Watch out for declining CPG consumption

CPG consumption continues its downward slide compared to 2022 sales — dollar sales growth continues to be fueled exclusively by rising prices. February reported an 8% lift in dollar sales, whereas unit consumption fell by 2%. This drop in unit consumption growth is similar to 2022 declines.

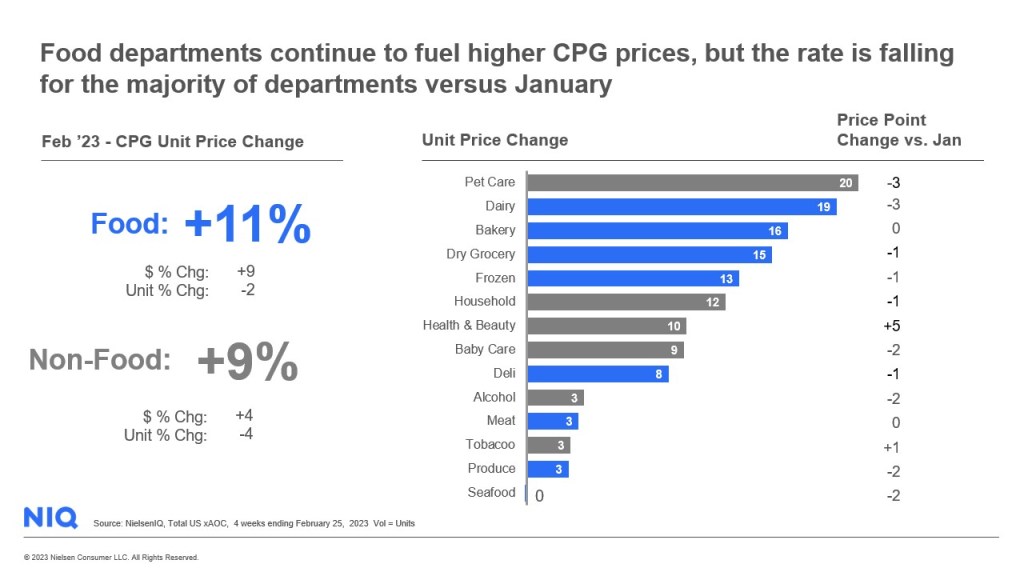

At the grocery store, food inflation (11%) is still outpacing non-food inflation at (9%). The consumer response to rising prices was more pronounced in non-food: food unit sales dropped 2% while non-food unit sales fell 4%.

A notable reason for the unit sales drop is consumers buying larger package sizes. A quarter of Americans are buying larger sizes of products with long shelf lives as a savings strategy to get a lower cost per use.

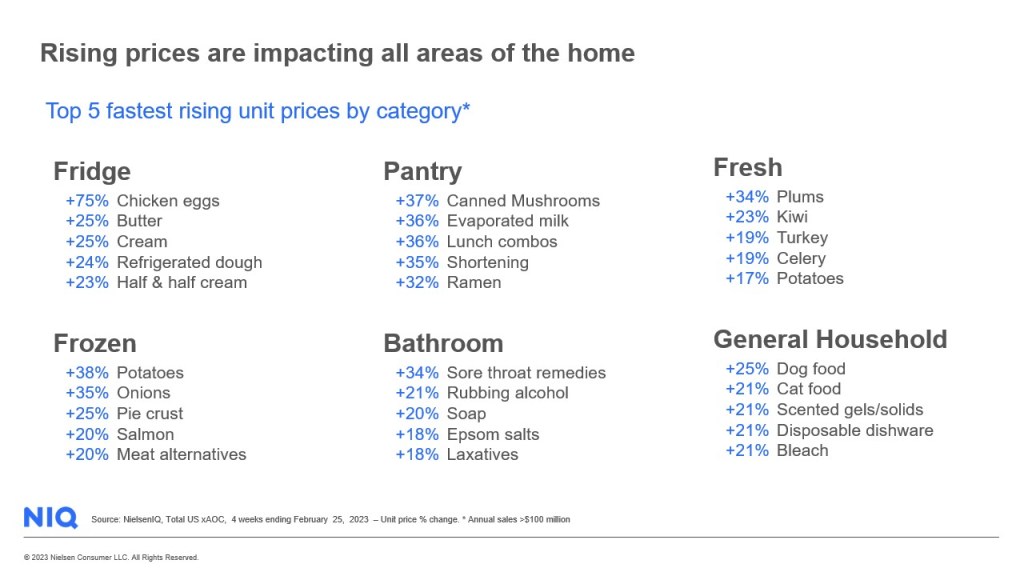

Rising prices continue to touch every area of the store, and by extension, consumers’ homes:

Behaviors we’re watching

As the inflationary stranglehold on consumer spending continues to soften, both manufacturers and retailers will need to shift their focus to new growth drivers.

As shoppers buy less and split those purchases into wants versus needs, marketers will need to work harder to engage them. Traditional marketing tactics may return to win back consumers who have shifted their purchases to value brands and retailers.

To pivot successfully, manufacturers and retailers will need to track consumer movements when it comes to:

More private label purchases: Private label (PL) brands captured 19.3% of the consumer wallet for CPG sales in February. PL brands reported an increase of +13% in February, outpacing the total market growth by 5 percentage points.

Retail switching: Value retailers’ sales growth outpaced the total market, jumping 11% and capturing 41.7% of CPG sales. Varying assortment across retail channels is more important than ever to break the decision tie — if items are the same, lowest price will continue to win.

Buying on promotion:Promotional sales continue to trend higher than the total market growth (15% vs. 8%). With 50% of shoppers willing to stock up when their brand is on sale, promoted prices will be a key basket driver for retailers. Some shoppers (29%) only buy what is on sale, meaning that promotions will remain a key deciding factor in where consumers shop and what they buy.

In short, engage consumers by providing value, whether through discounts, promotions, or higher-quality products.