After more than a year when online shopping was the lifeline of many US consumers, new GfK research affirms the continuing influence exerted by traditional in-store marketing tactics.

The latest findings from GfK’s FutureBuy® study – the definitive source for brick-and-mortar, online, and omnichannel shopping trends – show that in-store displays hold the strongest influence across 16 product categories measured. (See Table 1.)

The opinions of family, friends and colleagues ranked second, followed by information provided at store shelves. Online resources – general shopping websites and online shopper/user reviews – rounded out the top five influences.

Table 1. Top shopping influences across 16 categories

US consumers only

|

|

Total |

Men |

Women |

Under age 50 |

Age 50-plus |

|

In-store displays |

38% |

36% |

41% |

32% |

46% |

|

Opinions of family, friends, or colleagues |

32% |

31% |

32% |

36% |

28% |

|

Information at shelf |

30% |

28% |

32% |

27% |

34% |

|

General shopping sites |

30% |

29% |

30% |

31% |

30% |

|

Online reviews from other shoppers/users |

29% |

30% |

27% |

33% |

25% |

Source: GfK FutureBuy® 2021. Question: When shopping for [CATEGORY], which of these influences you the most?

The research shows that in-store displays and information at shelf are both significantly more influential with women and all consumers over age 50. The opinions of family, friends and colleagues were equally important for men and women, but hold diminishing influence as shoppers get older.

Sources of influence differ greatly by category, with in-store marketing proving strongest for FMCG products such as packaged food and beverages, household cleaners, and haircare products. When shopping for a smartphone, however, brand websites are by far the most influential, followed closely by the opinions of family, friends and colleagues.

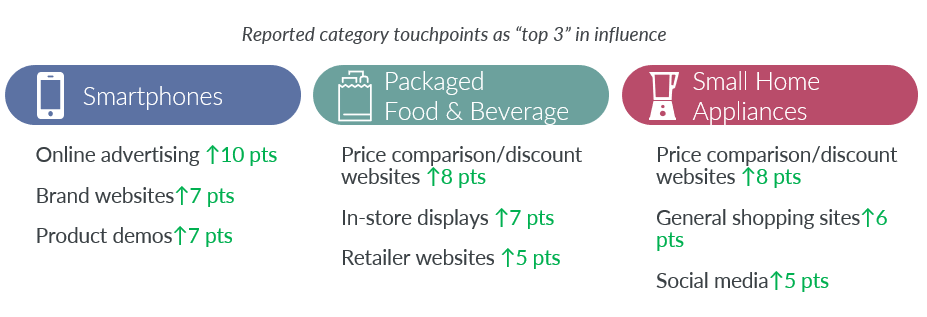

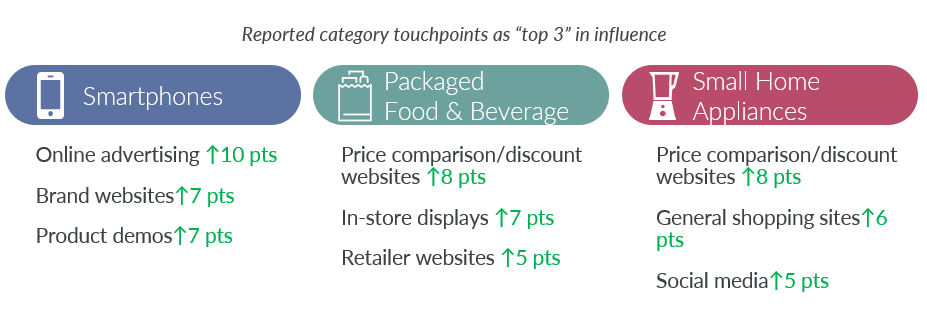

The biggest gainers among sources of influence were online touchpoints – from digital advertising to retailer websites to social media. (See Table 2.)

Table 2. Biggest gainers among sources of influence – key categories

Source: GfK FutureBuy® 2021. Question: When shopping for [CATEGORY], which of these influences you the most?

“While online shopping became essential during pandemic lockdowns, many consumers were reluctant to give up the in-store experience entirely,” said Joe Beier, EVP of GfK Consumer Insights and leader of the GfK FutureBuy® study. “This may be why, even after a year of growing dependence on web shopping, consumers still rely on in-store resources to make key decisions. From discounts to ingredients to features, in-store information feels most accessible for many shoppers. But we still see a host of online resources rising in importance, a trend we will watch closely as shoppers ultimately emerge from pandemic habits.”

For 2021, GfK has also incorporated into FutureBuy® a system for profiling consumers according to their levels of environmental concern. Part of the Green Gauge research program from GfK Consumer Life, the system includes Glamour Greens – those who see green actions as status symbols – and the Green InDeeds, who are willing to give their time and energy to environmental causes.

The new research found that those with higher levels of environmental concern and activism are also more likely to say they

- consider their smartphones to be their most important shopping tools,

- like getting personalized offers from retailers and brands, and

- find social media shopping to be convenient and easy.

“FutureBuy can now provide brands and retailers with an executional roadmap for satisfying the shopping preferences of their most environmentally focused consumers,” said Beier. “This helps them target sustainability efforts and spending more effectively – offering a clear understanding of how to win the loyalty and trust of environmentally conscious consumers.”

GfK FutureBuy® 2021 research was conducted in the US from February 6th to May 13th, 2021, among over 2,000 consumers ages 15 to 65. Globally, the study is fielded in 28 countries around the world, based on interviews with over 50,000 shoppers.