Attractive bright spots amid overall declines

In the run-up to IFA, one of the leading global events for Consumer Tech and Durables (T&D), GfK expert, Jan Lorbach, reveals the latest findings, developments, and trends impacting Consumer Electronics (CE). The global market is currently going through a difficult phase, with a 12 percent decline in revenue and an 8 percent decline in units sold in the first six months of 2023 compared to the same period last year. Full-year results for 2023 may not look much more promising either. However, there are some attractive opportunities in individual segments.

“We had already predicted saturation in 2023, following record sales during the pandemic, and the market was additionally hit by high inflation and the resulting squeeze on consumer budgets,” explains Jan Lorbach, GfK expert for Consumer Electronics. “Consumers are currently focusing their reduced disposable income on travel and leisure activities rather than tech. The industry’s hopes have remained pinned on the economic recovery in China, but this has not yet delivered the desired positive impact. In this low-demand landscape, it becomes even more important for retailers and manufacturers to understand their consumers’ preferences at a granular level, to attract as much shopper spend as possible.”

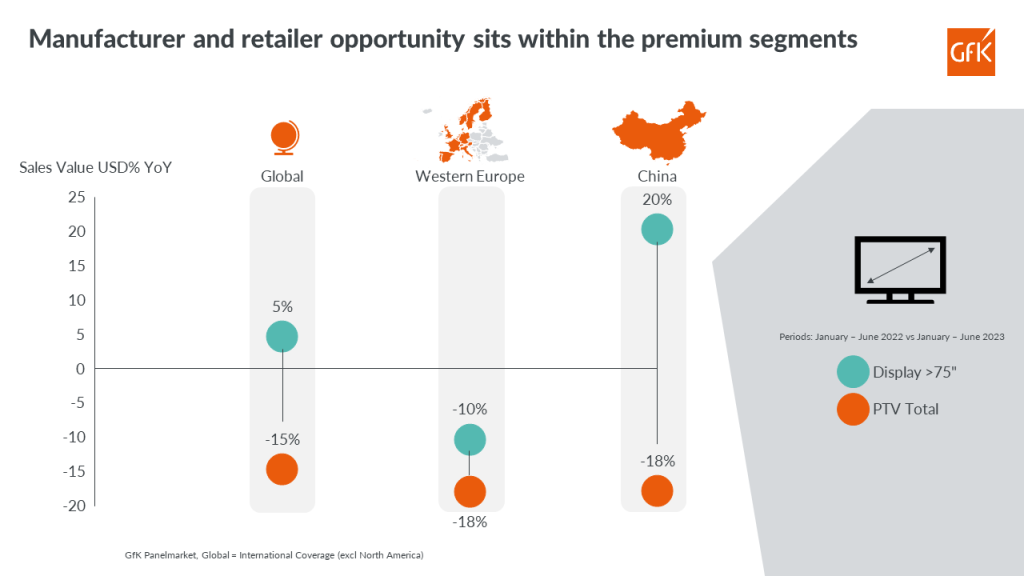

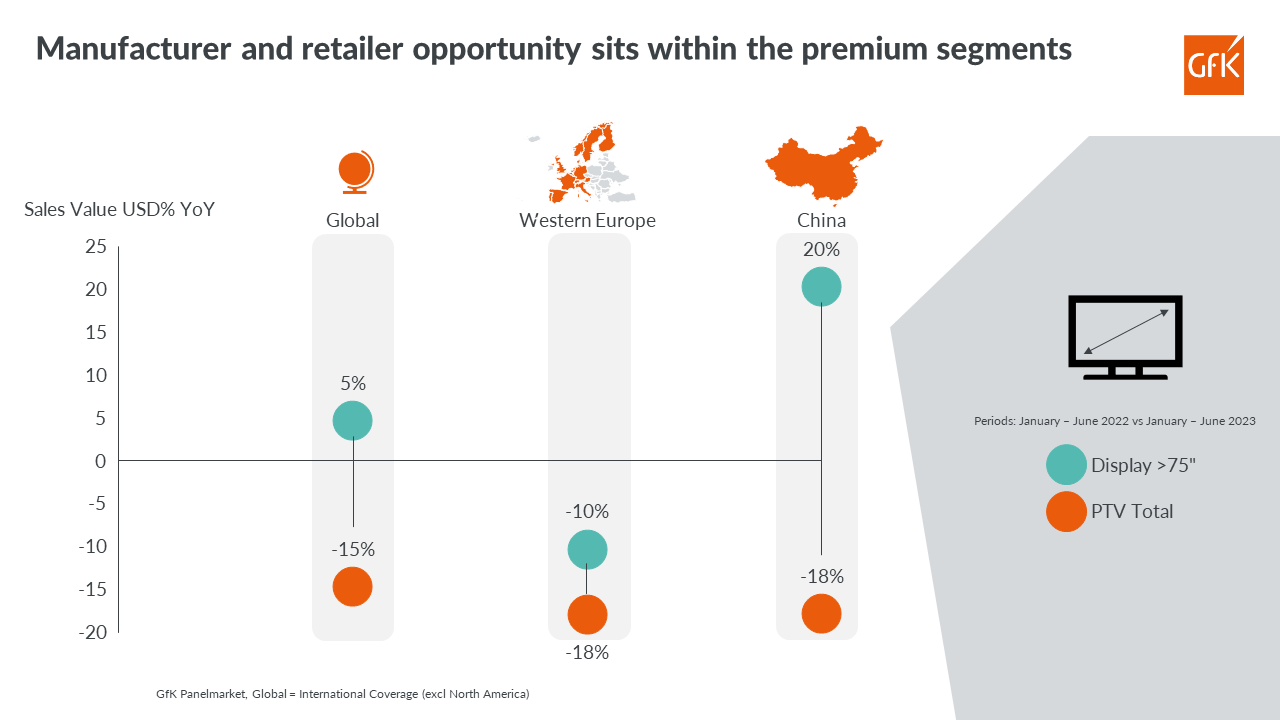

Premium TVs no longer the growth super-hero for all regions

Like the overall market, the TV sector is struggling with falling demand. In fact, revenue has dropped minus 15 percent between January and June 2023, compared to the same period last year, which is higher than the overall average for the total CE market.

Last year, premium TV sets were generally seen as the savior of the TV market. High-end models were the only sub-segment that continued to grow across most of the globe. This year, however, the picture is much more nuanced, with premium TV sets still performing better than the market average, but no longer managing to hit positive growth in some regions such as Western Europe:

Soundbars follow the same trend: Revenue of the overall market is down significantly by 10 percent compared to the same period last year, while premium units continue to grow, such as those with DolbyAtmos/DTS:X, which are up 10 percent.

The reasons for this development are obvious. While low-income households have had to cut back, buyers with above-average incomes still have a budget to spend and tend to opt for premium appliances. For example, the share of TV buyers with a medium to high income is already at 59 percent in the first quarter of 2023, compared to 49 percent in 2021. As a result, the global share of TVs over 75 inches has increased from 15 percent to 18 percent in the period under review.

Audio is the bright spot and continues to grow

One of the few positive signs in the CE market came from the home audio segment. From January to June 2023, this segment saw a 5 percent increase in sales revenue and a 3 percent increase in units sold compared to the same period last year. Growth was driven primarily by smart audio (up 2 percent) and high-end components, tuners, amplifiers, or receivers. Especially impressive is the 30 percent increase in wireless headband headphones – driven largely by the younger generation following this current fashion trend. According to gfknewron Consumer, the share of buyers aged 16 to 24 jumped to 26 percent in the first quarter of 2023, from 15 percent in 2021.

Conclusion and outlook

Overall, the global Consumer Electronics market is expected to end 2023 in the red, due to weak demand. However, specific areas of growth opportunities remain, particularly for innovative devices or those that appeal to premium consumers. Sales can also be boosted by unique or attractive designs, such as wireless headband headphones. Retailers and manufacturers need to be aware of these trends and react quickly to offset falling demand in other product lines.

**********

About the method

Through its retail panels, GfK regularly collects POS (Point of Sales) data in more than 70 countries worldwide for the consumer electronics, photography, telecommunications, information technology, office equipment, and small and large household appliances sectors. All figures are according to GfK panel market, with global data excluding North America and presented in US dollars, except stated otherwise.

gfknewron is an always-on platform that combines market, consumer and brand data supercharged with AI-powered recommendations. It enables companies to gain actionable and connected insights and act at speed to ignite sustainable growth. The platform offers three specific modules: “gfknewron Market” for market and competitor insights, “gfknewron Consumer” for an in-depth consumer understanding and “gfknewron Predict” that delivers recommendations for companies based on market data and AI-powered intelligence.

Download press release:

Media contact: Eva Böhm, T +49 911 395 4440, public.relations@gfk.com

GfK. Growth from Knowledge.

For over 89 years, we have earned the trust of our clients around the world by solving critical questions in their decision-making process. We fuel their growth by providing a complete understanding of their consumers’ buying behavior, and the dynamics impacting their markets, brands and media trends. In 2023, GfK combined with NIQ, bringing together two industry leaders with unparalleled global reach. With a holistic retail read and the most comprehensive consumer insights – delivered with advanced analytics through state-of-the-art platforms – GfK drives “Growth from Knowledge”.

For more information, visit GfK.com.