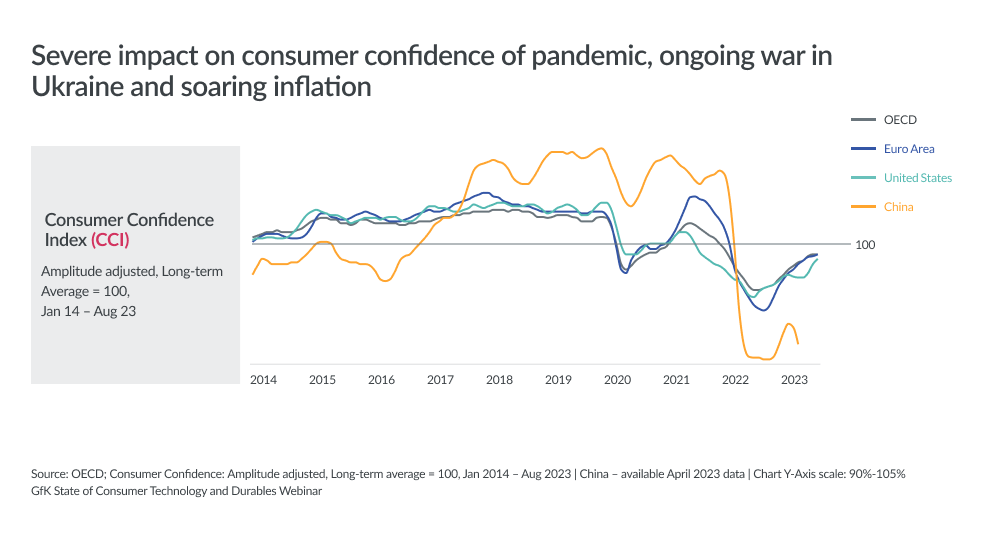

This year has seen Europe’s consumers continuing at a muted level of spending for Consumer Tech & Durables (T&D). Economic worries remain top of mind for consumers across the region, due to high inflation and the increased price of food, energy and goods.

Top concerns across Western Europe (BE, FR, DE, IT, ES, SE, UK)

- #1 “Inflation and high prices”

- #3 “Global climate change/global warming”

- #5 “Cost of healthcare”

- #8 “Recession and unemployment”

Source: GfK Consumer Life 2023, EU7

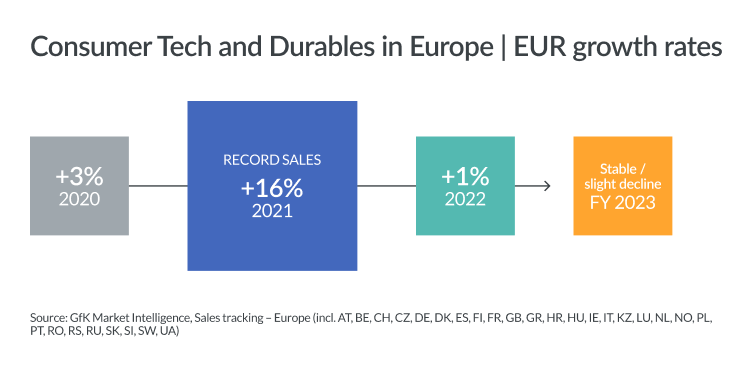

After the record growth in sales for Europe’s T&D market in 2021, last year’s revenue managed to add a further +1% year on year growth. Our full year forecast for 2023 sees that revenue level holding steady, or showing only a slight decline. Consumer confidence across Europe has also stabilized and the indications are that 2024, played wisely, presents opportunity for a solid return to growth across the majority of T&D sectors.

Stabilization, not normalization

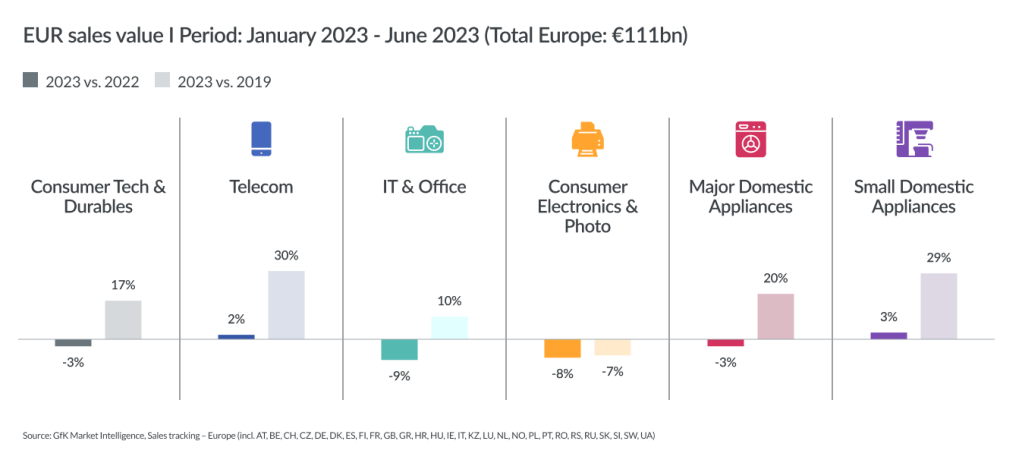

If 2022 was characterized by a volatility of supply, the first six months of 2023 were characterized by volatility of demand. Nearly all sectors within T&D have seen a decline in sales revenue in the first six months this year, compared to the same period last year, with only Telecom and Small Domestic Appliances (SDA) showing positive growth.

However, let us put this into perspective. If we compare these sales to H1 2019, it’s a very different picture – and one that shows relative market strength compared to pre-covid years, despite the current landscape of low propensity to buy and high market saturation.

What we are seeing is a degree of stabilization in market demand – but certainly not a return to what we knew as “normal”.

T&D manufacturers and retailers in 2023 are facing the crest of what could be termed a perfect storm. The sharp rise in sales of 2021 – caused by consumers moving their purchases forward during lockdowns – has left high levels of saturation in key categories, such as TVs, food preparation appliances, coffee machines, and entry-to-mid level mobile PCs. Supply chain issues also started during the pandemic and were exacerbated by the Russian attack on Ukraine in February 2022. On the heels of that came the soaring inflation and cost of living, which continues to depress consumers’ urge to replace or upgrade products early – along with their rising focus on out of home activities pulling them multiple ways in where to spend their reduced levels of disposable income.

On top of all this, manufacturers and retailers have the challenge of high levels of inventory left over from 2022, after consumers started to rein in their spending and demand faded – especially for high-energy-use items such as tumble dryers and washer-dryers.

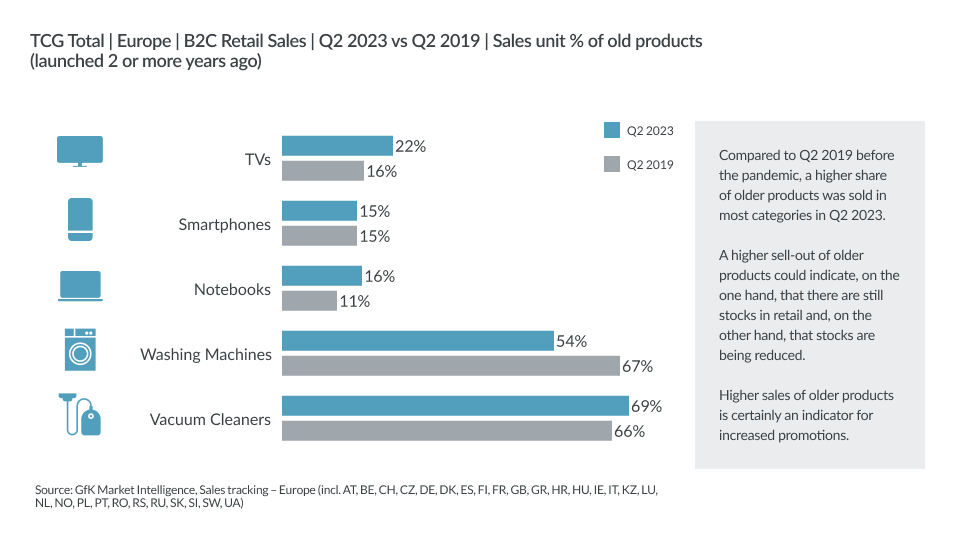

For retailers and manufacturers, this current consumer mindset presents a challenge. Although the share of newly launched products in categories such as TVs, smartphones-mobilephones-phablets (SMP), laptops, etc is similar to pre-covid levels, there has been a lack of ‘the next big thing’ in most sectors.

Disruption driven by launches of dramatic product innovation has been low this year. In Europe, TV purchases (for example) in Q2 saw 22% being of models launched two or more years ago, compared with just 16% in Q2 2019. Many consumers have not seen a persuasive reason to buy the latest, newly launched products in certain categories – and this also points towards elevated inventories at retail stores.

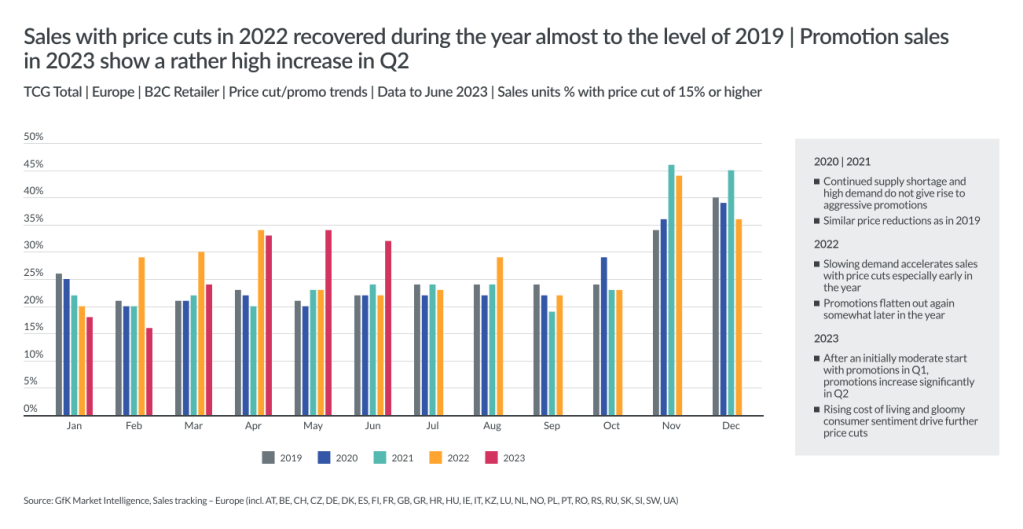

While significant discounts obviously impact retailers’ margins, the results of summer promotions this year show that these events are motivating consumers to open their wallets. We therefore expect similar promotions will be crucial to trigger volume demand in the remainder of 2023.

There are always exceptions to the rule; In certain regions, certain brands have declared they will not be doing aggressive promotions this year. Overall, however, our expectation is that Black Friday 2023 will see discounts at levels beyond prior years, owing to consumers deliberately timing their purchases for these events, and retailers wanting to clear old stock more than in the past year.

What factors will drive consumer spend in 2024+?

Planning for 2024+ global recommendations

How do manufacturers and retailers capitalize on the consumer trends above to shape an ambitious but sustainable strategic plan and budget allocation for 2024+?

With budget planning for 2024 in full swing, these are our global recommendations on how to drive growth over the next few years. The local market and consumer landscape set out above will drive how best these are implemented at regional and country level.

01

Invest in targeted innovation (product & service)

Innovation continues to appeal but must deliver value that is directly relevant to the consumer’s life. Develop targeted, consumer-centric use-cases that show the benefits of upgrading to ‘affordable premium’ models.

02

Build up your brand to be a differentiator, as well as your product

The emotional connection between consumers and a brand plays a crucial role in competitive markets. Balance tactical activity with long-term, upper-funnel brand marketing that allows you to differentiate based on brand, rather than product or pricing alone.

03

Intensify manufacturer-retailer collaboration to optimize omnichannel category management

By teaming up to deliver consumer-centric planning that is unified across their respective merchandising, marketing, and supply chains, manufacturers and their retailers can optimise their mutual goal of creating a consistently personalised and enjoyable product experience at every touchpoint.

04

Planning for the upcoming shopper generation:

Gen Z will soon surpass millennials in size. Two-thirds are aged 15-24 and starting to frame opinions about brands. They consume 53% more content than the average but spend 50% less time on content than millennials. Like any generation, they include complex segments with differing demands.

05

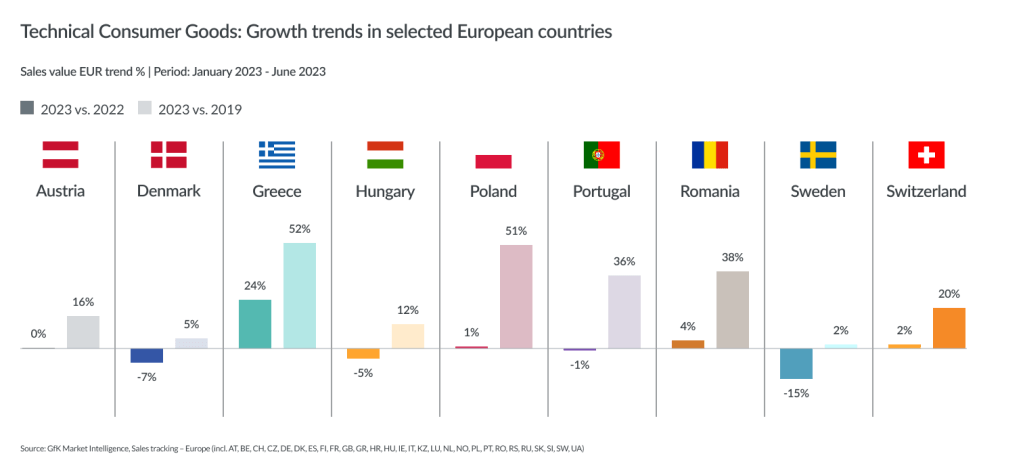

Review regional and category footprint to capitalize regional growth opportunities and mitigate individual category risks

Each region has unique market, category, and consumer dynamics. Manufacturers and retailers must have a full view across all regions and categories, and map this against their own portfolio, to pinpoint where growth opportunities exist for their products.