NielsenIQ (NIQ), the world’s leading consumer intelligence company, released the FMCG Quarterly Snapshot for Q4 2023 (OND’23) today. According to the report, the Indian FMCG (fast-moving consumer goods) industry has experienced a 6% growth in value, attributed to a 6.4% increase in volume, indicating positive consumption patterns at an All-India level.

The report further reveals that volume growth for the quarter is 6.1% higher than in the same period last year (i.e., Q4 2022). However, the report notes a moderation in consumption growth within the FMCG sector compared to the sequential quarters across the country.

Roosevelt Dsouza, Head of Customer Success – India, NIQ said, “For the first time in 2023, consumption gaps between urban and rural markets are narrowing down. The North and West regions are contributing to this phenomenon. The favorable interim Union Budget 2024-25, supporting several economic boosters for the rural sector, should augur well for companies with a rural strategy.

Despite a sequential-quarter decline, the rural recovery narrative continued to evolve throughout the year. In Q4 2023, we observe an uptick in consumption, primarily driven by habit-forming categories (such as biscuits and noodles) in food and essential home products. These categories have thrived despite flat to negative price growth, indicating resilience and sustained demand.”

Chart 1: FMCG grew at 6.0% in Q4’23 driven by consumption growth at 6.4%

Source: NielsenIQ, FMCG Quarterly Snapshot Q4 2023 (OND’23)

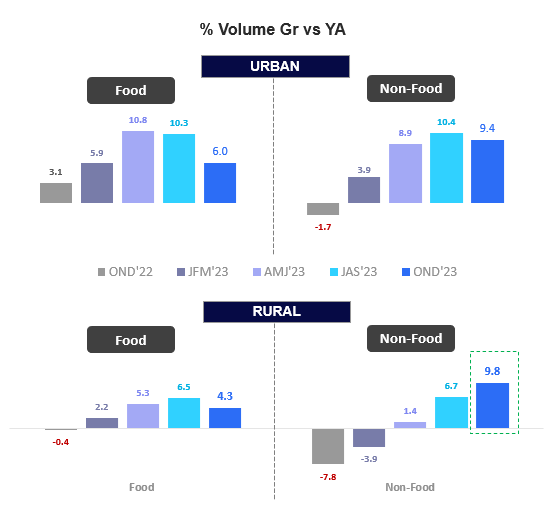

Market Dynamics: Contrasting Trends in Rural and Urban Consumption Patterns

In rural markets, there is a sequential slowdown in volume growth, with consumption experiencing a slight decline during this quarter (Q4’23) compared to Q3’23. However, the decline is more pronounced in urban markets. Within the retail sector, Modern Trade continues to experience double-digit consumption growth at 16.8%.

Traditional Trade, on the other hand, has experienced a decrease, with consumption registering at 5.3% in Q4 2023, down from 7.5% in the preceding quarter (Q3 2023). Despite certain challenges, the positive momentum in Modern Trade adds a promising dimension to the overall market scenario.

Chart 2: Slowdown in consumption growth across markets

Source: NielsenIQ, FMCG Quarterly Snapshot Q4 2023 (OND’23)

Average pack sizes in urban markets continue to remain positive, although there is a persistent preference for larger packs. In rural areas, there is a recovery path, with a growing preference for larger packs.

Chart 3: Average Pack size on the recovery path for Rural in Q4’23

Source: NielsenIQ, FMCG Quarterly Snapshot Q4 2023 (OND’23)

Non-Food categories growing faster, supported by Volume growth.

At the All-India level, both the Food and Non-Food sectors contribute to the growth in consumption (refer to chart 4). In Q4’23, more units were purchased in Food categories compared to the same period last year, whereas in Non-food, more large packs were bought.

The volume growth in the Food sector was at a rate of 5.3% compared to the same period last year (YA), down from 8.7% in Q3 2023. This slowdown in growth is primarily due to products falling under Staples (such as Refined and non-refined edible oils, etc.) and Impulse (such as confectionery, etc.) categories.

Within the Non-Food categories, there is an improvement, with volume growth reaching 9.6% in Q4’23 compared to last year, an increase from the 8.7% recorded in Q3’23. This improvement can be attributed to an increase in Rural consumption growth, with a growth rate of 9.8% in Q4’23 (vs. 6.7% in Q3’23). Volume growth is attributed to Home Care (Detergent cakes and bars, washing powder) and Personal Care (Toilet soaps) categories in Rural areas. In Urban areas, the Non-Food sector is witnessing slower consumption growth, with a growth rate of 9.4% in Q4’23, slightly down from 10.4% in Q3’23.

Chart 4: More units are bought for Food while larger packs are preferred for Non-Food.

Chart 5: Non-Food witnesses growth in Rural consumption

Source: NielsenIQ, FMCG Quarterly Snapshot Q4 2023 (OND’23)

FMCG Outlook 2024

Examining the broader FMCG industry, smaller manufacturers are recording higher volume growth rates for Non-Food categories compared to their larger counterparts, whereas Food categories exhibit a reverse trend.

Despite the challenges, the FMCG market in India remains resilient and is poised for 4.5%-6.5% growth in FY24. This outlook reflects the industry’s ability to navigate complexities and adapt to evolving market dynamics. The continued strength of the FMCG sector underscores its significance in the Indian economy and its ability to flourish despite external pressures, offering promising opportunities in the future.