Decline in FMCG price growth helps revive rural markets

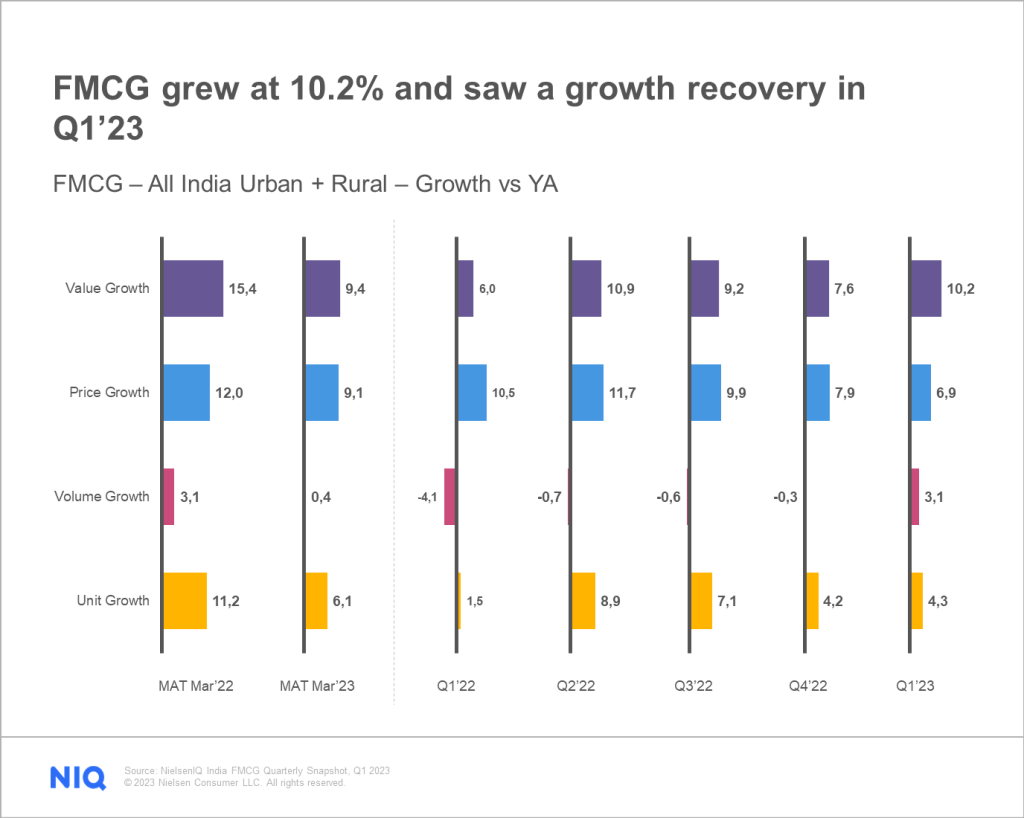

India’s FMCG industry observed a double-digit value growth of 10.2% in Q1 2023, a 2.6% increase compared to the previous quarter. This value growth is driven by a revival in consumption in the rural markets and traditional trade channels, which have been under pressure for over a year. We also see the stabilizing inflation arresting price growth, which has dropped from 7.9% in Q4 2022 to 6.9% in Q1 2023, aiding the revival of this quarter’s consumption growth.

Want to be the next pitch slam winner?

NIQ Founders’ Pitch Slam is now global and coming to China, India and Brazil!

Pitch Slam offers the most innovative and transformative emerging CPG brands the opportunity to pitch their companies to industry leaders and experts for the chance to win a prize valued at R$250,000

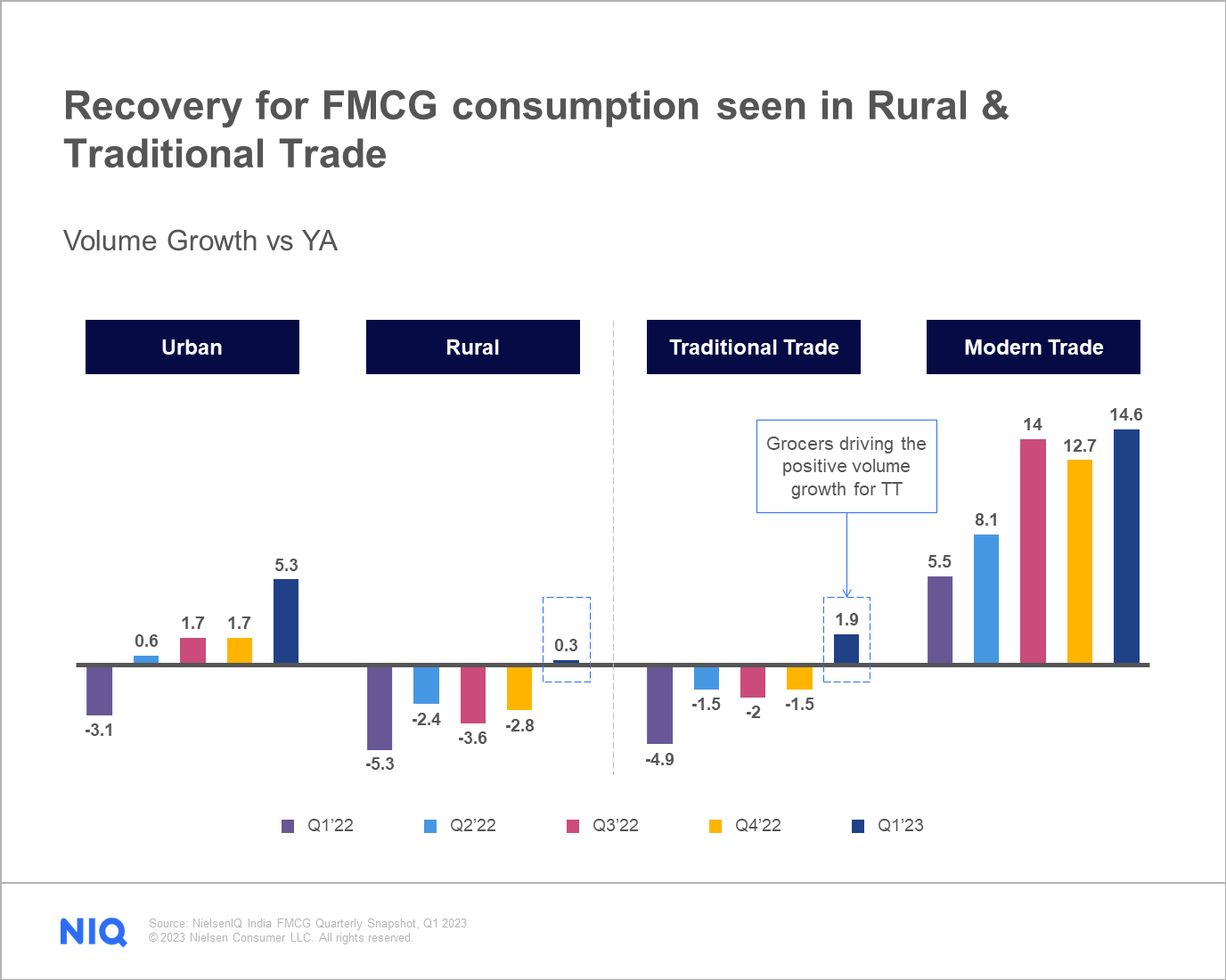

According to NIQ’s FMCG Quarterly Snapshot for Q1 2023, the consumption growth revival in rural India is being led by both the southern (2.8%) and eastern (3%) zones. Despite this revival, however, urban India continues to be the growth engine in terms of value growth. It observed an increase of 5.3% in Q1 2023 across both food and non-food categories, a 3.7% jump compared to the previous quarter.

Preference towards smaller pack sizes continues

While the organized retail of modern trade channels has been seeing high double-digit growth (14.6%), traditional trade also experienced a turnaround for the first time in the past year (1.9%), driven primarily by grocers. This positive consumption growth is led by an increase in the number of units consumed and shift towards smaller packs continues. Manufactures must focus on innovations and optimize their assortment to cater to evolving consumer demands.

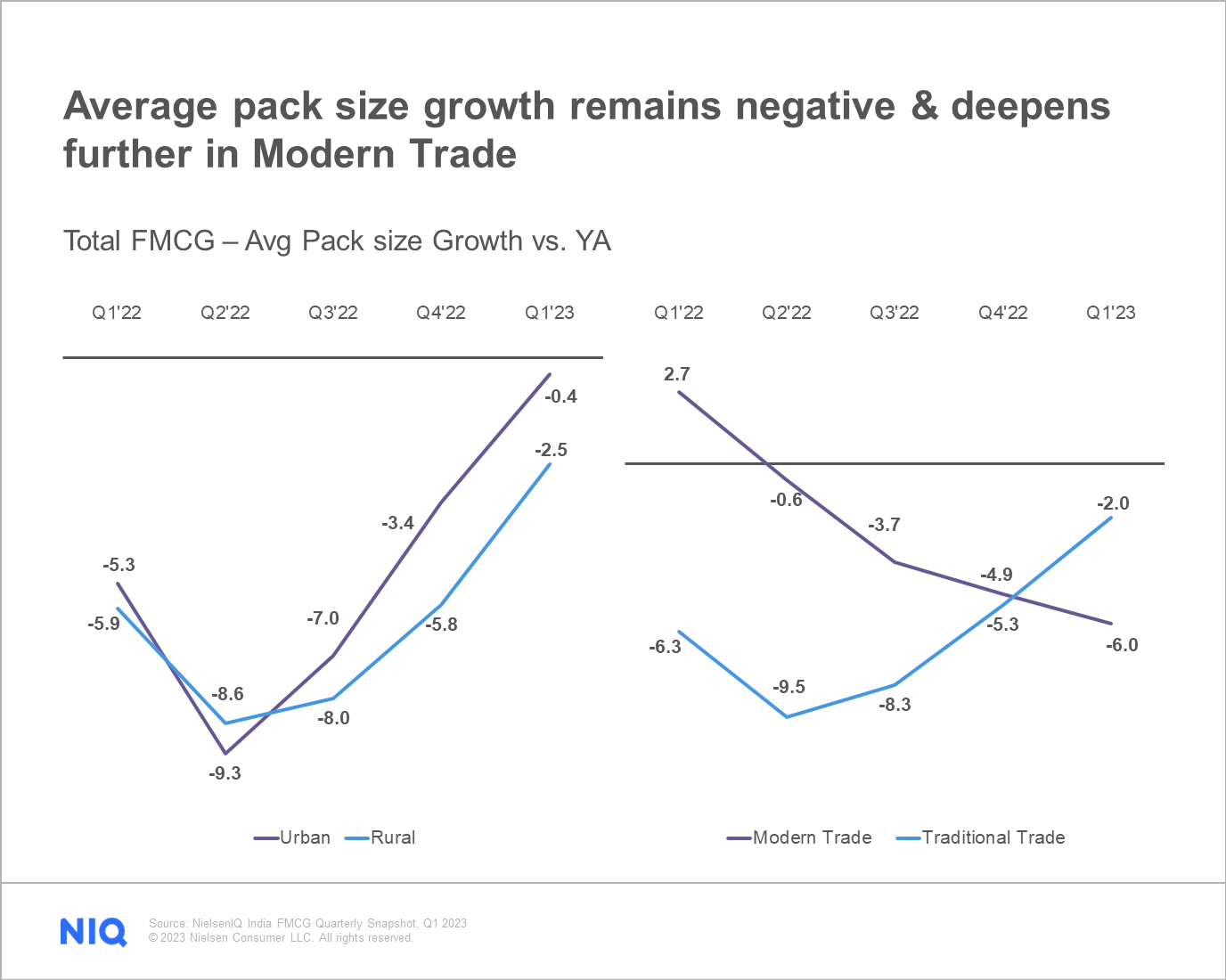

With a revival in the FMCG industry, a shift towards larger pack sizes is likely. For now, urban, rural, and traditional trade see an upward movement in terms of average pack size growth, but it still remains negative. Modern trade continues showing further decline in average pack size growth.

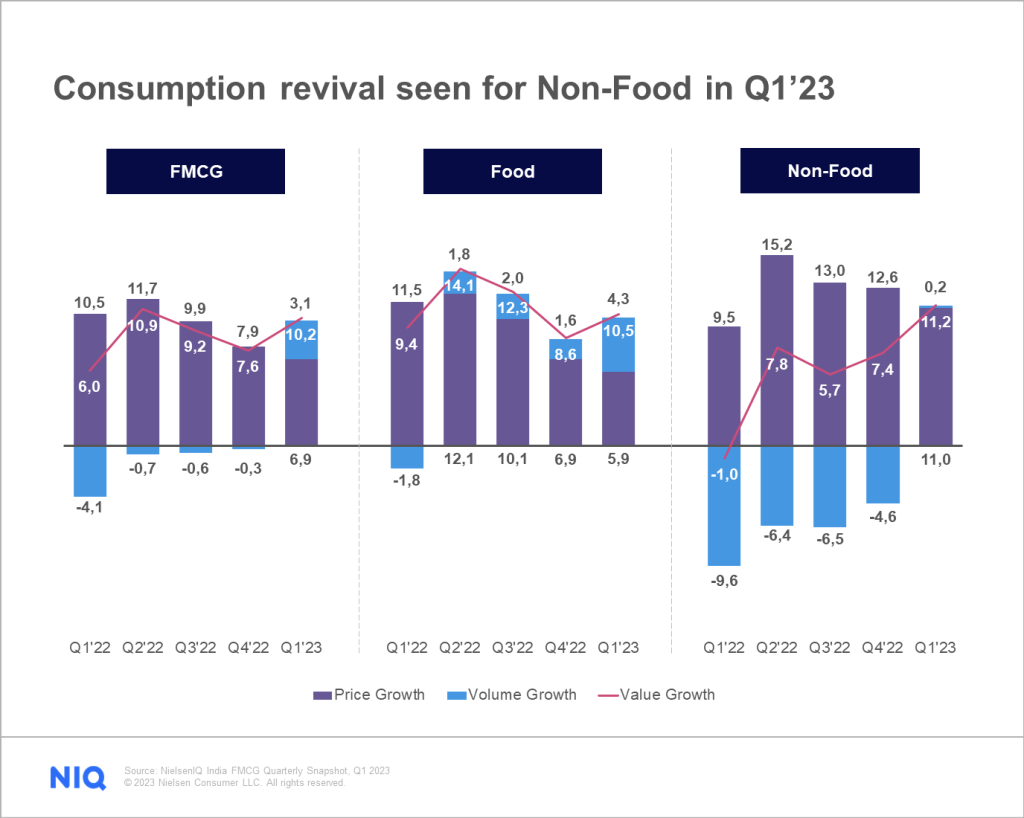

Non-food recovers, food continues to be prioritized

At an all India level, food continues to witness a high consumption growth of 4.3% in Q1 2023, compared to 1.6% in Q4 2022. While staples drove growth for food, home care categories led the consumption growth for non-foods after 6 consecutive quarters in decline.

Despite an improvement in Q4 2022, habit-forming categories continue to decline as double-digit price growth continues within the sub-category. Growth for personal care categories also stay negative as consumers continue to rationalize their overall spending within non-food, particularly in home care and personal care categories.

At an overall FMCG level, as well as within food, small manufacturers drive the value and consumption growth (volume growth for small manufacturers is 7.2% vs. 3.2% for large manufacturers in food). Within non-food, however, large manufacturers drive growth (Volume growth for large manufacturers is 0.6% vs. -1.8% for small manufacturers).

India FMCG forecast

Despite global uncertainties, India’s FMCG market stands tall with a forecast growth of 7%-9% for full year 2023. There are potential headwinds, however, such as inflationary pressure on consumers, low confidence levels, and a high unemployment rate. On the other hand, announcements made in the Union Budget 2023 on agriculture and capex investments, revisions in tax regime, a 6.4% GDP growth forecast by RBI for the next fiscal year, and forecast of normal rainfall could all act as tailwinds.

Get the full picture of India’s FMCG industry

To navigate the shifts in the retail landscape, you need the most accurate and trusted data in the industry. Book a meeting with us to see how we can help you make data backed decisions for your business.