After years of economic turbulence, Canadian consumers are stepping into 2026 with cautious optimism. Inflation has cooled and financial sentiment has improved slightly, yet uncertainty persists. Canadians are adapting to a new reality—one defined by intentional spending, value-driven choices, and a desire for control.

The post-inflation environment hasn’t delivered the stability many hoped for. While FMCG spending is up 4.8% year-over-year, the number of units per trip has declined 3.2%, signaling a shift toward selective purchasing. Caution, not complacency, remains the mindset.

The Cautious Consumer: Balancing Optimism with Restraint

Canadian households are more financially stable than last year, but they’re still hedging bets. 18% of consumers say they’re better off financially than a year ago, up 3 points from mid-2024, while those feeling worse off dropped by 6 points. Even so, uncertainty fatigue lingers.

Consumers are prioritizing essentials—groceries, utilities, and healthcare—while discretionary categories like dining out and apparel remain under pressure. Health & Beauty (+6.7%), Food (+2.6%), and Beverage (+2.7%) are leading selective recovery, driven by wellness trends and convenience.

Top concerns shaping spending include rising food prices, economic downturns, and housing costs, alongside growing attention to climate and political volatility.

Intentional Spending Becomes the Canadian Default

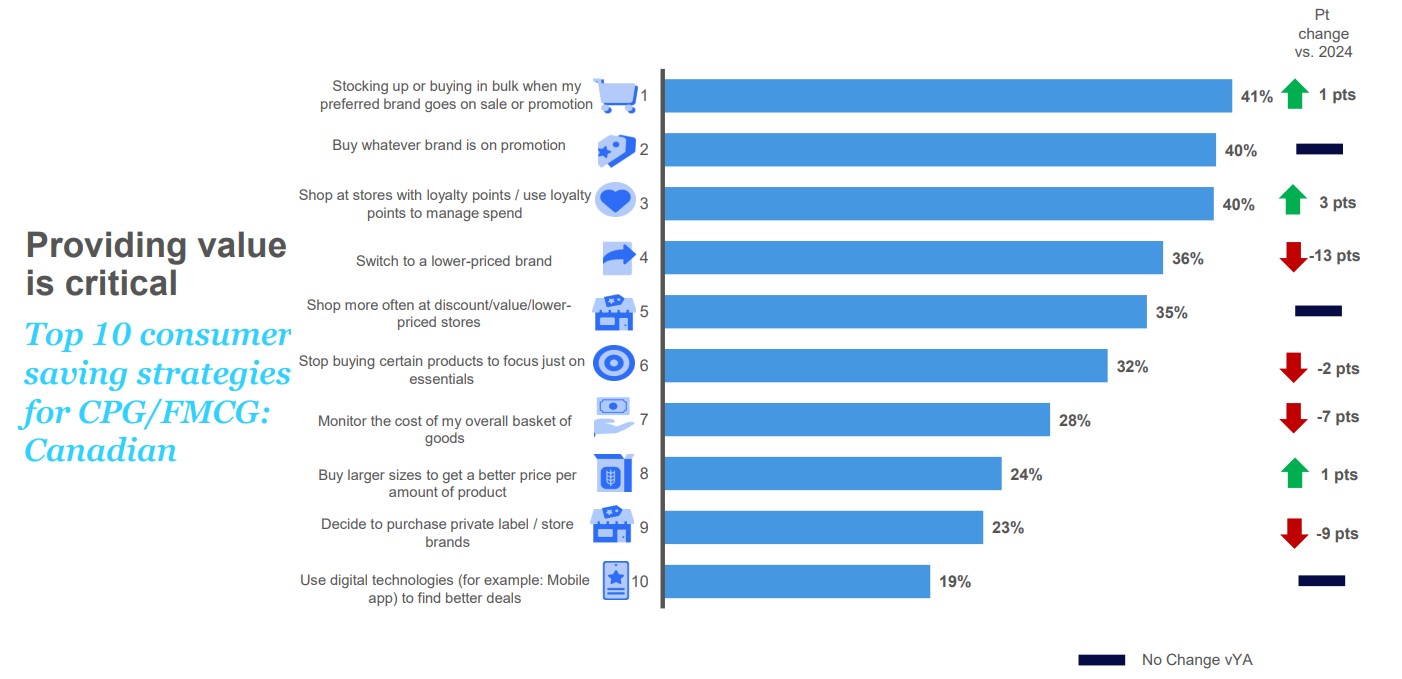

40% of consumers say they would buy whatever brand is on sale

Shoppers are deliberate, informed, and increasingly willing to trade loyalty for savings. The top money-saving strategies reflect this mindset:

- 41% stock up when preferred brands go on promotion

- 40% buy whatever brand is on sale

- 36% shop at discount/value stores

- 32% switch to lower-priced brands

- 28% choose private label alternatives

This isn’t just belt-tightening—it’s strategic behavior. Canadians monitor basket costs, leverage loyalty points, and shop across multiple retailers to maximize value. For many, “value” now means trust, transparency, and alignment with personal priorities—not just the lowest price.

Consumer Outlook: Your Guide to 2026

With volatility as the new normal, Canadians are looking to brands for reassurance and simplicity. Trust matters: 95% of consumers say brand trust is very or somewhat important, with product quality and consistency as the top drivers. Locally sourced products and clear labeling—claims like Made in Canada, Natural Ingredients, and No Added Sugar—are gaining traction.

Commerce is increasingly fragmented. While e-commerce grew 16% year-over-year, 83.5% of FMCG sales remain offline, underscoring the need for omnichannel consistency. Retail media networks and social commerce are emerging forces, but physical retail still dominates household spend.

Health and wellness trends are accelerating, with 43% of Canadians willing to pay more for healthier options. Meanwhile, commodity volatility and AI-driven discovery are reshaping competitive dynamics. Brands that anticipate these disruptions—and deliver simplicity, affordability, and trust—will win.

Download the U.S. Consumer Outlook Report

Want to compare trends across markets? Explore “From Inflation to Intention: How U.S. Consumers Are Redefining Value in 2026” for a deep dive into American consumer priorities and strategies.

The Global Outlook for 2026: Purpose Over Panic

If the past few years have been about survival, 2026 will be about refinement. Caution is no longer a reaction; it’s a strategy

Want to learn more about Global Consumers?