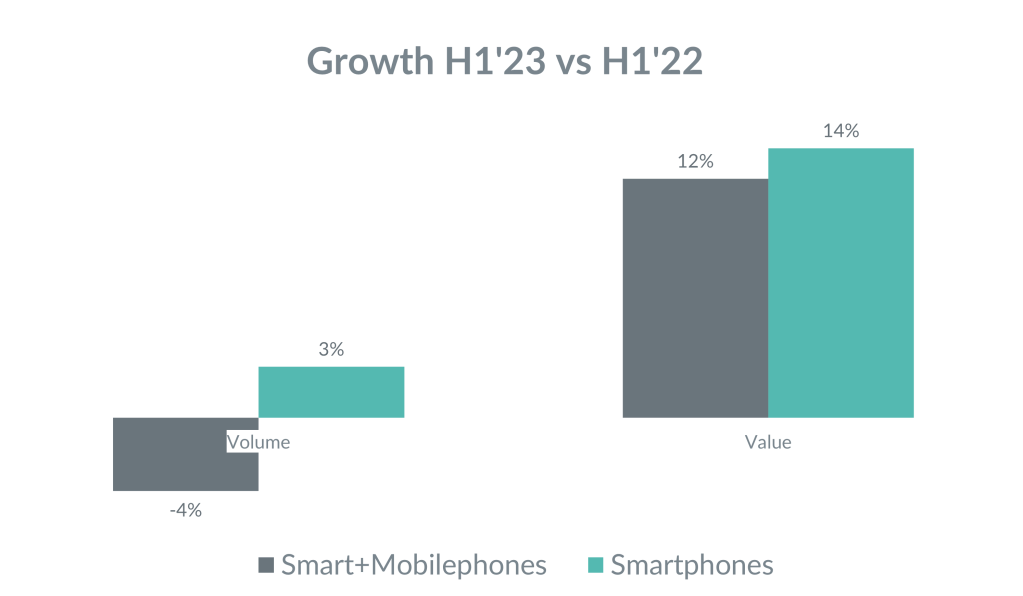

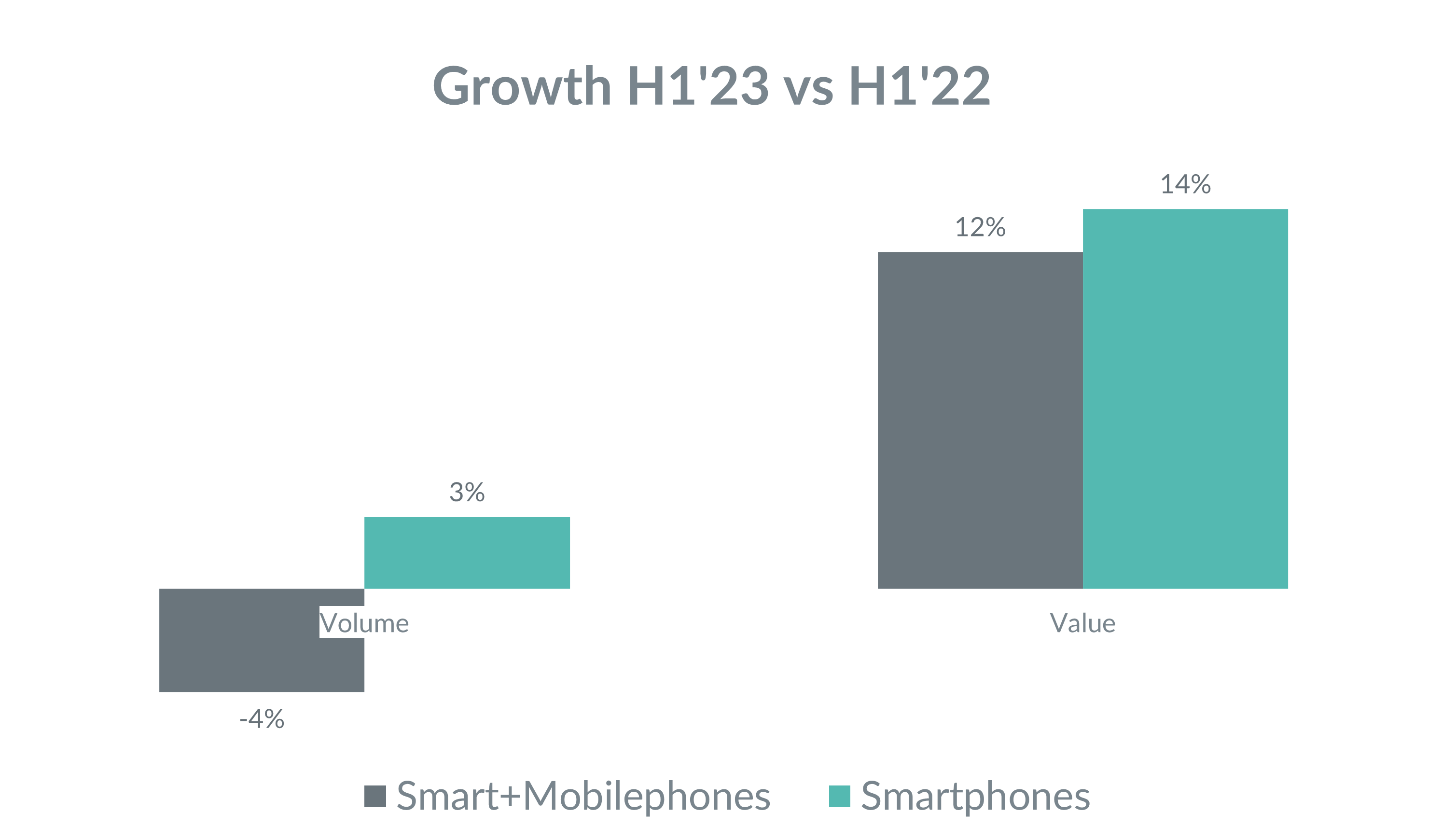

According to GfK Market Intelligence offline sales tracking, the Technical Consumer Goods (TCG) sector recorded an 8 percent growth in value during H1’23 compared to H1’22. While the telecom (Smartphone and mobile Phones) segment experienced a marginal 4 percent reduction in volume, it was offset by a substantial 12 percent increase in overall value. Several sectors witnessed significant growth in volume and value during the first half of 2023 compared to the same period in 2022.

“The Indian consumer market is undergoing a remarkable transformation driven by evolving consumer preferences and a growing appetite for innovative products. This substantial growth highlights the resilience and adaptability of the Indian consumer market in the face of changing dynamics. The Technical Consumer Goods market exhibited an impressive 8% growth in value. Meanwhile, the Consumer Electronics (CE) sector, i.e., Audio-Video categories, saw a remarkable 13% surge in volume, demonstrating a strong market presence.” – Soumya Chatterjee, Market Expert for Technical Consumer Goods – India, GfK said.

Technical Consumer Goods Record Steady Growth, as per the latest GfK Market Intelligence for Offline Retail Tracking during H1’23 compared to H1’22

The telecommunications (TEL) sector, i.e., Smart and Mobile phones, performed well in the first half of 2023, with a 12 percent increase in value despite a slight 4 percent decrease in volume. The Smartphone segment experienced a 3 percent increase in volume, resulting in a 14 percent growth in value.

One of the most striking observations from the data is the exponential growth in premium smartphones (priced above INR 30,000) during the first half of 2023, compared to the same period in 2022. Premium smartphone sales volume witnessed a remarkable 50 percent surge, accompanied by a staggering 54 percent growth in value. This shift in consumer preferences underscores the demand for advanced features, innovative technology, and an enhanced smartphone experience.

Source: GfK Market Intelligence offline sales tracking

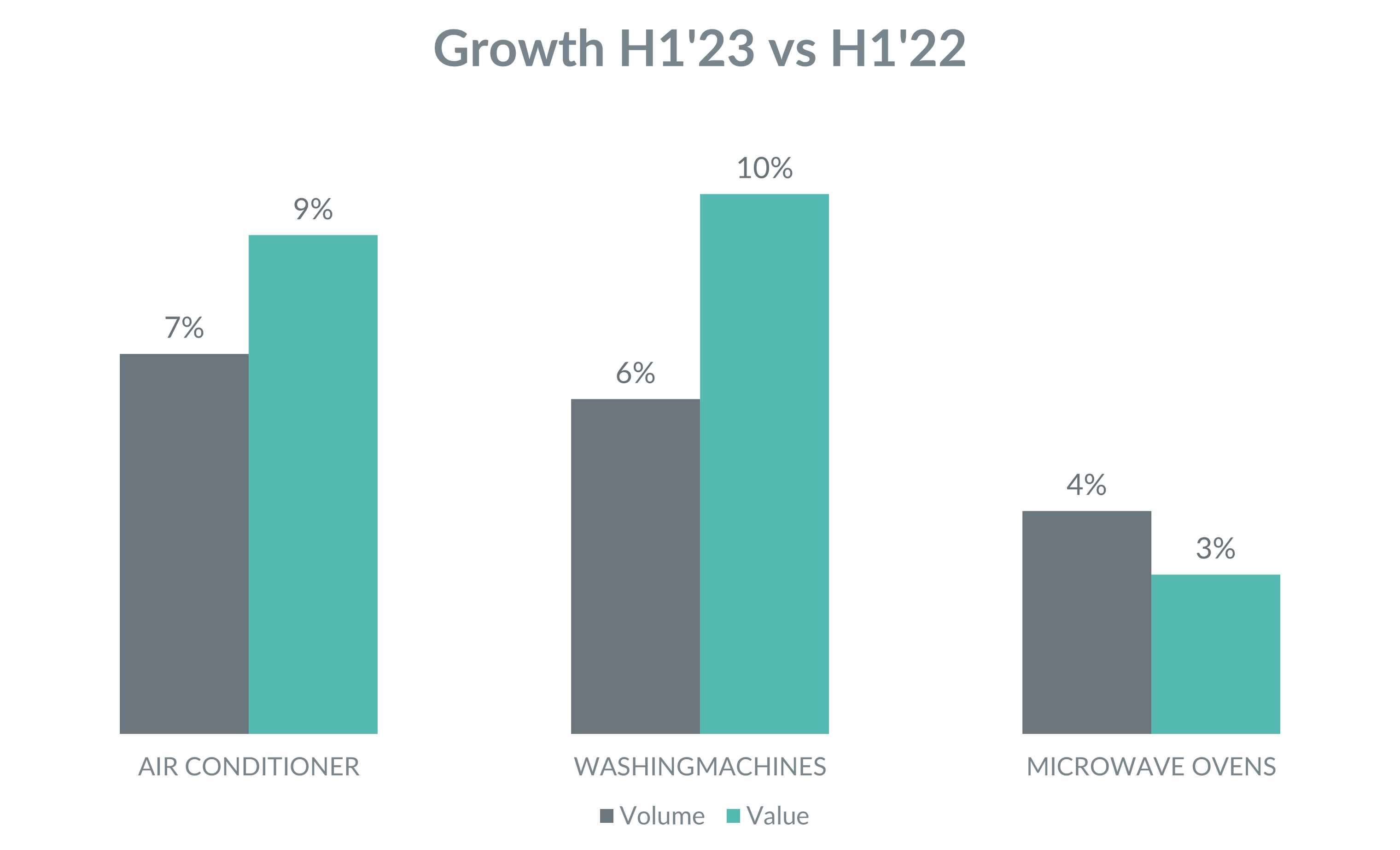

Major Domestic Appliances Exhibit Encouraging Growth

The Major Domestic Appliances (MDA) category also demonstrated encouraging growth, with Air Conditioners witnessing a 7 percent increase in volume and a 9 percent rise in value. Washing Machines followed closely with a 6 percent growth in volume and a 10 percent increase in value. Microwave Ovens maintained steady performance with a 4 percent growth in volume and a modest 3 percent increase in value.

One of the most intriguing aspects of this transformation is the untapped potential within the consumer appliances sector. Despite the growth, the penetration of these products remains relatively low, indicating a vast opportunity for industry leaders to explore further.

This growth signifies robust demand for cooling solutions, driven by factors such as rising temperatures and an increased focus on home comfort. However, despite the observed growth, there exists significant room for further expansion, as suggested by the low penetration of these products.

Source: GfK Market Intelligence offline sales tracking

Immersive Entertainment Experience Drives Demand

A notable trend among Indian consumers is the growing desire for a more immersive entertainment experience. Within the Consumer Electronics (CE) sector, Audio Home Systems experienced an impressive 21 percent surge in volume, accompanied by a 12 percent rise in value, highlighting a strong market presence. PTV/FLAT Televisions exhibited a growth trajectory with a 13 percent volume increase, while value growth remained modest at 2 percent.

In conclusion, the changing dynamics of the market reveal a prominent pattern – a surging aspiration among Indian consumers for an enhanced and captivating entertainment experience. These insights underscore the industry’s ability to adapt to consumer preferences, setting the stage for an engaging and innovative future in consumer electronics.

Stable Growth in the IT Sector

In the Information Technology (IT) sector, the Desktop Computing segment maintained steady growth, achieving a 7 percent increase in volume and a 9 percent increase in value, reflecting its consistent market positioning.

While Mobile PCs have experienced a 14 percent decline in value, Gaming laptops have shown a remarkable 6 percent growth in sales value. The gaming industry has experienced significant expansion during the pandemic. According to the GfK Consumer Life 2022 Report, 74% of urban Indians surveyed have played video games on a personal computer at least once, and 88% have played games on tablets. What is even more promising is that IT devices like PCs still have an estimated penetration of less than 10 percent in India, indicating a substantial growth opportunity.

Media Tablets, on the other hand, experienced a 10 percent growth in volume and a 17 percent increase in value, reflecting the continued demand for versatile and portable computing solutions.

The surge in media tablet sales signifies a shift in consumer behavior, where people increasingly seek entertainment and productivity on the go, valuing devices that cater to these needs.

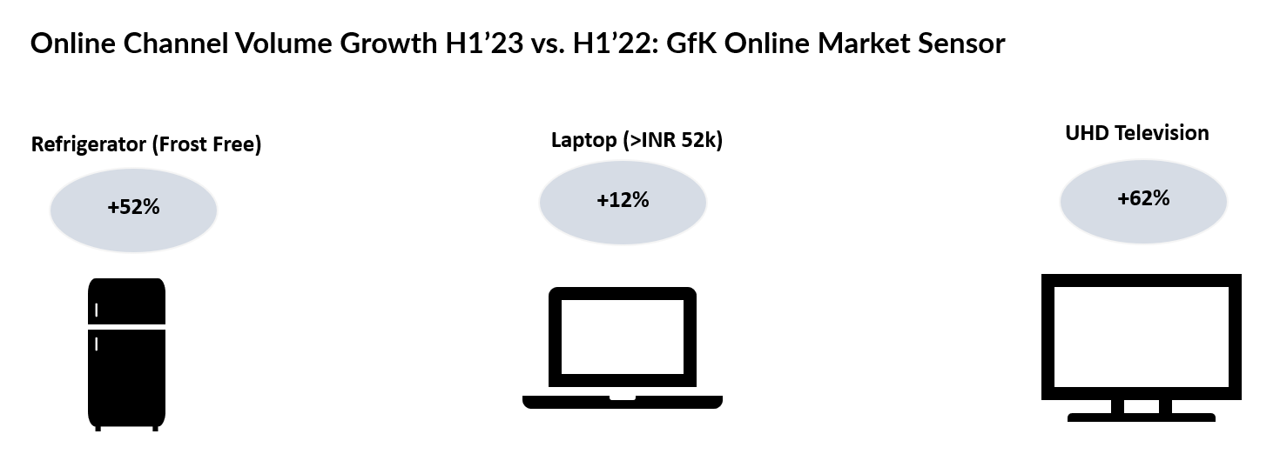

Surging Demand for Consumer Tech Products Through Online Channels

According to the GfK Consumer Life report, one out of every two consumers prefer to purchase products through online channels. This preference is reflected in the GfK Online Market Sensor reports, which show strong demand for consumer tech products in H1 2023 as consumers continue to realize the advantages of online shopping.

Panel television, Refrigerators and Mobile PC have registered high sales volume growth of 42%, 29% and 28% respectively. While health & well-being categories like Washing Machine and Water Purifier have witnessed a volume growth of 11% and 18% respectively. Premiumization trend is prominent in Online channel as well.

Source: GfK Online Market Sensor Report, Volume Growth (%), H1’23 vs. H1’22

The data showcases growth across various product categories, highlighting the opportunities within the Indian consumer market. While online shopping offers convenience, it is noteworthy that a substantial segment of buyers conducts online research but ultimately make their purchases offline. This indicates a blending of the lines between online and traditional shopping, reflecting the evolving consumer landscape.