What Is Clean & Sustainable Innovation?

Product innovation comes in many forms, from entirely new products to new packing to temporary flavor or scent variations. Often, these innovations are built with the help of experts, analytics, and lots and lots of data. CPG manufacturers and retailers are constantly innovating to stay ahead of shopper needs in new ways (even in times of crisis). In today’s market, successful CPG product innovations typically need to do more, cost less, or meet a particular consumer need to get attention.

Clean & Sustainable Innovation refers to when a brand’s product innovations are designed around sustainability trends. For example, when new products are intentionally created and marketed as “paraben-free” or as “sustainably sourced”. NIQ research has shown that sustainability matters to the public. Almost all consumers (95%) say they are trying to take some action to live sustainably. So, these product innovations are filling an important role that consumers are vocal about needing.

Uncover the Latest in Beauty and Health Innovation

In the report we highlight the top innovations in Beauty & Healthand explore the key themes driving innovation forward. This includes clean & sustainable, trusted representatives, personalization & inclusivity, and ingredient-focused.

The Clean and Sustainable Innovation Beauty Trend

The trend towards clean and sustainable products has been growing for years and is continuing across the entire CPG category. Consumers are showing increasing concern about climate change and the state of the environment and are evaluating their choices and habits to identify their individual climate impacts. In a recent survey, we found that 70% of US consumers find it important to make sustainable choices, and 27% of those have incorporated changes into their daily lives. Consumers overwhelmingly tell us that the responsibility for sustainability progress lies with brands, retailers, and consumers themselves.

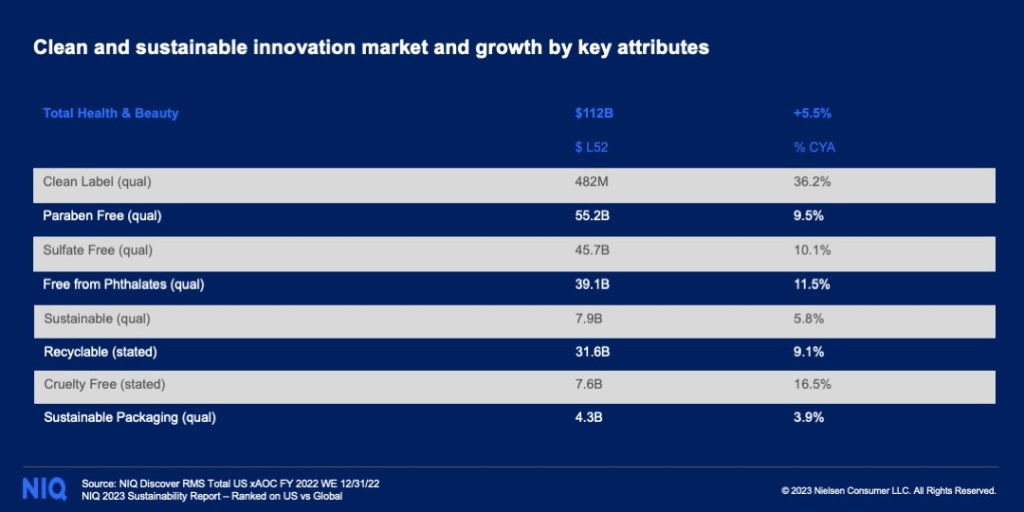

When it comes to beauty, clean and sustainable attributes continue to grow and out-pace the total category, even in a time of rising price inflation. Consumers continue to look for brands that are “free from”, cruelty-free, vegan, plant-based, reusable/refillable packaging, low carbon products, and more. The clean and sustainable trend is one where we see enduring growth and interest, it is safe to say this will be a long-lasting trend.

How to Use Sustainable Innovation

Knowing about the trends impacting your brand and acting on them are two different animals. To stay on top of the Clean & Sustainable trend, brands should actively be evaluating their product packaging and formulations, as well as how they communicate their clean credentials and sustainability initiatives to consumers. Identifying the most valuable product attributes to highlight and appropriately using stated and qualified product attributes is key. With those in hand, you can optimize your packaging and product listings to target the desired attributes and make it easier for customers to find your products.

Additionally, brands need to keep their ears on the ground and listen to what consumers are saying about their needs and wants from brands. Understanding shifting consumer behaviors can help you better understand future demand and where your products are in alignment. Investing in both POS and Panel data can help you fill the gaps and get a truly holistic view of the market and the opportunities available.

It’s also important to remember that adding brand extensions can be an easy way to meet these needs without having to start from scratch. For example, in the fragrance market, 5 of the 9 fastest-growing emerging brands are brand extensions with more than $50 million in sales last year combined. If you build your innovations around reliable data and expert insights, you can maximize your chance for success.

Sustain Your Growth with NIQ Insights

Understanding how clean and sustainable trends are impacting your brand growth and consumer behaviors can help you better plan your innovations. Investing in the best data and industry insights can make all the difference.

NIQ tracks 1,000+ attributes across total store and 250+ NIQ-only attributes. This means you can get granular with Product and Label Insights and act on them effectively with our expert insights and support.

For emerging beauty brands, our Byzzer™ platform can help by providing comprehensive reports and guidance. We’ll help you understand shoppers’ needs and behaviors better at a price fit for your budget. You can even start out with a free account to get a taste.

Methodology

NIQ’s 2023 Health and Beauty Innovation Report, an annual compilation and celebration of innovation successes, recognizes brands that offer meaningful category innovation and are representative of key trends observed across health and beauty. Broadly, we considered new innovations that:

- Are selling in-store, in our XAOC measured market

- Are part of the Health & Beauty department

- Represent a new ‘brand low’, ‘brand high’, SKU, or found success in a new channel

- Started selling in July 2021 or later (First month sales of $500,000 or greater)

- Had sales that reached over $3 mm in year 1*

For online launches, we considered brands that were new to selling online and experiencing rapid growth (the analysis looks at year-one sales and does not include any analysis of the long-term potential).

*Year 1 sales will not include a full 12 months of data for products that launched after January 2022