2025 total T&D full-year projection (value growth):

- Eastern Europe: +3%

- Middle East & Africa: +3%

2026 home appliance projections (value growth):

- MDA: +4%

- SDA: +6%

EEMEA market overview

For full-year 2025, we forecast low- to mid single-digit growth across both MDA and SDA. We expect only around 3% growth for MDA sales, with competition from Chinese brands pushing down price points and a peak replacement cycle not expected until 2028. In SDA, we expect approximately 6% growth, driven by premium purchases such as high-end vacuums and hot beverage makers, with peak replacement cycles for SDA kicking in during 2026 (following pandemic-era purchases).

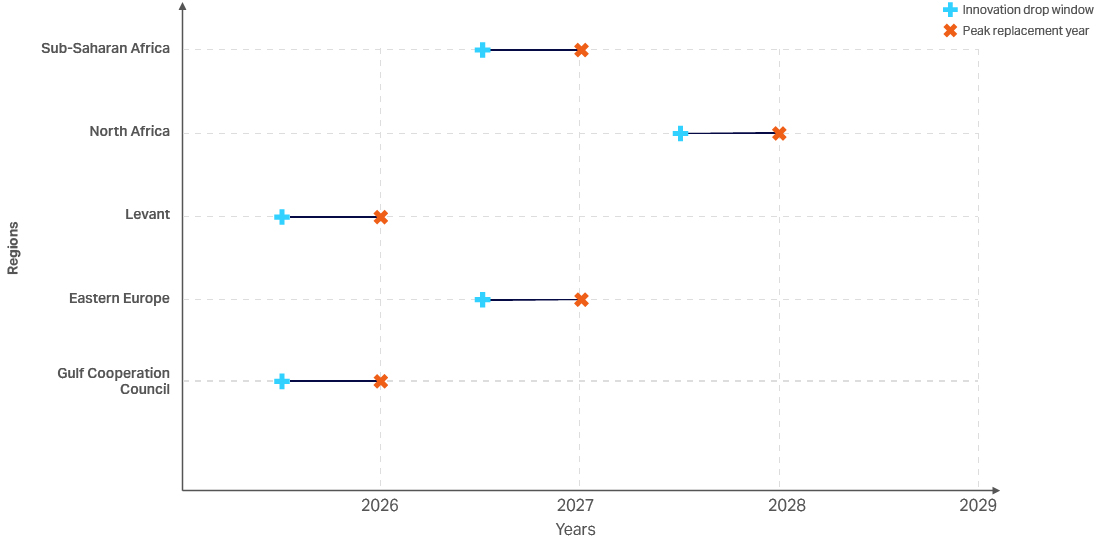

While SDA replacement cycles are far shorter than for MDA, if we look at all home appliances combined, we expect 2026 to mark the start of peak replacement cycles for Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates; 2027 onwards for Sub-Saharan Africa and Eastern Europe; and 2028 onwards for North Africa. However, compelling innovation in performance and/or features could encourage consumers to buy premium products earlier (see below). In Eastern Europe, we expect regional brands to gain share.

EEMEA: Replacement cycle peaks vs. innovation drop windows, MDA and SDA combined

What will drive EEMEA sales growth in 2026?

By appliance type

Price, convenience, and rising urbanization will drive consumer demand regionwide.

In Eastern Europe, a general increase in disposable income across the population will boost spending, with growing demand for premium laundry products (e.g., high-end irons), stylish small household appliances, and food heating solutions. Energy efficiency will be a key differentiator in the product choice of larger household appliances.

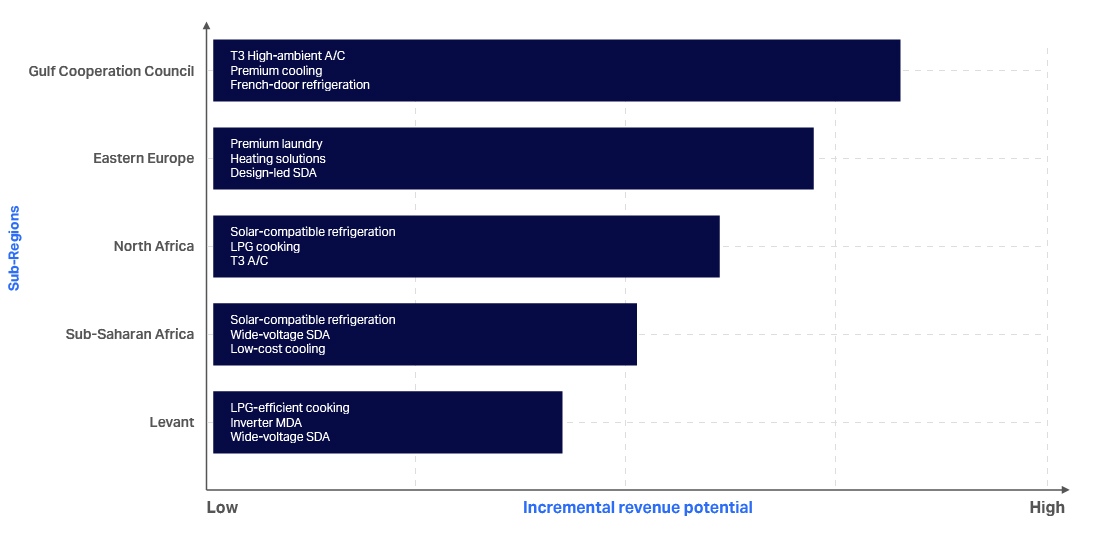

Innovation in cooling products (e.g., refrigerators, freezers) and high-ambient-temperature air conditioners will drive sales growth in the Middle East; efficient or solar-compatible cooling, liquefied petroleum gas (LPG) cooking, and wide-voltage SDA products show the highest growth potential in Africa.

2026 EEMEA: MDA & SDA growth opportunities—Innovation themes by sub-regions

By channel

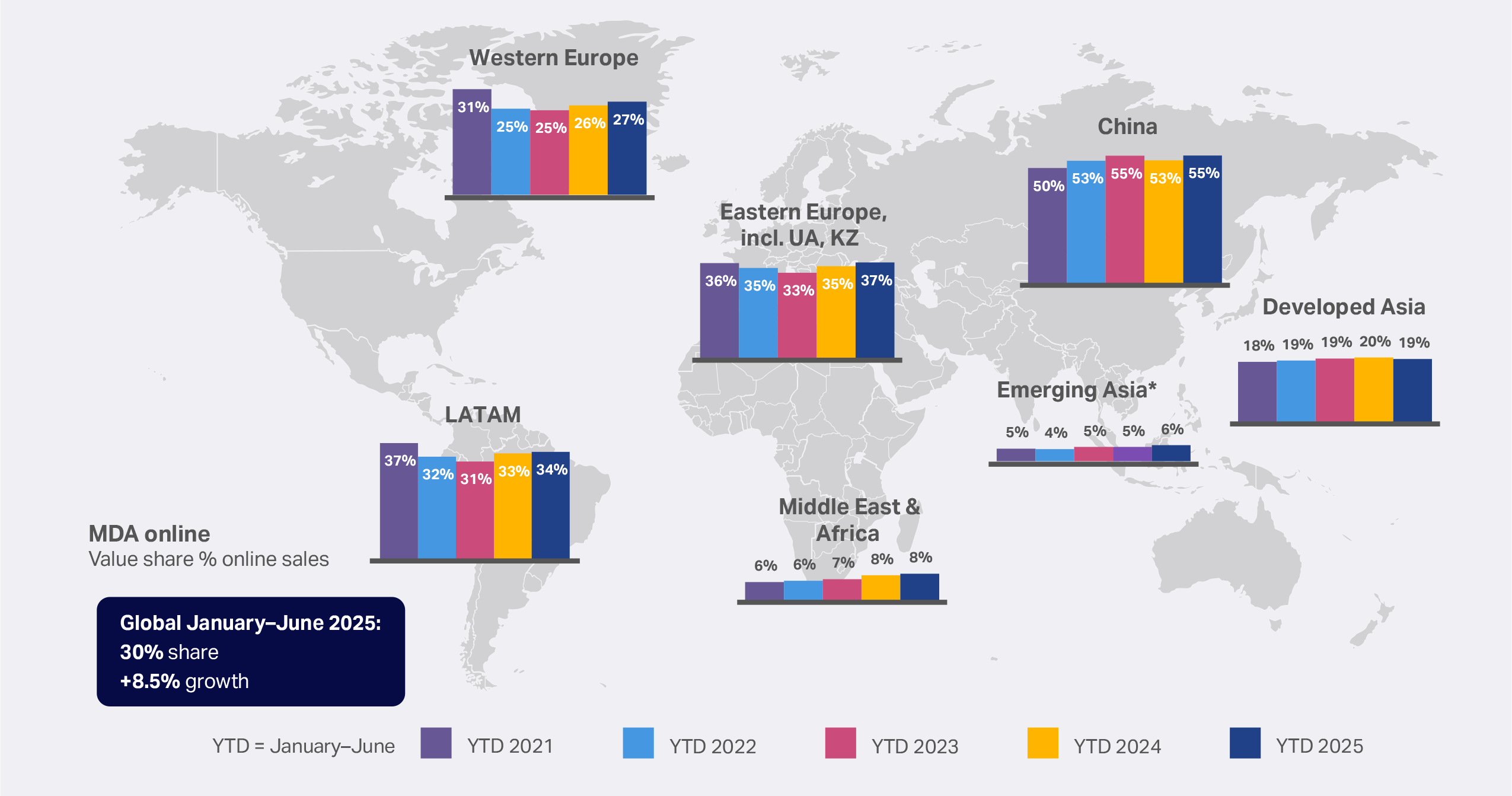

In Eastern Europe, 47% of all small household appliances purchases were made online in the first half of 2025, compared with 37% in MEA. Both regions have shown a steady upwards trend in the online share of SDA purchases, and we expect this to continue in 2026.

For large household appliances, offline will continue to dominate as the preferred point of purchase, especially in the Middle East & Africa (MEA). In Eastern Europe, online is gaining ground as the point of purchase, accounting for well over one-third (37%) of all MDA sales made in the first half of 2025, and an increase compared with the same period in 2024.

SDA online share has always been higher than for Consumer Tech and Durable Goods overall

It continues to grow—and it’s hitting almost 50% in some regions

MDA e-commerce improves over 2025

Online share of total sales grows again in select regions.

By payment model

Trade-in and rental are gaining popularity as purchase options for major home appliances, particularly in Eastern Europe and in MEA countries with a high percentage of expat workers on time-limited work visas.

Eastern Europe focus

Price sensitivity in Eastern Europe should ease by 2027, as consumer confidence rises. Until then, a focus on value, alongside compelling performance, will remain imperative.

In major home appliances, we expect strengthening demand for built-in appliances, driven by the number of new property developments within Eastern European countries. Products with lower current penetration, such as dishwashers, tumble dryers with heat pumps, and slimline dishwashers (in smaller properties) will also gain share.

In small home appliances, we expect particularly robust growth in Poland, Romania, and Ukraine, driven by increasing disposable income across income groups and by the commoditization of products featuring recent innovations.

Middle East & Africa (MEA) focus

Prices will continue to fall due to increased brand competition and the ongoing rise of online-only retailers and online marketplaces, together with mass-merchants offering strong discounts.

In major home appliances, demand will grow for products that help mitigate climate change—from electric fans and frozen dessert makers to high-ambient air conditioners and solar-compatible refrigerators. Additionally, sales of affordable washing machines and twin tubs will grow in markets with current low penetration of these items, while wealthier markets such as Saudi Arabia and the United Arab Emirates should focus on high-capacity washer-dryers.

In small home appliances, wide-voltage items will grow rapidly in sub-Saharan Africa and the Levant, given their capacity to operate across a range of voltage standards. In the Middle East, products such as robotic vacuums, multi-basket air fryers, food preparation appliances, and frozen dessert makers will be popular.

EEMEA key takeaways for 2026

- In major domestic appliance sales, manufacturers and retailers should focus on built-in, slimline products in Eastern Europe, while cooling will grow across MEA..

- Small domestic appliances will see significant growth in Eastern Europe and the Middle East, while sales of wide-voltage items and LPG cooking are expected to grow in Africa and the Levant.

- Across the region, manufacturers and retailers must sharpen their assortment and price point strategies on a country-by-country basis to reach lower- and middle-income households and to encourage wealthier homeowners to buy too.

- Innovative purchase models and smart omnichannel strategies will also be essential to support customers in appliance discovery and purchasing.

Get the full global picture

Go to our Home Appliances Outlook 2026: What consumers want report.

NIQ’s home appliances market experts, EEMEA

Navneet Chawnani

Regional Consulting Lead, EEMEA

Nicolet Pienaar

Customer Success Senior Manager, MEA

Forward-Looking Statements Disclaimer

This report may contain forward-looking statements regarding anticipated consumer behaviors, market trends, and industry developments. These statements reflect current expectations and projections based on available data, historical patterns, and various assumptions. Words such as “expects,” “anticipates,” “projects,” “believes,” “forecasts,” and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future outcomes and are subject to inherent uncertainties, including changes in consumer preferences, economic conditions, technological advancements, and competitive dynamics. Actual results may differ materially from those expressed or implied in these statements. While we strive to base our insights on reliable data and sound methodologies, we undertake no obligation to update any forward-looking statements to reflect future events or circumstances, except to the extent required by applicable law.