Key Factors for Emerging Brands to Stand Out to Investors

As an emerging or growth brand, you likely spend a lot of time convincing retailers to carry your products or increase your shelf space. But, getting investors to support your brand or acquire it, can be just as difficult and requires an equally complex set of data. We’ll cover some tips that would work for both below, but you can get an even more in-depth look at investor conversations by viewing our Roadmap to Growth Webinar.

With that in mind, here are 5 key factors for emerging brands to stand out to investors:

1. Strong Sales Figures

Unsurprisingly, one of the best ways to convince investors of your brand’s value is to show them strong sales figures. But, this doesn’t mean you need to have the best-selling version of the product on the market. Maybe you can show that you have a higher relative velocity than your competitors for a particular product or region. Or you can show that your products have a higher margin and sell-through rate. If so, you have a good sales figure to share with investors. Invest in a good data platform and dig deep to find the truth about your products. You might be surprised by a success that you were overlooking, and that can make all the difference when trying to get an investment.

2. Market Alignment

Investors are generally well-versed in the many factors that affect consumer demand. Consumers are becoming more vocal about what they want from brands and their dollars are supporting these claims. For example, in online searches, many consumers don’t look by brand, they look by product attribute. If your product lists that attribute, you’re more likely to appear in their searches, and better able to meet their needs. That means your brand should be aligned with the trends that look to emerge and grow in the market if you wish to show investors your value. When you’re aligned with these shifting tides, you’re more likely to attract investments, have room to experiment with innovative products, and build brand resonance. It’s truly a win-win when you fit into the future of your industry.

Source: Roadmap to Growth Webinar, 11/9/22

3. Brand Differentiators

Unless you’re at the forefront of a new trend, there are likely a lot of brands competing in the same space. You’ll need to be able to identify the competitors in your space and compare your brand to theirs. While sales figures are the first place to start, you’ll also want to identify the underlying differentiators. Perhaps your product is of a higher quality. Or, maybe you sell your product at a lower price point that is benefiting from a shift in consumer demand. Or, it could be that your product highlights state attributes that resonate with consumers more than the competition. Whatever it is, the better you are at conveying what makes your brand unique and investable over others, the more likely you are to get the investment or acquisition you seek.

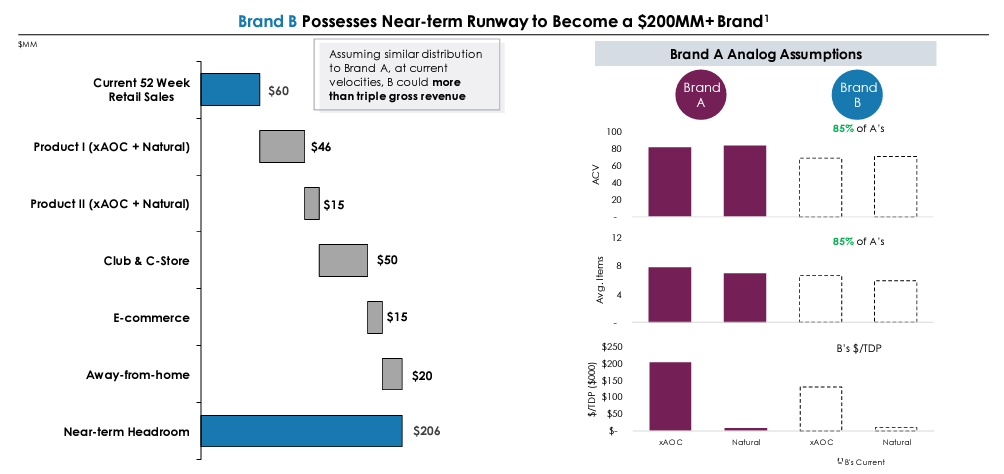

4. Defined Brand Trajectory

One of the most important aspects of any brand to an investor is the future trajectory it has. This might be a surprise to some, but not every brand has limitless growth potential. Some brands have headroom to triple their sales, while others are likely to stagnate. This comes down to a variety of things, including market penetration, the size of the existing competition, consumer demand for that type of CPG product, and more. If you can show how much you expect to expand your distribution and increase sales with powerful data, you’re more likely to convince investors that your brand is worth getting involved with. This all comes down to having accurate, trustworthy data and the ability to share it in a logical way.

Source: Roadmap to Growth Webinar, 11/9/22

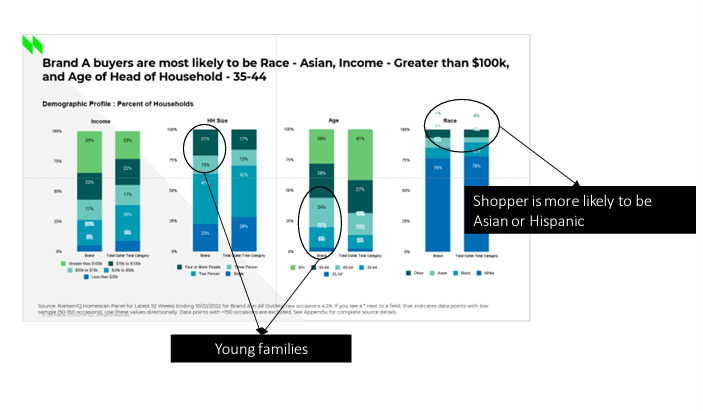

5. Convincing Data Sets

Every brand has a story and most of them are unique and compelling. But, investors won’t be swayed by your narrative, they need to see numbers. But, basic sales figures alone aren’t particularly convincing. Instead, investing in both POS and panel data is a great way to give them a holistic view of your brand. This holistic view can convey the actual value that you bring. Often, panel data can show a strong growth path ahead for a brand that hasn’t yet hit its stride. Without that data, you’re selling based solely on your sales figures, and may not get the right valuation. NielsenIQ is the gold standard in both POS and panel data. We emerging and growth brands access the data they need at a price built for their budget.

Source: Roadmap to Growth Webinar, 11/9/22

Use Data to Stand Out

Whether you want to impress a retailer, get acquired, or just sell more products, data is your best friend. Retail sales and category data can sway businesses to carry your product. Consumer data can help you understand the market and better meet your customers’ needs. NielsenIQ tracks 1,000+ attributes across total store and 250+ NielsenIQ-only attributes and can get granular with Product and Label Insights.

Learn more about our Total Wellness offerings and sign up for a demo to see this attribute data in action. Our team is always here to help you get the data you need when you need it.

As an emerging or growth CPG brand, the power to emerge on top of the wellness landscape rests in your hands. Fortunately, our Byzzer platform can help by providing comprehensive reports that help you understand shoppers’ needs and behaviors better. Best of all, we’ll give you actionable insights so that you know what to do next to grow your brand.