Myanmar’s booming economy, young population, and rising disposable incomes point to significant opportunities for local companies as well as Asian and global multinationals looking for new growth markets, particular FMCG brands and telecommunications companies.

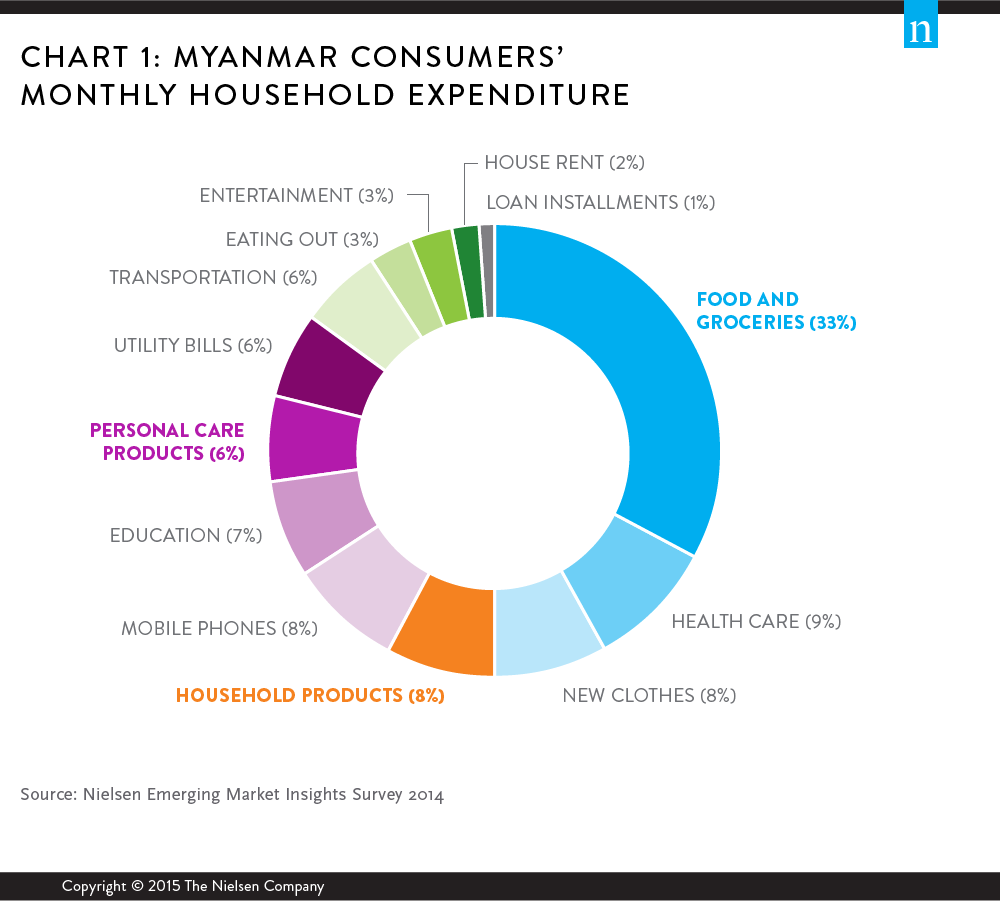

The FMCG sector has expanded 15% in the past four years and close to half of the typical Myanmar consumer’s monthly expenditure (47%) is on food and groceries, household products and personal care products.

But for the majority of Asian and global FMCG brands, Myanmar is relatively new territory, and for the most part Myanmar consumers are still familiarizing themselves with the abundance of international brands now flooding the market. Subsequently, consumers place a great deal of importance in the advice of those in their trusted network –familiarity and recommendations from friends and family are ranked by Myanmar consumers as among the key factors influencing their purchasing decisions, along with affordability.

For new brands looking to establish a foothold in the market, building awareness, trial and, ultimately, trust is critical to success.

It’s the availability of technology products such as mobile phones which is fast-tracking Myanmar’s modernization. The market has been closed off to the world for decades until only recently, and the speed with which consumers are adopting new technology is astounding. Household mobile penetration increased by 19 percentage points in 2014 compared to 2013, and mobile penetration currently stands at 44%.

Once again, word-of-mouth is a key driver of choice when it comes to purchasing a handset for Myanmar consumers, along with value for money and a desire to own the latest model handset. SMS is by far the most common form of mobile communication for Myanmar mobile phone owners (81%), while chat apps and social networks are gaining momentum (24%) along with browsing websites such as Facebook, Thithtoolwin, Google, Myanmarnews, and G-talk online (20%).

Myanmar consumers are also among the most engaged mobile users in Southeast Asia –an overwhelming majority (75%) are open to receiving ads on their phone as long as they can access content for free and more than half (53%) will happily click on ads on their phone as long as the ad doesn’t take them outside of the app they are in when they receive it.

This rapid up-take of mobile technology is presenting myriad opportunities for brands already established in or looking to enter the Myanmar marketplace to build a connection and engage with consumers. The trick is tapping into Myanmar consumers’ need for information to help with their brand purchasing decisions.

Insights contained in this article are based on the NielsenIQ Smartphone Insights Report and the NielsenIQ Emerging Market Insights Report. For further information contact media.relations@nielseniq.com