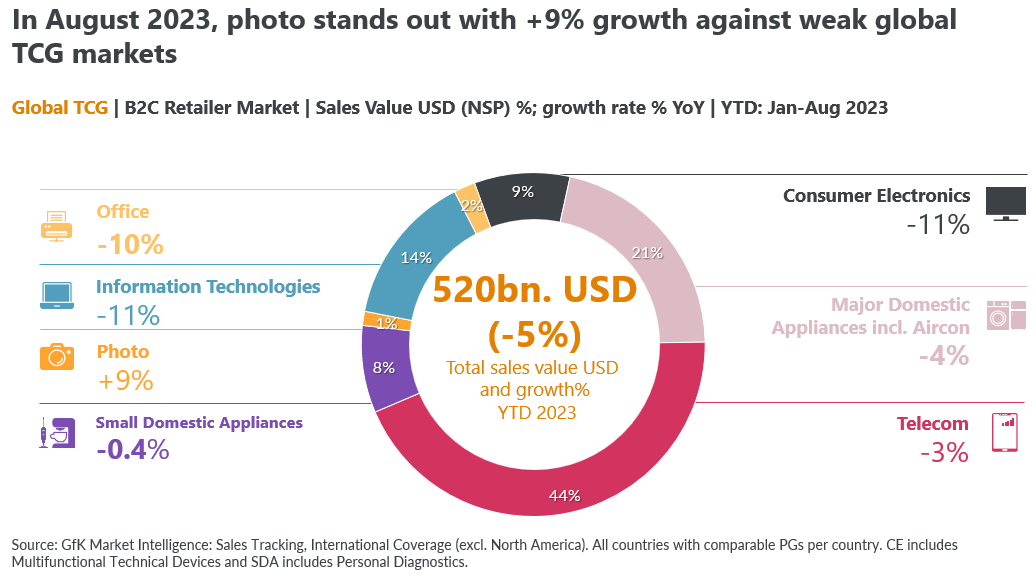

Photography has been the only sector in the global technical consumer goods (TCG) market to enjoy a solid sales increase in 2023.

Amid stagnant consumer confidence and tight household budgets, it saw year-on-year growth of 9% in January to August, whereas domestic appliances, consumer electronics, IT, office and telecom sectors all slumped. Take the poor performance of Latin America (-15%) and Russia and Kazakhstan combined (-13%) out of the equation along with Western Europe’s flat dynamics (+2%), and the bounce-back looks even stronger, with growth of 20% in the Middle East and Africa, 18% in China and 16% in Emerging Asia.

With sales value at 1% above pre-pandemic baselines, it seems the sector is finally showing modest hints of long-term recovery, having been the weakest of the TCG sectors since the start of the Covid-19 crisis.

Here we look at 6 key trends in the global photo market and how brands and retailers can find opportunities amid fragile consumer confidence.

The smartphone continues to overshadow the dedicated digital camera

When the first touchscreen smartphones made waves in 2007/2008, the camera industry was in robust health. But it wasn’t long before this new technology had a negative impact on camera purchases. Since peaking in 2010, worldwide digital camera shipments by members of the Camera & Imaging Products Association (CIPA) have plummeted by 93%.

Cameras built into phones may remain inferior to dedicated digital cameras, and single lens reflex cameras (SLRs) in particular, but consumers can see that the quality is improving year on year. Plus, they have the advantage of being close to hand and effortless to operate.

Of course, smartphone addiction is fuelled by social media, which now counts 4.8 billion users globally—more than half the world’s population. For every 100 people connected to the internet, 93 are social media users, spending an average of two hours and 24 minutes scrolling every day. If photo brands and retailers are to outsmart the smartphone, they need to appeal to these global legions of content creators, showing them quick and convenient new ways to make and share high-quality images and video.

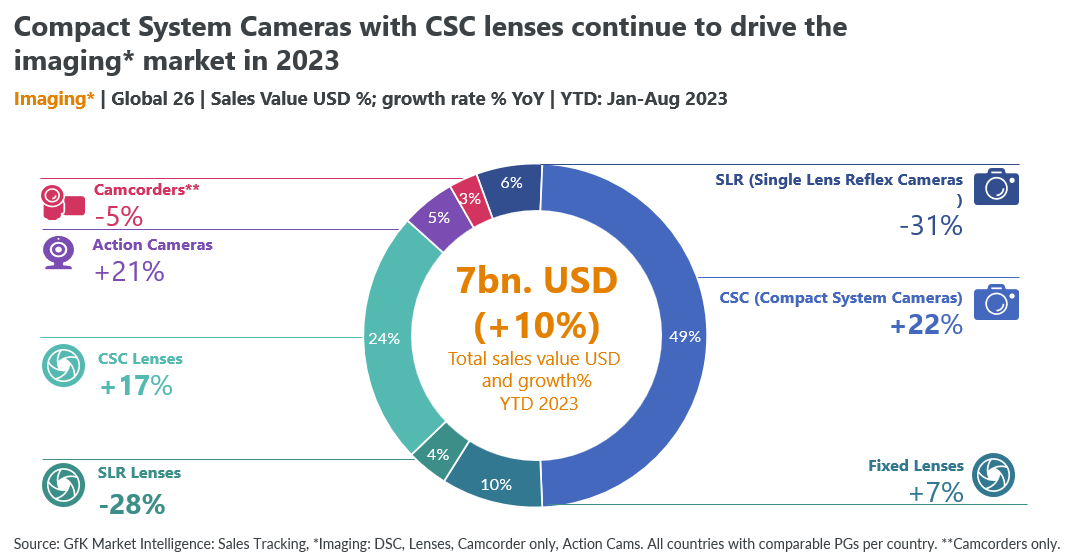

Mirrorless cameras continue to drive the imaging market

The precedent set by the smartphone as a small, lightweight, convenient camera is now fueling the widespread adoption of compact system cameras (CSCs). These mirrorless cameras and their lenses accounted for 73% of the imaging market’s $7 billion turnover in the year to August 2023.

CSCs grew by 22% and CSC lenses by 17% over that period. In sharp contrast, SLRs and their lenses plummeted by 31% and 28% respectively over the same period. In fact, demand for SLR products has fallen by around 70% on pre-pandemic levels.

It shows that when consumers are choosing cameras, they overwhelmingly now opt for these smaller, lighter models that tend to be less complex than SLRs without generally compromising on image quality or features. Manufacturers and retailers committed to digital SLRs should focus on differentiating features where they can offer a superior experience, such as larger sensors that can capture more light in low-light settings.

The boundaries between image and video creation are blurring

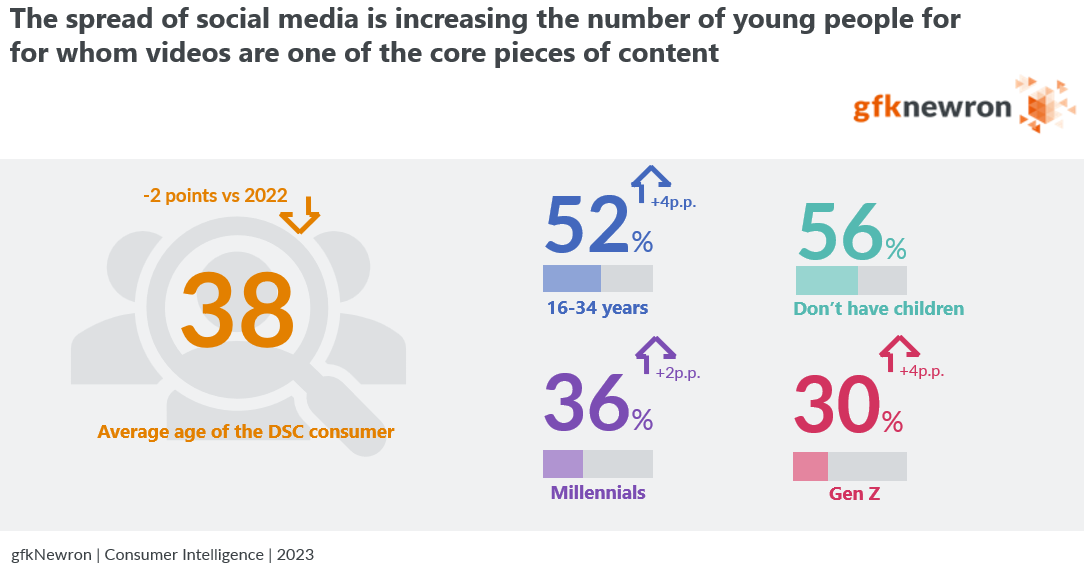

The unstoppable spread of social media and vlogging is increasing the number of young consumers making, sharing, and watching video content.

For manufacturers in the digital camera market this presents the opportunity to offer an upgrade from smartphones to cameras and equipment that enable consumers to produce both video and stills at high quality.

Reflecting this social media-fueled trend, we are seeing the average DSC owner drop in age. More than half are now aged between 16 and 34—up four percentage points since 2022—and 30% are Gen Z, making them between 11 and 26, while 56% don’t have children, according to gfkNewron Consumer Intelligence.

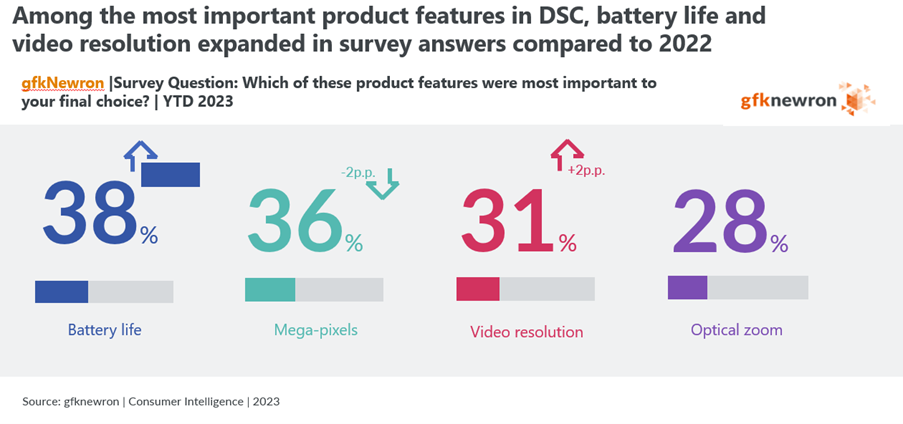

Illustrating video’s upward trajectory, battery life and video resolution were among the top four features influencing product choice in Q1 2023, cited by 38% and 31% of consumers respectively in the same gfkNewron study.

Although megapixels are still deemed more important than video resolution, consumers are beginning to mention this less as the vlogging universe expands, whereas resolution specifically for video is growing in importance.

The volume share of cameras with 4k+ video resolution has already doubled since 2019 and reached 90% value share in August 2023 compared with 81% in 2021 and 52% in 2019.

Price is a top purchase driver

Camera buyers have traditionally based their purchase decisions first and foremost on price. Yet, for the second year running, price is only the second top purchase driver after product features in 2023, cited by 61% of consumers. Consumers clearly prioritize the quality and functionality of their kit, and are prepared to stretch their budgets for a camera that fits their criteria.

The mid-range price class of US$1,000—$2,000 grew in the first eight months of 2023, driven by CSC and changeable lenses.

However, the $3,000+ price class shrank in APAC and Europe as well as the LATAM market.

Lenses compensate for muted demand

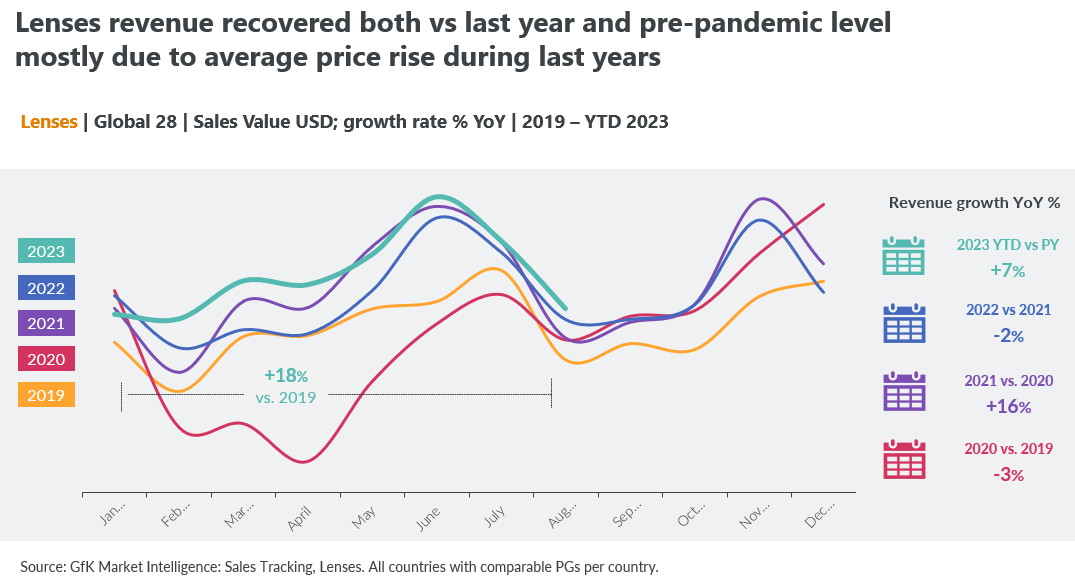

Lenses revenue recovered on pre-pandemic levels in January to August 2023, largely due to average price rises in recent years, with sales value up by 18% on 2019 but unit sales down by 11%.

The single focal length lens still rules, commanding 34% of value share, though the standard zoom and telezoom remain stable, accounting for over half of sales value between them.

Average CSC lens prices stabilized in 2022 and fell in the first eight months of the year to US$926, but SLR lenses have fallen more steeply, down from US$707 just two years ago to $538 as of August 2023.

Action cameras are back in action

After three years in the doldrums, action cameras posted solid growth in 2023 with volume and value growing by 13% and 19% respectively.

One explanation is that traveling is back on the agenda after the restrictive years of the pandemic. Year-on-year unit sales crashed by almost 25% in 2020 as the Covid-19 crisis forced people to stay at home. But this slump was mainly driven by European markets, where almost half of all the cameras are sold. Volume in the APAC market grew by 20% in the year to August 2023 while the smaller MEA and LATAM markets saw growth of 17% and 10% respectively, demonstrating the value of branching out to new regions.

Conclusion

The ever-expanding universe of social media content creators provides a key opportunity to attract consumers through compact, convenient cameras that offer superior stills and video.

The camera market is becoming more and more niche in its offerings – reflecting the fact that buyers are now more informed and sophisticated By keeping pace with consumer trends in different segments and regions, brands and retailers can position themselves for growth against steep competition from the smartphone.

Meanwhile, global tourism’s post-pandemic recovery is well advanced, and we expect to see this further reflected in camera sales as consumers start to dream big again about making memorable trips abroad.

Catch the latest tech trends and our take on how they impact your business.