Identifying best-fit consumer segments

Company B started off as an online marketplace and has dramatically increased the number of active users in recent years. As a part of its long-term growth strategy, the company has expanded its presence in the e-commerce space by acquiring a food delivery aggregator and partnering with lifestyle subscription services—for example, services providing content streaming, booking and tickets, taxi rides, etc). It had ambitions to expand beyond “a place for buying things” to become a destination “super app” platform for enjoying a range of services and experiences.

Company B wanted to understand how the expanded portfolio fit the needs of the market. Since Total Wellness was one of the fastest-growing categories within the existing portfolio, the company wanted to identify customer segments to focus on with total wellness solutions.

Eyes on the prize

Company B’s ultimate goal was to drive growth in the expanded range of services by getting customers to engage with the entire company ecosystem online—the online marketplace, food delivery, in and out-of-home entertainment, taxi booking, and so on.

Reaching this goal required pinpointing the right “bundle” of solutions for each segment rather than using a one-size-fits-all approach. To develop the best activation plans, the company wished to deepen its understanding of target consumers and identify the products and services they were likely to seek.

In this context, we conducted a segmentation study using NielsenIQ Segmentation Science.

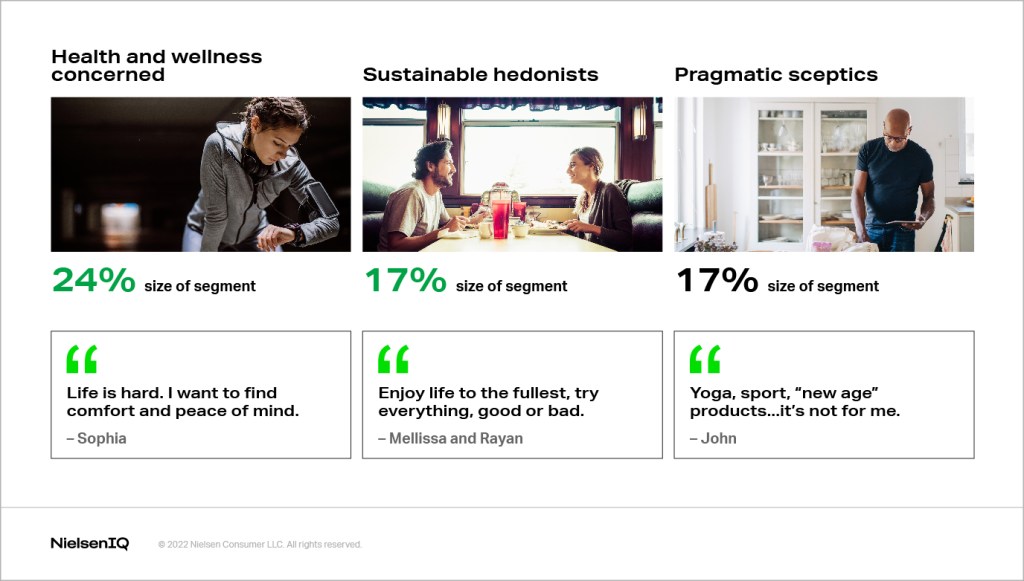

Meet the segments for Company B

With health and wellness being a trending topic for some time, marketers would expect that most consumers and shoppers are equally engaged health and wellness-related activities and buying products positioned to address this need.

However, profiling emerging segments in terms of the Individual, Mind space and Behavior framework clearly shows that each segment has a unique relationship with the Total Wellness space.

The Health and Wellness Concerned segment

The first segment representing a sizable opportunity is the Health and Wellness Concerned (23% of total shoppers), likely to be found in higher numbers among female shoppers but not restricted to any age group.

While health and mental wellbeing was very important (90%) to this segment, only half of them consider their own lifestyle healthy—much lower compared to the total market. This disparity signals an inherent dissatisfaction with their state of wellness.

Their main concerns were managing stress and maintaining or reducing weight. They stand out in terms of diet awareness and vitamin supplement consumption but are less likely to engage in active sports or fitness. They prefer to stay indoors, often doing home chores.

They enjoy cooking and eating at home, indulging in comfort foods and sweets on-hand and including natural organic foods; in effect, balancing pleasures with foods that promote health. They don’t mind spending more on products that call out distinct health benefits.

A focus on food over activity

Health is a top priority for the Health and Wellness Concerned, but their actions are limited to food selection and preparation rather than physical activity beyond household chores.

Sustainable Hedonists

This segment profile stands out because it is comprised of the highest proportion of Generation Z and Millennials, a mix of both males and females. They tend toward extraversion and lead a very active lifestyle, participating in high-energy sports as well as mental balance practices such as yoga or meditation.

Intriguingly, they are less concerned about health and well-being compared to shoppers overall. Most of them consider their current lifestyle “healthy.”

As distinct from other segments, Sustainable Hedonists are externally focused, whether on friends, media, influencers, doctors, specialists or on broader society and events happening around them-—such as environmental sustainability concerns. Friends, as well as influencers, inspire them in adopting healthy habits and lifestyles.

They gravitate towards sustainable, organic and “clean label” products. Interestingly, most of them follow a diet, but not one that involves home cooking. They seek out-of-home options or order custom meal plans.

The Sustainable Hedonist diet

Sustainable Hedonists are exploring a variety of beverage and food options, including:

- Regular and herbal teas, fresh juice, or smoothies (moving away from relying heavily on coffee because of health concerns)

- Seafood, meat, and grains (likely from dining out)

- Canned and processed convenience food (likely to minimize cooking)

They have the highest interest in superfoods and plant-based products when compared to other segments due to concerns regarding regular milk and dairy products.

Sustainable Hedonists have the highest usage of organic and clean label cosmetics. They also have the highest purchase rates of organic food products: for them, it’s a “must have” rather than an occasional luxury.

While clearly oriented towards health and wellbeing among Sustainable Hedonists, there is also a relatively high incidence of smokers—especially e-cigarettes—and alcohol consumption. Some report increased consumption of alcohol, tobacco and coffee because of stress from the pandemic.

A deliberate balancing act

At one level, Sustainable Hedonists believe in enjoying themselves fully, but this doesn’t deter them from following the latest trends in food or environmental sustainability. They see nothing paradoxical in it.

This dichotomy follows through in their behavior: smoking, drinking, eating out as well as leading very active lives as well as buying the “good foods.” They probably see this as balancing out the good with the bad.

Pragmatic Skeptics

The third segment is Pragmatic Skeptics (17% of shoppers), with a higher proportion of male shoppers and baby boomers compared to all shoppers. They are also likely to be from smaller households with just 1-2 people.

Their personality profile suggests being relatively unwilling to change or adapt their lifestyles in response to external circumstances or events. The main drivers of maintaining a healthy lifestyle for this group are aging and the intention to reduce or maintain weight.

They approach the current total wellness category with some skepticism. Although they would lower potential risk factors by avoiding smoking, reducing sugar consumption (and limiting their fat intake, they would not try the newly emerging superfoods or beverages, practice a trending diet (except for low-sugar or low-fat options), or perform a specific exercise routine. As expected, they showed low interest in health apps or tracking devices.

As a result, the Pragmatic Skeptic shopping basket has the lowest purchase rate of food options associated with health benefits or positioned as being a “healthy choice,” such as crispbread, plant-based beverages or meat alternatives. They are unwilling to spend more for the “healthy,” “natural,” “free of,” “clean,” or organic labels in food or personal care items.

Pragmatic Skeptics in a nutshell

Their strategy is centered around avoiding products with known risk factors while following their own path, without the distractions of influencers or the avalanche of content available around wellness.

They are not interested in following the latest wellness trend. Pragmatic Skeptics want to maintain the status quo regarding good health and lead a “normal” life without major changes.

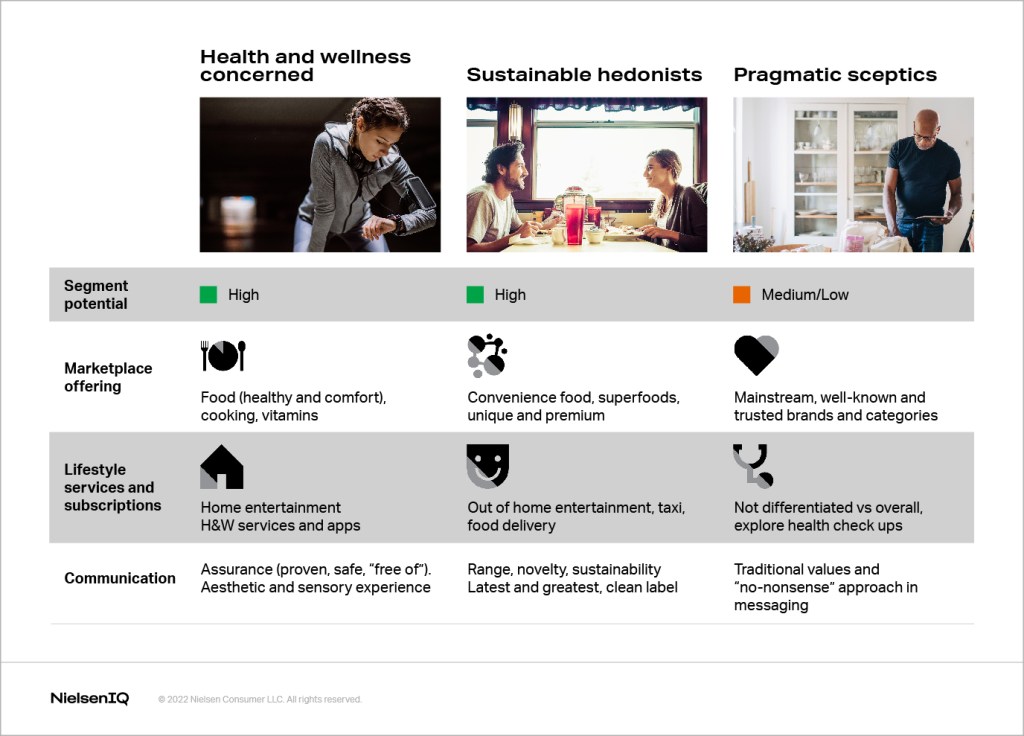

Product and lifestyle services opportunities

Research findings have shown that a sizable proportion of the market is interested in health and wellness offerings. However, it’s equally clear that each segment’s perspective on health and wellness is unique.

This leads us to different conclusions regarding the optimal product and content strategy. What products and services would be likely to resonate with each segment, and how should CPG businesses deliver this message?

Winning over the Health and Wellness Concerned

Health and Wellness Concerned consumer product offerings should include food (both comfort and health food), cooking ingredients and supplies, healthy snacking options, vitamins and supplements. These products can command a premium price, as consumers with this profile are willing to spend more on products with health benefits.

There are also service and lifestyle opportunities. These consumers are likely to subscribe to:

- Home entertainment content, including streaming, books, and music

- Health and wellbeing services and apps (healthy recipes, diet content and consultation)

- Health monitoring apps (diet trackers, calorie counters)

- Mental health apps (meditation, sleep and breathing practices)

Effective messaging and communication for this segment should focus on:

- Assurance (“best in class,” “proven,” “effective,” “free of,”)

- Aesthetic aspects

- The sensory experience

Innovation attracts Sustainable Hedonists

Sustainable Hedonists’ product choices are focused on range, novelty, and sustainability. They prefer the latest and greatest: superfoods, unique or authentic categories and brands, and so on. They are willing to pay more for products that meet their expectations. Sustainable, organic, and clean label food and personal care is a part of their daily routine.

A cornerstone of Sustainable Hedonists’ consumption choices is convenience food: food that is freshly prepared, easy to cook, or simply does not require cooking. Cooking less helps them to save time for more thrilling adventures and activities.

There are attractive opportunities in service and lifestyle for this group as well. These consumers have the highest potential to purchase subscription services, especially food delivery, taxi rides, out-of-home entertainment, and similar offerings.

Best-fit products for Pragmatic Skeptics

Product opportunities for Pragmatic Skeptics center on the standard proposition. They patronize well-known, trusted mainstream brands and categories, with a focus on products containing less sugar or fat. A medium-price or value offering will be most effective for this consumer group, as they are not willing to pay for “minor” product benefits. When purchasing vitamins and supplements, they are primarily interested in preventing aging, controlling blood pressure and addressing other major concerns.

Service and lifestyle opportunities are not differentiated compared to overall shoppers. To reach shoppers in this segment, it is best to focus on communicating traditional values and take a “no-nonsense” approach to messaging. It is also worth exploring whether the health consultations, checkups, and prevention programs can resonate with them.