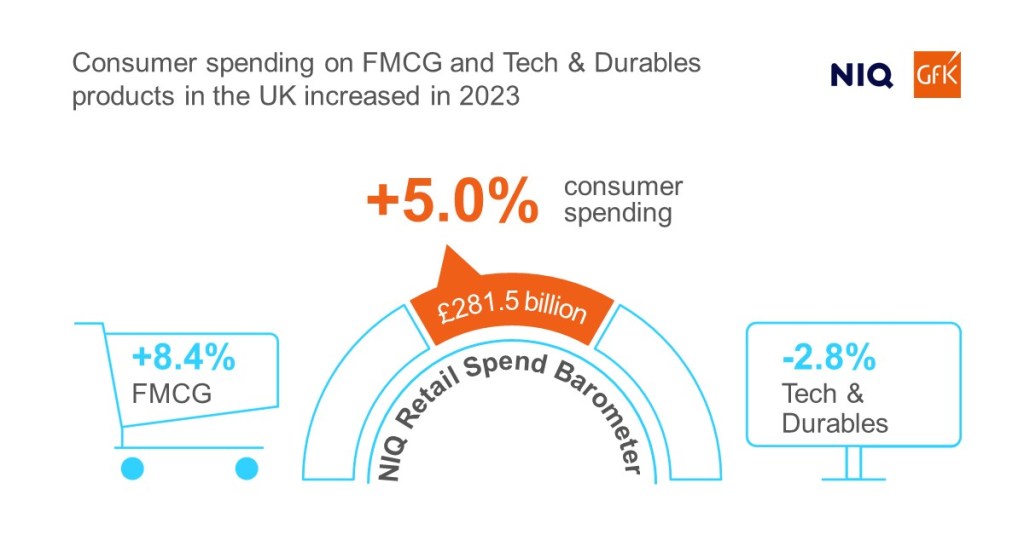

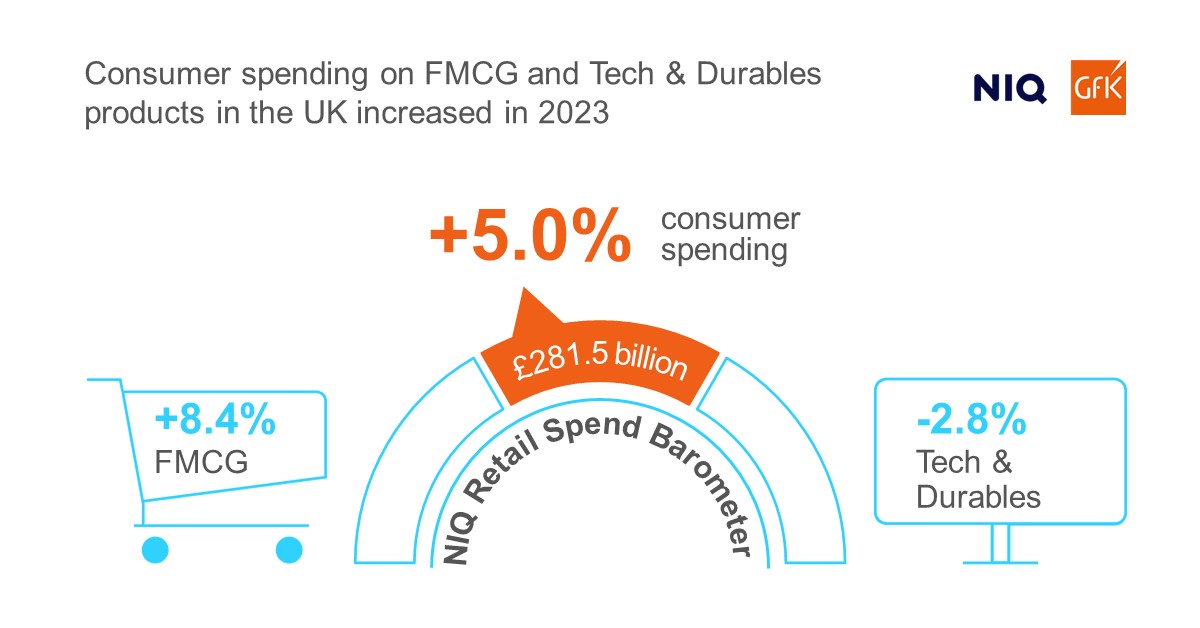

Consumer spending in the UK on FMCG and Tech and Durables products (T&D) increased by 5% last year compared to 2022.

- New data reveals that UK shoppers spent a total of £202.2bn on FMCG products in 2023, an 8.4% uplift on the previous year. However, this came at a cost to Tech and Durables (T&D) where sales declined by -2.8% to £79.2bn

- Sales for air-fryers grew 68% in 2023, showing that shoppers are willing to pay for technology products if they serve a tangible benefit

- UK shoppers still sought to make savings, leading to sales growth in private own-label items over brands, while supermarket promotions reached their highest levels in four years (25.3%)

London, UK, 14th March 2024: Consumer spending in the UK on FMCG and Tech and Durables products (T&D) increased by 5% last year compared to 2022. In total, this market amounted to £281.5bn in sales in 2023. This increase in spending was driven by price increases for food and personal care products, while consumers saved in the T&D sector. The new NIQ Retail Spend Barometer combines data from NIQ and GfK to measure the turnover in sales of FMCG and Tech & Durables products sold online and in retail stores across the UK.

The NIQ Retail Spend Barometer provides a complete overview of spending in the FMCG sector (ambient and fresh food and drink, personal care, homecare and general merchandise) and in the T&D sector (technical consumer goods, household appliances and DIY) in the UK. This cross-category and cross-channel overview is based on real sales data and is set to be published on a quarterly basis to provide a new lens into household spending priorities.

Cost of living crisis drives spending in the FMCG sector

According to NIQ data, despite slowing inflation, shopper spending power remained challenging throughout 2023 due to price increases, with prices in December still 17% higher compared with the last two years. The growing sentiment around the cost of living crisis was key to driving shopper purchasing decisions throughout the year. Shoppers looked to reduce non-essential spend both on hospitality and general merchandise in favour of eating at home. This led to significant growth rates for sales in food (+7.6%) and fresh food (+9.6%) in the last quarter of 2023.

Concerns over the cost of living also impacted the way shoppers chose to make their purchases. In the last quarter of 2023, sales of private label items exceeded those of brands in UK grocery. Moreover, increases in supermarket promotions, which rose to the highest levels (25.3%) in four years also helped FMCG sales as inflation slowed at the end of 2023.

Savings are being made on T&D products

While spending on FMCG increased, this led to sacrifices in T&D. NIQ and GfK data reveals that the overall T&D market was -2.8% in 2023, and slipped into an even further decline in Q4 (-3.5%). A downturn in sales for technical consumer goods (-7%), which includes products such as TVs and computing are a major contributor to this decline. However, DIY & home improvement (-0.8%) and home appliances (-0.4%) had a more stable 2023. Despite this, trends such as premium wellbeing and personal care led to an uplift in sales for hair stylers (+8.4%) electric toothbrushes (+9%), and even health based products such as blood pressure monitors (+11.2%). UK shoppers were also still making necessary purchases on the home, with a YoY uptick in sales for painting & decorating (7.4%) and power tools (+14.5%), which reflects people investing more in their own homes as the housing market slowed.

According to gfknewron Consumer in 2018, the amount of money spent on tech and durables was evenly split between higher and lower earners, with 47% of spend coming from higher earners. Yet in 2023 this has now jumped to 57% from higher earners, highlighting the divergence between those that can afford and those that can’t. This is evident from the GfK Consumer Life study in 2023, where 47% of consumers stated that they prefer to own fewer but higher quality items.

Ben Morrison, Retail Services Director UK & IRE at NIQ, said: “With the cost of living crisis dominating headlines and consumer mindsets over the last year, it is no surprise that this impacted consumer spending. Shoppers sought to make savings where necessary, which came at a cost to other categories, such as technology and durable goods. Despite inflation slowing, shoppers are still impacted by the rise in prices and in 2024 we anticipate they will continue to strive for value and affordable solutions in where and how they shop. Grocery retailers will therefore continue to drive an intense focus on competitive pricing, promotions and loyalty card benefits.”

Morrison continues: “When it comes to technology and durables, this sector has had significant challenges over the last year. This was brought on by the surge in demand over the pandemic, which in turn has led to consumers no longer needing new products. But it is also compounded by the cost of living crisis – consumers simply have had their income squeezed and are cutting unnecessary costs on this category. However, our data shows that 46% of shoppers are prepared to pay more for a product that makes their lives easier. The well documented success of air fryers, which saw 193% growth in 2022, and a further 68% YoY growth in 2023, confirms that when a new exciting product which provides tangible benefits to consumers enters the market, shoppers are willing to find the money to pay for it.”

Michael McLaughlin, President, Global Retail at NIQ, said: “Market dynamics and consumer behaviour are changing ever faster. In a competitive environment, fragmented data and a dose of gut feeling are no longer enough. That’s why we use the Full View™ to offer our clients a comprehensive, data-based understanding of market developments and clear, actionable recommendations for future growth.”

——————–

For media enquiries please contact: NielsenIQ@propellergroup.com

About the Study

The NIQ Retail Spend Barometer examines consumer spending on FMCG and T&D products in the UK. It tracks real sales figures and measures changes in past purchase trends. The FMCG categories covered include food, groceries, perishables and near-food (Healthcare, Toiletries, Homecare and General Merchandise), and the T&D categories include technical consumer goods, household appliances and DIY. The data comes from NielsenIQ and GfK retail market measurement, which together measure the sales of over 150,000 retail partners worldwide.

About NIQ

NIQ is the world’s leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. In 2023, NIQ combined with GfK, bringing together the two industry leaders with unparalleled global reach. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View™.

NIQ, is an Advent International portfolio company with operations in 100+ markets, covering more than 90% of the world’s population. For more information, visit niq.com.

About GfK

GfK – An NIQ Company

GfK has earned the trust of our clients around the world by solving critical questions in their decision-making process. In 2023, GfK combined with NIQ, bringing together the two industry leaders with unparalleled global reach. Together, we fuel client’s growth by providing a complete understanding of their consumers’ buying behavior, and the dynamics impacting their markets, brands and media trends. With a holistic retail read and the most comprehensive consumer insights – delivered with advanced analytics through state-of-the-art platforms – NIQ and GfK deliver the Full View™.

For more information, visit gfk.com and niq.com