The rise of Canada’s omnishopper is the key to growth

Penetration of online shopping increased to 44% of Canadian households over the 52 weeks ending April 3, 2021. These omnishoppers have increasingly adapted their buying routines to embrace the convenience and ease of e-commerce, as evidenced by a consistent increase in online purchases.

Nationally, e-commerce accounts for 3% of all Canadian FMCG purchases, but that share nearly doubles when isolating just the omnishopper group. And their contributions to overall store sales demonstrate the value of winning this group’s share of wallet.

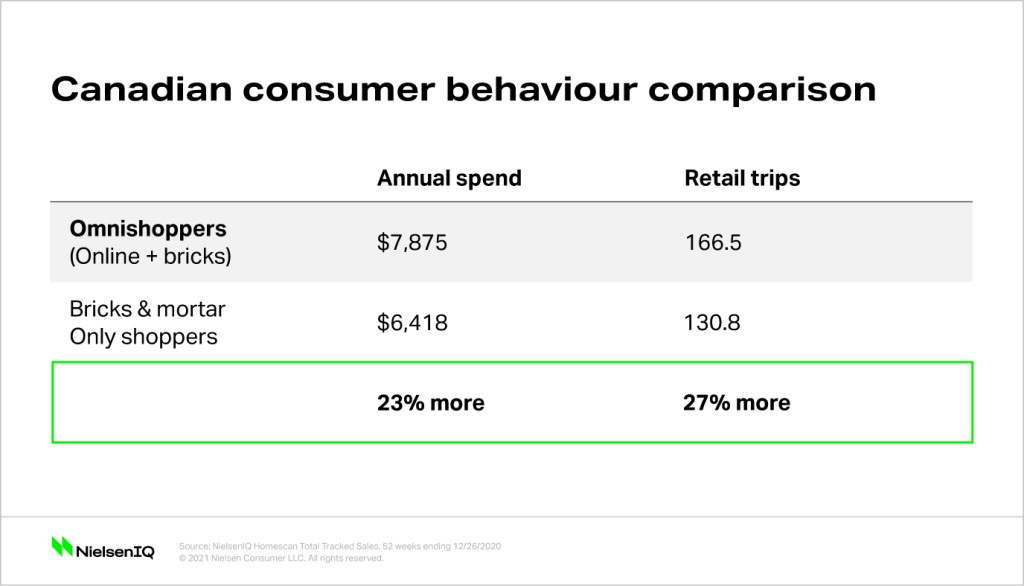

On average, omnishoppers make 27% more retail trips than individuals who exclusively shop in-store, and that translates to 23% more spend annually. “Affluence level and household size are two current indicators of today’s omnishopper,” explains Carman Allison, Vice President of Consumer Intelligence at NielsenIQ. “And those groups tend to spend more regardless of channel. However, it’s important to note that two of the fastest-growing groups of omnishoppers were households without kids and Boomers. So there’s interest across demographics.”

The consistency of purchase intervals and lower concerns over variance in quality fueled non-edible products such as pet food or disposable diapers to blaze the e-commerce trail. But shoppers are increasingly fulfilling grocery orders online as well, which offers an incredible opportunity for merchants to gain new shoppers and drive retention. Three-quarters of all FMCG sales are food items, so broadening the basket to include more edible items could accelerate e-commerce’s growth rates.

The untapped potential in winning unconverted shoppers

Another factor in the channel’s success? Engaging those on the fence. Not everyone who tested buying their groceries online in the past year has maintained the habit. Approximately one-third of Canadian households that tried online shopping in the past year did not repeat the purchase.

Similar to what’s seen in other countries, Canadian shoppers expressed concerns about higher fees, the quality of selection of perishable items, and an immediate need for the groceries. Each percentage point conversion from trial purchaser to repeat buyer carries a CA$126M opportunity.

Furthermore, one-quarter of Canadians aren’t recent online grocery shoppers, but they are open to it. Taking a cue from successful retailers in more mature e-commerce markets, Canadian retailers may consider expanding same-day delivery service, introducing annual subscription plans rather than one-time delivery fees, or increasing the availability of curbside pickup to alleviate some of the concerns and increase online conversions.

With billions of dollars being invested into e-commerce infrastructure and services, and online FMCG sales forecasted to grow by 50% by the end of 2021, building the next wave of omnishoppers will be crucial for success.

Trade-offs in the Canadian market amid rising prices

Balance immediate pricing strategies with long term goals.