But stable outlook for future personal finances is encouraging

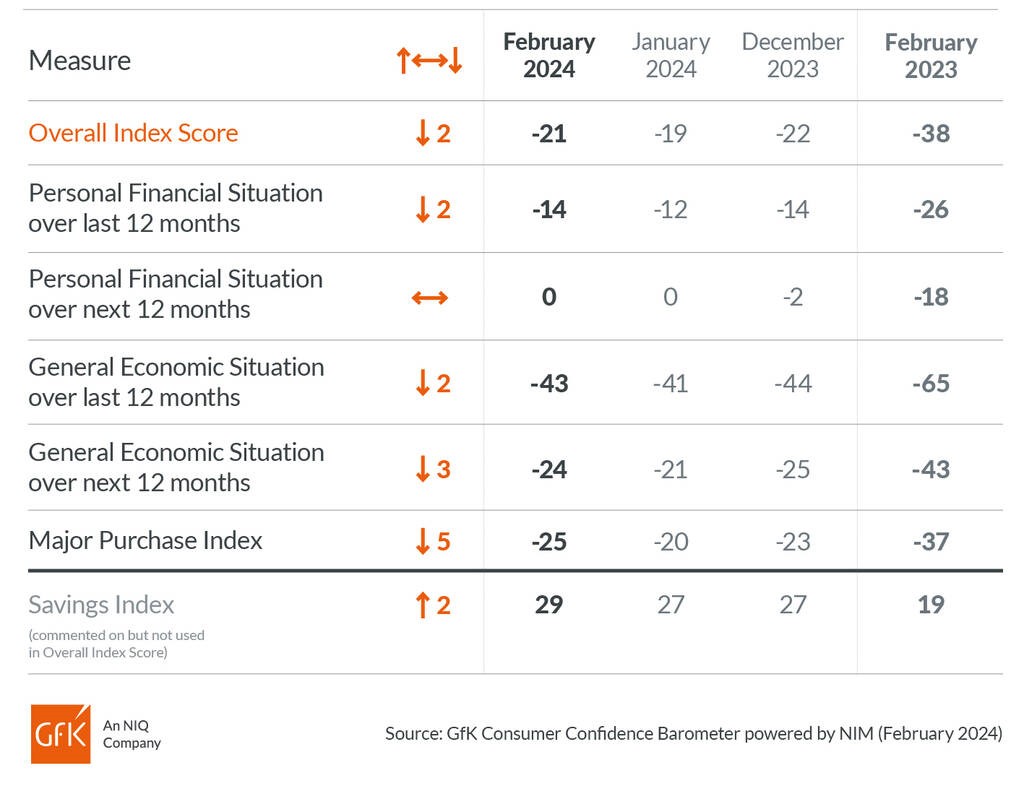

GfK’s long-running Consumer Confidence Index fell two points to -21 in February. Four measures were down and one was unchanged in comparison to last month’s announcement.

Joe Staton, Client Strategy Director GfK, says: “There’s a mixture of bad news and good news for February. The bad news is that the improvement in the Overall Index Score seen over recent months stalled slightly in February due to a fall across most measures. However, the good news is that optimism for our personal financial situation for the next 12 months has not slipped back. Although registering again at zero, this is a significant improvement on the -18 score from February last year. This metric is key to understanding the financial mood of the nation because confident householders are more likely to spend despite the cost-of-living crisis. Looking forward, it will be interesting to see what the forthcoming Budget delivers in terms of taxation and inflation. These are important issues to everyone – especially in an election year. The recent performance of the economy will play a crucial role in determining results at the ballot box. All the measures this February are better than a year ago, but consumer confidence alone will not carry us into a brighter economic future.”

UK Consumer Confidence Measures – February 2024

The Overall Index Score fell two points to -21 in February. Four measures were down and one was unchanged in comparison to last month’s announcement.

Personal Financial Situation

The index measuring changes in personal finances during the last year is down two points at -14; this is 12 points better than February 2023.

The forecast for personal finances over the next 12 months is unchanged with a value of 0, which is 18 points higher than this time last year.

General Economic Situation

The measure for the general economic situation of the country during the last 12 months is down two points at -43; this is 22 points higher than in February 2023.

Expectations for the general economic situation over the next 12 months have decreased by three points to -24; this is 19 points better than February 2023.

Major Purchase Index

The Major Purchase Index is down five points to -25; this is 12 points higher than this month last year.

Savings Index

The Savings Index has increased two points to +29 in February; this is 10 points higher than this time last year.

Measuring 50 Years of Consumer Confidence

January 2024 marks 50 years of the UK Consumer Confidence Barometer. There is no other consumer research project with the longevity, rigour and reliability of the Consumer Confidence Barometer. Each month since January 1974, this study has provided insight into how UK consumers feel about their personal finances and the wider economy, as well as the outlook for the next 12 months. Through the winter of discontent, the Falklands War, economic boom and bust, the Brexit vote, and most recently the coronavirus pandemic, CCB has seen many highs and lows over five decades.

The highest value of the Overall Index Score – the headline score – was in January 1978, when it reached +21. It reached +16 twice in 1979 (first in July and again in September). The lowest score recorded was -49 in September 2022, and other lows include -39 in July 2008, during the global financial crisis, and a score of – 35 in March 1990, in the lead-up to the 1990/1991 recession. The largest monthly increase was in May 1993 when the headline score jumped 12 points. There have been seven monthly drops of 10 or more since the survey started, with the largest by far happening during the coronavirus crisis when it dropped 25 points from -9 in mid-March 2020 to -34 at the end of March.

If you’d like the 50th-anniversary consumer confidence report, click here to download.

Notes to editor

Please source all information to GfK.

Press contact: for further details or to arrange an interview, please contact Greenfields Communications:

Stuart Ridsdale E: stuart@greenfieldscommunications.com T +44 (0) 7790 951229

Lucy Green E: lucy@greenfieldscommunications.com T +44 (0) 7817 698366

- The UK Consumer Confidence Barometer is conducted by GfK.

- This month’s survey was conducted among a sample of 2,003 individuals aged 16+.

- Quotas are imposed on age, sex, region and social class to ensure the final sample is representative of the UK population.

- Interviewing was conducted between February 1st and February 15th 2024.

- The figures contained within the Consumer Confidence Barometer have an estimated margin of error of +/-2%.

- The Overall Index Score is calculated using underlying data that runs to two decimal points.

- The press release dates for 2024 are: March 22nd; April 26th; May 24th; June 21st; July 19th; August 23rd; September 20th; October 25th; November 22nd and December 13th.

- Any published material requires a reference to GfK e.g. ‘Research carried out by GfK’.

- This study has been running since 1974. Back data is available from 2006.

- The table below provides an overview of the questions asked to obtain the individual index measures:

|

Personal Financial Situation (Q1/Q2) |

This index is based on the following questions to consumers: ‘How has the financial situation of your household changed over the last 12 months?’ ‘How do you expect the financial position of your household to change over the next 12 months?’ (a lot better – a little better – stay(ed) the same – a little worse – a lot worse) |

|

General Economic Situation (Q3/Q4) |

This index is based on the following questions to consumers: ‘How do you think the general economic situation in this country has changed over the last 12 months?’ ‘How do you expect the general economic situation in this country to develop over the next 12 months?’ (a lot better – a little better – stay(ed) the same – a little worse – a lot worse) |

|

Major Purchase Index (Q8) |

This index is based on the following question to consumers: ‘In view of the general economic situation, do you think now is the right time for people to make major purchases such as furniture or electrical goods?’ (right time – neither right nor wrong time – wrong time) |

|

Savings Index (Q10)

|

This index is based on the following question to consumers: ‘In view of the general economic situation do you think now is?’ (a very good time to save – a fairly good time to save – not a good time to save – a very bad time to save) (Commented on but not included in the Index Score) |

About the GfK Consumer Confidence Barometer powered by NIM

There is no other consumer research project with the longevity, rigor, and reliability of GfK’s Consumer Confidence Barometer (CCB). Each month since January 1974, it has provided a snapshot of how UK consumers feel about the crucial economic topics today and their outlook for the next 12 months. It has provided insight into the UK’s thinking through boom and bust, the Brexit vote, and most recently the coronavirus pandemic. Since October 2023, GfK has been cooperating with the Nuremberg Institute for Market Decisions (NIM), GfK’s not-for-profit founder, on the Consumer Confidence Barometer. The aim of the cooperation is to provide even more in-depth analysis of the reasons behind shifts in consumer confidence. GfK’s high-quality survey methodology and rigorous processes have not changed so there is no impact on the CCB dataset and trends. This is the background to the sourcing in the release, ‘GfK Consumer Confidence Barometer powered by NIM’.

About GfK

For over 89 years, we have earned the trust of our clients around the world by solving critical questions in their decision-making process. We fuel their growth by providing a complete understanding of their consumers’ buying behavior, and the dynamics impacting their markets, brands and media trends. In 2023, GfK combined with NIQ, bringing together two industry leaders with unparalleled global reach. With a holistic retail read and the most comprehensive consumer insights – delivered with advanced analytics through state-of-the-art platforms – GfK drives “Growth from Knowledge”. For more information, visit www.gfk.com or follow www.twitter.com/GfK.

Nuremberg Institute for Market Decisions (NIM)

The Nuremberg Institute for Market Decisions (NIM) is a non-profit research institute at the interface of academia and practice. NIM examines how consumer decisions change due to new technology, societal trends or the application of behavioral science, and what the resulting micro- and macroeconomic impacts are for the market and for society as a whole. A better understanding of consumer decisions and their impacts helps society, businesses, politics, and consumers make better decisions with regard to “prosperity for all” in the sense of the social-ecological market system. The Nuremberg Institute for Market Decisions is the founder of GfK. For more information, visit www.nim.org/en